The Congressional Republican Tax Plan Is A Tax On Disability

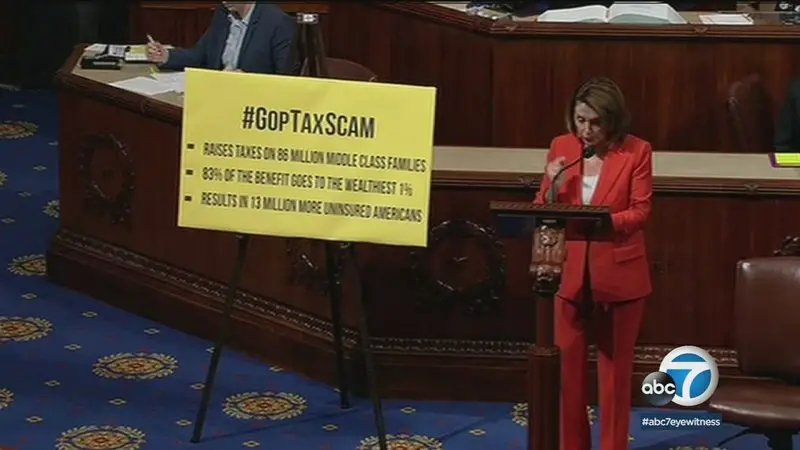

Throughout 2017, President Donald Trump and congressional Republicans have continually taken aim at the health, well-being, and independence of Americans with disabilities. From repeated attempts to repeal the Affordable Care Act and end Medicaid as we know it to budget proposals that slash Social Security disability benefits, disability employment services, Meals on Wheels, and more, the agenda Trump and his colleagues in Congress are pursuing would be nothing short of a disaster for people with disabilities. The latest attack comes in the form of their partisan tax plan, which passed the House on November 16 and is set to be voted on in the Senate as soon as this week.

Although they have sold the plan as a Christmas present for the middle class, under the Senate bill, a staggering 87 million* middle- and working-class families would see their taxes rise by 2027. Meanwhile, the top 0.1 percent would receive an average tax cut of $208,060. Furthermore, by repealing the Affordable Care Acts individual mandate, the tax plan would also undermine the individual insurance market, driving up premiums and leaving 13 million more Americans without health insurance by 2025.

Here are seven ways that President Trump and congressional Republicans tax plan is a tax on disability.

Personal Exemption And Healthcare Mandate

The law suspended the personal exemption, which was $4,150, through 2025. The law also ended the individual mandate, a provision of the Affordable Care Act or “Obamacare” that provided tax penalties for individuals who did not obtain health insurance coverage, in 2019. the taxpayer will still be exposed to a penalty for not being covered by health insurance all year.)

According to the Congressional Budget Office , repealing the measure is likely to reduce federal deficits by around $338 billion from 2018 to 2027, but lead 13 million more people to live without insurance at the end of that period, pushing premiums up by an average of around 10%. Unlike other individual tax changes, the repeal will not be reversed in 2025.

Senators Lamar Alexander and Patty Murray proposed a bill, the Bipartisan Health Care Stabilization Act, on Mar. 19, 2018, to mitigate the effects of repealing the individual mandate. The CBO estimated that this legislation would still leave 13 million more people uninsured after a decade. The bill failed to make it into the $1.3 trillion spending bill that was passed on Mar. 23, 2018. As such, the burden of providing affordable health insurance will be on states and health insurers.

Republicans Pass Historic Tax Cuts Without A Single Democratic Vote

Vice President Mike Pence walks through the Capitol to the House Chamber to watch the passage of the Republican tax bill. Photo: J. Scott Applewhite / AP

For history … 12:47 a.m.: “WASHINGTON Senate passes 1st major rewrite of US tax code in 31 years, setting stage for final House vote on Wednesday.”

Being there, per AP: “he Senate narrowly passed the legislation on a party-line 51-48 vote. Protesters interrupted with chants of ‘kill the bill, don’t kill us’ and Vice President Mike Pence repeatedly called for order. Upon passage, Republicans cheered, with Treasury Secretary Steve Mnuchin among them.”

