What Is Difference Between Cdd And Edd

CDD aims at collecting data about customers identity and contact information as well as measuring their risk. EDD is used for high-risk customers, aka those who are more likely to implement related to money laundering and terrorism financing activities due to the nature of their business or transactions.

What Are The Pros Of The Patriot Act

The USA Patriot Act deters and punishes terrorist attacks in the United States and abroad through enhanced law enforcement and strengthened money laundering prevention. It also allows the use of investigative tools designed for organized crime and drug trafficking prevention for terrorism investigations.

Interagency Interpretive Guidance On Customer Identification Program Requirements Under Section 326 Of The Usa Patriot Act

FAQs: Final CIP Rule

The staff of the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Financial Crimes Enforcement Network, National Credit Union Administration, Office of the Comptroller of the Currency, Office of Thrift Supervision, and the United States Department of the Treasury are issuing these frequently asked questions regarding the application of 31 C.F.R. § 103.121. This joint regulation implements section 3261 of the USA PATRIOT Act and requires banks, savings associations, credit unions and certain non-federally regulated banks to have a Customer Identification Program .

While the purpose of the FAQs document is to provide interpretive guidance with respect to the CIP rule, the Agencies recognize that this document does not answer every question that may arise in connection with the rule.The Agencies encourage banks to use the basic principles set forth in the CIP rule, as articulated in these answers, to address variations on these questions that may arise, and expect banks to design their own programs in accordance with the nature of their business.

Finally, these FAQs have been designed to help banks comply with the requirements of the CIP rule. They do not address the applicability of any other Federal or state laws.

31 C.F.R. § 103.121 — Definition of account

31 C.F.R. § 103.121 — Definition of bank

31 C.F.R. § 103.121 — Definition of customer

31 C.F.R. § 103.121 Person with an existing account

You May Like: Republicans And Democrats Switched

How Can We Help

With strong expertise in ID verification for governments, Gemalto supports private customers by providing a solution that helps them comply with the new rules, particularly those regarding CDD and KYC obligations.

ID Verification helps banks provide a smooth customer onboarding experience that complies with KYC regulations and minimizes fraud risk.

Our solution automatically provides, in a matter of seconds:

- digital capture of customer information for instant auto-fill in enterprise data systems

- multichannel identity document verification, with adaptable security levels

- the option of customer authentication using biometric technologies

- the option of customer risk assessment through the review of PEPs, sanction or watch lists

Our system is using the A.I. approach, where the system is capable of learning from data.

It’s a central component of the latest-generation algorithms developed by Thales in its ID Verification systems.

In short, you will rapidly increase your onboarding rate as the system learns and gets better all the time.

What Is Edd In Bank

Enhanced due diligence is a KYC process that provides a greater level of scrutiny of potential business partnerships and highlights risk that cannot be detected by customer due diligence. EDD goes beyond CDD and looks to establish a higher level of identity assurance by obtaining the customers identity and

You May Like: Trump In Blue Tie

Duke Street Alexandria Va 22314

Dear Board of Directors:

The USA Patriot Act requires credit unions and other financial institutions to establish and maintain documentation of a Customer Identification Program . The purpose of the CIP is to reasonably identify members opening accounts.

Since the CIP was implemented on October 1, 2003, numerous questions have been raised. To ensure consistency among financial institutions, a jointly drafted list of frequently asked questions and answers interpreting CIP requirements has been approved by the Federal Financial Institutions Examinations Council agencies.

Please note the term “bank” is used interchangeably with “credit union” throughout the joint FAQs to assure consistency with longstanding Treasury and FinCen regulations.

If you have other questions about your CIP, please contact your regional office, examiner, or state supervisory authority.

Sincerely,

Acceptable Identification Must Meet The Following Requirements:

- The identification must contain a photo of the borrower

- The identification must contain the Borrowers name

- The identification must contain the Borrowers date of birth

- The identification must contain a street address

- In the event that the individual does not have a street address, the loan originator must collect a military P.O. Box number or street address of next of kin or another contact individual.The identification must contain a Taxpayer ID Number .

For non-US citizens the identification must contain a taxpayer ID number, passport number with country of issuance, alien ID card number, or other foreign-issued picture ID.

It is not necessary for each piece of identification to meet all of the requirements . However, all requirements must be met with a combination of identification.

