Simplified Customer Due Diligence Or Cdd

Know your Customer checks are performed on initial customer onboarding stages. It usually assesses the potential risks posed by customers. This level of due diligence does not require an in-depth screening. It is a basic process because individuals are not categorised as high or medium risk profiles.

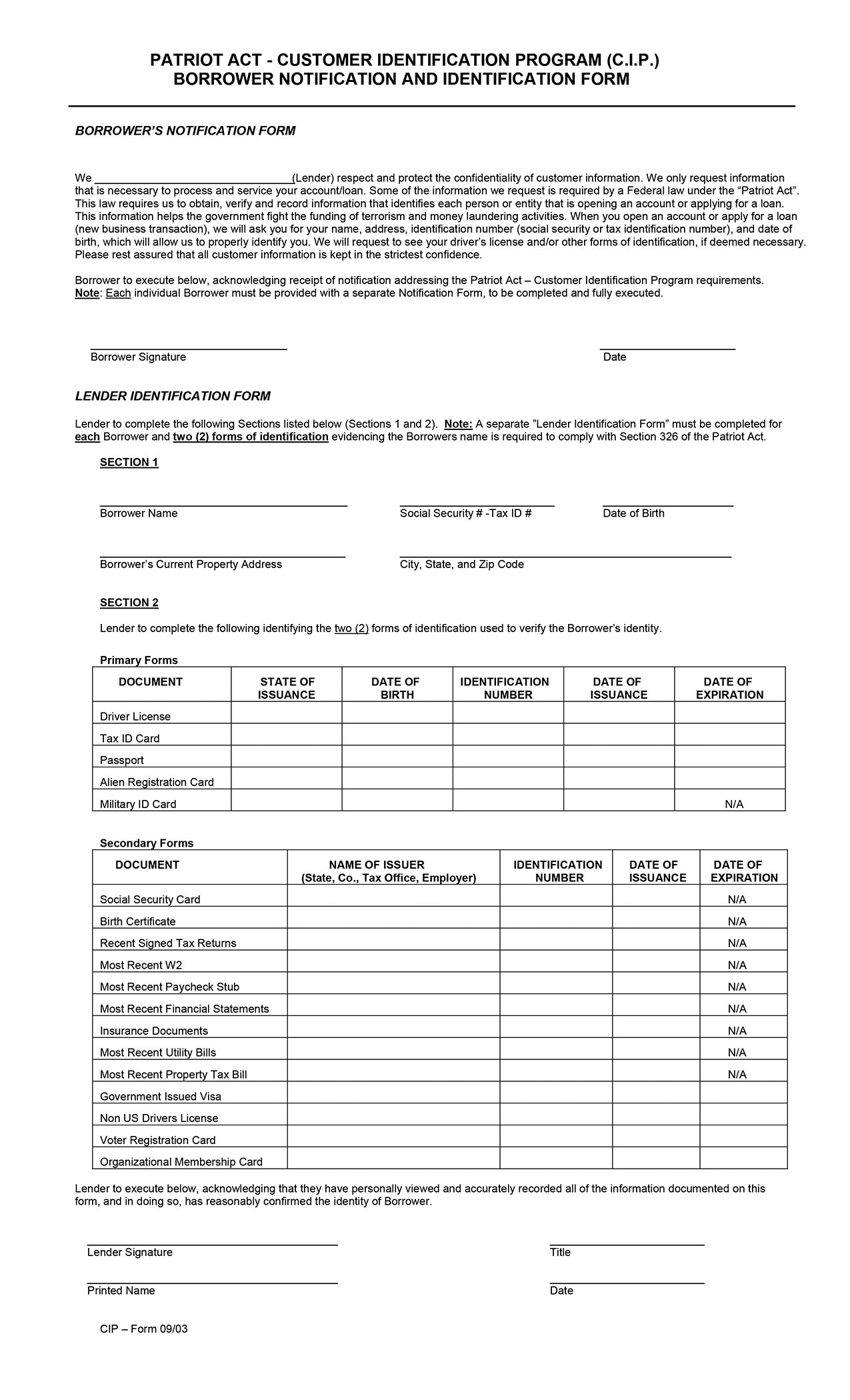

Acceptable Identification Must Meet The Following Requirements:

- The identification must contain a photo of the borrower

- The identification must contain the Borrowers name

- The identification must contain the Borrowers date of birth

- The identification must contain a street address

- In the event that the individual does not have a street address, the loan originator must collect a military P.O. Box number or street address of next of kin or another contact individual.The identification must contain a Taxpayer ID Number .

