The Us Trustee Or Bankruptcy Administrator

The U.S. trustee plays a major role in monitoring the progress of a chapter 11 case and supervising its administration. The U.S. trustee is responsible for monitoring the debtor in possession’s operation of the business and the submission of operating reports and fees. Additionally, the U.S. trustee monitors applications for compensation and reimbursement by professionals, plans and disclosure statements filed with the court, and creditors’ committees. The U.S. trustee conducts a meeting of the creditors, often referred to as the “section 341 meeting,” in a chapter 11 case. 11 U.S.C. § 341. The U.S. trustee and creditors may question the debtor under oath at the section 341 meeting concerning the debtor’s acts, conduct, property, and the administration of the case.

In North Carolina and Alabama, bankruptcy administrators perform similar functions that U.S. trustees perform in the remaining forty-eight states. The bankruptcy administrator program is administered by the Administrative Office of the United States Courts, while the U.S. trustee program is administered by the Department of Justice. For purposes of this publication, references to U.S. trustees are also applicable to bankruptcy administrators.

805-258-0080 for Bankruptcy Help in Ventura.

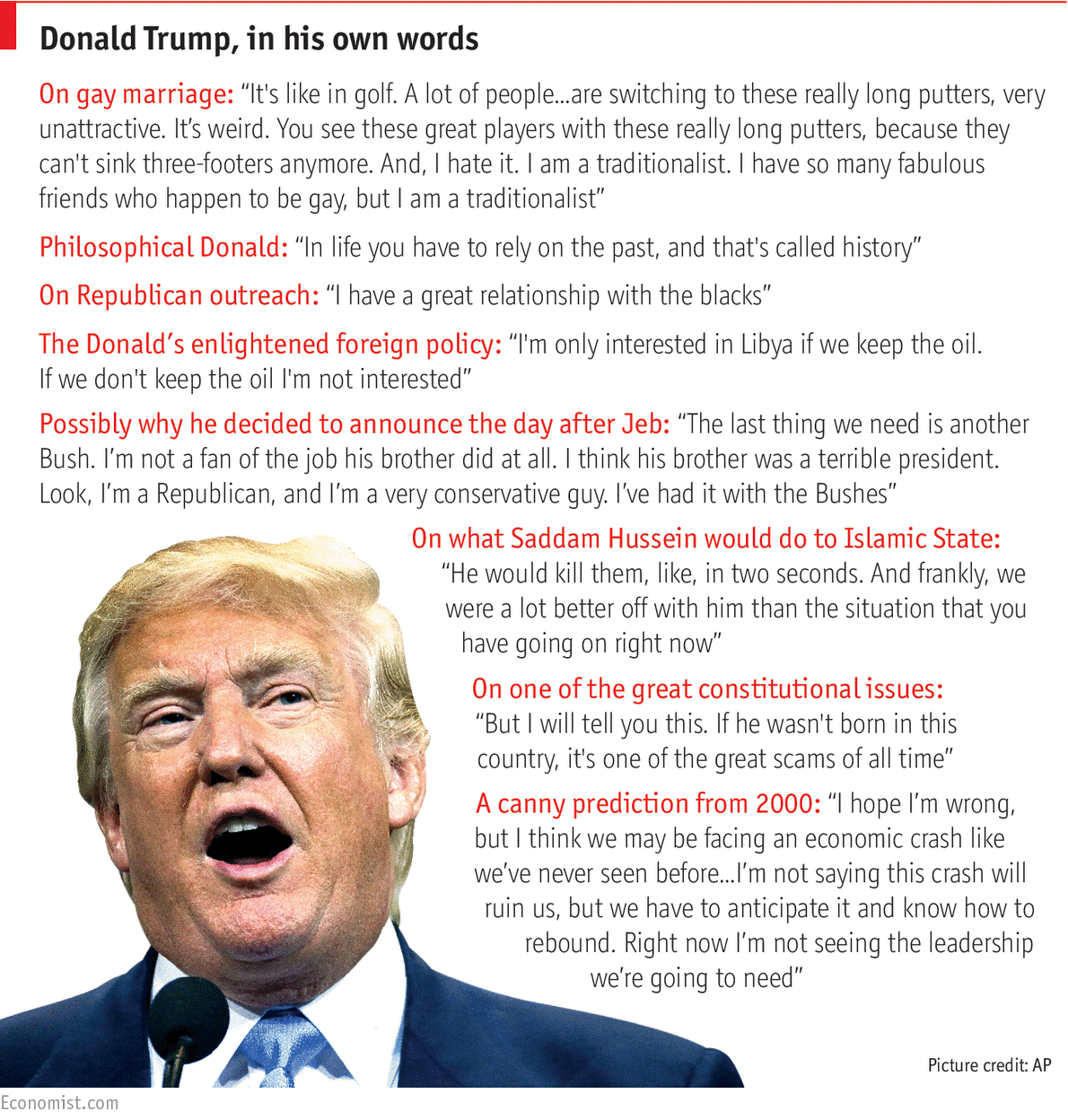

Donald Trump Speaks The Truth

I never thought I’d write this, but Donald Trump speaks the truth, at least as far as bankruptcy is concerned.

