The Relationship Between Generosity And Political Affiliation And Gender

Most people tip their hair stylists, while only 27% tip their hotel housekeeper.

Tipping can be a social and cultural maelstrom. And social media doesnt always help.

A National Basketball Association player who has a $30 million contract drew internet ire last week after leaving a $13.97 tip on a $487.13 bill. Andre Roberson of the Oklahoma City Thunder made headlines for the paltry tip, and the strong reaction shows just how emotional the question of tipping can be.

But it wasnt quite as clear-cut as it seemed. Roberson released a statement on Twitter TWTR, +1.63% saying he was misrepresented, saying he bought one bottle of liquor for $487 at a bar, around five times the retail price and rounded it out to $500. Roberson said he also had a $100 tab on shots for which he left a $200 tip. I thought hed be grateful for the $200 tip, he wrote of the barman who served him.

Meanwhile, some restaurants have banned tipping while Uber is finally encouraging riders to open their wallets to drivers who go the extra mile.

See more:Meet the most generous tipper in America

Some of the findings seemed to play out in real life when three supporters of President Donald Trump left a $450 tip for a Washington, D.C. waitress in January, though they were from Texas, not the relatively more generous northeast.

Dont miss:How much to tip everyone

Also read: Is this the worst tipper in America?

Statistics On Us Generosity

In this section youll find charts and graphs laying out the most important numbers in American philanthropy. They document how much we give, how that has changed over time, what areas we give to, and what mechanisms we use to donate. There are figures here on where charities get their money, how many people offer volunteer labor, the demographic factors that influence generosity , and how various states and cities differ. The top foundations and donor-advised funds are ranked by their giving. We present surprising information on overseas aid, and statistics on how the U.S. compares to other countries when it comes to donating to charity.

Beto Orourke Other Democrats See The Downside Of Releasing Tax Returns

CHARLOTTESVILLE About 24 hours after presidential hopeful Beto ORourke released his tax returns from the past decade, a University of Virginia student asked him why he didnt donate more money to charities.

ORourke, a former congressman from El Paso, and his wife reported in their 2017 tax return that they donated $1,166 which was one-third of 1 percent of their $370,412 of income that year. ORourke told reporters on Wednesday that, over the years, he and his wife have donated thousands of dollars more that they did not itemize because it wasnt important for us to take the deduction. The campaign has yet to provide updated numbers.

Ive served in public office since 2005. I do my best to contribute to the success of my community, of my state and, now, of my country, ORourke said in responding to the student on Tuesday night. Im doing everything that I can right now, spending this time with you not with our kiddos, not back home in El Paso because I want to sacrifice everything to make sure that we meet this moment of truth with everything that weve got.

ORourke is not the only Democratic candidate who has had personal finances questioned at a time when many voters are frustrated by the ever-growing economic divide in the country. One by one, Democratic candidates have released their tax returns something that President Trump has refused to do in an attempt at transparency.

Also Check: How Many Presidents Have The Republicans Tried To Impeach

Charitable Giving By State: Are Republicans More Generous Than Democrats Or Just More Religious

It turns out that the old Bushism about compassionate conservatism may not be a myth after all. In a new analysis of Internal Revenue Service tax records, the Chronicle of Philanthropy on Monday ranked U.S. cities and states by how much money their residents give to charity. The bottom line? People in red states are more generous with their green.

The study, which compared IRS data from 2012 with data from 2006, showed that the 17 most generous states — as measured by the percentage of their income they donated to charity — voted for Mitt Romney in the last presidential election. The seven states at the bottom of the list, meanwhile, voted for Barack Obama.

Exactly why is a bit of a mystery. Stacy Palmer, editor of the Chronicle of Philanthropy, said the data only showed how much money people gave away, not which types of organizations they gave to. But generally speaking, she said its fair to assume that political ideology aligns to some extent with ideas about charitable giving.

