Gop Tax Law Will Not Pay For Itself

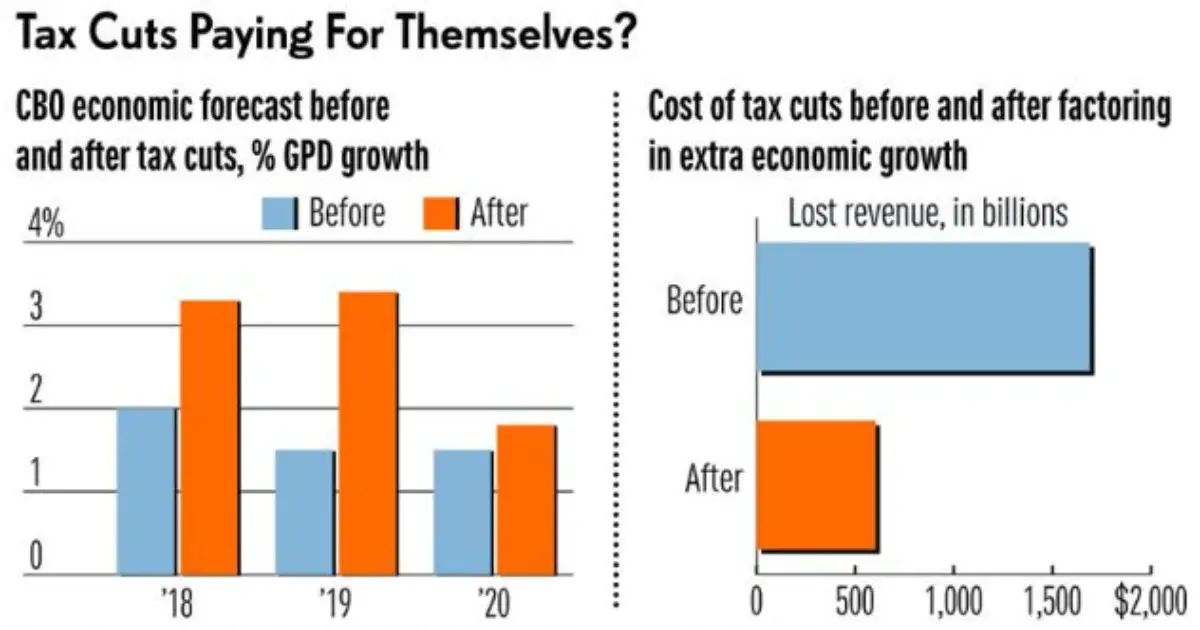

Treasury Secretary Steven Mnuchin claimed that the tax law would not only pay for itself through higher growth, but would reduce the deficit by a trillion dollars. When asked whether these claims were true, Director Hall was unambiguous: No. As his testimony makes clear, the economy isnt likely to grow quickly enough to shrink the budget deficit.

CBO projected that the tax cut will add $1.9 trillion to deficits over 10 years, even after accounting for any growth effects. We are already seeing this play out. The deficit grew 17 percent last year and is projected to grow another 15 percent this year even as the economy grew faster. The idea that tax cuts for the wealthy and corporations would allow us to grow our way out of debt one of Republicans favorite myths has proven incorrect once again.

It Rose Almost $78 Trillion During His Time In The White House Approaching World War Ii Levels Relative To The Size Of The Economy This Time Around It Will Be Much Harder To Dig Ourselves Out

One of President Donald Trumps lesser-known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch.

The national debt has risen by almost $7.8 trillion during Trumps time in office. Thats nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

The growth in the annual deficit under Trump ranks as the third-biggest increase, relative to the size of the economy, of any U.S. presidential administration, according to a calculation by Eugene Steuerle, co-founder of the Urban-Brookings Tax Policy Center. And unlike George W. Bush and Abraham Lincoln, who oversaw the larger relative increases in deficits, Trump did not launch two foreign conflicts or have to pay for a civil war.

