Rubio Puerto Rico Governor Spar Over Tax Reform

3 years ago;;|;; By

Sen. Marco Rubio said he is disappointed in Puerto Rico Gov. Ricardo Rosselló for calling him out over the new Republican tax bill H.R. 1 suggesting the commonwealth’s leader is blame-shifting because of criticism of his job performance. The disagreement between the two leaders centers on provisions of the new bill that could put companies in Puerto Rico at a competitive disadvantage because they would be treated as if they’re offshore firms subject to higher taxes than mainland-based corporations. Rosselló threatened political retribution Monday when he told Rubio’s hometown…

The House on Tuesday passed the Republican tax bill in a 227-203 vote.If passed into law, the bill would make significant changes to the Affordable Care Act.The Senate is expected to vote on the bill on Tuesday.The GOP is on the brink of passing its massive tax reform bill.On Tuesday, the House voted in favor of the bill, sending it to the Senate, which is expected to vote on the bill later in the day. If it passes – and after the House revotes on the bill on Wednesday – Trump could sign the bill as soon as Wednesday.The bill would cut the corporate tax rate to 21% from 35% and…

Limited Or No Wage Impact

Corporate executives indicated that raising wages and investment were not priorities should they have additional funds due to a tax cut. A survey conducted by Bank of America-Merrill Lynch of 300 executives of major U.S. corporations asked what they would do with a corporate tax cut. The top three responses were that they would pay down debt, conduct stock buybacks, and conduct mergers. An informal survey of CEOs by Trump advisor Gary Cohn resulted in a similar response, with few hands raised in response to his request for them to do so if their company would invest more.

Former Clinton cabinet Treasury Secretary Larry Summers referred to the analysis provided by the Trump administration of its tax proposal as “…some combination of dishonest, incompetent, and absurd.” Summers wrote that the Trump administration’s “central claim that cutting the corporate tax rate from 35 percent to 20 percent would raise wages by $4,000 per worker” lacked peer-reviewed support and was “absurd on its face.”

Rep Dana Rohrabacher Of California

Rohrabacher told Roll Call before the vote that his vote would be determined by how his constituents would fare if the bill became law. He is one of the most vulnerable House members in 2018, in part because of his ties to Russia. He is a top DCCC target. Clinton;carried his 48th District by;2 points in 2016 while Rohrabacher won re-election to a 15th term by 17 points. Inside Elections rates the race Tilts Republican.

Recommended Reading: Do Republicans Wear Red Or Blue

These Are The 12 House Republicans Who Voted Against The Tax Bill

Congressional Republicans support for the Tax Cuts and Jobs Act was overwhelmingbut not universal.

The tax reform bill easily passed the House of Representatives Tuesday, with 227 members of Congress voting for it and 203 voting against. The Senate is expected to vote on the bill late Tuesday before sending it to President Donald Trumps desk.

The vote was almost entirely divided along party lines; no Democrats voted for the bill, and only twelve Republicans voted against it. Those Republicans are:

-

Rep. Dan Donovan, 11th District of New York

-

Rep. John Faso, 19th District of New York

-

Rep. Rodney Frelinghuysen, 11th District of New Jersey

-

Rep. Darrell Issa, 49th District of California

-

Rep. Walter Jones, 3rd District of North Carolina

-

Rep. Peter King, 2nd District of New York

-

Rep. Leonard Lance, 7th District of New Jersey

-

Rep. Frank LoBiondo, 2nd District of New Jersey

-

Rep. Dana Rohrabacher, 48th District of California

-

Rep. Chris Smith, 4th District of New Jersey

-

Rep. Elise Stefanik, 21st District of New York

-

Rep. Lee Zeldin, 1st District of New York

Donovan said in a statement that he was unable to support the bill because it capped the state and local tax deductions at $10,000. He said he had been fighting tooth and nail to protect the deduction, along with fellow GOP members of the New York congressional delegation, Faso, King, Stefanik and Zeldin.

Differences Between The House And Senate Bills

There were important differences between the House and Senate versions of the bills, due in part to the Senate reconciliation rules, which required that the bill impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. For example:

In final changes prior to approval of the Senate bill on December 2, additional changes were made that were reconciled with the House bill in a conference committee, prior to providing a final bill to the President for signature. The Conference Committee version was published on December 15, 2017. It had relatively minor differences compared to the Senate bill. Individual and pass-through tax cuts expire after ten years, while the corporate tax changes are permanent.

In the Senate, Republicans eager for a major legislative achievement after the Affordable Care Act debacle have generally been enthusiastic about the tax overhaul.

A number of Republican senators who initially expressed trepidation over the bill, including Ron Johnson of Wisconsin, Susan Collins of Maine, and Steve Daines of Montana, ultimately voted for the Senate bill.

Read Also: How Many States Are Controlled By Republicans

Republican Tax Bill Passes Senate In 51

By Thomas Kaplan and Alan Rappeport

WASHINGTON Republicans took a critical step toward notching their first significant legislative victory since assuming full political control, as the House and Senate voted along party lines on Tuesday and into early Wednesday to pass the most sweeping rewrite of the tax code in decades.