Not to be too simplistic about it, but if you believe that government should take care of basic social services, then youre going to go that way, Palmer told International Business Times. If you think charities should take care of things, and not government, then youre probably going to give more generously to charity.

Got a news tip? . Follow me on Twitter .

Volunteering In The Us

This data comes from detailed time logs that statisticians ask householders to keep. In less strict definitions like phone surveys, more like 45 percent of the U.S. population say they volunteered some time to a charitable cause within the last year.

Current estimates of the dollar value of volunteered time range from $179 billion per year to more than twice that, depending on how you count.Volunteering is closely associated with donating cash as well. One Harris study showed that Americans who volunteered gave 11 times as much money to charity in a year as those who did not volunteer.

An interesting pattern emerges if one studies giving by income level. As incomes rise, more and more of the people in that bracket make gifts to charity. The sizes of their gifts tend to rise as well. However: if you look at average donations as a fraction of funds available, they tend to level off at around 2-3 percent of income.

Religious faith is a central influence on giving. Religious people are much more likely than the non-religious to donate to charitable causesincluding secular causesand they give much more.

Among Democrats, Independents, and Republicans alike, almost exactly half of the group averaged $100-$999 in annual charitable donations at the time of this 2005 poll. There was virtually no difference among the parties in the size of that moderate-giving group, so those results were not included in the graph to the left.

