How Should You Choose The Best Credit Union Account

Examine how you use banking products, and choose the credit union that best fits your needs. Its crucial to find a credit union that makes your life easy, offers the essential products you need, and keeps fees low. Review several factors as you compare options:

- Does the credit union charge monthly fees in checking accounts, and if so, can you qualify for a waiver?

- Are savings account rates competitive?

- If you overdraw your account periodically, are there reasonable fees or mechanisms to cover overdrafts from savings?

- Is the website easy to navigate?

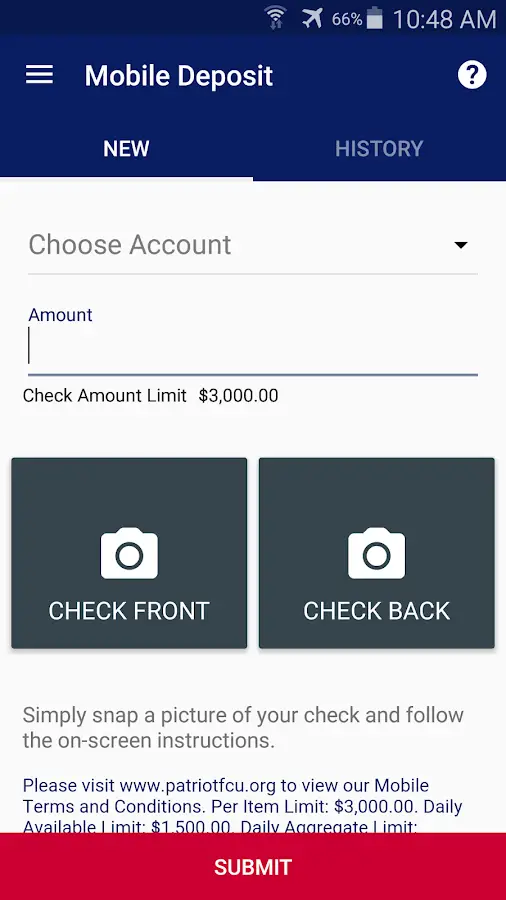

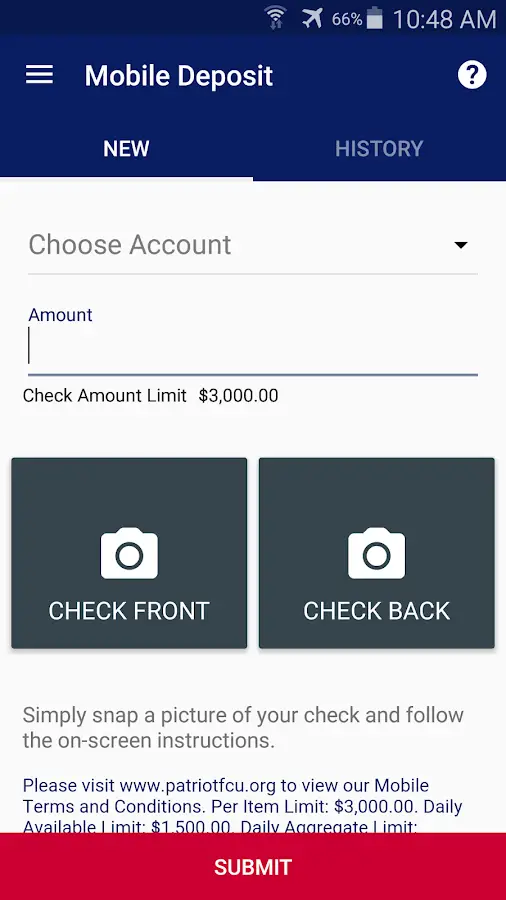

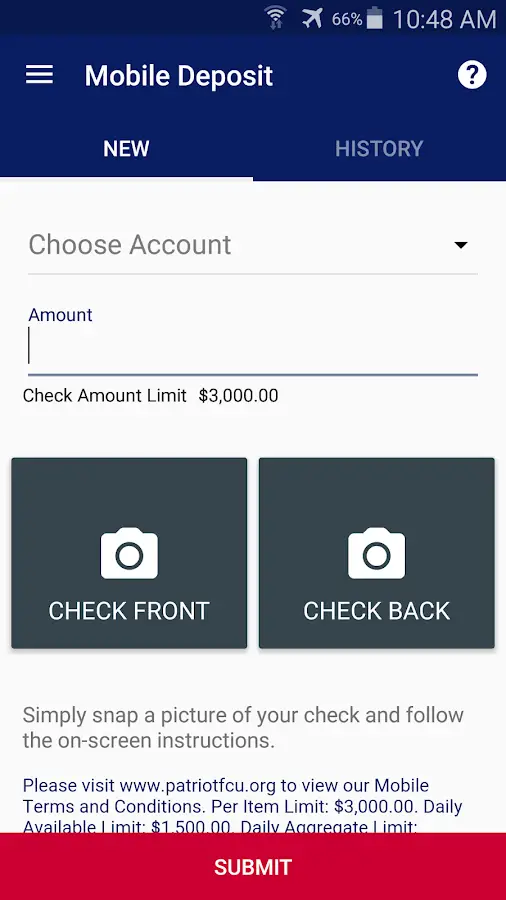

- Is there an app, and what features does it include?

- Can you deposit checks with your mobile device?

- Do you pay fees for using other banks ATMs?

- Are ATM fee rebates available?

- Are branches convenient for you?

- Does the credit union participate in a nationwide shared branching network?

- If you need to borrow money, does the credit union offer the types of loans you need ?

- Can you pay bills online?

Important Information About Procedured For Opening A New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account at Mississippi Federal Credit Union.

When you open an account, we will ask you for your name, address, date of birth and other information that will allow us to identify you. We will also ask to see your drivers license or other identifying documents.

If you presently have an account with us and you open additional accounts, add joint owners to an existing account or apply for a loan, we must also verify and retain copies of your identification.

We ask for your understanding as we work to support these efforts to maintain the security of your funds and our country.

Platinum Visa Credit Card

Because you have enough to worry about, the last thing you need to be concerned with is getting the best rate on your credit card. For all your major purchases and everyday expenses, Patriots Platinum VISA® Credit Card has a low interest rate to stretch your budget!

- Rates as low as 7.49% APR* on purchases and cash advances

You May Like: 115th Congress Demographics By Party

