What Is The Patriot Act And How Does It Impact Aml

Very few pieces of legislation have impacted the fight against money laundering and terrorist financing like the Patriot Act. That being said, many people are unaware of what the Patriot Act actually is and how it helped shape the international legislative landscape. For those of us who are compelled to abide by AML and CTF legislation, it makes sense to understand the history that has led us to where we are today.

Lets dive in.

Katherine Manning February 9 2021 Banking

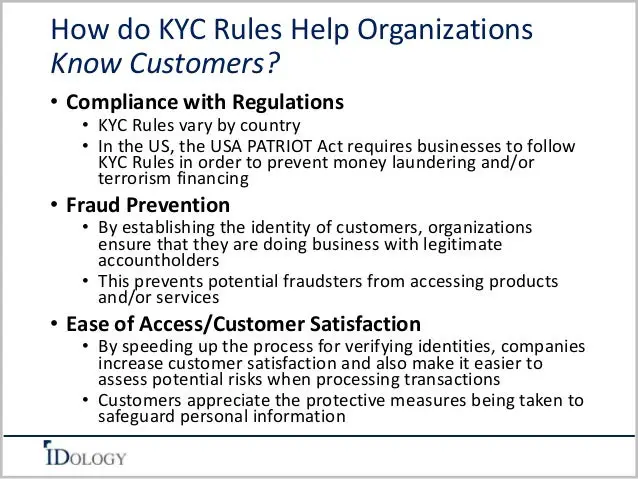

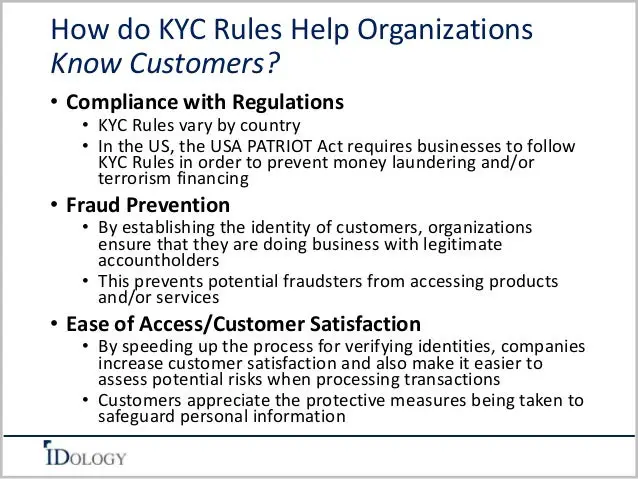

Banking is a highly-regulated industry, and the government has been holding this sector to higher standards regarding Know Your Customer laws. The impact is broad for customers, and the mandates affect every institution that manages money. As a result, banks are certainly on the hook in complying with KYC to mitigate fraud, but they also share the responsibility with anyone who transacts with their business.

KYC laws are designed to ensure banks always verify identities, assess risks adequately, and provide customers with no prohibited lists. Further, KYC laws help combat fraud schemes, money laundering, and the financing of terrorism. The crucial component is finding the right balance, so innocent customers do not have to bear the requirements brunt.

Banks cannot escape the mandatory KYC process of verifying customers. Initially, KYC laws were incorporated and introduced in 2001 as part of the Patriot Act, passed to help prevent and monitor terrorist activities. Today, every financial product and transaction must pass KYC checks.

How To Ensure Kyc Compliance For Ach Payments

KYC procedure requires that banks inform the customer of the regulations and the use of their personal data, seek and verify customer identification, assess the risk management of having a business relationship with that client, and continue monitoring transactions over the ACH Network, among others. It also requires that the bank follows the regulations set out by NACHA, Regulation E of the Electronic Funds Transfer Act, the Office of Foreign Assets Control of the US government, and the GPRA and CCPA.Banks maintain KYC compliance typically through regular assessments as well as through regular personal re-assessments. With regular re-assessment, the bank is decreasing its chance of financial risk and it can afford being flagged by any of the regulating bodies. In order to process an ACH transfer, the bank must provide proof that the personal data is securely stored, that any sharing of the data online is encrypted and securely transferred, and that data processing is protected.