There’s plenty to criticize regarding Donald Trump, but I really wish the media would back off the bankruptcy angle of his career, or at least be smarter about it.

In any event, Trump’s response about his companies’ bankruptcy filings is “what’s the big deal? I took advantage of the law. So do lots of people.”

You know what? He’s right. Bankruptcy is a background term to every contract. It’s an embedded option. Lenders price for it. This is old news to bankruptcy scholars, even if it still shocks some people. Trump had every right to file his companies for bankruptcy, and no one should weep for his lenders having lost money. They were sophisticated parties , who presumably priced for Trump’s bankruptcy risk and had diversified portfolios. Frankly, Trump would be a fool if he hadn’t filed for bankruptcy.

What ticks me off about the media questioning is that it suggests that Trump’s move of “taking advantage of the Chapters” imputs some sort of moral turpitude, while an entire business modelprivate equitythat is often touted as a pinnacle of American ingenuity is built on the idea of “heads I win, tails bankruptcy”. That’s the story of the leveraged buyout. Is that gamble really any different from Trump’s? Leveraged gambling seems to be the story of America.

How The Bankruptcy Laws Helped Donald Trump Stay Rich

We have all heard Donald Trump talk, a lot, during this Republican presidential campaign, and, in the debates, many of his challengers, and the debate moderators, criticized him about his four bankruptcies. Yes, 4 bankruptcies! Take a look at this article, that shows a few things that Donald Trump got right about Bankruptcy.

First question: how can he file for bankruptcy and still be so rich? The answer is that he didnt file personal bankruptcy, he filed corporate bankruptcy. This means that when his business was struggling to pay its creditors, he would reorganize his debts in a Chapter 11 case, to essentially cut deals with his creditors to pay them less money, and still allow his company to function. He remained rich because, even though he lost money as the value of his companies went down, he didnt have his own personal assets on the line. He didnt have to sign any personal guarantees on the loans for the companies. So, while his companies had to go into Bankruptcy Court to restructure his debts, he didnt have to do that. Can you or I do that? Not likely, because for banks, small business owners dont have a track record that allows them to have so many other successful businesses, or the name recognition of Donald Trump, so we have to sign personally on our business loans. And, if the typical small business goes south, most likely, that business owner have to consider personal Chapter 7 or Chapter 13 bankruptcy.

Daniel J. Winter

Also Check: Patriots Point Apartments Concord Nc

Who Can File A Plan

The debtor has a 120-day period during which it has an exclusive right to file a plan. 11 U.S.C. § 1121. This exclusivity period may be extended or reduced by the court. But in no event may the exclusivity period, including all extensions, be longer than 18 months. 11 U.S.C. § 1121. After the exclusivity period has expired, a creditor or the case trustee may file a competing plan. The U.S. trustee may not file a plan. 11 U.S.C. § 307.

A chapter 11 case may continue for many years unless the court, the U.S. trustee, the committee, or another party in interest acts to ensure the case’s timely resolution. The creditors’ right to file a competing plan provides incentive for the debtor to file a plan within the exclusivity period and acts as a check on excessive delay in the case.

We Are Watching Trumps 7th Bankruptcy Unfold

Donald Trump was a businessman who ran six businesses that went bankrupt because they couldnt pay their bills. Trump, who is running for president again, repeats some of his business mistakes and risks the demise of another venture: his political operation.

