The Middle Class Is Seeing Slower Income Growth Than Both The Rich And The Poor

This fact is made all the more egregious in light of evidence that the middle class isnt doing well and needs help. Stagnating incomes, opportunity gaps, and fragile families are all reasons to worry about the middle class. Public policy has done little to ameliorate these concerns. After accounting for taxes and transfers, growth in average middle-class household incomes has lagged significantly behind the lowest and, especially, the highest income quintiles. Incomes of the top 20 percent rose by 97 percent from 1979-2014over twice as much as middle-class incomes. Even the lowest quintile has seen faster income growth, 69 percent, or two thirds higher than income growth for the middle class. In short, both public policy and the economy are leaving the middle class behind.

Two Years After Trump Tax Cuts Middle

- Over the next two years, income for middle-class Americans is projected to grow at less than half the rate as for the richest 1%, a recent Congressional Budget Office found.

- The country’s top-earning households will also enjoy a bigger decline in tax rates than all other groups.

- As a result, income inequality in the U.S. already at a 50-year high is expected to worsen.

Income for middle-class Americans is growing more slowly than for both top earners and the poor, according to the Congressional Budget Office. The analysis comes two years after President Donald Trump enacted the Tax Cuts and Jobs Act, a major overhaul in the nation’s tax laws billed by the White House as a boon for the middle class.

After accounting for taxes and government benefits, the middle fifth of households will see their income grow by 6.6% through 2021, the CBO forecast that compares with a 17% gain projected for America’s richest workers. In dollars and cents, the middle 20% of families will have seen their income grow a total of only $4,400, to $70,300, between 2016 and 2021, the agency estimated.

Income for the top 1% is expected to rise nearly $200,000 over that same five-year period to nearly $1.4 million the bottom 20% could see their annual income grow a total of $1,700 to $36,700.

The analysis factors in the impact of taxes and of government “transfers,” which include benefit programs such as Medicaid and food stamps .

Trumps Alleged Tax Cut For The Middle Class Has Been Anything But

The 2-year-old tax law pushed by President Donald Trump and his congressional allies has helped the wealthy enrich themselves and left out working people.

Known as the Tax Cuts and Jobs Act , the law has benefitted corporations and the wealthy while doing little or nothing for working families, according to a new analysis from the Economic Policy Institute and the Center for Popular Democracy.

One of the largest tax overhauls in half a century, the Trump tax law has failed to boost American workers wages or to deliver broad prosperity for low-income communities or communities of color, the papers authors write.

Among other findings, the new analysis suggests that the law:

- Has had no discernible impact on wages for working people

- Has decisively failed to spur business investment

- Has caused corporate tax revenues to plummet

- Has caused corporate stock buybacks to surge

- Has fueled income inequality and exacerbated racial wealth divides.

Like a customer manipulated by an unscrupulous salesman, the American worker understandably feels betrayed and perplexed. The companies that saved big with the tax law have failed to invest in their employees, choosing instead to spend their extra money on stock buybacks.

This is why workers need a voice on the job through a strong union. Workers can build power and demand fairness in the workplace and bargain for better pay, benefits and basic dignity through their unions.

You May Like: Rwanda Patriots Jersey For Sale

Trumps Rumored Tax Cuts 20 Proposals Arent Focused On The Middle Class

The rumored elements of the Trump administrations Tax Cuts 2.0 plan are skewed to people with higher incomes, just like the 2017 tax law.

- Galen Hendricks

In 2017, President Donald Trump and congressional Republicans enacted the so-called Tax Cuts and Jobs Act a tax plan that was heavily skewed toward wealthy Americans. Ever since, they have been floating rumors about a new tax proposal, which they are calling Tax Cuts 2.0. This time, they say, the tax plan will actually be focused on the middle class. No specific plan has been released, but some of the White Houses policy discussions have leaked in the press. True to form, the tax cuts they are considering are hardly focused on the middle class. The rumored elements of Tax Cuts 2.0 include:

- Lowering the tax rate for the 22 percent bracket to 15 percent. This would make no difference for most middle-class families while benefiting high-income people the most.