Read Also: American Patriot Log Cabins

What Is Enhanced Due Diligence Or Edd

Unlike customer due diligence and standard due diligence, high-risk individuals go through extensive screening to check the involvement in money laundering, terrorist financing, and corruption. Business ultimate beneficial owners are identified, along with sources of income, and screened against PEPs and global sanction lists to eliminate risks of financial crimes.

Apart from that, additional background checks are also performed, as needed. Enhanced due diligence also exposes the nature of the business and the purpose of bigger transactions through know your customer remediation. Due diligence is an important step that companies take to get rid of risk by performing extra checks in return keeping businesses safe from bad actors and money laundering activities.

What Ey Can Do For You

A changing regulatory environment, increasingly sophisticated financial crime tactics, and high customer expectations are prompting financial institutions to rethink and transform their KYC processes. However, satisfying ever-increasing compliance and due diligence requirements without compromising the client experience is challenging. Doing so efficiently and cost-effectively is further complicated by legacy systems, disparate data silos, and differing global regulatory requirements.

Financial institutions can adopt digital technology to reduce costs, improve quality and transform KYC operations and client lifecycle management capabilities. But doing it alone can be risky and disruptive, given the need to select, deploy and manage technology, engage the necessary talent and manage relationships with regulators.

Our KYC services help firms address these challenges and enable them to reallocate technology investments to their growth strategies and to access an experienced workforce that can handle fluctuating volumes. This reduces the need to incur one-time costs, make temporary investments, and spend time managing non-core processes. These services encompass due diligence processes for client onboarding and renewals across multiple jurisdictions as well as case management, advanced analytics for next generation customer risk rating, complex entity management, and secure digital exchange of customer information.

Our KYC services include:

Why EY

Don’t Miss: Patriot Carbon Air Purifier Reviews

What Is Kyc Verification

Know Your Customer is a regulation standard. As such, KYC is the standard requirements banks and other financial institutions must follow to verify their customers. Meanwhile, the phrase KYC verification is the process in which banks and financial institutions request documents to achieve KYC compliance.

Bsa & Related Regulations

The Bank Secrecy Act , 31 USC 5311 et seq establishes program, recordkeeping and reporting requirements for national banks, federal savings associations, federal branches and agencies of foreign banks. The OCC’s implementing regulations are found at 12 CFR 21.11 and 12 CFR 21.21. The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program.

Also Check: Republican Vs Democrat Differences

What Are Know Your Customer Regulations

Know Your Customer regulations, otherwise known as the 2090 rule, are a set of regulations that are used in financial services requiring a financial institution to verify the identity of their customers and clients.

These regulations originally stemmed from the banking Anti-Money Laundering policy have evolved and are primarily in place to release financial liability from the financial institution in the case of identity theft or financial crime incurred during the financial transaction process. AML regulations still apply to KYC as part of the verification process and to stop money launderers from tapping into the electronic payment process.

An outdated form of bank account and customer verification was customer due diligence , which ensured that the attached beneficiary was cleared for completing financial transactions. Some older financial institutions still abide by CDD or refer to it, but KYC is now mandatory for all banks and financial institutions.

KYC regulation covers customer identity acceptance and identity verification, risk management assessment, and transaction monitoring, and it will encompass the following:

While KYC regulations are recognized worldwide, the individual governance procedures will vary based on the geographical location of the bank or financial institution and the remittance capabilities of that bank.

Kyc For Gaming And Gambling Industry

The online gambling industry is rapidly growing and is expected to reach over $94 billion U.S. dollars by the year 2024. One of the reasons for this unanticipated growth is uninterrupted digitization. This continual digitization is bringing convenience to businesses and customers alike.

Over 4.4 billion people around the globe use the internet for interacting with the online world in one way or the other. Online gambling and gaming industries are mandated to verify the identity of their customers including age verification and address verification for risk profiling. The whole idea of KYC for online gambling and gaming sites is to prevent it from bad actors including frauds and restricting minors from approaching age-restricted platforms or items. It provides a secure player environment, builds trust among customers, and helps online companies to stay compliant, eliminating non-compliance fines.

Don’t Miss: 116th Congress Party Breakdown

Kyc Verification: Innovative Approaches Welcome

In November 2018, US agencies, including the Federal Reserve, issued a joint declaration that encourages some banks to become increasingly sophisticated in their approaches to identifying suspicious activity and experimenting with artificial intelligence and digital identity technologies.