Economists agree that we needed massive deficit spending during the coronavirus crisis to ward off an economic cataclysm, but federal finances under Trump had become dire before the pandemic. That happened even though the economy was booming and unemployment was at historically low levels. By the Trump administrations own description, the pre-pandemic national debt level was already a crisis and a grave threat.

California Braces For Trumps Border Wall Hallucination Tour

But the OMB directors answer inadvertently added to the confusion since it turns out he was quoting figures for 2019 to 2028, which applied more directly to his new budget. A review of the scores from a compilation of administration sources clarifies the picture. The 10-year cost of the initial bill passed in December is in fact higher: $2 trillion for 2018 to 2027. For the years, 2019 to 2028, the cost drops to about $1.8 trillion the figure Mulvaney used.

The differences are largely explained by simple math. The costs of the corporate tax cuts are smaller in the out years as some business breaks are schedule to be phased down. And the costs of the tax cuts for this current year, about $174 billion, drop out of the new budget window which begins in 2019.

The good news, for anyone confused, is that once the extensions are factored in these discrepancies fade. The 10-year cost in both cases evens out around $2.3 trillion.

As explained by Mulvaney in his House testimony, one reason the Treasury figures are higher is the departments analysts took a dim view of one of the health care-related offsets which the Congressional Budget Office accepted. This was not entirely a surprise since CBO has seemed conflicted about the merits of those savings. But in the final deliberations, Republicans badly needed the offset to expedite passage.

Nonetheless its not an easy matter to break out the relative weight of these different elements.

- Filed under:

You May Like: Patriot Ceiling Fan Light Kit

Impact Predicted By Other Organizations

In examining the likely impact of the TCJA, other organizations came to dramatically different conclusions about the likely impact of the new tax law. Their analysis predicted increases in the federal debt and deficit.

The Joint Committee on Taxation analyzed the tax cuts alone, independent of the FY 2018 budget. This analysis found that the TCJA wouldincrease the deficit by $1 trillion over the next 10 years. In creating this prediction, the committee expected the economy to grow 0.8% per year.

The Tax Foundation came up with a second conclusion, predicting that the TCJA would add almost $448 billion to the deficit over the next 10 years. It looked at the effect of the tax cuts themselves and the TCJA’s elimination of the Affordable Care Act mandate.

The Tax Foundation analysis stated that the tax cuts would cost $1.47 trillion in decreased revenue while adding only $600 billion in growth and savings. The plan would also:

- Boost economic growth by 1.7% per year

- Create 339,000 jobs

- Add 1.5% to wages

Signs That The Economy Is Losing Steam

Worrying outlook.Amid persistently high inflation, rising consumer prices and declining spending, the American economy is showing clear signs of slowing down, fueling concerns about a potential recession. Here are other eight measures signaling trouble ahead:

Retail sales.The latest report from the Commerce Department showed that retail sales fell 0.3 percent in May, and rose less in April than initially believed.

Consumer confidence.In June, the University of Michigans survey of consumer sentiment hit its lowest level in its 70-year history, with nearly half of respondents saying inflation is eroding their standard of living.

The housing market.Demand for real estate has decreased, and construction of new homes is slowing. These trends could continue as interest rates rise, and real estate companies, including Compass and Redfin, have laid off employees in anticipation of a downturn in the housing market.

Start-up funding.Investments in start-ups have declined to their lowest level since 2019, dropping 23 percent over the last three months, to $62.3 billion.

The stock market.The S& P 500 had its worst first half of a year since 1970, and it is down nearly 19 percent since January. Every sector of the index beyond energy is down from the beginning of the year.

Oil.Crude prices are up this year, in part because of supply constraints resulting from Russias invasion of Ukraine, but they have recently started to waver as investors worry about growth.

