Can You Lose Your Money In A Money Market Account

No, you cant lose your money in a money market account. Thats because the bank doesnt invest your money in risky markets such as stocks and forex, so your money is safe. As an added layer of protection, because your account is insured, you can rest easier knowing that you are covered should something happen to the bank or credit union where you hold your account.

How Do I Open A Savebetter Account

A. Check out our savings marketplace and choose a product in which you would like to deposit money.

B. Create your username and password.

C. Complete an application and, after successful identity verification, link a bank account from which to fund your first savings product.

D. Start earning interest as soon as your money is received by the bank or credit union offering the savings product you selected.

Any questions or concerns? Email us at .

How To Get Started

There are two ways to open a Patriot Bank money market account. You can visit a branch if you live near one or get started online. If you want to open an account online, you can do so through the Patriot Bank website. But theres a catch. In order to get the highest APY and reduce your minimum initial deposit to just $1, youll need to open your account through SaveBetter.com instead.

SaveBetter is an online marketplace that partners with banks to offer savings accounts, money market accounts, and other deposit account options. When you open an account through SaveBetter, youre still getting a Patriot Bank account. And again, youll need to choose this option to get the highest APY otherwise, youll earn a much lower rate on your money market balance.

Opening an account at SaveBetter is as simple as creating a username and password. From there, you can select the Patriot Bank money market account and complete the application. Youll need to share your name, address, date of birth, and Social Security number. Youll also need to provide a routing number and bank account number, which is used to make your initial $1 deposit.

You May Like: Where Is My Patriot Supply Located

Money Market Accounts At Big Banks

So far, we’ve only talked about online banks, because they give the best rates. What about traditional brick-and-mortar banks? Perhaps you don’t like the idea of purely online banking. Or if you already have checking accounts at these banks, you may want savings at the same bank.

These traditional banks provide money market accounts, but note that the APY won’t be as high.

- Wells Fargo Money Market AccountAlso known as the Platinum Savings Account. 0.25% – 2.00% APY. Minimum opening deposit of $25. $12 monthly service fee, unless you maintain a minimum daily balance of $3,500. Bonus APY of 2.01% requires account linked to Portfolio by Wells Fargo relationship.

What Is A Money Market Account

A Money Market Account is a type of savings account that includes some features that some types of checking accounts offer. These features can have the ability to write checks and a debit card but this differs from one bank to the next.

MMAs also come with a generous APY, which is typically higher than what checking accounts offer. That said, it could be lower than what youd get by opening a savings account or a high-yield savings account.

There are no rules that say which type of account has a lower or higher interest rate. Each bank is free to offer different rates on different accounts. Thats why its important first to assess your financial needs and then see which type of account is best suited to meet your goals.

Don’t Miss: Is Patriot Power Greens Good For You

Is It Worth It

Patriot Bank offers relatively attractive APYs across its accounts. Youll find respectable rates with a bank that has a highly-rated mobile app to handle your banking needs.

But as a customer considering a new bank account, you can find higher rates elsewhere. With that, youll likely need to look for another banking option if top rates and low fees are your biggest priority.

What Is Regulation D

Regulation D is a regulation by the Federal Reserve Board that limits the number of withdrawals from savings accounts to 6 per month. Since money market accounts are a type of savings, this rule can apply even to these accounts.

On the 24th of April 2020, the Board of Governors of the Federal Reserve System deleted this rule, and many banks followed suit.

Banks who still apply this rule will charge a few for excessive transactions, which means more than six transactions per month. You might even face account closure if you consistently make more than the allowed number of transactions. Because of this, it is important to check what the rules are before opening an account.

Read Also: How Many Republicans Are In The 116th Congress

Patriot Bank Money Market Account Review 2022

Money market accounts or MMAs can be used to save for short- or long-term goals. These accounts can combine features of savings accounts with checking accounts to help you grow your money. Depending on where you decide to open a money market account, you may enjoy a competitive interest rate as well as benefits like check-writing or debit card access.