- Indexing capital gains for inflation. This would provide a windfall for wealthy investors.

- Extending the individual and estate tax provisions of the TCJA beyond their scheduled expiration date. This would permanently lock in tax cuts that are skewed to the wealthy.

- Creating a new tax-preferred savings vehicle. This would only double down on the tax codes already very top-heavy investment tax breaks.

- Implementing even more corporate tax cuts. This would overwhelmingly benefit the wealthy, who own most of the corporate stock.

Trump Says He Will ‘cut Middle Class Taxes’ As Gop Plans Increase Next Year

President Donald Trump promised on Saturday that he would cut taxes on the middle class even further if he’s elected to a second term on November 3. Tax cuts have long been part of his pitch to voters.

Trump told a campaign rally in Bucks County, Pennsylvania that if he secures a second term, middle class taxes will be further reduced, but critics charge Republicans in Congress intend to do the exact opposite.

“With your vote, I will cut middle class taxes even more,” Trump said. “I mean, we cut them at the highest level in the history of our country. Even more. You saw what it did.”

“That’s why we’re coming back so quick because we have a strong foundation, a base. And I will always defend and promote Pennsylvania energy and there will be no more lockdowns,” Trump went on.

“We’re not gonna have lockdowns.”

Despite the president’s claims, the 2018 tax cuts were not the biggest in history in absolute terms or as a measure of GDP.

While Trump has repeatedly touted further tax cuts for middle class Americans, the Republican tax reforms will mean tax increases for most Americans between 2021 and 2027.

As Nobel Prize winning economist Joseph Stiglitz pointed out in The New York Times on Saturday, tax increases had already been approved by Congress in the 2017 Tax Cuts and Jobs Act.

Recommended Reading: Know Your Customer Rule Patriot Act

Cutting The 22 Percent Income Tax Rate Wouldnt Benefit Most Middle

One idea floated by both Rep. Kevin Brady ranking member of the House Ways and Means Committeeand National Economic Council Director Larry Kudlow would lower the 22 percent marginal income tax rate to 15 percent. Some commentators and media outlets dubbed this provision a middle class tax cut. Upon closer examination, this is not the case.

To receive any benefit from this rate cut, taxpayers incomes need to be high enough to fall in the 22 percent bracket or above. For married couples, the minimum adjusted gross income to fall into the 22 percent bracket this year is $105,051.* As most couples in the United States will make less than $105,051 in 2020or will have deductions that put them below the 22 percent bracketthey wouldnt benefit at all from the rate reduction. Moreover, because the rate cut would only affect the portion of income that falls within the 22 percent bracket, even those with incomes higher than $105,051 would not see the full benefit unless their incomes place them in higher brackets. For couples, the minimum AGI to be in the next tax bracket is $195,850three times higher than what the median household earned in 2018.

Altogether, according to CAP calculations using the open-source tax calculator Tax-Brain, nearly two-thirds64 percentof the tax cut from this plan would go to taxpayers in the top 10 percent, while the bottom 50 percent wouldnt see any change at all.

Explaining The Trump Tax Reform Plan

For most people, tax season comes to a close on April 15 each year. In 2019, many taxpayers were surprised to find they had to pay more taxes than the previous year, while others received significantly lower refund checks from the Internal Revenue Service even though their financial circumstances didn’t change.

Many tax specialists and accountants urged their clients to update their withholdings in order to avoid a hefty bill at tax time. Doing so is easy and can be done by filling out and submitting IRS Form W-4 to your payroll department.

But how did this happen? Let’s take a closer look at President Trump’s changes to the tax codethe largest overhaul made in the last 30 yearsand how it impacts taxpayers and business owners.

Recommended Reading: Patriots Vs Eagles Preseason Live Stream

Trumps Tax Cuts Helped Billionaires Pay Less Than The Working Class For First Time

Economists calculate richest 400 families in US paid an average tax rate of 23% while the bottom half of households paid a rate of 24.2%

They were billed as a middle-class miracle but according to a new book Donald Trumps $1.5tn tax cuts have helped billionaires pay a lower rate than the working class for the first time in history.