For non-US citizens the identification must contain a taxpayer ID number, passport number with country of issuance, alien ID card number, or other foreign-issued picture ID.

It is not necessary for each piece of identification to meet all of the requirements . However, all requirements must be met with a combination of identification.

Usa Patriot Act Certification

In order to comply with USA PATRIOT Act requirements, State Street Bank and Trust Company, on behalf of all of its non-US branches and non-US affiliated banks, has prepared a Global Certification for use by US financial institutions that deem they require a PATRIOT Act Certification from State Street Bank and Trust’s non-US branches or non-US subsidiaries.

Read Also: What’s The Difference Between Democrats And Republicans

Kyc For Crypto Exchanges

The technology is also revolutionising the crypto industry. Cryptocurrencies like Bitcoin are easily available for people to buy from crypto exchanges. But various financial crimes such as money laundering are being actively carried out through cryptocurrency due to its complex infrastructures as it makes the sources untraceable. According to financial crime reports, around $2 trillion is laundered every year.

Therefore, the need for KYC verification continues to grow along with the growth of the crypto industry. Virtual currencies have always seemed to be involved in some kind of scandals so, for the cryptocurrency industry to work, KYC crypto for customer identity verification is stressed upon by regulatory authorities to eliminate not only money laundering but fraudulent ICOs from taking place.

Other use cases of KYC are and not limited to:

- Online Crowdfunding platforms

- Airport clearance

Customer Identification Program Information Resources

Much of the CIP rules and regulations have been covered, but there are certain details that are too nuanced to sufficiently address here.

- For more information about the CIP and its requirements, please refer to this PDF on the Federal Deposit Insurance Corporation website

CIP-related Blog Posts

1 Read our blog post about modern-day data breaches to see just how problematic they are. Click here to read the post.

2 A Tax Identification Number can apply to both U.S. persons and non-U.S. persons. There are five different types of Tax Identification Numbers: the Social Security Number , the Employer Identification Number , the Individual Taxpayer Identification Number , the Taxpayer Identification Number for Pending U.S. Adoptions , and the Preparer Taxpayer Identification Number . The EIN, ITIN, ATIN, and PTIN can be issued to non-U.S. persons.