Read Also: Why Are Republicans Wearing Blue Ties

The Impossible Inevitable Survival Of The Trump Tax Cuts

How Democrats went from unanimous opposition to an unpopular policy to doing nothing about it in the five years since it became law.

Evan Vucci/AP Photo

President Donald Trump shakes hands with then-House Speaker Paul Ryan during an event after the passage of the “Tax Cut and Jobs Act Bill” on the South Lawn of the White House, Dec. 20, 2017.

Right as the Trump tax cuts were being finalized in December 2017, I wrote a piece for The New Republic about the silver lining that accompanied this large giveaway to the wealthy and well-connected. Democrats had put themselves in a straitjacket for years, with self-imposed paygo laws that they offset all new spending with revenue. That was fairly absurd in and of itself, but suddenly it was no longer a problem. The Trump tax cuts rolled back the estate tax, eliminated the alternative minimum tax, slashed the corporate tax rate, and created a new loophole, used mostly by the rich, for pass-through businesses.

Repealing those measures alone could net you around $3 trillionand all you would have to do is go back to the pre-Trump tax code circa fall 2017. Every Democrat in office at the time opposed the Trump tax cuts: Joe Manchin, Kyrsten Sinema, Josh Gottheimer, and Kurt Schrader every single one of the cast of characters that has become so familiar today. They all opposed it, and presumably would all be satisfied with a 2017-era tax code.

Family Credits And Deductions

The law temporarily raised the child tax credit to $2,000, with the first $1,400 refundable, and creates a non-refundable $500 credit for non-child dependents. The child tax credit can only be claimed if the taxpayer provides the child’s Social Security number. Qualifying children must be younger than 17 years of age. The child credit begins to phase out when adjusted gross income exceeds $400,000 . These changes expire in 2025.

Also Check: How Many Presidents Were Democrats And Republicans

The Standard Deduction Vs Itemized Deductions

A single filer’s standard deduction increased from $6,350 in 2017 to $12,550 in 2021 and $12,950 in 2022. The deduction for married joint filers increases from $12,700 in 2017 to $25,100 in 2021 and $25,900 in 2022.

The Tax Foundation estimated in September 2019 that only about 13.7% of taxpayers would itemize on their 2018 returns due to these changes. That’s less than half of the 31.1% who would have itemized before the TCJA.

That would save them time in preparing their taxes. It might also hurt the tax preparation industry and decrease charitable contributions, which are an itemized deduction.

The National Debt Increased Under Trump Despite His Promise To Reduce It

Daily total national debt from 2009 to present.

Economists agree that we needed massive deficit spending during the COVID-19 crisis to ward off an economic cataclysm, but federal finances under Trump had become dire even before the pandemic. That happened even though the economy was booming and unemployment was at historically low levels. By the Trump administrations own description, the pre-pandemic national debt level was already a crisis and a grave threat.

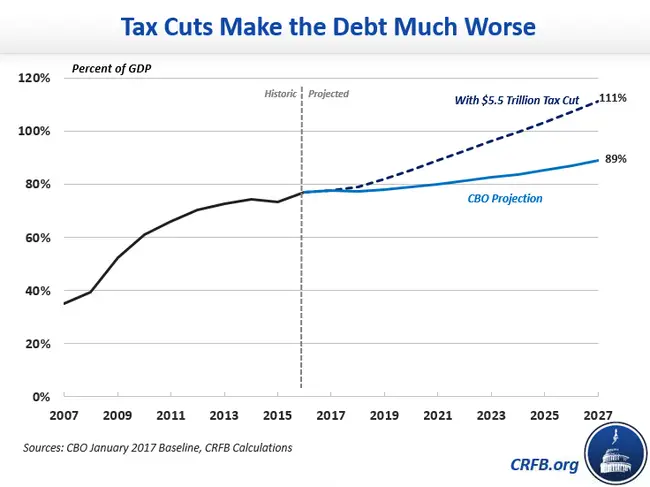

The combination of Trumps 2017 tax cut and the lack of any serious spending restraint helped both the deficit and the debt soar. So when the once-in-a-lifetime viral disaster slammed our country and we threw more than $3 trillion into COVID-19-related stimulus, there was no longer any margin for error.