Also Check: What Did Republicans Gain From The Compromise Of 1877

How Political Ideology Influences Charitable Giving

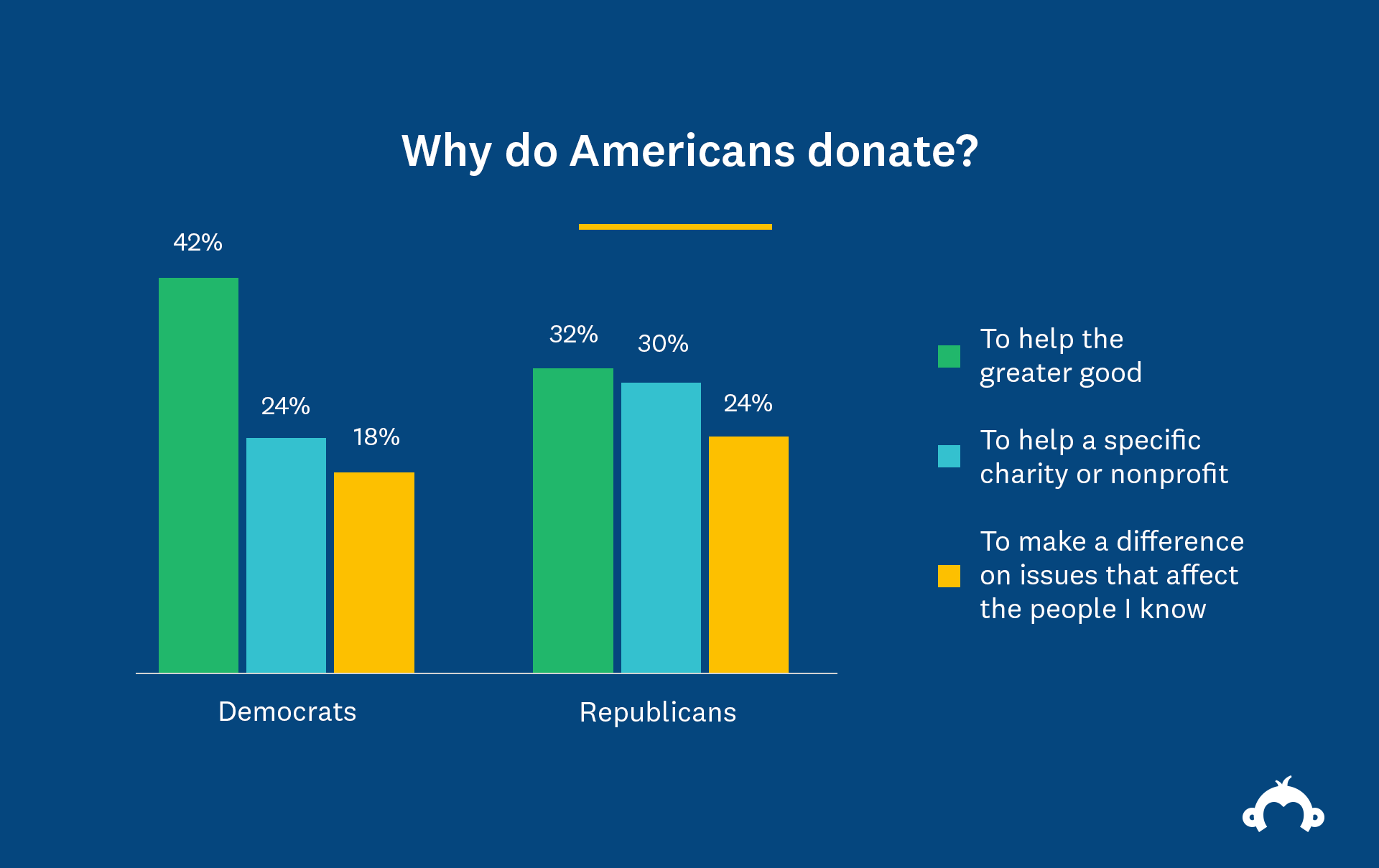

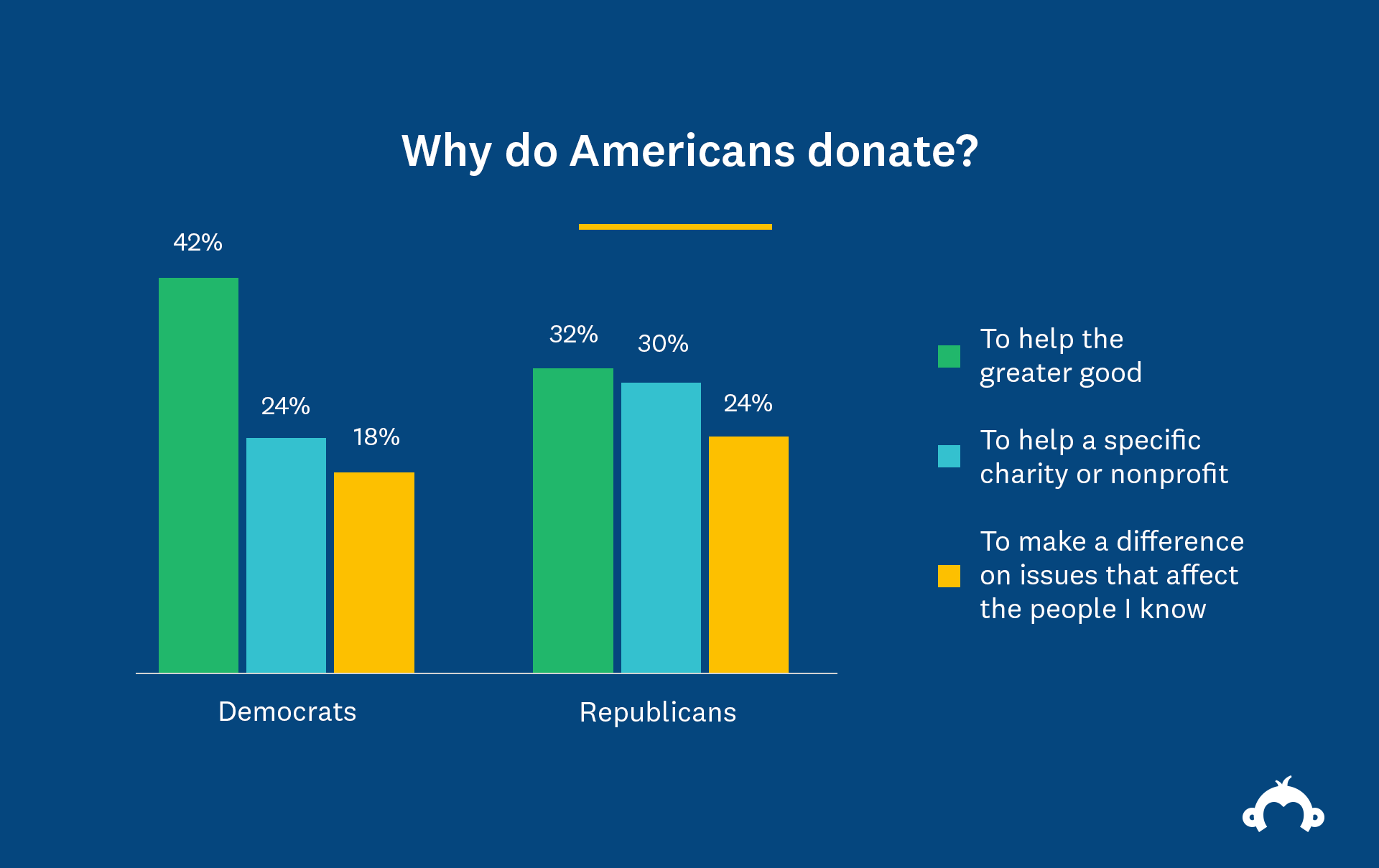

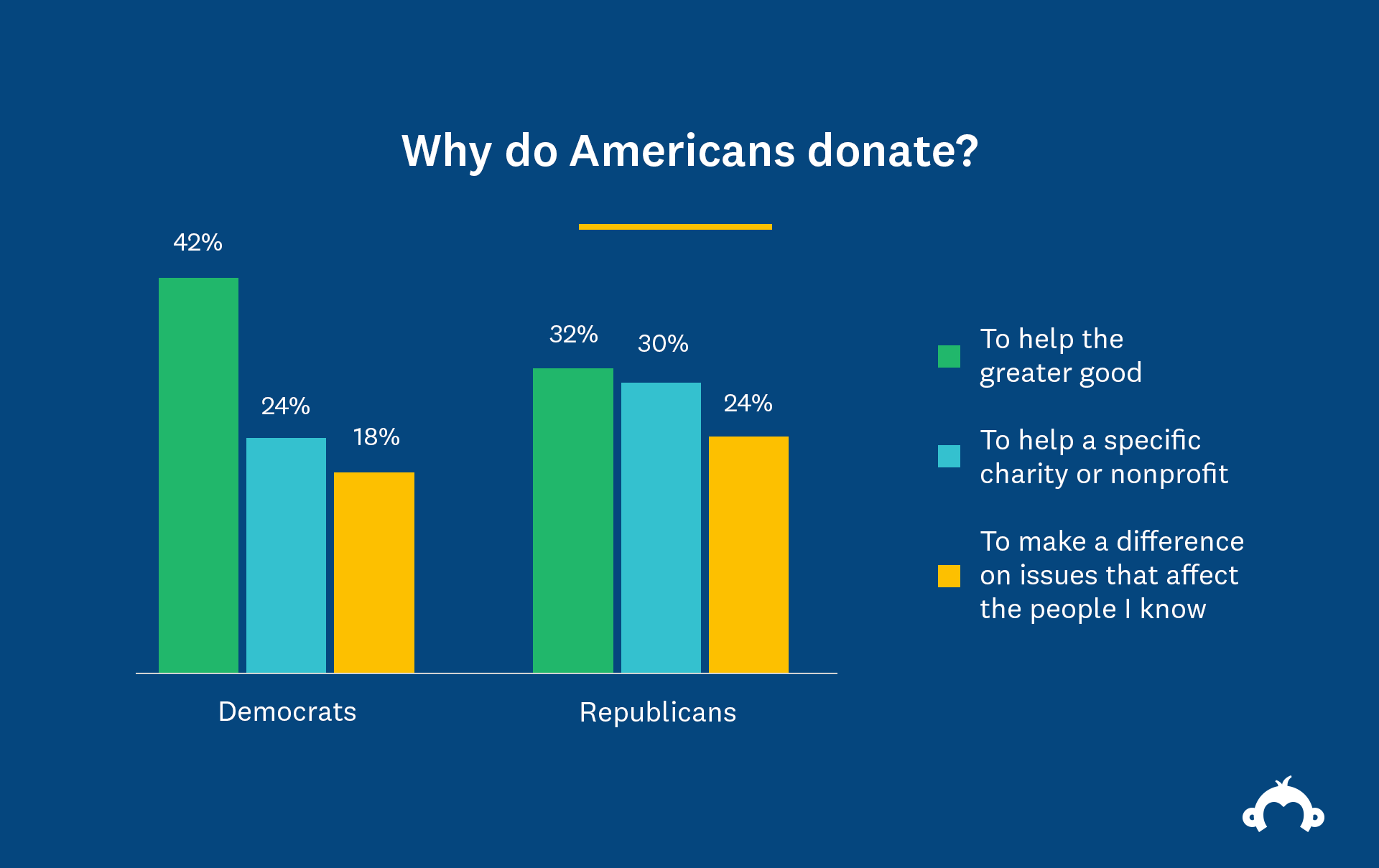

Many issues seem to divide Democrats and Republicans, and new research has found one more: philanthropy.

Red counties, which are overwhelmingly Republican, tend to report higher charitable contributions than Democratic-dominated blue counties, according to a new study on giving, although giving in blue counties is often bolstered by a combination of charitable donations and higher taxes.

But as red or blue counties become more politically competitive, charitable giving tends to fall.

Theres something about the like-mindedness where perhaps the comfort level rises, said one of the authors of the study, Robert K. Christensen, associate professor at the George W. Romney Institute of Public Service and Ethics at Brigham Young University. They feel safe redistributing their wealth voluntarily. It also matters for compulsory giving.