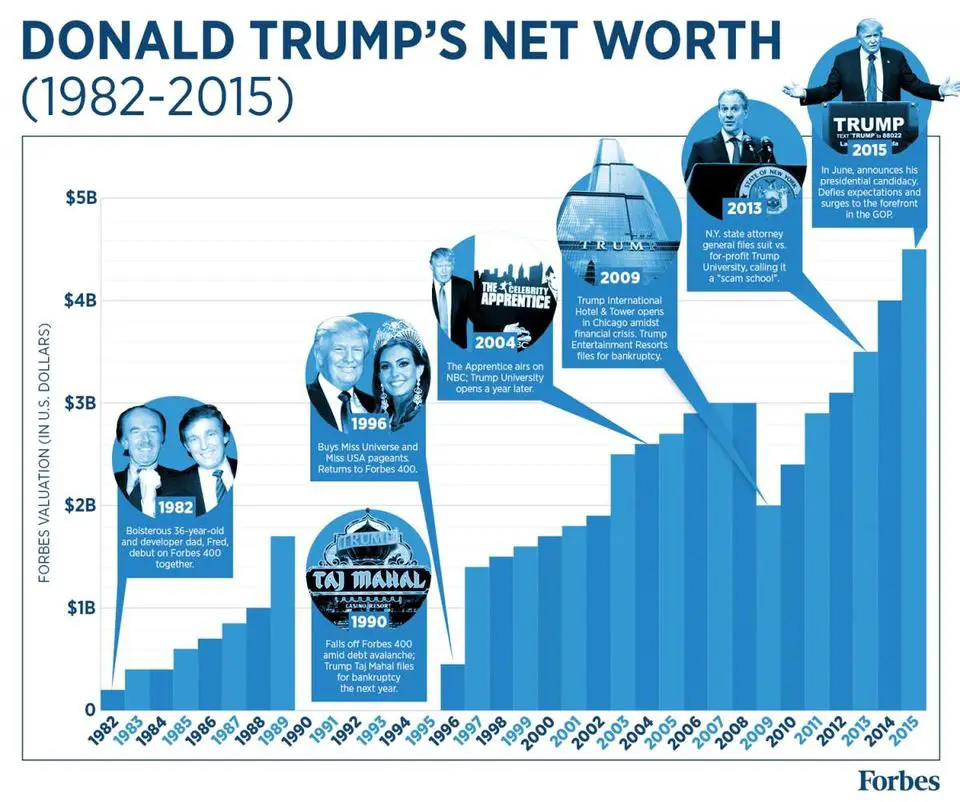

Trump, a charismatic real-estate investor and swashbuckler in the 1980s, bet big on Atlantic Citys rise after New Jersey legalized gaming. Trump acquired three casinos that couldnt pay off their debts by 1991. In 1991, the Taj Mahal, Trump Plaza and Trump Castle declared bankruptcy.

Trump transferred his casino assets to a new company, which went bankrupt in 2004 after the lenders restructured the debt. In 2009, the company that emerged from this restructuring declared bankruptcy. Trumps sixth bankruptcy was the Plaza Hotel which he purchased in 1988. It was declared bankrupt in 1992.

Trumps 2016 surprise win mirrors the 30-year-old arrival of Atlantic Citys brash young man. Trumps presidency is now in its fourth year. He gets poor marks from voters for his handling of the coronavirus crisis. The outbreak exacerbated this at Trumps White House.

Democrat Joe Biden is winning in most swing states, and an Election Day blowout could be possible. Trump has suggested he wont leave office if he loses, threatening a constitutional crisis and political legacy.

Trumps bankruptcies are an essential reason for the Trump campaigns current turmoil.

These are five similarities:

Don’t Miss: Best Western Patriots Point Mount Pleasant

Trump Castle Associates 1992

In less than a year he was back in bankruptcy court for his other Atlantic City casinos. This bankruptcy included the Trump Plaza Hotel in New York, the Trump Plaza Hotel and Casino in Atlantic City as well as the Trump Castle Casino Resort. He gave up half his interest in the New York Plaza to Citibank, but retained his stake in the casinos.

The Single Asset Real Estate Debtor

Single asset real estate debtors are subject to special provisions of the Bankruptcy Code. The term “single asset real estate” is defined as “a single property or project, other than residential real property with fewer than four residential units, which generates substantially all of the gross income of a debtor who is not a family farmer and on which no substantial business is being conducted by a debtor other than the business of operating the real property and activities incidental.” 11 U.S.C. § 101. The Bankruptcy Code provides circumstances under which creditors of a single asset real estate debtor may obtain relief from the automatic stay which are not available to creditors in ordinary bankruptcy cases. 11 U.S.C. § 362. On request of a creditor with a claim secured by the single asset real estate and after notice and a hearing, the court will grant relief from the automatic stay to the creditor unless the debtor files a feasible plan of reorganization or begins making interest payments to the creditor within 90 days from the date of the filing of the case, or within 30 days of the court’s determination that the case is a single asset real estate case. The interest payments must be equal to the non-default contract interest rate on the value of the creditor’s interest in the real estate. 11 U.S.C. § 362.