In 2018 the richest 400 families in the US paid an average effective tax rate of 23% while the bottom half of American households paid a rate of 24.2%, University of California at Berkeley economists Emmanuel Saez and Gabriel Zucman calculate in their new book, The Triumph of Injustice.

Taxes on the rich have been falling for decades. In 1960 the 400 richest families paid as much as 56% in taxes, by 1980 the rate had fallen to 40%. But Trumps tax cuts his most significant legislative victory proved a tipping point.

Thanks to the controversial tax package the top 0.1% of US households were granted a 2.5% tax cut that pushed their rate below that of the lower 50% of US earners.

This is a revolutionary change and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labor, and as wages start going up at levels that you havent seen in many years, Trump said in September 2017 as he fought to pass the tax package.

Trump Tax Cuts Results: Full Review

The Tax Cuts and Jobs Act, championed by President Trump and congressional Republicans, spurred a boom in economic growth that took Americans off the sidelines and got them back to work. Thanks to these reforms, our economy doesnt have to strain under a tax code from 1986, but will recover with a modern, dynamic tax code that promotes growth.

To download this factsheet as a PDF, .

MORE JOBS AND INVESTMENT

- Lowered tax rates for job creators of all sizes.

- Made it easier for companies to bring jobs and investments back to the U.S.

How the Economy Responded:

FAIRER TAXES

- Simplified that tax filing process for millions of workers.

- Eliminated the Alternative Minimum Tax for most taxpayers.

- Expanded popular savings tools, like 529 accounts.

How the Economy Responded:

- Millions of Hours Saved. Nearly nine out of 10 Americans took the standard deduction in 2019, no longer needing to go through the complicated process of itemizing.

- Revenues Soared. Breaking dire predictions from experts, federal revenues reached an all-time high, due to more Americans working, bigger paychecks, and businesses expanding.

BIGGER PAYCHECKS

- Cut income tax rates across the board.

- Nearly doubled the standard deduction.

- Doubled the Child Tax Credit.

How the Economy Responded:

Want to read more on the fight against Coronavirus? Read our Coronavirus Bulletin here which contains our extensive FAQ about recent federal actions.

Was this message forwarded to you? to subscribe to our emails.

Recommended Reading: How Many Registered Democrats And Republicans Are There

Changes To The Tax Code

President Trump signed the Tax Cuts and Jobs Act into law on Dec. 22, 2017, bringing sweeping changes to the tax code. How people felt in principle about the overhauls of more than $1.5 trillion depended to some extent on their opinion of Trump’s presidency. Individually, the impact of the changes depended on factors like income level, filing status, and deductions. Those living in a high-tax state with soaring property values may have paid more in taxes in 2019.

For the wealthy, banks, and other corporations, the tax reform package was considered a lopsided victory given its significant and permanent tax cuts to corporate profits, investment income, estate tax, and more. Financial services companies stood to see huge gains based on the new, lower corporate rate , as well as the more preferable tax treatment of pass-through companies. Some banks said their effective tax rate would drop under 21%.

Given the popular criticism of the tax overhaul’s disparities, coupled with GOP losses in the 2018 midterm elections, as well as Trump’s potential trade war muting the benefits of the tax cuts for voters, there were discussions surrounding tax reforms. The reforms could make individual tax cuts permanent and encourage retirement savings and business innovation. More on that later.

Surprise Tax Bills For Some Middle

The lower income tax rates should have helped Americans throughout the year because employers generally withheld less income tax from employee paychecks, increasing their after-tax income. Unfortunately, many workers didnt know they needed to make changes on their W-4 forms to counteract the changes. The result was that some workers had more take-home pay, but then underpaid their income taxes and owed the IRS thousands of dollars on Tax Day.

Make sure to update your W-4 for this year, especially if you’ve had any unexpected tax bills int he past few years. The IRS doesnt require anyone to make changes unless they get a new job, so you need to put in the effort to adjust your W-4 withholding yourself.

Ready to shop for life insurance?

Recommended Reading: Patriot Power Solar Generator 1500

State And Local Tax Deduction

The new law capped the deduction for state and local taxes at $10,000 through 2025. A number of Republican members of Congress representing high-tax states opposed attempts to eliminate the deduction, as the Senate bill would have done.