The study was conducted by four research professors who set out to explore how political differences affect charitable giving. It was published on Oct. 20 in the academic journal Nonprofit and Voluntary Sector Quarterly. The other authors were Laurie E. Paarlberg of Indiana UniversityPurdue University Indianapolis, Rebecca Nesbit of the University of Georgia and Richard M. Clerkin of North Carolina State University.

Dr. Christensen said the team had analyzed more than 3,000 counties, but it did not reveal the county-by-county breakdowns. Its hard to pull those counties out because of the control variables, he said.

Charitable Giving Does Not Match Government Aid

Those in favor of lower taxes have argued that individuals are more capable than the government of allocating money to important causes, including people in need of assistance. But the study found that was not true. Donations do not match government assistance, and without tax money, social services are not funded as robustly.

The evidence shows that private philanthropy cant compensate for the loss of government provision, Dr. Nesbit said. Its not equal. What government can put into these things is so much more than what we see through private philanthropy.

On the other hand, private philanthropy can do many things better than government aid, as in being responsive to a need and willing to fail without political fallout.

The studys authors make the case for a combination approach.

Theyre complementary means of redistribution of wealth rather than substitutions for each other, Dr. Christensen said. We cant put all of our eggs in one basket.

You May Like: Who Are The Republicans On The Ballot

Conservatives Are Happier Than Liberals

Second, a much larger body of research has long demonstrated that, all things being equal, conservatives tend to be happier overall than their liberal neighbors are. This is truer for social conservatives than for fiscal conservatives, and the more conservative a conservative is, the happier he or she seems to be. Thats not nothing.