Connecticut-based Patriot Bank offers money market accounts with guaranteed earnings for savers. Branches and ATMs are located in Fairfield and New Haven counties, as well as Scarsdale, New York. But its possible to open a Patriot Bank MMA online. The question is, is it worth it? And is this the best place to have a money market account? This Patriot Bank review can help you to decide.

Online Banks Are More Attractive

Also, consider which banks offer the best rates for money market accounts. Most often, this is likely to be an online bank rather than a brick-and-mortar bank.

Online banks usually have lower overhead costs than traditional banks. They’re able to pass those savings on to their customers in the form of higher interest rates and lower fees.

The trade-off, of course, is that using an online bank means forgoing branch banking. But whether this is important to you depends on your preferred banking method.

Accessibility can be important if you need to withdraw money from your money market account quickly. Having to wait several days for an ACH transfer to be completed could make paying for emergency expenses more difficult.

Also, look at the online and mobile banking user experience. Again, SaveBetter doesn’t have a separate mobile app. Instead, you’re limited to managing your money market account online.

Finally, look at how easy it is to open a new money market account.

You can open a money market account with Patriot Bank online in just a few minutes through SaveBetter. But not all banks offer online account opening which is good to know if you’d rather not have to go to a branch to get started.

Also Check: Wilkes Journal Patriot Drug Bust

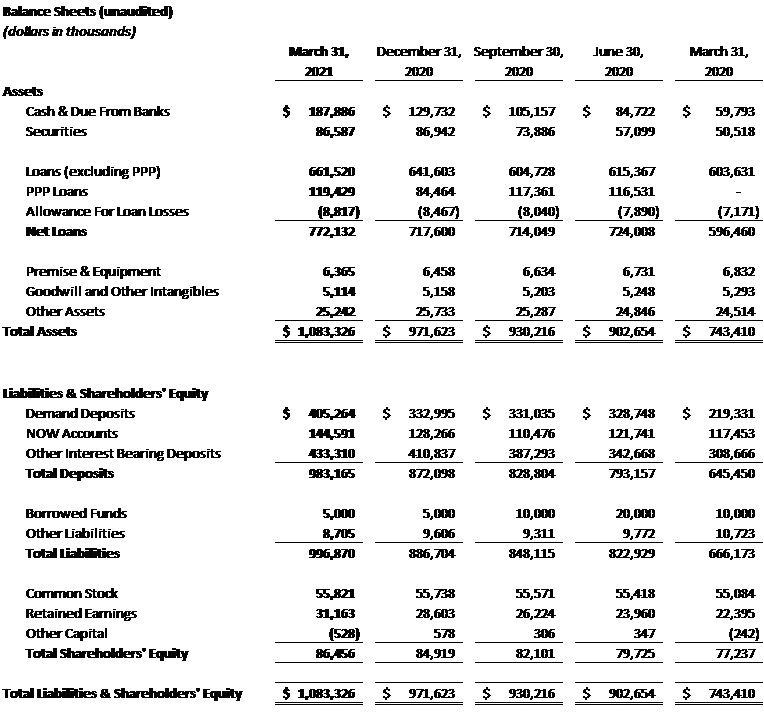

How Patriot Bank’s Savings Rates Compare

Patriot BankNational AverageCompare Offers

Patriot Bank charges customers above-average fees compared to the average U.S. bank. Patriot Bank’s checking account has a monthly fee of $5.00, rating it fair for anyone looking for a hassle-free account. For those who will need cash in a pinch, it is ideal because it has no out-of-network ATM fees. Additionally, at $36.00, Patriot Bank has a slightly steeper overdraft fee compared to the national average overdraft fee. Patriot Bank unfortunately doesn’t refund out-of-network ATM fees, which means you will be required to find a Patriot Bank ATM or eat the ATM charge.