You May Like: Did Republicans Cut Funding For Embassy Security

Notice To Customers Of Identity Verification Requirements

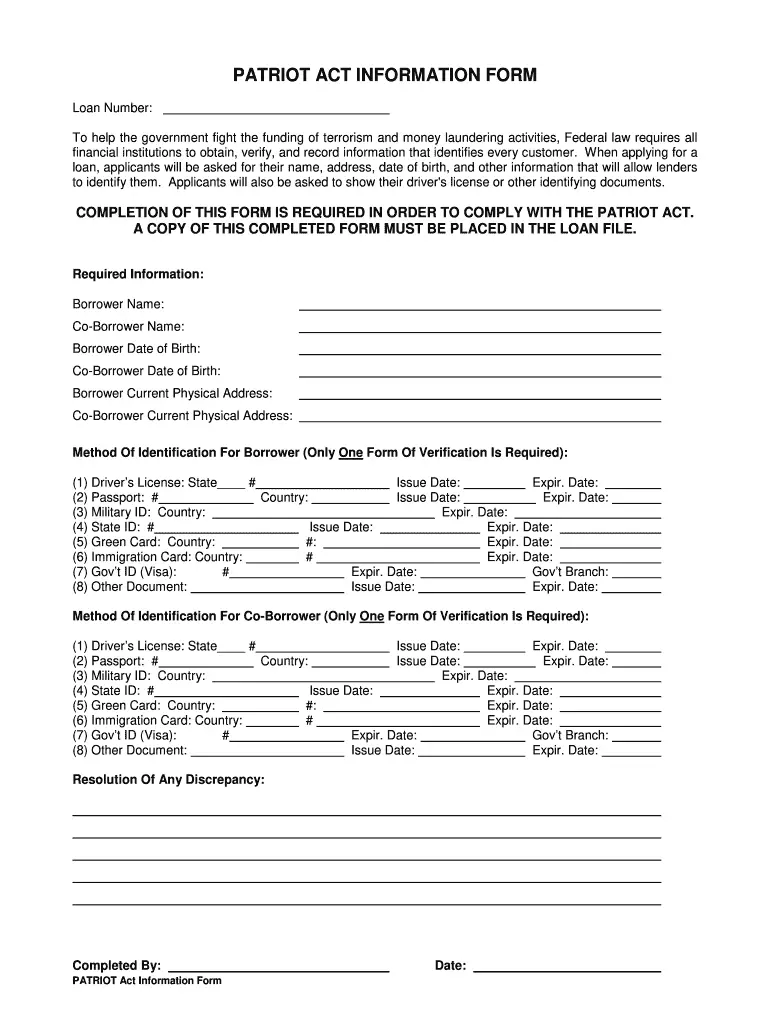

To help the government fight the funding of terrorism and money laundering activities, federal law requires all US financial institutions to obtain, verify and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your identifying documents.

Borrower Identification Under The Patriot Act

Question: The company that generates my loan documents includes a form which requires the closing agent to obtain two forms of ID from the borrower. Does the Patriot Act require us to obtain and verify a borrowers identity at closing with at least two forms of identification?

Answer: No. There is no set number of forms of ID required by the USA Patriot Act. Section 326 of the USA Patriot Act requires financial institutions to implement a Customer Identification Program that is appropriate for the size and location of the financial institution. This regulation requires the CIP to be in writing, incorporated into the institutions Identity Theft Prevention and Red Flags program, and approved by the Board of Directors, a committee of the Board of Directors, or Senior Management.

A financial institution must implement reasonable procedures for verifying the identity of any person who applies for a residential or commercial mortgage loan. These procedures may vary based upon the circumstances of each situation and whether any Red Flags are present based on the information obtained by the financial institution regarding the consumer.

This Guidance can be located by .

Joyce Pollison is director of legal and regulatory compliance for Lenders Compliance Group. She may be reached by phone at 442-3456.

Read Also: Claiborne Apartments Louisville Ky

Id For The Patriot Act

The Patriot Act does not specify acceptable forms of identification. Rather, it charges the institution with collecting certain pieces of identifying information and verifying that information in accordance with risk-based standards established by the institution. Those methods can include both documentary and non-documentary verification methods. The bank has to do an assessment of risks posed by the types of customers, accounts, and locations where the bank is doing business, and, based on that assessment of risk, determine for itself what types of identification would be acceptable. Since these requirements went into place several years ago, most established banks should already have a Customer Identification Program in place that specifies acceptable identity verification methods and tools. The CIP should be reviewed periodically to ensure that the risk assessment continues to be valid, and the specified ID verification methods and tools are still current. If this relates to a new bank being formed, then the risk assessment and bank choosing the types of identity verification methods to include in its CIP is the way to go. First published on BankersOnline.com 6/12/06

Sec 326 Verification Of Identification

IN GENERAL- Section 5318 of title 31, United States Code, as amended by this title, is amended by adding at the end the following:

IDENTIFICATION AND VERIFICATION OF ACCOUNTHOLDERS-

IN GENERAL- Subject to the requirements of this subsection, the Secretary of the Treasury shall prescribe regulations setting forth the minimum standards for financial institutions and their customers regarding the identity of the customer that shall apply in connection with the opening of an account at a financial institution.