Earlier in the year, the European Supervisory Authorities promoted new solutions to address specific compliance challenges. They suggest retaining a common approach for a consistent application of standards across the EU.

They anticipate several types of control, such as «a built-in computer application that automatically identifies and verifies a person from a digital image or a video source or a built-in security feature that can detect images that are or have been tampered with whereby such images appear pixelated or blurred.

The use of biometrics can be challenged by local or regional regulations .

On this topic, read our September 2020 web dossier on biometric data and data protection regulations.

Mobile biometric authentication with Thales Gemalto Mobile Protector

What Are Kyc Requirements

The two basic mandatory KYC documents are proof of identity with a photograph and a proof of address. These are required to establish one’s identity at the time of opening an account, such as a savings account, fixed deposit, mutual fund, and insurance.

List of documents commonly accepted as standard proof of identity:

-

PAN card

-

Lease agreement along with last three months rent receipt

-

Employerâs certificate for residence proof

Don’t Miss: Donald Trump Calling Republicans Stupid

Us Regulations On Ach Payment Data

Both an ACH debit and ACH credit must move online through the ACH network. Therefore, U.S. regulations around the protection of ACH payment data requires that cybersecurity measures are followed to ensure personal data is accurately protected and that the information is properly and securely stored. Therefore, for the security of ACH payment data and all electronic payments ledgers, U.S. financial institutions must rely on encryption, authentication, and order to ensure compliance with U.S. regulations and customer privacy laws.The KYC processes to store sensitive banking information include the following:

- Store data on Payment Card Industry Data Security Standard approved hardware and software, typically on hardware on-site first

- KYC data should be sent as an encrypted copy and securely uploaded over a cryptographic HTTPS protocol

- Sensitive data copies are stored in a secure cloud many banks used Amazon A3 for secure storage

- Create privileged accounts with restricted access via multi factor authentication

- If using any outside parties, only use service providers who undergo extensive testing and is marked as a PCI DSS Validated Entity

- Do not store card security number or electronic track data

- Encrypt the electronic storage of all credit card account information and cardholder data

- Encrypt phone recordings containing credit card account information

Kyc For Travel Industry

The travel industry has seen remarkable changes due to technological advancements. Technology is making things easier for global industries including travel. Travel agencies now improve their customer experience through powerful KYC and AML practices. Since technology has maximized the risk of online frauds, know your customer for identity verification is eliminating these risks to a greater extent.

Over the course of a few years, the travel industry is a favorite sector for cybercriminals to target. In 2018, a travel booking site Orbitz lost sensitive customer data including credit card details to a security breach. These stolen payment details are then used for identity theft and sold on the black market, bought by other cybercriminals, used for the purpose of account takeovers. Therefore, KYC for identity verification including biometric technology can prevent these crimes from happening.

Don’t Miss: Yorktown Apartments Louisville Kentucky

Know Your Customer: Final Thoughts

Know Your Customer protocols are an important part of ensuring financial integrity. These regulations decrease fraud and money laundering. However, this requires more work from the account holder and financial institution during the onboarding process. Regardless, its worth the effect.

When opening an account with a financial institution, ensure theyre protecting your assets with KYC compliance, payment fraud protection services, and other various security procedures.

Article Sources

Kyc Cost Of Doing Business

While KYC does increase the cost of doing business in the financial sector, its more expensive not to comply. The most vital component is to find a balance of compliance while still meeting customer needs and expectations.

Banking will continue to be more highly regulated than other industries, so its time to determine how to meet compliance effectively without disrupting operations or causing customer loss. Another issue is if your bank is fined for fraud, it may not only cost steep fines but may also damage vendor relationships permanently and cause reputational loss.

According to a Thomson Reuters survey, 89% of corporate customers shared that they did not have a good KYC experience. Nonetheless, the government implemented KYC before contemporary tech tools were available. This means many KYC systems currently in place are outdated, and when updated, they can make compliance more comfortable and seamless.

You May Like: Trump Interview Republicans Dumb

Suspicious Activity Monitoring And Reporting

Section 356 of the USA PATRIOT Act amended the BSA to require broker-dealers to monitor for, and report, suspicious activity .