Our national debt has reached immense levels relative to our economy, nearly as high as it was at the end of World War II. But unlike 75 years ago, the massive financial overhang from Medicare and Social Security will make it dramatically more difficult to dig ourselves out of the debt ditch.

Also Check: When Do Democrats And Republicans Compromise

What Does The Composition Of The Revenue Shortfalls Tell Us About The Effect Of The Tcja

The TCJAs changes mostly affected the corporate and individual income taxes . The act reduced the top corporate tax rate from 35% to 21%a 40% reduction. Actual corporate income tax revenue in FY2018 was $135 billion lower than CBOs projection from 2017almost exactly a 40% decline. The most recent CBO projections estimate further decreases in corporate tax revenue. The TCJA also reduced income taxes for most Americans, which led to a decline in revenues relative to prior projections. For individual income taxes, actual collections in FY2018 were $97 billion, or 5.4%, below pre-TCJA projections.

These effects are accentuated if one looks at taxes as a share of GDP . In 2017, before the tax cuts were considered, the CBO estimated that total revenues would be 18.1% of GDP in FY2018. With the TCJA, revenues were only 16.4% of GDP. Similar patterns hold for individual income taxes and for corporate income taxes. Due to data limitations, the revenue numbers in Table 1 are on a fiscal year basis. As a result, 2018 data include the three months prior to the acts enactment. If the values were instead on a calendar year basis so that 2018 only included post-TCJA revenues, the revenue declines would be even larger.

Low Revenue Is Straining Our Fiscal Outlook

Republicans like to claim that we have a spending not a revenue problem. But by any measure, the U.S. is taking in an unusually low level of revenue, a problem exacerbated by the 2017 tax law. This helps explain why deficits are getting larger despite a faster-growing economy. For example, as a share of GDP, revenue projected this year is nearly a percentage point below the 50-year historical average .

And year-over-year revenue growth is far below where it should be, given the strength of the economy. The last time that annual real GDP growth was as high as the 3.1 percent in 2018 was in 2005, when revenue grew by 15 percent from the previous year. In 2018, revenue grew by just 0.4 percent. Similarly, over the last half-century, revenue has averaged 18.3 percent of GDP in years in which the unemployment rate has fallen below 5 percent. That is nearly 2 percentage points higher than projected revenue this year.

Revenue is also coming in lower than recent projections. In its June 2017 forecast, for instance, CBO predicted that we would spend 20.5 percent of GDP on outlays in 2018 and collect 17.7 percent of GDP in revenue. In actuality, spending was 20.3 percent of GDP below what was forecast and consistent with the 50-year average but revenue was only 16.4 percent of GDP. Contrary to Republicans claims, last years deficit was not the result of out-of-control spending.

You May Like: How Can I Watch The Patriots

Did The Ctc Help Low

The CTC can only bring your tax liability how much income tax you owe for the year to $0. If the CTC brings your tax liability below $0, you can get the remaining part of it refunded to you through the additional child tax credit, or ACTC.

The ACTC was claimed more in 2018, overall, but taxpayers with an AGI of less than $25,000 claimed the ACTC 10.9% less. Taxpayers with AGI under $10,000 saw the biggest decline in ACTC filings, claiming it 19.4% less in 2018 than 2017. This drop in ACTC claims suggests that low-income Americans may not have gotten the full child tax credit they were entitled to, even though more families were eligible to claim the credit overall.

Did The Tcja Spur Enough Growth To Maintain Federal Revenue Levels

While some TCJA supporters observe that nominal revenues were higher in fiscal year 2018 than in FY2017, that comparison does not address the question of the TCJAs effects. Nominal revenues rise because of inflation and economic growth. Adjusted for inflation, total revenues fell from FY2017 to FY2018 . Adjusted for the size of the economy, they fell even more.