How Do You Open A Credit Union Account

To open an account, youll need to complete an application and provide personal information, as you would when opening any bank account. In many cases, you can do this entirely online. Credit unions also require you to meet membership qualifications.

Personal details include things like:

- Names of all account owners.

- Date of birth.

- Social Security Number or other identifying number.

- Government-issued identification details.

- Physical address .

Runner Up: Blue Federal Credit Union

Blue Federal Credit Union pays a competitive rate on its Sky High Savings Account and offers checking accounts with no monthly fees. You also can open a checking account that pays a high dividend on your balance and offers ATM rebates if you meet certain criteria. With competitive rates, low fees, and access to nationwide shared branching, its hard to go wrong with Blue FCU.

- Sky High Savings Account pays 0.45% APY.

- Checking accounts with no monthly fees.

- Checking account that pays up to 3.00% APY.

- Live phone support available 24/7.

- Mobile app for managing accounts and depositing checks.

If you dont meet Blue FCUs family, employer, or military membership requirements, you can join by donating $5 to the Blue Foundation, an advocate for local nonprofits. If you choose this route, youll deposit $10 to open your account, and Blue FCU will automatically use $5 for your donation.

-

Generous interest rate on Extreme checking account.

Recommended Reading: Who Manufactures Patriot Ceiling Fans

Patriot Federal Credit Union For Pc Conclusion:

Patriot Federal Credit Union has got enormous popularity with its simple yet effective interface. We have listed down two of the best methods to Install Patriot Federal Credit Union on PC Windows laptop. Both the mentioned emulators are popular to use Apps on PC. You can follow any of these methods to get Patriot Federal Credit Union for Windows 10 PC.

We are concluding this article on Patriot Federal Credit Union Download for PC with this. If you have any queries or facing any issues while installing Emulators or Patriot Federal Credit Union for Windows, do let us know through comments. We will be glad to help you out!