Don’t Miss: How Many Democratic And Republican Presidents

Related To A Customer Identification Information Form And Such Other Forms And Verification As Wells

Customer Identification Program NoticeCustomer Identification ProgramIDENTIFYING INFORMATION AND PRIVACY NOTIFICATIONCustomer Identification – USA Patriot Act NoticeIdentifying Information and PrivacyNo Reliance on Agents Customer Identification ProgramCertification Regarding Lobbying Applicable to GrantsIdentification CardsNo Reliance on Administrative Agents Customer Identification ProgramPatient InformationPlans & Pricing

Patriot Act Identification Requirements

As of October 1, 2003, the USA Patriot Act requires to collect information from borrowers to confirm their identity.

The Patriot Act requires 2 forms of identification to be collected and verified by the VA mortgage home loan originator when an applicant applies for a VA loan.

Each piece of identification must meet an item on the list below.

Don’t Miss: How Many Republicans In Congress 2017

Identity Verification Notice Us Patriot Act

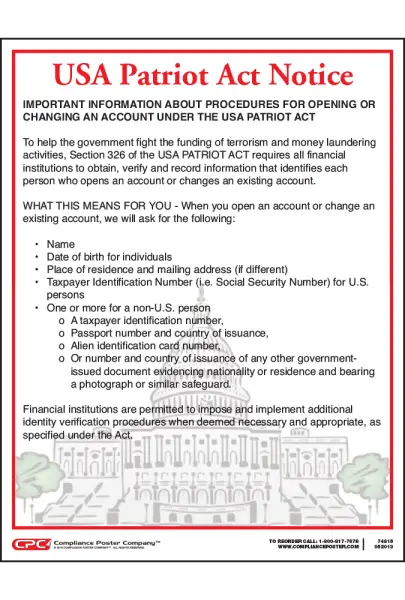

The USA PATRIOT Act requires all financial institutions in the United States to ask new and existing members/customers for identification prior to opening new accounts , adding individuals/entities to existing accounts, and for sometransactions like wires and ACH.

When employees of NorthRidge Community Credit union, or its wholly owned subsidiary CU Financial Services of Minnesota, Inc., requests a photo ID or other identification, the request is not intended to invade your privacy or not acknowledge you as a valued member/customer. We are simply complying with a new federal regulation that is designed to protect you from identity theft, protect the credit union and its subsidiary from being used for illegal or questionable activity.

For account transactions, you will only be asked for one form of ID. If you are opening a new account or adding someone to an existing account, you will be asked to provide at least two forms of ID. If you do not have this information with you at the time you make your request, financial institutions are prohibited from completing the transaction until it is provided.

Following are acceptable forms of ID. ID provided needs to show your name, social security number or tax identification number, residence and date of birth.

Kyc And Customer Due Diligence Measures

The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. Its origin stems from the 2001 Title III of the Patriot Act to provide various tools to prevent terrorist activities.

To comply with international regulations against money laundering and terrorist financing, reinforced Know Your Customer procedures need to be implemented in the first stage of any business relationship when enrolling a new customer.

Banks usually frame their KYC policies incorporating the following four key elements:

- Customer Policy

- Customer Identification Procedures aka Customer Identification Program

- Risk assessment and management

- Ongoing monitoring and record-keeping

This involves verifying a customer’s identity through documents, including a national ID Document with a document reader and advanced document verification software.