The Senate bill was amended on Dec. 1, 2017, apparently to win Susan Collins’ support:

The Senate tax bill will include my SALT amendment to allow taxpayers to deduct up to $10,000 for state and local property taxes. Sen. Susan Collins Dec. 1, 2017

Tax Cuts 20 Would Likely Double Down On The Failures Of The Tcja

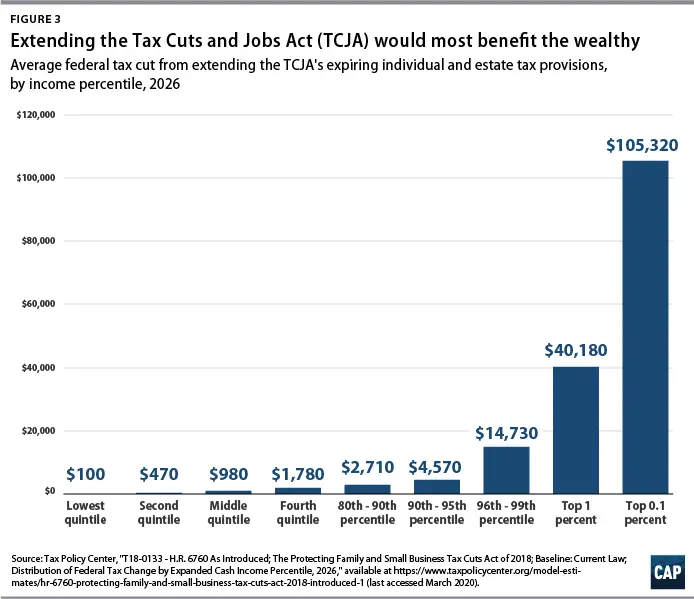

The Tax Cuts 2.0 plan is also likely to lock in the TCJAs regressive tax cuts by making permanent the individual income and estate tax provisions, which are currently scheduled to expire in 2026. President Trump proposed to make these tax cuts permanent in his recent annual budget, at a cost of $1.4 trillion over 10 years. The then-Republican-controlled House passed a similar proposal in 2018, but it was not enacted. The measure would have given the top 0.1 percent a tax cut of $105,000more than 100 times larger than the cut for middle-income households and more than 1,000 times greater than the cut for the bottom 20 percent, according to the TPC.

You May Like: Why Do Democrats And Republicans Disagree

The Most Significant Benefits Accrued To Working

Batya Ungar-Sargon makes important points in her op-ed Democrats Are the Party of the Overclass . But at the end of her article, she writes, Democrats typically ask: What about Republicans handouts to the rich? What about the Trump tax cuts? They have a point about the other side, but its not much of a defense.

IRS data reveal that all income brackets benefited as result of the Trump tax reforms, with the most significant benefits accruing to working- and middle-class filers, not to the wealthiest, as media and Democrats have ceaselessly claimed. For instance, those earning between $50,000 and $100,000 a year had a reduction in taxes of about 17%, while those with $100,000 to $500,000 in income saw their tax bill reduced by about 13%. All working Americans shared in the economic benefits of the 2017 legislation.

Steve Orebaugh

How Tax Rates Work

Remember that the tax rates are marginal. The tax rate of your total income applies only to the income earned in that bracket. For instance, if youre single and your taxable income is $300,000 in 2022, only the income you earn past $215,951 will be taxed at the rate of 35% shown on the corresponding federal income tax chart above. The lower rates apply to income in the corresponding brackets.

This is important to consider when thinking about deductions and figuring out your taxable income. Just because your total income reaches a new tax bracket, doesnt mean all your money is taxed at that rate. In fact, it only applies to anything above the threshold for the new bracket.

Keep in mind that tax brackets change for inflation each year. As a result, this could put you in a different tax bracket from one year to the next. That means that you might also have to pay a different tax rate for part of your income. If youre wondering how the tax changes affect your specific tax situation, use SmartAssets income tax calculator. It will help you see what you can expect to pay under the new plan.

Also Check: Jeep Patriot 6 Inch Lift Kit