The Debt To Gdp Ratio Is The Highest It’s Been Since World War Ii

Federal debt held by the public as a percentage of gross domestic product since 1900.

Falling deeper into the red is the opposite of what Trump, the self-styled King of Debt, said would happen if he became president. In a March 31, 2016, interview with Bob Woodward and Robert Costa of The Washington Post, Trump said he could pay down the national debt, then about $19 trillion, over a period of eight years by renegotiating trade deals and spurring economic growth.

After he took office, Trump predicted that economic growth created by the 2017 tax cut, combined with the proceeds from the tariffs he imposed on a wide range of goods from numerous countries, would help eliminate the budget deficit and let the U.S. begin to pay down its debt. On July 27, 2018, he told Sean Hannity of Fox News: We have $21 trillion in debt. When this really kicks in, well start paying off that debt like its water.

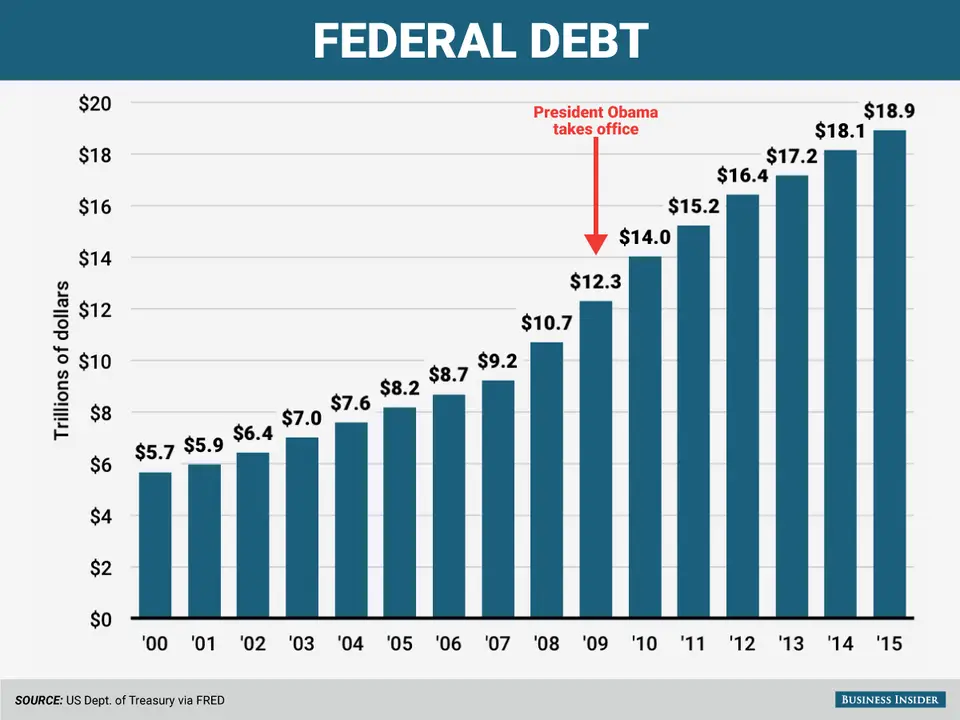

Nine days later, he tweeted, Because of Tariffs we will be able to start paying down large amounts of the $21 trillion in debt that has been accumulated, much by the Obama Administration.

Thats not how it played out. When Trump took office in January 2017, the nonpartisan Congressional Budget Office was projecting that federal budget deficits would be 2% to 3% of our gross domestic product during Trumps term. Instead, the deficit reached nearly 4% of gross domestic product in 2018 and 4.6% in 2019.

The National Debt Increased 39 Percent During Trumps Presidency

By December 21, 2020, with just a few weeks left in Trumps one-term presidency, the national debt had climbed to $27.76 trilliona 39-percent jump from the $19.95-trillion debt the country had four years prior when this self-described king of debt was sworn into office.

Although most of the deficit increase resulted from the COVID-19 pandemic, but the pre-pandemic debt amount had already made for a national debt crisis and a grave threat to our economic and societal prosperity in the words of Trumps own administration.

Tracking The Federal Deficit: July 2019

The Congressional Budget Office reported that the federal government generated a $120 billion deficit in July, the tenth month of Fiscal Year 2019. This makes for a total deficit of $867 billion so far this fiscal year, 27 percent higher than over the same period last year . Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 8 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Increased revenues were driven mostly by a 7 percent increase in payroll taxes due to the strong labor market that has resulted in continued job growth and rising wages. On the spending side, outlays for Social Security, Medicare, and Medicaid increased by a combined 6 percent . Department of Education outlays rose by 79 percent , mostly due to an upward revision to the net subsidy costs of previously issued student loans. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

Read Also: Patriot Lighting Solar Deck Lights

$2000 Stimulus Checks But To Whom

The Biden administration may have a difficult time convincing lawmakers to support $2,000 stimulus checks â a popular idea advocated by both Trump and Senator Bernie Sanders.