Patriot Bank is a brick-and-mortar bank, with 10 total branches in Connecticut and New York. With mobile and web apps, Patriot Bank makes mobile banking convenient, even on the go. Patriot Bank receives reasonably satisfactory feedback from customers for its mobile app. Out of 33 ratings on Apple and Android platforms, the Patriot Bank mobile app is scored at 4.3 out of 5 . You can utilize Patriot Bank’s mobile app to control your bank accounts by looking at account balances, transferring funds as well as accessing customer service. Patriot Bank gets an excellent consumer satisfaction score due to comparatively few complaints brought to the Consumer Financial Protection Bureau , a government-sponsored consumer protection agency.

Texas Ratio Analysis

No Monthly Fee Low Minimum Deposit

Banking fees can hinder your savings progress.

The more you pay in fees, the less of your interest you get to keep each month. High fees mean even the highest APY loses some of its luster.

Fortunately, you’ll pay no fees to open a Patriot Bank money market deposit account through SaveBetter. This is because of how SaveBetter structures its fees.

Banks can join the SaveBetter network to attract customers to their deposit accounts. This usually means offering a much higher rate than you’d get if you were to open an account directly with the bank.

SaveBetter charges the banks a fee to promote these accounts. But consumers pay nothing to use the platform and they get some of the best rates in the bargain.

You’ll need just $1 to open a Patriot Bank money market account with SaveBetter. That means it’s easy to get started with very little money.

You May Like: Patriot P5 Electric Fence Charger

Money Market Accounts Vs Money Market Funds

While their names are similar, money market accounts and money market funds are different products.

Money market accounts are offered by banks or credit unions, and theyre insured by the FDIC or NCUA for up to $250,000. Meanwhile, money market funds are offered by brokers and do not come with FDIC insurance.

How Do I Open An Account

Want to work with Patriot Bank? Start with the Apply Now button.

Select the account you wish to open. When ready, youll be asked to provide the following information:

- Social Security Number or Individual Taxpayer Identification Number

- A government-issued ID

- Bank account information to cover the opening deposit.

The application should take just a few complete online.

Don’t Miss: American Made Patriotic T Shirts

Money Market Accounts Vs Certificates Of Deposits

Money market accounts are designed to be accessible, while CDs are longer-term investments. With a CD, you agree to let your money sit for a set period of time, getting a fixed interest rate in return. If you withdraw early, you may be penalized.

Money market accounts are liquid, but they come with variable interest rates that are sometimes lower than CDs.

Fx Booths And Exchange Kiosks In Richmond Hill

Some of the currency exchange kiosks that can be found in the Richmond Hill area include Calforex Currency Exchange, Persica Currency Exchange, and International Currency Exchange. Calforex Currency Exchange and International Currency Exchange are both located in malls, so they may be convenient places to visit for international currency exchange in Richmond Hill. Dont expect the best prices here either, but at least you can get international money in physical cash fast. These chain franchises are great options if youre only transacting small amounts, such as a few hundred dollars or less.

Recommended Reading: Patriot Mobile Coverage Vs Verizon

Does My Savebetter Account Have Deposit Insurance

The short answer is yes!

For SaveBetter customers who hold savings products offered by one of our partner banks, funds are insured by the FDIC up to the maximum amount in accordance with and as permitted by law at each bank holding their funds. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per account ownership category. Ownership categories as defined by the FDIC include single bank accounts and joint bank accounts . Revocable trust accounts and some types of retirement accounts are among the other ownership categories covered by FDIC insurance. All deposits you have at a bank â whether facilitated through SaveBetter or otherwise â count toward the deposit insurance limit. If funds held at a bank in a certain ownership category exceed the coverage limit, then the amount in excess of the limit will not be insured.

If you hold a savings product offered by one of our partner credit unions â making you a member of the institution â funds are insured by the NCUA through its Share Insurance Fund. According to the NCUA, each credit union member has at least $250,000 in total coverage. The Share Insurance Fund insures individual accounts up to $250,000. Additionally, a memberâs interest in all joint accounts combined is insured up to $250,000.

How Does Patriot Bank Compare

Although the rates offered by Patriot Bank are good, you can find more attractive APYs elsewhere.

If you are looking to maximize your APY, then Patriot Bank is likely not the best option. Take a look at our list of the top high yield checking accounts to see which bank suits your needs best.