Recommended Reading: What Is The Definition Of Republicanism

Tax Returns And Withholding

Tax filing season brings up many questions for taxpayers, such as, How big will my tax refund be? or, Will I have a balance due when I file taxes this year? Changes to withholding tables in the aftermath of the TCJA resulted in lower-than-expected refunds, but it is important to remember that decreased tax refunds do not necessarily translate to increased tax liabilities.

The chart below shows the aggregate amount of refunds returned to taxpayers in each income group through the 30th week of the filing season in 2017 and 2019. While total refunds in 2019 fell for some income groups relative to 2017, effective tax rates dropped across all income groups over the same period. This pattern is similar to tax year 2018, when aggregate refunds also fell for most income groups.

Many Large Profitable Corporations Are Paying No Tax

Researchers at the Institute on Taxation and Economic Policy surveyed corporate financial reports for the first year that the TCJA was in effect and recently published their findings. Examining 379 profitable Fortune 500 companies, they found that the companies paid an average effective tax rate of just 11.3 percent on their U.S. income in 2018slightly more than half of the 21.2 percent average effective rate that large corporations paid from 2008 to 2015. Shockingly, ITEP found that 91, or nearly one-quarter, of these major corporations paid no federal income tax on their U.S. income in 2018.

Read Also: Patriot Lighting Flexible Rope Light

Any Economic Growth From The Gop Tax Law Is Slight And Short

The tax law boosted the economy last year, helping spur real GDP growth of 3.1 percent. According to CBOs projections, however, that boost is waning. Real GDP growth is expected to slow to 2.3 percent this year and 1.7 percent next year. By 2023, the tax laws positive effect on economic growth will fade away entirely.

Beyond this temporary boost, the tax law does not change our longer-term path of growth. Between 2023 and 2028, CBO expects the economy to grow by an average 1.8 percent. That is slightly lower than the average growth rate CBO projected in June 2017, before the tax cuts were enacted . These estimates are also far below the Trump Administrations forecast of annual growth of at least 3 percent over the next several years.

While CBO estimates that the tax law will increase the size of the economy by an average 0.7 percent between 2018 and 2028, there is no evidence that it is making a meaningful difference for families that are struggling financially. Households with incomes of $25,000 or less, for example, saved an average $60 in 2018 from the tax cut, according to the Tax Policy Center. By comparison, the top 1 percent of households saw savings of more than $51,000 on average.

The Tcja 2 Years Later: Corporations Not Workers Are The Big Winners

The massive corporate tax cut is costing more than expected and not trickling down to workers.

On December 22, 2017, President Donald Trump signed into law the so-called Tax Cuts and Jobs Act , a $1.9 trillion tax bill favoring corporations and wealthy Americans. At its heart is a large cut in the corporate tax rate. Corporations are literally going wild over this, Trump said upon signing the bill. He predicted that the corporate tax cut would cause a boom in business investment and that factories are not going to be abandoned any longer. His White House, meanwhile, estimated that the corporate tax cuts would trickle down to workers in the form of a $4,000 annual raise.

Two years later, however, business investment is actually declining. Factory closings and mass layoffs have not ended. Wage growth is tepid, despite the continuation of the economic expansion that began 10 years ago, and gross domestic product growth is slowing and projected to revert to its long-term trend or below. Meanwhile, budget deficits are higher due to revenue losseswhich have largely been triggered by the massive corporate tax cut at the heart of the TCJA. Nevertheless, earlier this month, acting White House Chief of Staff Mick Mulvaney told a gathering of CEOs that the Trump administration will seek to cut the corporate tax rate further if the president gains a second term in office.

This column explores just how much the bill has benefited corporations in the two years since its passage.

You May Like: Is Economy Better Under Democrats Or Republicans