Led by Majority Leader Mitch McConnell, many Republicans have opposed $2,000 stimulus checks. Last week, moderate Democrat Senator Joe Manchin initially told the Washington Post he was âabsolutelyâ against $2,000 stimulus checks. He later clarified he could support more checks if they were narrow in scope and targeted for those who need them.

How The Budget Process Works

When discussing presidents and budget deficits, it’s essential to keep some things in mind. First, Congress must approve all spending while a president proposes an annual budget. The president’s power over the budget is never absolute. It can be severely limited if the opposition party holds a majority in either the House of Representatives or the Senate or if they hold the majority in both.

Another thing to know is that “discretionary” spending accounts for only about one-third of the typical U.S. budget. The majority is “mandatory” spending that is dictated by law. The most significant sources of mandatory spending are Medicare and Social Security.

In addition, the federal fiscal year runs from Oct. 1 to Sept. 30. This means that during a new president’s first year in office, the budget that is in place was passed during their predecessor’s term. However, incoming administrations can request additional spending upon taking office.

Don’t Miss: Patriot 8500 Diesel Welder Generator

Tracking The Federal Deficit: January 2022

The Congressional Budget Office estimates that the federal government ran a surplus of $119 billion in January 2022, the fourth month of fiscal year 2022. Januarys surplus was the first recorded since September 2019, and it was the difference between $467 billion in revenues and $348 billion in spending. In comparison, last January, the federal government ran a $163 billion deficit. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted some payments that would have normally been due at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a smaller monthly surplus in January 2022 of $95 billion.

Analysis of notable trends: In the first four months of FY2022, the federal government ran a deficit of $259 billion, $477 billion less than at this point in FY2021. It is noteworthy, however, that the cumulative deficit for FY2022 thus far compares favorably to that of FY2020 , prior to the onset of COVID-19.

Notably, net interest on the public debt rose 22% to $140 billion for the fiscal year to date, primarily reflecting the impact of rising inflation on adjustments to the principal of inflation-protected securities.

Economic Impact Of Trade Policies

In January 2020, the Congressional Budget Office explained how tariffs reduce U.S. economic activity in three ways: 1) Consumer and capital goods become more expensive 2) Business uncertainty increases, thereby reducing or slowing investment and 3) Other countries impose retaliatory tariffs, making U.S. exports more expensive and thus reducing them. CBO summarized the economic impact of Trump’s tariffs as follows:

- âIn CBO’s estimation, the trade barriers put in place by the United States and its trading partners between January 2018 and January 2020 would reduce real GDP over the projection period .

- The effects of those barriers on trade flows, prices, and output are projected to peak during the first half of 2020 and then begin to subside.

- Tariffs are expected to reduce the level of real GDP by roughly 0.5 percent and raise consumer prices by 0.5 percent in 2020.

- As a result, tariffs are also projected to reduce average real household income by $1,277 in 2020.

- CBO expects the effect of trade barriers on output and prices to diminish over time as businesses continue to adjust their supply chains in response to the changes in the international trading environment. By 2030, in CBO’s projections, the tariffs lower the level of real GDP by 0.1 percent.â

You May Like: Who Is More Educated Democrats Or Republicans

Tracking The Federal Deficit: June 2020

The Congressional Budget Office reported that the federal government ran a deficit of $864 billion in June, the ninth month of fiscal year 2020. This monthly deficit is more than 100 times larger than last Junes deficit of $8 billion. This difference came from a sizable drop in revenues, which were down 28% from last June , and especially from a massive increase in outlays, up 223% from last June . The budget deficit so far this fiscal year has surged to $2.7 trillion, $2 trillion more than at the same point last year. As exemplified by June, the cumulative difference stems from a drop in revenues13% lower than at the same point last yearand a much bigger leap in outlays49% higher than at this time last year.

The drop in revenue between last June and this one was due almost entirely to the administration delaying the deadline for quarterly tax payments from June 15 to July 15. Monthly revenue was down $93 billion compared to a year ago, of which $43 billion came from delaying corporate tax payments while $42 billion came from delaying individual and payroll tax payments. CBO expects most of this delayed revenue to eventually be collected, although some will be lost as businesses fail before the new payment deadlines.

Economic Policy Of The Donald Trump Administration

| This article is part of a series about |

The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act , trade protectionism, immigration restriction, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.