Recommended Reading: How Many Republicans Voted For Obamacare In 2008

What You Need To Know About The 45th President Of The United States

Donald Trump is a wealthy businessman, entertainer, real estate developer and president-elect of the United States whose political aspirations made him one of the most polarizing and controversial figures of the 2016 election. Trump ended up winning the election against all odds, defeating Democrat Hillary Clinton, and took office on Jan. 20, 2017.

Trumpâs candidacy for the White House began amid the largest field of presidential hopefuls in 100 years and was quickly dismissed as a lark. But he won primary after primary and quickly became the most unlikely presidential front-runner in modern political history, vexing the pundit class and his opponents alike.

He ran for reelection in 2020 against Democrat Joe Biden. After losing both the popular and electoral votes, Trump refused to accept the results of the election and mounted several campaigns in court and in the media to promote his claims. He joins the list of one-term presidents, the most recent of whom was fellow Republican George H.W. Bush.

You May Like: What Are Trumpâs Poll Numbers Now

Fact Checking: Donald Trump Has Filed Bankruptcy Six Times

The Differences Between Bankruptcies: Chapters 7, 11, and 13

Recently, I met a prospective client with over $30,000.00 in medical debt. She lives with her one minor child and her annual household income around $40,000.00. She can pay her basic bills, but the massive medical debt is a different story. The collection phone calls are picking up and her stress level is beginning to affect her health. This same woman filed for Chapter 7 bankruptcy relief 6 years ago following a job loss, meaning that she would not be eligible for another Chapter 7 bankruptcy filing for 2 more years. She looks at me and says If our President can file bankruptcy whenever he gets into a pinch, why do I have to suffer for 2 more years? She recalled a news story saying that President Trump had filed bankruptcy at least four times prior to becoming our U.S. President.

Fact Checking: Has Donald Trump filed for bankruptcy relief 4 or 6 times?

Lets do some fact checking about how many times Donald Trump has filed for bankruptcy protection and why there is some debate over this number. During the 2016 presidential campaign, Hillary Clinton correctly pointed out that Donald Trump had filed bankruptcy 6 times. Here is a quick breakdown of the six Chapter 11 bankruptcy filings by companies owned by Donald Trump. All six of Donald Trumps bankruptcy filings were prior to him becoming our current U.S. President.

Don’t Miss: Walker’s Patriot Series Electronic Ear Muffs

Despite Holding Huge Assets Trump Needs Money More Than His Presidential Predecessors Ever Did But He Faces Multiple Barriers Of His Own Making

Find your bookmarks in your Independent Premium section, under my profile

Find your bookmarks in your Independent Premium section, under my profile

As Trump knows only too well, lawyers are expensive

What next for Donald Trump? World leaders dont, as a rule, go hungry upon leaving office. There are positions on corporate boards to take up, lucrative speaking engagements to be booked, handsome advances for books even if they dont sell quite as well as expected . The consulting opportunities are endless, as Tony Blair has proved. Theyre not always terribly savoury but that usually merits only passing attention.

Trump, however, is in the difficult position of needing the money more than any of his predecessors did, despite holding huge assets. He also faces barriers of his own making the insurrection he fomented the most obstructive of all to at least some of the perks former presidents typically enjoy. Many of the people who welcomed George W Bush and cut him a cheque when he wasnt painting wont want to associate with Trump.

His legal problems, meanwhile, are just beginning and legal experts consider the idea of Trump preemptively pardoning himself a non-starter. Besides, this would only cover federal, and not state, offences.

The New Jersey Generals

Service rendered: Football

Years in business: 2

What went wrong: Since Trump couldnt buy an NFL team of his own, he settled on the next best thingthe short-lived United States Football League established to challenge the NFL. Realizing he had a million other projects on his plate, though, Trump quickly sold the team only to buy them back again in the very same year.

Things only got worse from there, according to Business Insider, The team folded one year later, in 1985, along with the entire USFL. People blamed Trump for the demise of not only the team, but the entire league. Allegedly, he was trying to pull the Generals into the NFL and made poor investment decisions in the process.

Talking about the ordeal now, Trump notes that he did something I rarely do with the USFL. I went into something that was not good. As rare as every single endeavor on this list.

Recommended Reading: Republican View On Student Loans

Trump Contractors: ‘it Was The Beginning Of The End For Us’

Trump takes umbrage at the idea that he went bankrupt, always pointing out that he never filed personally and that he used the bankruptcy laws to get richer.

Connolly said taking his casinos into Chapter 11 was “reasonable and responsible” and the right decision for Trump and his bondholders.

“It looked like a fair deal and actually kept them going,” Connolly said.

But Mike D’Antonio, author of the book “Never Enough: Donald Trump and the Pursuit of Success,” said the bankruptcies shouldn’t come with bragging rights.