Recommended Reading: People Magazine Trump Article 1998

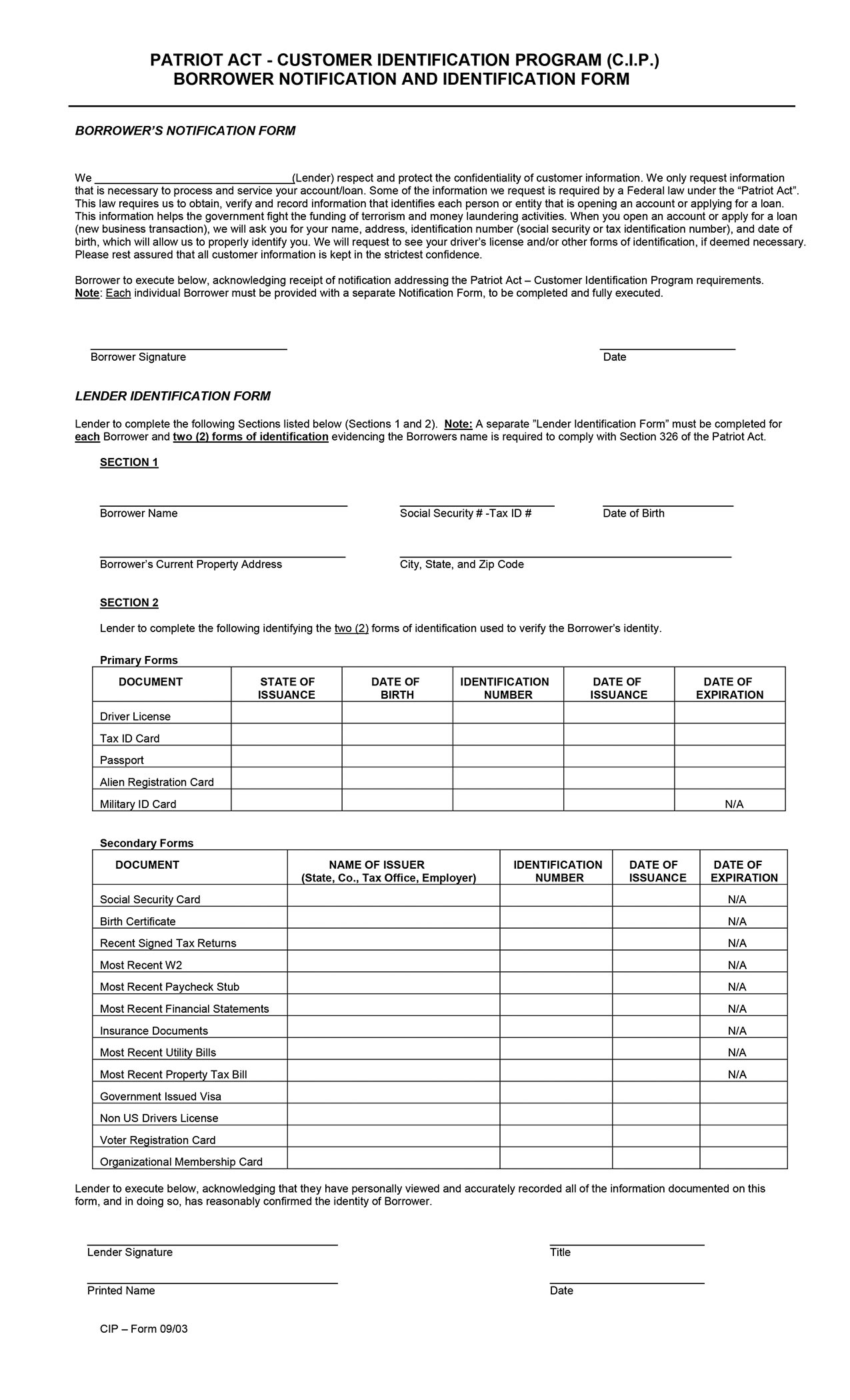

What Is A Borrower Identification Form

Borrower Identification Form is used to record the identification information of the borrower to establish the true identity of the borrower. The purpose of the form is to ensure the lender has obtained documentary evidence of the identity of the borrower. It is used to comply with the Customer Information Program under the Bank Secrecy Act regulations as well as to limit the incidence of identity theft. A separate form is used for each co-borrower.

At the time of closing, the closing agent will ask the borrower to show identity cards or documents. The identification documents may include passport, driver’s license, State Id cards, etc. The form is used to record the key identifying information from the documents such as document type, id number, state/country, issue date, and expiry date. Copies of identification documents are not required. For example, if the borrower provides driver’s license then the closing agent will record the license number, issue date, expiration date, and other important details in the form. A copy of the driver’s license is not retained.

Why Is The Kyc Process Important

KYC procedures defined by banks involve all the necessary actions to ensure their customers are real, assess, and monitor risks.

These client-onboarding processes help prevent and identify money laundering, terrorism financing, and other illegal corruption schemes.

KYC process includes ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification.

Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud. KYC compliance responsibility rests with the banks.

In case of failure to comply, heavy penalties can be applied.

In the U.S., Europe, the Middle East, and the Asia Pacific, a cumulated USD26 billion in fines have been levied for non-compliance with AML, KYC, and sanctions-fines the past ten years – let alone the reputational damage done and not measured.

According to the United Nations, criminals are laundering between $1.6 to $4 trillion annually. Stricter KYC/CDD processes are helping to stop that.

Recommended Reading: Patriot Lighting Belle Collection

What Are The Provisions Of The Patriot Act

Specifically, the Patriot Act gave federal officials new surveillance authority in terrorism cases, as well as the ability to conduct searches of property without the consent or knowledge of the owner or occupant. Increased federal authority to freeze financial assets of suspected terror groups and individuals.

Patriot Act Requirements For Opening A Bank Account

The War on Terrorism has changed many procedures in the United States, including banking. President George W. Bush signed the USA PATRIOT Act into legislation in 2001, shortly after the 9/11 attacks. Patriot Act is an acronym for the full act title, “Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism.” Part of the legislation includes stricter regulations on banks when it comes to opening new accounts.