The $1.5 trillion tax bill, which is expected to head to President Trumps desk in the coming days, will have broad effects on the economy, making deep and lasting cuts to corporate taxes as well as temporarily lowering individual taxes.

The endeavor was not without hiccups, however, as three small provisions in the final tax bill agreed to by the House and Senate were found by the Senate parliamentarian to violate the budget rules that Republicans must follow to pass their bill through a process that shields it from a Democratic filibuster. As a result, the bill changed slightly in the Senate, and the House will now need to vote on it again since both chambers must approve identical legislation. Among the items that were deemed out of order was the title of the bill: the Tax Cuts and Jobs Act.

The approval of the bill in the House and Senate came over the strenuous objections of Democrats, who have accused Republicans of giving a gift to corporations and the wealthy and driving up the federal debt in the process.

transcript

Increases Income And Wealth Inequality

Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.Congressional Budget Office

The New York Times editorial board explained the tax bill as both consequence and cause of income and wealth inequality: Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nations wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests. The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

In 2027, if the tax cuts are paid for by spending cuts borne evenly by all families, after-tax income would be 3.0% higher for the top 0.1%, 1.5% higher for the top 10%, -0.6% for the middle 40% and -2.0% for the bottom 50%.

Recommended Reading: How Many States Are Controlled By Republicans

Charts: See How Much Of Gop Tax Cuts Will Go To The Middle Class

Both provisions have been found to be in violation of the Byrd Rule, which governs the types of legislation that can be passed under reconciliation. Reconciliation is the process that allows budget bills to pass the Senate with 51 votes, without first getting the 60 votes needed to close debate. In part, the Byrd Rule says that provisions can’t contain “extraneous matter” that doesn’t pertain to the budget.

The House will reconvene Wednesday morning and is set to vote again then.

The House passed the final version of Republicans’ $1.5 trillion tax overhaul on Tuesday afternoon, by a vote of 227-203.

Rep Peter T King Of New York

King also voted no due to the SALT deduction changes, and he warned that passing the tax bill would cause Republicans to lose House seats next year. The 13-term congressman is a new DCCC target though Trump;carried his;2nd District by 9 points. One of the Democrats hoping to take on King, Tim Gomes, has loaned his campaign $1 million. Inside Elections rates the race Solid Republican.

Read Also: How Many States Are Controlled By Republicans

Chart: How The New Version Of The Republican Tax Bill Would Affect You

That vote fell largely along party lines. No Democrats voted in favor of the bill, as was the case when the House passed its initial version of the bill in November. Twelve House Republicans voted against the bill.

The Senate bill passed largely along party lines as well. No Democrats voted for the bill in either of the House or Senate’s initial votes, and the bill did not undergo any major changes in conference committee, where the differences between the House and Senate versions were reconciled.

Just before the House vote Tuesday, Speaker Paul Ryan, R-Wis., spoke, casting the bill as a long-awaited conservative victory that would benefit American workers.

“My colleagues, this is a day I have looked forward to for a very long time,” he said. “We are about to achieve some big things â things that the cynics have scoffed at for years, decades even.”

As he and other Republicans have done for months while promoting the plan, he likewise framed the bill as beneficial to workers and families.

“This is real relief for families out there living paycheck to paycheck, struggling to make ends meet,” he later added.

However, House Minority Leader Nancy Pelosi, D-Calif., castigated Republicans for a bill that she said would particularly benefit the already-wealthy.

“In this holy time, the moral obscenity and unrepentant greed of the GOP tax scam stands out even more clearly,” she said.

Senate Republicans Pass Sweeping Overhaul Of Us Tax Code

Bill passed in early hours of Saturday will benefit big businesses and the wealthy, and give Donald Trump his first major legislative victory

Senate Republicans have passed the most sweeping overhaul of the US tax code in three decades, a significant step that moves Donald Trump closer to achieving the first major legislative victory of his presidency.

The Senate passed its tax plan in a 51-49 vote early on Saturday morning, with Vice-President Mike Pence presiding over the chamber and after a frantic rewrite. Bob Corker was the sole Republican to vote against the bill, which would bestow huge benefits on US corporations and the wealthiest Americans.

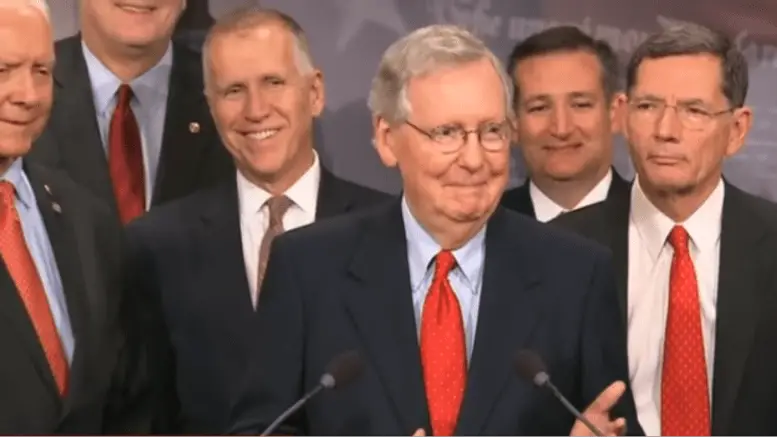

We think this is a great day for the country, the Senate majority leader, Mitch McConnell, said at a celebratory press conference.