Joining Is A Lifetime Of Value

Patriot Federal Credit Union membership is open to anyone who lives, attends school, works, regularly conducts business or worships in Franklin County, Pennsylvania Frederick County, Maryland Washington County, Maryland and the Eastern Panhandle of West Virginia Berkeley, Jefferson and Morgan Counties.

Recommended Reading: Did Republicans Vote For Obamacare

Best For No Fees: Pennsylvania State Employees Credit Union

PSECU Logo

Pennsylvania State Employees Credit Union makes it easy to manage your money without worrying about fees. The checking account does everything you need with no monthly fees, and you can get rebates on fees you pay to other banks for using their ATMs. If you overdraw your account, theres no charge to transfer funds from a linked savings account.

- No monthly maintenance charge for checking or savings accounts.

- Free basic checks.

- ATM rebates up to $20 per month.

- Free Overdraft Protection Transfer Service for certain transactions.

- Mobile app with remote check deposit and other features.

- Potential cash-back rewards for debit card spending.

- Savings account pays 0.05% APY.

To meet the eligibility requirement at PSECU, you can join the Pennsylvania Recreation and Park Society with a $20 donationand PSECU will cover $10 of that for you. Youll also need to keep $5 in your savings account.

-

No fees for essential needs.

-

Cash-back rewards on debit card spending.

-

Low savings account interest rate.

Transporte Pblico A Patriot Federal Credit Union En Robinwood

¿Te preguntas cómo llegar a Patriot Federal Credit Union en Robinwood, Estados Unidos? Moovit te ayuda a encontrar la mejor manera de llegar a Patriot Federal Credit Union con indicaciones paso a paso desde la estación de transporte público más cercana.

Moovit proporciona mapas gratuitos y direcciones en vivo para ayudarte a navegar por tu ciudad. Mira los horarios, las rutas, los servicios y descubre cuánto tiempo lleva llegar a Patriot Federal Credit Union en tiempo real.

¿Buscas la estación o parada más cercana a Patriot Federal Credit Union? Mira esta lista de paradas más cercanas a tu destino: Robinwood Medical Center Rosebank Way.

Puedes arribar a Patriot Federal Credit Union en Autobús. Estas son las líneas y rutas que tienen paradas cercanasAutobús: 221

¿Quieres ver si hay otra ruta que te lleve allí antes? Moovit te ayuda a encontrar rutas y horarios alternativos. Obtén fácilmente instrucciones y direcciones desde Patriot Federal Credit Union con la aplicación Moovit o desde el sitio web.

Hacemos que viajar a Patriot Federal Credit Union sea fácil, por eso más de 930 millones de usuarios, incluidos los usuarios de Robinwood, confían en Moovit como la mejor aplicación de transporte público. No necesitas descargar una aplicación de autobús individual o una aplicación de tren, Moovit es tu aplicación de transporte todo en uno, que te ayuda a encontrar el mejor horario de autobús o de tren disponible.

Also Check: Watch The Patriots Game Live Online For Free

Becoming A Credit Union Member

To qualify for membership, you need to meet certain criteria, such as living in a particular area, working for specific employers, or joining an organization that opens the door to membership. In many cases, the easiest way to qualify for a credit union that youre not eligible for is to join a nonprofit organization with a modest donation.

Shippensburg Area Chamber Of Commerce

A small town with big opportunities is what you will find here in Shippensburg. No matter what you skill level, there is a great blend of retail, service and manufacturing jobs, as well as professional and health and human services career choices.

Those who live in and around Shippensburg not only work hard, but they also know ho to play hard. Take your pick: the choices are practically endless.

Until you spend a day discovering Shippensburg, you won’t know what a unique things it has to offer. Our town area is complete with shops, restaurants, and historical sites.

Recommended Reading: Patriots Game Directv

The Great Starter Card

- An equivalent deposit must be maintained in your share savings account for the total amount of the line. For example, a deposit of $500 held as collateral is the amount of your credit limit.

- When you use the Secured VISA® Credit Card, you must pay it back with regular payments to establish a good track record.

- Your good track record will be reported to the credit bureaus, which means you begin building a good credit history.