MINIMUM REQUIREMENTS- The regulations shall, at a minimum, require financial institutions to implement, and customers to comply with, reasonable procedures for–

verifying the identity of any person seeking to open an account to the extent reasonable and practicable

maintaining records of the information used to verify a person’s identity, including name, address, and other identifying information and

consulting lists of known or suspected terrorists or terrorist organizations provided to the financial institution by any government agency to determine whether a person seeking to open an account appears on any such list.

FACTORS TO BE CONSIDERED- In prescribing regulations under this subsection, the Secretary shall take into consideration the various types of accounts maintained by various types of financial institutions, the various methods of opening accounts, and the various types of identifying information available.

Read Also: Donald Trump People Magazine 1998 Quote

Kyc Regulations In The Uk

After Brexit, the United Kingdom is following the Sanctions and Money Laundering Act of 2018. As per the law, the UK will follow the United Nations sanctions to meet international policy objectives and national security. All enterprises are guided to maintain updated anti-money laundering and counter terrorist financing measures. Lastly, the Act of 2018 has suggested the entities to perform due diligence checks on all the entities to maintain domestic security and comply with the international security standards.

For Our Business Customers:

When you open a new account or apply for a new loan on or after May 1, 2018, you will be required to provide information about your beneficial owners.

A Beneficial Owner is:

- Each individual who owns 25% or more of the company.

- One individual who has significant managerial responsibility for the company.

A Legal EntityBusiness includes a corporation, a limited liability company , or other entity that is created by a filing of a public document with a Secretary of State or similar office, and a general partnership.

You May Like: Patriot Tires Mt 33×12 50r20

What Is Enhanced Due Diligence Or Edd

Unlike customer due diligence and standard due diligence, high-risk individuals go through extensive screening to check the involvement in money laundering, terrorist financing, and corruption. Business ultimate beneficial owners are identified, along with sources of income, and screened against PEPs and global sanction lists to eliminate risks of financial crimes.

Apart from that, additional background checks are also performed, as needed. Enhanced due diligence also exposes the nature of the business and the purpose of bigger transactions through know your customer remediation. Due diligence is an important step that companies take to get rid of risk by performing extra checks in return keeping businesses safe from bad actors and money laundering activities.

When Opening Or Amending An Account Via Us Mail:

We may verify the information we receive via U.S. Mail through alternative methods that allow us to establish a reasonable belief that we know your true identity. These methods include, but are not limited to, credit reports from consumer reporting agencies, contacting your employer to verify employment, comparing information received against other consumer databases, checking references and requiring you to have your signature notarized.

Also Check: The Patriot Streaming Service

Why Choose Csis Id Verification Solution

As a leading KYC vendor, our goal is to simplify compliance for your business. Our identity verification software helps you mitigate compliance and strategic risk across your entire enterprise. Whether your customers are local or global, WatchDOG CIP offers ongoing risk profiling with alerts and customer profiles that monitor and predict potential impact to your business operationsand keep auditors happy.

- Manage volume, scale and internal bandwidth while staying compliant with KYC and USA PATRIOT Act regulations

- Reduce costs and effort with WatchDOG CIPs integration

- Receive senior-level support from CSIs team of compliance experts

Benefits Of Performing Automated Kyc Processes

KYC processes ensure transactional transparency between customers and financial institutions. Some of the most important benefits of performing KYC processes are as follows:

- Know your customer processes establish institutional credibility among customers and across industries

- On one side it protects customers sensitive data from going into the wrong hands, and on the other side, it saves businesses from facing reputational and legal damages due to breaches and cases of identity theft

- Keeps investors interest secure at all costs

- As mentioned earlier, the main focus of KYC is to prevent financial crimes such as money laundering, tax evasion, corruption, and terrorist financing

- Preventing fraudsters from conducting fraudulent ICOs is also one of the KYC benefits

- Manual KYC costs are pretty high, automating know your customer procedures using identity verification solutions is a step in the right direction

- Replacing manual Know your customer with online KYC verification is time and cost-effective

- Automation and digitization is reducing manual labor, consequently eliminating errors

- Helping companies stay compliant with the rapidly changing and expanding regulation landscape

- KYC procedures for swifter customer onboarding

- Automated KYC can help with frictionless verification processes regardless of geographical boundaries