Or check out this quick comparison below:

| Header |

|---|

Don’t Miss: Where Are The Patriots Playing

Can I Link My Savebetter Account Or Selected Savings Product To A Third

You cannot currently link your SaveBetter account to a third-party app, but we may offer this feature in the future. For now, you will not be able to link your selected savings product to a third-party app even if the bank or credit union offering that product does so outside of the SaveBetter platform.

Get 400% Apy In Our Digital Money Market Account

Earn 19x the national average2 while keeping your funds liquid for whatever you need, whenever you need it. Give yourself a gift open your Digital Money Market account today, and experience the Republic Bank advantage for yourself.

Great question. Were a family-owned bank, and weve been dedicated to serving our clients since our first branch opened in 1964. Over the years, weve expanded our financial services, reinvested in our communities, and have grown to 19 locations throughout Chicagoland.

While our branches may only be in the Midwest, we embrace innovation, entrepreneurship, and hard work regardless of where you live. And the exceptional service we provide knows no geographic boundaries.

If youre in a jam and need unbiased advice, weve got your back.

Our point? You can count on us to work hard for you.

Opening your account online should only take 5 minutes. Youll need:

- Social Security Number

- Drivers License or State ID

- Opening Deposit via ACH

Need help? Call us at 800-526-9127. Were available Monday through Friday, 7:00am 6:00pm, and on Saturday from 8:00am 1:00pm.

At the end of the application process, you can fund your account with any amount from $2,500 to $75,000.

Once your Digital Money Market account is open, you can deposit additional funds via check or wire transfer. Youll need your new account number and our routing number, which is 071001180.

Recommended Reading: Did Republicans And Democrats Switch Names

Borrowing With Patriot Bank

As mentioned, Patriot Bank also offers a number of different loan options. Some of the ways you can borrow include:

- Small business loans

Qualification requirements, borrowing limits, interest rates, and repayment terms vary for each type of loan. Patriot Bank also offers personal lines of credit and overdraft lines of credit. The overdraft line can be attached to a Patriot Bank checking account to help you avoid overdraft fees.

Patriot Bank Money Market Deposit Account: 400% Apy

If youre looking for a new savings account available nationwide, Patriot Bank Money Market Deposit Account is offering you 4.00% APY powered by SaveBetter.com.

Below is all the information you need to earn the competitive rate on your funds when you open a Patriot Bank Money Market Deposit Account.

Recommended Reading: Patriot Solar Powered Portable Generator 1500

Online Independent Fx Brokers

If you are exchanging over $5,000 worth of Canadian dollars, using a specialized currency exchange broker is the absolute cheapest way to exchange Canadian to US dollars. KnightsbridgeFX is a leader in the Canadian currency exchange space, making it the best place for dollar to dollar conversions in the GTA.

Best Money Market Accounts

Online banks have higher money market rates. They have less overhead, so they’re able to offer higher interest rates and less fees. You can still conduct all your business through free online and mobile banking.

We narrowed down the best money market savings account for different needs below.

Read Also: Has Trump Improved The Economy

How To Choose The Best Money Market Account For You

Before getting started, you might want to sit down and think about why you want a money market account and what you hope this will help you achieve. You might also want to consider how much money you can set aside, as thatll also influence which account is best for you.

While the accounts with the most competitive rates might seem like the best ones, this is not always the case. The truth of the matter is that choosing the best one is not always a straightforward affair.

In this section, we will be covering some of the most important aspects of MMAs. None of these things are necessarily good or bad, but they can put extra strain on your finances depending on how you want to use the account.

Benefits Of A Patriot Bank High

Like many other banks, Patriot Bank gives you the option to open a joint money market account. Youll also get these perks.

- Attractive APY. Earns an impressive 4% APY on your entire balance.

- Low opening deposit. Open an account with only $1.

- No fees. This account doesnt cost a thing to open or maintain, so you can just sit back and let your money grow.

Don’t Miss: Is There Any Republicans Running For President Besides Trump