The Secured VISA® Credit Card requires you to stay within a credit limit covered by a savings deposit in the same amount. So, if you have the discipline to make your payments on time and pay off the balance, youll be rewarded with a credit score that opens up options for loans down the road!

Serving Our Community Since 1965

Patriot Federal Credit Union has been helping members achieve financial success in our community since 1965, when the Credit Union was first formed. Patriot is governed by member-volunteers elected to the Board of Directors and managed by experienced financial professionals.

At Patriot Federal Credit Union, youre more than an account numberyoure an owner! Patriot Federal Credit Union is a not-for-profit financial cooperative owned and operated by members like you. We have no stockholders to pay, resulting in higher dividend rates on deposit accounts, minimal fees and lower interest rates on loans.

Recommended Reading: Did The Republicans And Democrats Switch Platforms

Patriot Federal Credit Union Login

You can login to Patriot Federal Credit Union online account by visiting this link and access all the features. Make sure you have an account already with them. Launch your Web browser and navigate to Patriot Federal Credit Union’s Login page .

If you do not have an account, create an account. You will need to enter your email id, phone number and some personal data to verify your information.

How We Chose The Best Credit Unions

We started with a group of more than 50 credit unions and narrowed down the list to highlight the best offerings available. These credit unions are available to consumers nationwide, and many of them allow you to qualify for membership with relative ease. We evaluated fees for checking and savings accounts, ATM access, rates on deposits, product offerings, and more when selecting the best options. Finally, these financial institutions have deposit insurance to keep your money safe, up to applicable limits.

Read Also: Trump 1998 People Magazine Quote

Patriot Federal Credit Union

Pay Your Bills Securely with doxo

- State-of-the-art security

- Free mobile app available on Google Play & Apple App Store

- Never miss a due date with reminders and scheduled payments

- Real-time tracking and bill history

- Pay thousands of billers directly from your phone

doxo is a secure all-in-one service to organize all your provider accounts in a single app, enabling reliable payment delivery to thousands of billers. doxo is not an affiliate of Patriot Federal Credit Union. Logos and other trademarks within this site are the property of their respective owners. No endorsement has been given nor is implied. Payments are free with a linked bank account. Other payments may have a fee, which will be clearly displayed before checkout. Learn about doxo and how we protect users’ payments.

Simplify Your Life With Ebranch

Patriots eBranch gives you free, secure access to your accounts wherever you go so you can manage your money when its most convenient for you. Log in to eBranch anytime, anywhere you have access to the Internet to:

- Check your current account balances

- Monitor deposits, withdrawals, payments and other transactions

- Transfer money between accounts

- Pay bills using eSMART

- Review your account statements and view check images using e-Statements

- View loan information including payments made, next due date, and interest rate

- Set up account alerts to your email or mobile device

- Reorder checks

For added convenience, try Patriot Mobile or SMARTLINE .

Recommended Reading: Patriots Pro Shop Foxborough Ma

About Patriot Federal Credit Union Patriot Federal Credit Union Customers Added This Company Profile To The Doxo Directory Doxo Is Used By These Customers To Manage And Pay Their Patriot Federal Credit Union Bills All In One Place When Adding Patriot Federal Credit Union To Their Bills & Accounts List Doxo Users Indicate The Types Of Services They Receive From Patriot Federal Credit Union Which Determines The Service And Industry Group Shown In This Profile Of Patriot Federal Credit Unionhelp

General information about Patriot Federal Credit Union

| Services doxo users have associated this company with these services.help |

| Industry groups comprise multiple related services.help |

| doxo users have indicated this company does business in these areas.help |

Common questions, curated and answered by doxo, about paying Patriot Federal Credit Union bills.

How can I pay my Patriot Federal Credit Union bill?

How can I contact Patriot Federal Credit Union about my bill?

I forgot my account balance. Where can I find my bill?

What types of Patriot Federal Credit Union payments does doxo process?

Best For Military: Navy Federal Credit Union

Navy Federal Credit Union

Navy Federal Credit Union focuses on servicemembers and their families in all branches of the armed forces. The credit unions banking and customer service earns high marks in the J.D. Power 2021 U.S. Credit Card Satisfaction Study, signaling that your experience with Navy Federal should be a satisfying one.