On Saturday morning, Trump praised lawmakers and said he was looking forward to signing the bill before Christmas.

It was a fantastic evening last night, the president told reporters outside the White House before he left for New York. We passed the largest tax cuts in the history of our country and many other things along with it.

Now we go on to conference and something beautiful is going to come out of that mixer. People are going to be very, very happy. Theyre going to get tremendous, tremendous tax cuts and tax relief, and thats what this country needs.

This, as I have seen it unfold tonight, it is not designed to have one Democrat on the bill, he added.

You May Like: Did Republicans And Democrats Switch Names

Senate Passes Gop Tax Reform Bill With 51 Votes

The Senate passed the GOP tax reform bill along party lines early morning on Saturday. The passage means the Republican Party will likely deliver its major legislative achievement this year.

In fact, President Donald Trump wants to sign the tax reform legislation by Christmas as a gift to Americans. Last week, the President said, Were going to give the American people a huge tax cut for Christmas.; Hopefully, that will be a great, big, beautiful Christmas present.

On Friday, Republican leaders spent all day and night making negotiations and amendments to the legislation before the final vote.

Senate Majority Leader Mitch McConnell told the Associated Press that the GOP tax reform bill is just what the country needs to get growing again. He also ignored the fact that the legislation has little public support. According to him, Big bills are rarely popular. You remember how unpopular Obamacare was when it passed?

Tax Cuts And Jobs Act Of 2017

| Long title | An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 |

|---|---|

| Tax Cuts and Jobs ActGOP tax reformCut Cut Cut Act | |

| Enacted;by | |

| Internal Revenue Service | |

| Legislative history | |

|

Some critics in the media, think tanks, and academia assailed the law, mainly based on forecasts of its adverse impact , disproportionate impact on certain states and professions and the misrepresentations made by its advocates. Some of the reforms passed by the Republicans have become controversial within key states, particularly the $10,000 cap on state and local tax deductibility, and were challenged in federal court before being upheld. According to an aggregation of polls from Real Clear Politics, 34% of Americans were in favor of the new plan, 39% not in favor, and 28% unsure.

Don’t Miss: Breakdown Of Trump Voters

Senators Voted Big Tax Cuts For Rich But Attack Relief Bill

Sen. Rick Scott

Several Republican senators who voted “no” on the new bipartisan COVID relief bill passed by Congress on Monday took to Twitter to complain that the bill was too expensive despite a record of supporting 2017’s monumental tax break for billionaires.

Sen. Rick Scott tweeted Tuesday that he voted against COVID relief, calling the bill “wasteful”.

“I supported and fought for many of the COVID provisions in last night’s bill,” he wrote on the platform. “Unfortunately, they were attached to an omnibus spending bill that was thousands of pages long and chock full of handouts to special interests and wasteful spending. I couldn’t support it.”

Also on Tuesday, Sen. Ted Cruz retweeted a story from a far-right outline with the headline, “Sen. Ted Cruz Is Right: Congress Labeled End-of-Year Spending Bill ‘COVID Relief’ to Cover the Pork.”

In a Monday night , Cruz slammed the bill as a “spending monstrosity”.

“Tonight, badly-needed #COVID19 relief was tied to a $1.4T end-of-year spending monstrosity because three times Democrats rejected good faith efforts to pass targeted legislation that would have helped Americans hurting as a result of the pandemic,” Cruz wrote.

She voiced objections to the bill expanding visas, providing Pell grants for prisoners, and “sending cash to households with illegal aliens”.

“Increasing the federal deficit and spending money we do not have will harm our economic recovery,” she added.

An Affinity For Small Business

Passing a law that helped fuel increases in stock prices wasnt the only way Republicans enriched themselves. The new law also contained a 20 percent deduction for income from so-called pass-through businesses, a provision called the crown jewel of the act by the National Federation of Independent Businesses, a lobbying group.

Pass-throughs are single-owner businesses, partnerships, limited liability companies and special corporations called S-corps. Most real estate companies are organized as LLCs. Trump owns hundreds of them, and Public Integritys analysis found that 22 of the 47 members of the House and Senate tax-writing committees in 2017 were invested in them.

Pass-throughs can be found in any industry. They pay no corporate taxes and steer their profits as income to business owners or investors, who are taxed only once at their individual rates. Despite their favored treatment as a business vehicle, the 2017 tax act did them another favor: It allowed 20 percent to be deducted off the top of the pass-through income for tax purposes.

Our investigations. Your inbox.

Sign up for the Center for Public Integritys weekly Watchdog newsletter.

No doubt. Johnson, with his wife, held interests that year in four real estate or manufacturing LLCs worth between $6.2 million and $30.5 million, from which they received income that year between $250,000 and $2.1 million, according to his financial disclosure form.

Read Also: How Many States Are Controlled By Republicans