A massive study published earlier this year, involving five different data samples from 16 Western countries spanning more than four decades, adds more meat to this topic. These scholars from the University of Southern California found, as they put it, In sum, conservatives reported greater meaning in life and greater life satisfaction than liberals.

Of course, both qualities are much deeper and richer than happiness itself. This was the robust and consistent finding in the 16 distinct countries examined. It was generally truer for social conservatives than their fiscal brethren, and the greater-meaning-in-life slope spiked upward among individuals who were very conservative.

These scholars explain in their academic parlance that this was true for conservatives at all reporting periods . This is a significant finding. Conservatives experience greater meaning in life across their lives generally, but also daily and at most given moments throughout the day. The researchers conclude these findings are robust and that there is some unique aspect of political conservativism that provides people with meaning and purpose in life.

Conservatives Are Satisfied With Their Family Lives

New research released by the Institute for Family Studies demonstrates that conservatives tend to be much more completely satisfied with their family lives compared to their liberal friends and neighbors. Forty-one percent of both liberals and moderates report being completely satisfied with their family lives, while 52 percent of conservatives do.

Conservatives are also vastly more likely than liberals to believe marriage is essential in creating and maintaining strong families. They are also much more likely to actually be married, 62 versus 39 percent, thus benefiting from all the ways marriage improves overall well-being and contentment, personal happiness, economic security, long-term employment, longevity, better physical and mental health, and more.

These scholars explain that regardless of other basic life characteristics such as family income, marital status, age, educational attainment, race/ethnicity, and church attendance, being a conservative increases the odds of being completely satisfied with family life by 23 percent, a considerable positive impact given the centrality of these other life factors. Married men and women who believe marriage is needed to create strong families have 67 percent greater odds of being completely content with their own family life than married couples who do not believe this.

You May Like: Who Are The 10 Republicans Who Voted For Impeachment

Poorer Conservatives More Generous Than Wealthy Liberals New Study

Respected non-government sector newspaper The Philanthropy Chronicle collated the itemized charity deductions on the tax returns of hundreds of millions of Americans between 2006 and 2012, the latest year available. While only about a third of all givers write off their charity expenses, the sums included about 80 percent of all donations in the country.

The Extreme Views Of The Donor Class

The main finding of the research is that the policy views of elite donors are more extreme than the views of partisan voters at large. They also vary widely by party.

If you look at Republican donors, explains Malhotra, they have much more extreme views than ordinary Republicans on economic issues, such as taxation, the redistribution of wealth, and spending on social programs. For example, a good number of Republican voters want universal health care, but very few Republican donors want that. On the other hand, Republican donors and voters have very similar views on social issues, such as abortion and gay marriage. They are not out of line in that arena.

Malhotra and Broockman found a similar pattern among Democratic donors and partisans, but in a mirror image. Democratic donors are, if anything, a little more liberal on economic issues than Democratic partisans, says Malhotra. But their social views are much more liberal than partisans, especially when you look at issues like the death penalty.

Don’t Miss: Who Won More Democrats Or Republicans

Who Gives More To Charity Democrats Or Republicans

About Patt Morrison

Patt Morrison

The ongoing calls for presumptive Republican presidential nominee Mitt Romney to issue additional years of his tax returns havent ceased.

Romney has faced criticism for his reasoning that doing so would violate his religious freedom because it would reveal exactly how much money he has tithed to his Mormon church. Democrats continue to press the issue, but should they be so vocal about taking a look at charitable contributions?

According to philanthropy.com, a website that tracks charitable giving state-by-state, Utah tops the list of giving, with residents donating 10.2 percent of their discretionary income to charities. Utah is a solidly red state and went for John McCain 62 percent to 24 percent in 2008 and it has a large Mormon contingent.

Blue state New Hampshire is bringing up the rear with residents of the The Granite State donating only 2.5 percent of their discretionary income to philanthropic organizations. But if you tweak the numbers to remove donations to religious charities the giving evens out some.