Read Also: Where’s New England Patriots Stadium

Meet Kyc And Red Flags Rule Requirements

Acquiring new customers is one of the key factors in growing your business. WatchDOG CIP makes the process of customer identity verification simple and cost effective. As a Red Flags Rule service provider, our certified consultants help you meet regulatory requirements under the USA PATRIOT Act Identity Theft Prevention Program for Red Flags Rules and support KYC compliance for banks. Our identity verification services:

- Meet KYC regulations by checking customer information against the latest OFAC lists

- Verify that customers SSNs are not listed on the Social Security Administrations Death Master File

- Authenticate all key customer information against public databases and the national consumer reporting agency

- Reduce costs associated with identity theft prevention

- Limit your risk by enhancing your prevention tactics and scoring the validity of consumer data

Customer service is the shining star at CSI.

CSI has been very responsive and detailed in their commentary. I am particularly pleased with the reporting format, which gives readers a clear understanding with the right amount of detail.

In a recent audit, the auditor commented that he was impressed with the improvements wed made as a result of our partnership with CSI, including additional controls now in place that were not available to the bank prior to working with CSI.

How Can Kyc Protect Global Businesses

Knowing your customer is considered important because it tells you about the customers you are doing business with. It allows the financial sector to carry out extensive customer due diligence to verify their identities to prevent identity theft, money laundering, and fraud. Know your customer compliance protects businesses against unanticipated reputational damages due to external breaches from sneaking into systems. The regulations of money laundering and terrorist financing are becoming stricter by the day in a lot of countries around the world.

Robust KYC verification processes perform a thorough analysis of entities undergoing identification including anyone wishing to connect with a business in any way or form. An in-depth customer due diligence is performed for identification, screening against blacklists to identify money laundering suspicions, checking UBOs in case of KYB , collecting customer information, and checking against PEPs global lists for additional security.

Read Also: Republicans And Democrats Switch

The Most Robust Wayto Identify Your Customer

Under the USA Patriot Act, all financial institutions have to maintain Customer Identification Programs to verify customer identity to facilitate the detection and prevention of international money laundering and the financing of terrorism. To comply with strict CIP requirements, many banks are deploying identity verification solutions as the backbone of their program. Veratads flexible suite of solutions provides an automated and cost-effective way to know your customers, satisfy CIP requirements and combat criminal activity.

Important Information About Procedures For Opening Or Changing A Personal Account

In order to prevent the use of the U. S. banking system in terrorist and other illegal activity, federal regulations require ALL financial institutions to OBTAIN, VERIFY, AND RECORD identification from ALL persons opening new accounts or being added as signatories to existing accounts. If this required identification can not be produced and verified, the Bank must refuse to open the account and/or to close the account if it has been opened.

Minimal Mandatory Identification Information:

- Address

- Date of Birth

- Identification as approved:

No financial institution can waive these requirements.

TrustTexas Bank apologizes for any inconvenience this may cause our customers however, we are compelled, by federal law, to comply with all facets of the USA PATRIOT Act to assist in preventing illegal and/or fraudulent banking activities.

You May Like: How Many Senate Republicans Voted For Obamacare

Facial Recognition And Liveness Detection

Many financial institutions make use of biometric authentication and liveness detection for fraud prevention. In facial recognition, the face of the person is matched against one or more faces to ascertain the existence of the match, to begin with. This technology is growingly becoming a part of everyday life. On the other hand, liveness detection is the technology that recognizes whether the face in front of the camera belongs to the person it was supposed to in order to avert face spoofing or identity theft. It ensures the remote presence of the users at the time of verification through micro-expression analysis and 3D-depth perception in order to combat face spoof attacks.

The Details: Customer Identification Program Requirements & Compliance

Financial institutions need to comply with CIP regulations whenever a customer opens a new account: when a customer opens an account, the customers identity needs to be authenticated in such a way that the financial institution has a reasonable belief that customers identity is true and valid.

A financial institution is an entity, such as a bank, that provides financial services, such as opening a checking account.