Over his term, Trump reduced federal taxes and increased federal spending, both of which significantly increased federal budget deficits. The positive economic situation he inherited from the Obama administration continued, with a labor market approaching full employment and measures of household income and wealth continuing to improve further into record territory. Trump also implemented trade protectionism via tariffs, primarily on imports from China. During Trump’s first three years in office, the number of Americans without health insurance increased by 4.6 million , while his tax cuts were projected to worsen income inequality.

Don’t Miss: How Many Times Did Republicans Investigate Hillary

Drawback Of Measuring Debt By President

Neither of the techniques mentioned above is a very accurate way to measure each president’s impact on the national debt because the president doesn’t have much control over the national debt during their first year in office.

For example, President Donald Trump took office in January 2017. He submitted his first budget in May. It covered the 2018 fiscal year, which didn’t begin until October 1, 2017. Trump operated the first part of his term under President Barack Obama’s budget for fiscal year 2017, which ended on Sept. 30, 2017.

While the time lag may make it seem confusing, Congress intentionally sets it up this way. An advantage of the federal fiscal year is that it gives the new president time to put together their budget during their first months in office.

How Did The National Debt Increase

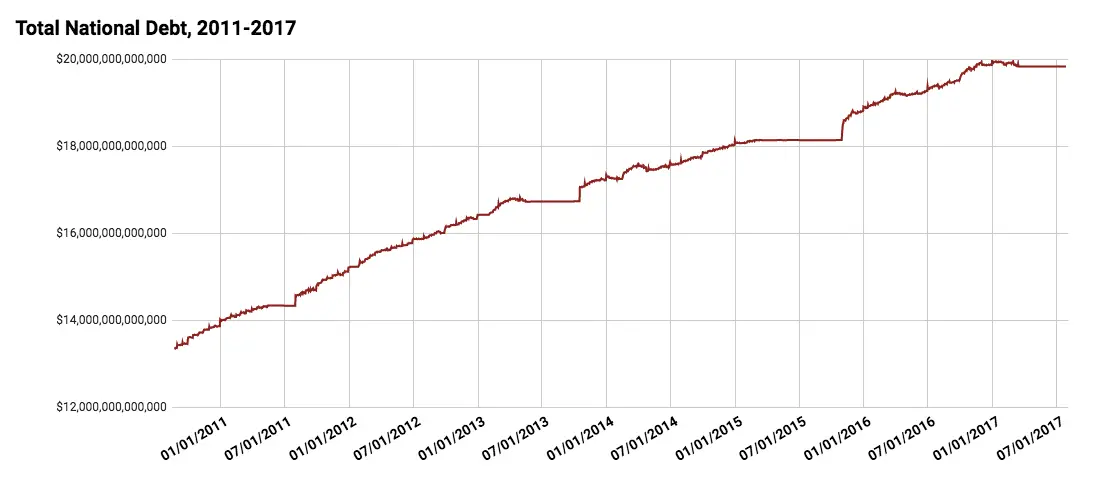

At first it seemed that Trump was lowering the debt. It fell $102 billion in the first six months after he took office. The debt was $19.9 trillion on Jan. 20, the day Trump was inaugurated. It was $19.8 trillion on July 30, thanks to the federal debt ceiling.

Trump signed a bill increasing the debt ceiling on Sept. 8, 2017. The debt exceeded $20 trillion for the first time in U.S. history later that day. Trump signed a bill on Feb. 9, 2018, suspending the debt ceiling until March 1, 2019. The total national debt was at $22 trillion by February 2019. Trump again suspended the debt ceiling in July 2019 until after the 2020 presidential election.

The debt hit a record $27 trillion on Oct. 1, 2020 before reaching further peaks in 2021 that caused Congress to act again to raise the debt limit in December.

Trump oversaw the fastest increase in the debt of any president, almost 36% from 2017 to 2020.

Don’t Miss: My Patriot Supply Vs Legacy

Tracking The Federal Deficit: August 2019

The Congressional Budget Office reported that the federal government generated a $200 billion deficit in August, the eleventh month of Fiscal Year 2019. This makes for a total deficit of $1.067 trillion so far this fiscal year, 19 percent higher than over the same period last year. Total revenues so far in FY 2019 increased by 3 percent , while spending increased by 7 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Trends in the major categories of revenue and spending continued from previous monthscompared to last year, individual income and payroll taxes collectively rose by 3 percent , while spending for the largest mandatory programs collectively increased by 6 percent . Revenues from customs duties increased by 72 percent , primarily due to new tariffs imposed on certain imports from China. Estate tax revenue decreased by 25 percent due to the 2017 tax cuts which doubled the value of the estate tax exemption. Additionally, Fannie Mae and Freddie Mac remitted $16 billion more in payments to the Treasury this year. Finally, net interest payments on the federal debt continued to rise, increasing by 14 percent versus last year due to higher interest rates and a larger federal debt burden.