Republican Donate More To Charity Than Democrats

8 comments:

- Anonymoussaid…

-

Just this weekend, in an ongoing election year discussion with my sister, I stated my experience is and has been when Democrats see others money or wealth, they want it and/or want to tell them what to do with it… I was also informed that others are not like me. Yours being the very first site I checked regarding this subject, I would like to thank you for the confirmation that this happens elsewhere, just not in my “little” world. Bellyburke

- Anonymoussaid…

-

Thanks, I try to leave informative bits of information that are skipped over in the drive by soundbites and stereotype attacks that are out there. Sorry I have’t posted more lately.To go beyond that, I think that Republicans- particularly religious republicans give a lot more than Democrats because we beleive we have a moral duty to give to charity. Democrats seem to want to government to control the “giving” even though that actually corrupts the ‘charity’ aspects of the gift when you ‘have to do it’ or the IRS will come knocking.

Read Also: Who Controls The Senate Republicans Or Democrats

Giving Under Different Governments

A change in government didnt seem to change peoples donations of money to charities, but there did seem to be an increase in time given to volunteering when the Coalition and Conservative governments were in power.

The exception to this came from the Greens. When Labour were in power from 1997-2010, Green Party supporters gave 182% more of their income to charity than Labour supporters did although this fell to 85% under the Coalition, and fell again when the Conservatives went into government on their own in 2015.

In terms of volunteering, under a Labour government, Green supporters gave no more of their time than did Labour supporters. After 2015, Greens increased their volunteering time by 56%.

Do Your Political Views Make You Charitable

24 Jul, 2019

Professor Sarah Brown,Professor Karl Taylor

A new working paper asks whether people on the left or right give more to charity

Student volunteers at the University of Essex

In 2017, people in the UK gave over £10 billion to charity, and ONS figures suggest that unpaid labour in the form of volunteering is worth over £20 billion.

But what motivates us to give our money or time? Theres existing research which shows that we give in order to feel good, or to look good to others, but we wanted to look at another motivation: our political leanings.

Also Check: Should Republicans Vote In Democratic Primary

Data Sources: Irs Forms 990

The Form 990 is a document that nonprofit organizations file with the IRS annually. We leverage finance and accountability data from it to form Encompass ratings. .

Impact & Results

This score estimates the actual impact a nonprofit has on the lives of those it serves, and determines whether it is making good use of donor resources to achieve that impact.

Impact & Results Score

Leftist Media And Academia Tell The Public The Opposite

Some liberals might argue that religious, conservative republicans are happier simply because they are mentally ill; they are disassociated with reality and just dont know any better. They claim this is even demonstrated in scientific research. In fact, one articles first line in reporting this research was quite blunt: Anyone whos wanted to dismiss Republican politics as straightforwardly mean now has some data to back them up. Lands sakes.

Some research did appear to show this, and it got a great deal of press. Retraction Watch, however, tells us it had some serious mistakes in its calculations, and an erratum was published by the American Journal of Political Science. In fact, Retraction Watch reports, The descriptive and preliminary analyses portion of the manuscript was exactly reversed. The data shows a strong correlation between liberalism and psychoticism, not conservatism. This correction was not widely reported for some curious reason.

Finally, if you had to guess who are more generous with their money and volunteering their time to help those in need, would you guess Democrats or Republicans? Of course, its Democrats. Republicans only care for themselves and their own pocketbook. In fact, dont they want to actually punish the poor for not working hard enough? Well, you would be right if stereotypes were the arbiter of truth. But what does objective research tell us?

Recommended Reading: What News Channel Do Republicans Watch

Percentage Of Us Donations Going Tovarious Causes

Nonprofits have grown faster than government and faster than the business sector over the last generation, even during boom periods.

The figures charted here actually underestimate the fraction of American manpower that goes into charitable workbecause they show only paid employment, while volunteers carry out a large share of the labor poured into these groups. Various calculations of the cash value of donated labor suggest that at least an additional 50 percent of output by charities takes place invisibly because it is produced by volunteers. Youll find more statistics on American volunteering in Graphs 8 and 9.