“Donald likes to say his bankruptcy filings were just a tool he’s been using for his businesses,” D’Antonio said. “He’s had a string of failures. And you’re not just talking about big investors. You’re also taking about bond holders, not big banks…people who invested their retirements.

“So, you can call it a legal tool that he’s using, but lots of people have been hurt along the way. Its been a badge of shame for him.”

About Cibik Law Law Firm

Our company is in the business of offering debt relief to our clients. Bankruptcy often includes shame, fear, and anxiety. We understand how you feel because we have helped so many in getting through what is a stressful time. We know how to confront the issues involved in individual and small business consumer bankruptcy, here in Philadelphia and surrounding areas.

Our most important desire to share our compassion and respect with you, our clients. Our lawyers are well-versed in providing bankruptcy services which include:

- Mortgage foreclosure assistance

- Medical debt cases

- Small business bankruptcy claims

When you call us, we will make an appointment for a free consultation if you are considering bankruptcy. Our no-pressure environment will allow you to share with us your financial situation, your options, and come up with the right solution for you. Once we have met, we will guide you in the areas of:

- The types of bankruptcy

Read Also: Will Any Republicans Vote To Remove Trump

The Six Trump Company Bankruptcies

Donald Trump has made huge sums of money in his lifetime, but heâs also lost astronomical amounts. Between 1990 and 1994, for instance, Trumpâs businesses lost more than $804.4 million, even while similar companies saw profits. During that time, and throughout his career, Trump has strategically used bankruptcy to keep himself and his businesses afloat.

Trump-owned businesses have filed for bankruptcy six times so far. Each time, the bankruptcies freed Trump from debt and allowed him to start his next venture. He famously went on to occupy one of the worldâs most powerful positions: President of the United States.

Trump Entertainment Resorts 2009

His most recent bankruptcy came in 2009, after the company missed a $53.1 million bond payment. That was pretty much the end of the road for Trump in Atlantic City. While his name remained on three casinos, he resigned from the board and gave up his remaining stake in the company.

“I had the good sense, and I’ve gotten a lot of credit in the financial pages, seven years ago I left Atlantic City before it totally cratered,” he said during the debate.

The two Atlantic City casinos that still had the Trump name filed for bankruptcy yet again in 2014. At the time Trump made sure people knew he was no longer running the company, and sued to have his name removed.

Don’t Miss: Where To Stream Patriots Day

Used Little Of Own Money

The New York Times, which conducted an analysis of regulatory reviews, court records, and security filings, found otherwise, however. It reported in 2016 that Trump “put up little of his own money, shifted personal debts to the casinos and collected millions of dollars in salary, bonuses, and other payments.

“The burden of his failures,” according to the newspaper, “fell on investors and others who had bet on his business acumen.”

Examining Donald Trumps Chapter 11 Bankruptcies

personal bankruptcyFact-checking claims about Donald Trumps four bankruptcies.Chapter 7Chapter 13Joel R. Spivack Esq. is an experienced bankruptcy attorney who specializes in helping individuals through personal bankruptcy. Contact him today to help you explore your legal options so that you can move on with your life and make a fresh financial start. Examining Donald Trumps Chapter 11 BankruptciesSpivack Law

Read Also: Are Republicans Or Democrats Better For Small Business

‘keep The Donald Afloat’

” could have simply taken everything he had right then, but they wanted his cooperation,” said Lynn LoPucki, a bankruptcy expert and professor at UCLA Law School. “There’s that old saying, ‘If you owe your banks a little, you’re at their mercy. If you owe the banks a lot, the banks are at your mercy. They saw the best way for him to repay the money was to keep the Donald afloat.”

The Donald struck a deal with the banks to hand over half his ownership, and half of the equity, in the casino in exchange for a lower interest rate and more time to pay off his debt. He sold off his beloved Trump Princess yacht and the Trump Shuttle airplane to make his payments, and his creditors put him on a budget, putting a cap on his personal spending.

“The first one was a really big hit for him. They had him personally, and he ended up taking substantial losses in that bankruptcy. He also had the humiliation of having some bankers deciding how much money he could spend — the numbers are just astonishing — the amount of his monthly budget,” LoPucki said.

John Pottow, a bankruptcy expert and law professor at the University of Michigan, said banks would often agree to lose millions in reorganizations like Trump’s to prevent the massive losses they would incur if they foreclosed on the property.

“Banks will take considerable haircuts,” Pottow said. “It’s sort of like you have a sick patient so you cut off a couple toes to stop the gangrene. Now he’s missing a few toes, but he’s still alive.”