A customer is one who opens a new account or opens a new account on behalf of another individual or entity, and can be:

- an individual

- an estate

Customers are not:

- A person who ultimately does not enter into a formal banking relationship with a financial institution i.e. a person whose loan application was denied

- An existing customer whose identity has given the financial institution the reasonable belief to be true

- Federally regulated banks

- Banks regulated by a state bank regulator

- Governmental entities

- Publicly traded companies

Opening a new account is defined as the establishment of a formal banking relationship between a customer and a financial institution in which the financial institution provides or engages in services, dealings, or other financial transactions, including:

- opening a deposit account

- financial trust services

Opening an account does not include the following types of financial transactions:

Requirements of a written, customized CIP

Customer Notice

You May Like: If I Were To Run I’d Run As A Republican. They’re The Dumbest Group Of Voters In The Country

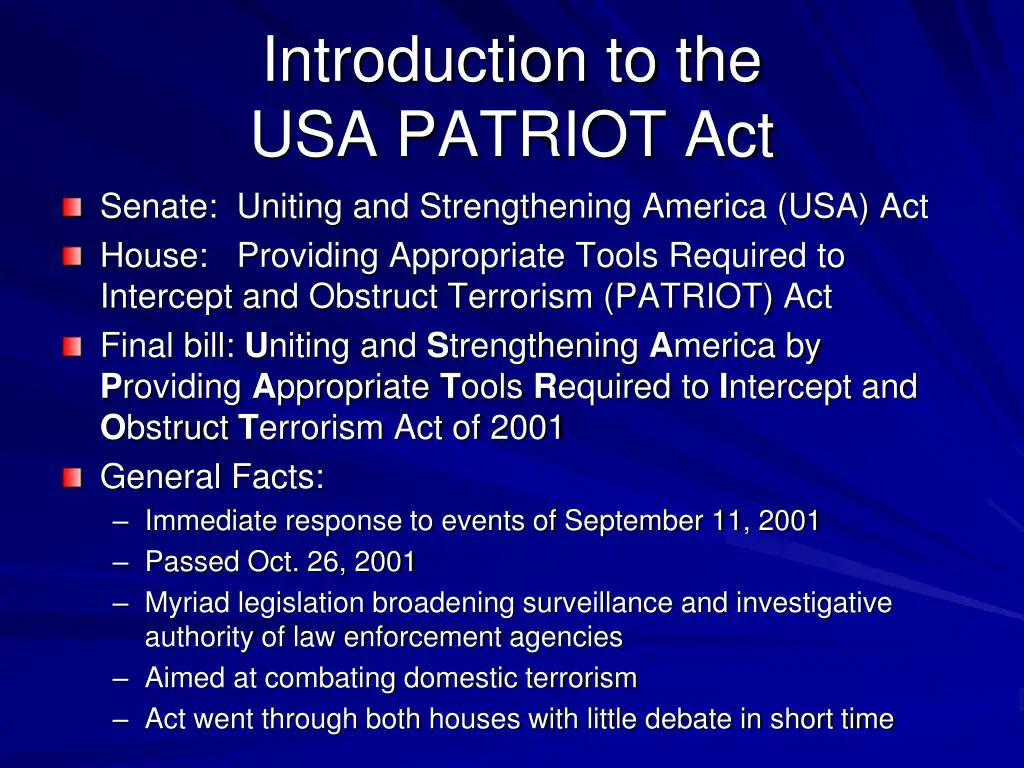

The Legal Impacts Of The Usa Patriot Act

Upon its introduction, the USA Patriot Acts anti-money laundering and counter-financing of terrorism laws impacted existing articles of legislation: specifically, the Money Laundering Control Act of 1986 and the Bank Secrecy Act of 1970, the latter of which primarily imposes record-keeping and reporting regulations on obligated institutions.

The Patriot Act is an important legal consideration. Financial institutions that fall short of their Patriot Act AML compliance obligations may face civil and criminal penalties, including fines of $1 million or twice the value of the violating transaction .

Screening Tools that Comply with the USA Patriot Act

The USA Patriot Act requires all financial institutions to develop and implement their own AML programs. Get started today