Recommended Reading: Difference Between Federalists And Democratic Republicans

Related To Usa Patriot Act Section 326 Customer Identification Program

Customer Identification – USA Patriot Act NoticeCustomer Identification ProgramCustomer Identification Program NoticeUSA PATRIOT Act, EtcUSA Patriot Act NotificationUSA PATRIOT Act NoticeUSA Patriot Act ComplianceOFAC, PATRIOT Act ComplianceUSA Patriot Act Notice CompliancePATRIOT Act, etcPlans & Pricing

Ekyc Facial Recognition And Digital Account Opening

Banking is undoubtedly the area where the use of facial recognition was least expected.

And yet, it promises a lot.

KYC onboarding with facial recognition online is a hot topic in 2021.

Why?

Covid-19 pushed customers and banks to rely more heavily on digital channels and apps.

64% of primary checking account openings were done online in Q2 2020 in the United States alone.

And this is not going to change.

A recent study from Visa and BAI showed that the trend would continue after the pandemic.

Beyond that, increased mobile usage urges businesses to have a mobile-first focus and develop fully mobile user-friendly onboarding experiences.

During the identification process , the software usually provides a liveness detection feature to avoid spoofing attacks using a static image. Liveness detection proves that the selfie taken comes from a live person.

The result?

Adapting to current customer preferences, financial institutions can invest in digital onboarding, including video KYC , and leverage biometrics through online and mobile channels.

Authentication cloud services to secure access to digital banking

Also Check: Donald Trump Calls Republicans Stupid

In What Ways Did The Usa Patriot Act Augment The Bank Secrecy Act

Among other things, the USA PATRIOT Act criminalized the financing of terrorism and augmented the existing BSA framework by strengthening customer identification procedures prohibiting financial institutions from engaging in business with foreign shell banks requiring financial institutions to have due diligence

Bring Identity Documents At Closing

It order to complete the Borrower Identification Form, the closing agent will ask you to bring at least two forms of identification at closing. It is the closing agent’s responsibility to note down the information on the form. However, as a safeguard, you should review the form completed by the closing agent to ensure the information on the form is correct. Remember to take back your id documents back.

Don’t Miss: How Many Senators In Ct

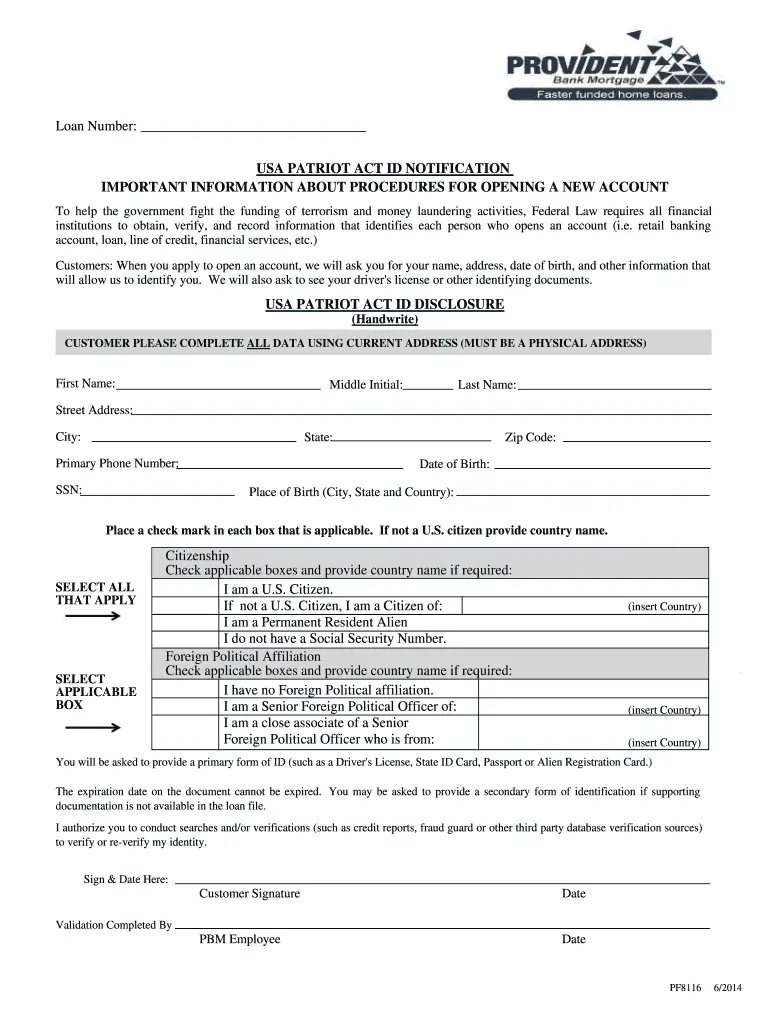

What Is A Patriot Act Disclosure

Patriot Act Disclosure informs the borrower that the lender is requesting identifying information for each borrower to establish their identities. It is provided at the time of account opening to explain to the borrower that the information is required in pursuance of federal regulations.