The Types Of Presidential Decisions That Impact National Debt

Presidents can have a tremendous impact on the national debt. They can also have an impact on the debt in another presidentâs term. When President Trump took office in January of 2017, for the first nine months of his presidency, he operated under President Obamaâs budget which didnât end until September, 2017. So for most of a new presidentâs first year in office, he isnât accountable for the spending that takes place. As strange as this may seem, itâs actually by design to allow time for the new president to put a budget together when in office.

You May Like: How Many Democrats And Republicans Are In The Us Senate

Biden Releases $58t Budget Claims Deficit Cut Despite Massive Spending

Bidens recent deficit-reduction bragging didnt mention that he wants to increase the deficit even more. Last week, he put taxpayers on the hook for $5.8 billion in debt from people who attended Corinthian Colleges. Now he wants taxpayers to pay hundreds of billions more so other students dont have to pay.

Biden also bragged about a record 6.7 million jobs created last year the most in the first year of any president in American history. But the president didnt create those jobs.

In panic over COVID, governments shut down so many businesses that they raised the unemployment rate to 14.7%. Biden then slowed hiring further by giving non-workers extended unemployment benefits and fat stimulus checks. For many people, that meant they could make as much, or more, collecting unemployment. No wonder they didnt go back to work.

Finally, most benefits have run out, so of course, we have job growth now. Its not because of anything good that Biden did.

Under Biden, Trump and Obama, federal spending almost doubled.

Hope for future spending responsibility is bleak. Bidens 10-year outlook still would rack up $14.4 trillion in deficits, reports Bloomberg. More money gets printed, inflation gets worse and the national debt grows.

Politicians need to make actual cuts to make a difference in our debt.

Budget cuts are needed to give our children hope for a prosperous future. But Biden wont do that.

Biden’s Smaller Budget Deficit

One of Joe Biden’s campaign promises was to reduce the federal deficit, and there’s been progress on the account. The Congressional Budget Office estimates that the federal budget deficit was $475 billion in the first five months of fiscal year 2022, which represented an amount lower than those for the years 2021 and 2020.

“It is less than half the shortfall recorded for the same months of fiscal year 2021 and three-quarters of the deficit recorded in 2020 , just before the start of the coronavirus pandemic,” noted the CBO. The turnaround is due to more robust revenues and fewer expensesâfrom October 2021 through February 2022, revenues were $371 billion higher, and outlays were $201 billion lower than they were during the same period a year ago,” CBO estimates.

Still, the federal budget deficit stands at an estimated $900 billion.

Recommended Reading: Patriot Family Dental El Paso Tx

Tracking The Federal Deficit: February 2020

The Congressional Budget Office reported that the federal government generated a $235 billion deficit in February, the fifth month of fiscal year 2020. Februarys deficit is a $1 billion increase from the $234 billion deficit recorded a year earlier in February 2019. Februarys deficit brings the total deficit so far this fiscal year to $625 billion, which is 15% higher than the same period last year . Total revenues so far in FY2020 increased by 7% , while spending increased by 9% , compared to the same period last year.

Analysis of Notable Trends inThis Fiscal Year to Date: Through the first five months of FY2020, individual income tax refunds fell by 6% , increasing net revenue, as the timing of refund payments varies annually. Customs duties rose by 14% , partly due to tariffs imposed by the current administration, primarily on imports from China. On the spending side, net interest on the public debt increased by 6% even amidst historically low interest ratesbecause the overall debt burden has risen. Outlays for the Department of Veterans Affairs rose by 7% because of rising participation in veterans disability compensation, growing average disability benefits, and increasing spending on a program that helps veterans receive treatment in non-VA facilities.

Tracking The Federal Deficit: March 2019

The Congressional Budget Office reported that the federal government generated a $149 billion deficit in March, the sixth month of Fiscal Year 2019, for a total deficit of $693 billion so far this fiscal year. Marchs deficit is 29 percent less than the deficit recorded a year earlier in March 2018. If not for timing shifts of certain payments, the deficit would have been 9 percent smaller than the deficit in March 2018. Total revenues so far in Fiscal Year 2019 increased by 0.6 percent , while spending increased by 5 percent , compared to the same period last year.

Analysis of Notable Trends this Fiscal Year to Date: Customs duties increased by 86 percent compared to last year. On the spending side, outlays for Social Security, Medicare, and Medicaid increased by a combined 4 percent . Department of Defense spending rose by 9 percent , and net interest payments on the national debt were up by 13 percent , largely due to interest rates on short term debt being substantially higher now than they were during the first half of Fiscal Year 2018.

Read Also: Was Bloomberg Ever A Republican