Under FinCENs SAR rule, a broker-dealer is required to file a suspicious activity report if: a transaction is conducted or attempted to be conducted by, at, or through a broker-dealer the transaction involves or aggregates funds or other assets of at least $5,000 and the broker-dealer knows, suspects, or has reason to suspect that the transaction:

Broker-dealers must report the suspicious activity using FinCEN SAR Form 111, which is confidential. FinCEN maintains instructions for filing the form, which detail, among other things, the minimum information requirements for the form.

How Can Kyc Protect Global Businesses

Knowing your customer is considered important because it tells you about the customers you are doing business with. It allows the financial sector to carry out extensive customer due diligence to verify their identities to prevent identity theft, money laundering, and fraud. Know your customer compliance protects businesses against unanticipated reputational damages due to external breaches from sneaking into systems. The regulations of money laundering and terrorist financing are becoming stricter by the day in a lot of countries around the world.

Robust KYC verification processes perform a thorough analysis of entities undergoing identification including anyone wishing to connect with a business in any way or form. An in-depth customer due diligence is performed for identification, screening against blacklists to identify money laundering suspicions, checking UBOs in case of KYB , collecting customer information, and checking against PEPs global lists for additional security.

Read Also: People Magazine 98 Trump

Kyc Requirements For Banks In The Digital Age

Today, banks and their fintech counterparts can go to great lengths to assure compliance with KYC standards. As a result, more money is poured into new KYC technologies constantly. This was found as a study of the CEB TowerGroup. Currently, KYC solutions rank amongst the most valuable banking technologies. More than 62 percent of executives are certain, KYC investments will grow even more in the future.

In the modern context of digital, border-free and contactless payments, AML and KYC cannot deny their beginnings. Many KYC procedures still derive from a time when financial services were stationary. Back then, the client had to be physically present in a banking branch to access them. Identity verification was a simple matter of seeing the client physically. This was usually followed with collating the paper documents and ID with official records. The client databases had to be updated manually.

Users supply bank account data, social security numbers, etc to fulfil the KYC requirements for banks. They may also provide hard physical proofs of identity like a valid passport and utility bills . Should the customer deliberately hand over false information, the reviewing company will have the case investigated. This may ultimately lead to legal action. Modern technologies help alleviate the human factor. AML procedures today are more about lines of code on a server than types of seals on paper documents.

The Financial Action Task Force

FATF is a global intergovernmental organization committed to fighting against money laundering and terrorist financing crimes. It has 36 member states spread across its jurisdictions. FATF has been putting forth the global standards for anti-money laundering compliance by monitoring customers under AML and CTF guidance. FATF has made it mandatory for financial institutions to perform thorough know your customer procedures, risk assessment, screening against global sanctions, and due diligence processes before onboarding customers and businesses.

Recommended Reading: Donald Trump People Magazine 1998 Quote

What Is Mobile Kyc

Now that we know what is KYC, and enhanced KYC. Its time to discuss Mobile KYC. Mobile KYC allows businesses and customers to authenticate identities using smartphones. Everyone owns a smartphone these days, the features of having a front camera and 4G internet connection makes the whole verification experience smoother. Mobile KYC services increase customer outreach with more credibility. It is revolutionizing the banking sector and eCommerce sector. In this day and age, everyone is buying and selling stuff straight from their mobile phones, therefore, identity verification through mobile for customer authentication is an effective way forward.

The ease of the digital world brings with it various online crimes thus identifying customers with just a few clicks is convenient and advantageous. In todays digitized world, customers are carrying out their banking operations including transactions using their mobile devices. Regulations around the globe are changing due to technological advances, financial institutions are bound to follow the guidelines for AML, and are required to follow Know your customer checks for remote customer identification. The reason why mobile KYC is coming in handy for banks to authentic transactions, and account opening.

What Triggers Kyc

The Know Your Customer process is only required in certain situations. Such situations include new account initiation and the request for major changes to an existing account. The following may trigger KYC verification procedures:

- Client onboarding

- An adjustment to the owner of the account

- A new or existing client needs a new product

Also Check: 1599 Geneva Bible Patriot’s Edition