Mortgage lenders are required to implement a Customer Information program under the Bank Secrecy Act regulations. CIP must contain procedures to obtain identifying information for each customer at the time of account opening. Additionally, the regulation requires a lender to provide the Patriot Act Disclosure to the customer to inform that the purpose of requesting identifying information is to verify their identity.

At the time of closing, the closing agent will ask the borrower to show identity cards or documents. The identification documents may include passport, driver’s license, State Id cards, etc. The form is used to record the key identifying information from the documents such as document type, id number, state/country, issue date, and expiry date. Copies of identification documents are not required. For example, if the borrower provides driver’s license then the closing agent will record the license number, issue date, expiration date, and other important details in the form. A copy of the driver’s license is not retained.

From Visual Id Check To Digital Verification

For some, this is still primarily a paper-based check with KYC forms to fill. See examples here.

For others, it’s a digital process that involves verifying that an identity document is genuine or even going further to authenticate the holder of the document through additional biometric checks such as facial or fingerprint checks.

A digital ID verification process enables a bank to automatically capture customer demographic data, which can be integrated into enterprise systems like CRM to:

- streamline the customer onboarding process,

- conduct further due diligence and risk assessment,

- review for PEPs .

Financial institutions must also maintain records on transactions and Information obtained through the Customer Due Diligence measures.

These requirements should apply to all new customers and also to existing customers based on materiality and risk.

Read Also: Have The Democrats Tried To Impeach Every Republican President Since Eisenhower

Kyc Verification: Innovative Approaches Welcome

In November 2018, US agencies, including the Federal Reserve, issued a joint declaration that encourages some banks to become increasingly sophisticated in their approaches to identifying suspicious activity and experimenting with artificial intelligence and digital identity technologies.

Earlier in the year, the European Supervisory Authorities promoted new solutions to address specific compliance challenges. They suggest retaining a common approach for a consistent application of standards across the EU.

They anticipate several types of control, such as «a built-in computer application that automatically identifies and verifies a person from a digital image or a video source or a built-in security feature that can detect images that are or have been tampered with whereby such images appear pixelated or blurred.

The use of biometrics can be challenged by local or regional regulations .

On this topic, read our September 2020 web dossier on biometric data and data protection regulations.

Mobile biometric authentication with Thales Gemalto Mobile Protector

Why The Patriot Act Is Unconstitutional

Who can they demand it from? Section 215 of the Patriot Act violates the Constitution in several ways. It: Violates the Fourth Amendment, which says the government cannot conduct a search without obtaining a warrant and showing probable cause to believe that the person has committed or will commit a crime.

Recommended Reading: 4patriots Solar Charger Not Charging

Why Is Customer Identification Program Important

The core purpose of the CIP is to verify the identity of a customer, where customer can mean any individual or organization that qualifies as a legal person that can open and use an account. Every CIP must have a risk-adjusted procedure to verify the identity of a potential customer who wants to open an account.

What Is Ekyc

- In India, Electronic Know Your Customer or Electronic Know your Client or eKYC is a process wherein the customer’s identity and address are verified electronically through Aadhaar authentication. Aadhaar is India’s national biometric eID scheme.

Why is eKYC so popular in India?It’s because 99% of the adult population has a digital identity in the country. In May 2021, 1,29 billion residents got their Aadhaar number.

- eKYC also refers to capturing information from IDs , the extraction of digital data from government-issued smart IDs with a physical presence, or the use of certified digital identities and facial recognition for online identity verification.

Customer onboarding can then be done via mobile.eKYC is considered more and more feasible as its accuracy is improving by utilizing Artificial Intelligence .

Don’t Miss: Did Southern Democrats Become Republicans

What Is Kyc

KYC means Know Your Customer and sometimes Know Your Client.

KYC or KYC check is the mandatory process of identifying and verifying the client’s identity when opening an account and periodically over time.

In other words, banks must make sure that their clients are genuinely who they claim to be.

Banks may refuse to open an account or halt a business relationship if the client fails to meet minimum KYC requirements.