- Savings account pays 0.25% APY

- Checking accounts with no monthly fees

- Potential ATM fee rebates

- Free basic checks

- Mobile app allows you to deposit checks and manage your accounts

- Live phone support available 24/7

Navy Federal Credit Union limits membership to:

- Active duty or retired servicemembers

- Members of the Delayed Entry Program

- Department of Defense civilians, contractors, and retirees

- Family or household members of the groups above

In addition to meeting membership criteria, youll need to keep $5 in a savings account.

Recommended Reading: Did Any Republicans Vote For Affordable Care Act

Best For Customer Service: Wings Financial Credit Union

Wings Financial Credit Union

Minnesota-based Wings Financial Credit Union makes it easy for customers to bank with them at more than 30 branches total in five statesMinnesota, Florida, Georgia, Michigan, and Washington. Those without access to a physical branch still can visit one of 80,000 surcharge-free ATMs nationwide since Wings is part of both the CO-OP and Allpoint networks.

Text support is available 24/7, and customer service representatives are available Monday through Friday from 7 a.m. to 7 p.m. CST and Saturday from 9 a.m. to 1 p.m. CST.

Residents of Minnesota, Wisconsin, Seattle-Tacoma, Detroit, Orlando, and Atlanta, or those who have worked in aviation are eligible to join. You also can join the Wings Financial Foundation for $5 to become eligible to join this highly rated credit union.

This credit union offers generally great accounts, including a no-monthly-fee checking account. The Signature Rewards program offers cash back on debit purchases as well.

Like most credit unions, Wings Financial offers a range of banking products such as loans and credit cards. Unlike some, it also offers investment and insurance products that allow you to keep your entire financial life with one institution, which is another benefit for those who want to keep things simple.

Patriot Federal Credit Union Download For Pc Windows 10/8/7 Method :

Bluestacks is one of the coolest and widely used Emulator to run Android applications on your Windows PC. Bluestacks software is even available for Mac OS as well. We are going to use Bluestacks in this method to Download and Install Patriot Federal Credit Union for PC Windows 10/8/7 Laptop. Lets start our step by step installation guide.

- Step 1: Download the Bluestacks 5 software from the below link, if you havent installed it earlier

- Step 2: Installation procedure is quite simple and straight-forward. After successful installation, open Bluestacks emulator.

- Step 3: It may take some time to load the Bluestacks app initially. Once it is opened, you should be able to see the Home screen of Bluestacks.

- Step 4: Google play store comes pre-installed in Bluestacks. On the home screen, find Playstore and double click on the icon to open it.

- Step 5: Now search for the App you want to install on your PC. In our case search for Patriot Federal Credit Union to install on PC.

- Step 6: Once you click on the Install button, Patriot Federal Credit Union will be installed automatically on Bluestacks. You can find the App under list of installed apps in Bluestacks.

Now you can just double click on the App icon in bluestacks and start using Patriot Federal Credit Union App on your laptop. You can use the App the same way you use it on your Android or iOS smartphones.

Bluestacks4

Also Check: Donald Trump People’s Magazine 1998

Best For Apy: Consumers Credit Union

Consumers Credit Union

If your goal is to earn as much as possible on your checking and savings balances, you might try Consumers Credit Unions Rewards Checking Account. That account pays up to 4.09% APY on a maximum of $10,000 if you meet certain criteria. To qualify for that rate, you need to:

- Enroll in electronic documents.

- Make at least 12 debit card purchases monthly.

- Make direct deposits, mobile check deposits, or incoming ACH. transfers of at least $500 each month.

- Spend at least $1,000 per month on a CCU credit card.

- Open your account with at least $5.

CCU is part of the CO-OP shared branching network with free access to nearly 30,000 ATMs.

- Smart Saver savings account pays up to 1.50% APY.

- Checking account with no monthly fees.

- Mobile banking enables you to manage accounts and deposit checks.

You can become eligible for CCU membership by joining the Consumers Cooperative Association with a $5 membership fee. You also need to keep $5 in a share savings account.

-

Generous interest rate on Rewards checking account.