Charitable activity is becoming a bigger and bigger part of Americas total economy. For perspective, consider that annual U.S. defense spending totals 4.5 percent of GDP. The nonprofit sector surpassed the vaunted military-industrial complex in economic scope way back in 1993.

Real Rise In Us Giving

After adjusting for inflation, charitable giving by Americans was close to seven times as big in 2016 as it was 62 years earlier.

Of course, one reason total giving went up is because the U.S. population almost doubled. But if we recalculate inflation-adjusted charitable giving on a per capita basis, we see that has also soared: by 3½ times. Charitable causes are very lucky to have a remarkably expansive American economy behind them, and a standard of living that refuses to stagnate.

What if we calculate charitable giving as a proportion of all national production ? The math reveals that over the last 60 years, donations as a proportion of our total annual output increasedbut only very slightly. For most of the last lifetime, giving has hovered right around 2 percent of our total national treasure.

Two percent of GDP is a huge sum, particularly in comparison to other countries . But it’s interesting that even as we have become a much wealthier people in the post-WWII era, the fraction we give away hasn’t risen. There seems to be something stubborn about that 2 percent rate.

Keep in mind too that religious charities tend to have less access to supplemental funds than other nonprofits. Hospitals and colleges charge users fees to supplement their donated income; other nonprofits sell goods; many museums charge admission; some charities receive government grants. Churches and religious charities, however, operate mostly on their donated funds depicted in this graph.

Recommended Reading: What Cities Are Run By Republicans

What Elite Donors Want

Big-money donors, both Democrat and Republican, not only have more political influence than the average voter, they also have more extreme beliefs.

The outsize political influence of elite donors, whose views tend to be more extreme than that of mainstream voters, partly explains why political polarization is on the rise. | Illustration by Alvaro Dominguez

In November 2012, newly elected Democratic members of the United States Congress got about a week to savor their victories. Then, the Democratic Congressional Campaign Committee advised them to start hitting the phones for 3-4 hours per day. Who were they supposed to be calling? Mainly, elite donors the fewer than 1% of Americans who give candidates more than $200 in any given election cycle.

It isnt news that politicians court elite donors or that elite donors have greater political access and influence than the typical voter. But, as Stanford Graduate School of Business political economist Neil Malhotra points out in an article recently published in Public Opinion Quarterly, we know remarkably little about what they actually want from government.

This is a particularly relevant issue during the current, seemingly endless, election cycle, in which the battle for control of the executive and legislative branches of the federal government is unusually contentious and fraught with implications for the future of the nation.

Do Democrats Hate Charity

Another round of COVID-19 relief from Congress is on life support but not dead, as centrist Democrats have begun to pressure Speaker of the House Nancy Pelosi toward compromise. That would mean finding some middle ground between the $3 trillion House HEROES Act, with its bailout for profligate blue-state governments, and the Republican $500 billion skinny bill. If serious negotiations do ensue, there is one provision on which Senate Republicans should not budge: a strong new form of tax relief for individual charitable giving. Its a provision both important in its own right and revealing of a larger philosophical difference between the parties when it comes to charity.

The latest skinny Senate bill would specifically have expanded the so-called above-the-line tax deduction included in the original CARES Act, which authorized a $300 deduction even for those who do not itemize their tax returns. The Senate bill proposed to double that amount for 2020 taxpayers, to $600 for individuals and $1,200 for those filing a joint return. The House bill included no such provision, or even an extension of a less-generous version included in the first COVID-19 relief bill.

The above-the-line deduction proposed by Republicans provides an incentive for all taxpayers, not just the wealthy, to give to charity.

This piece originally appeared at the Washington Examiner

______________________

Recommended Reading: How Many Republicans Are In The Us House