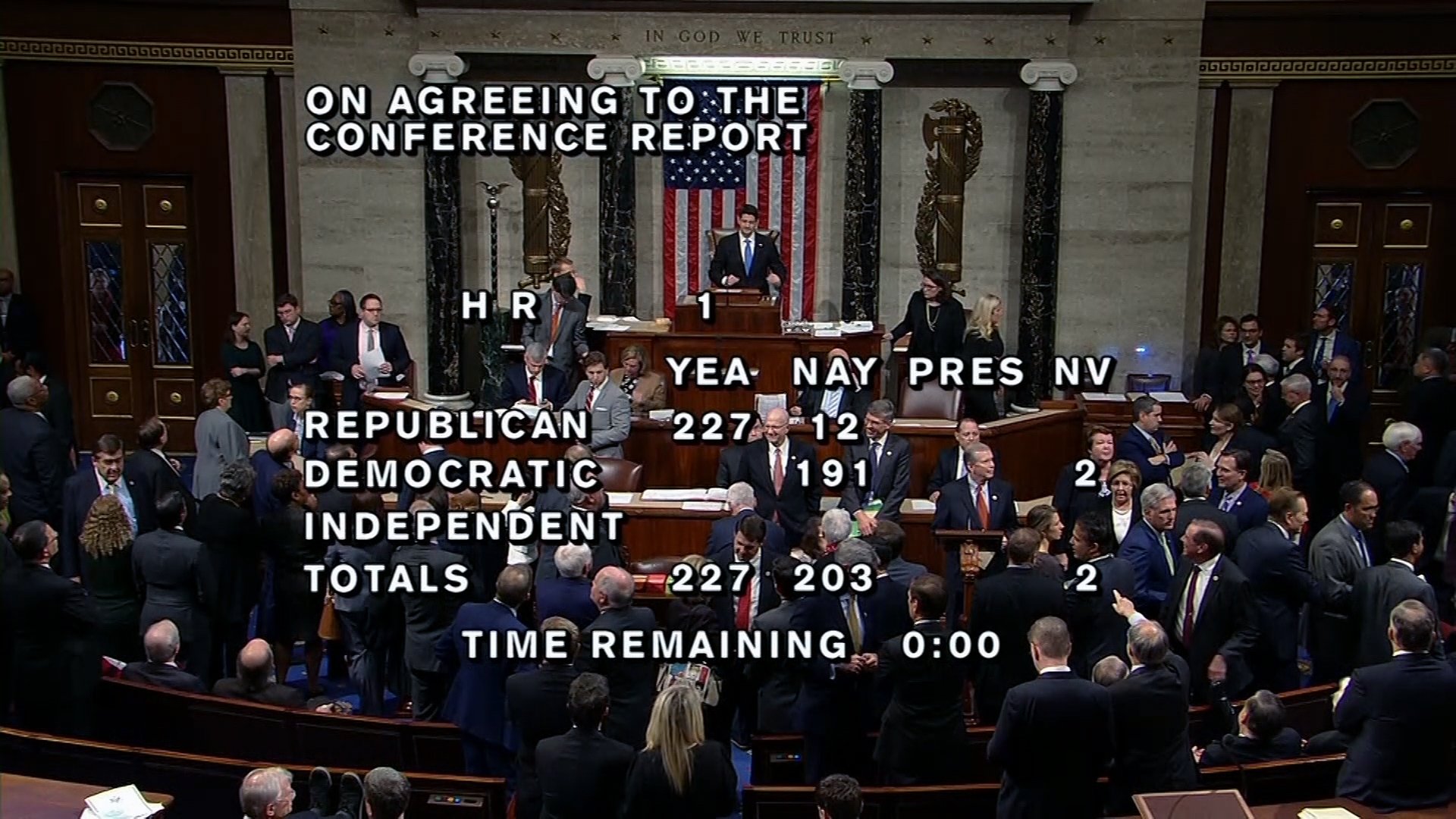

- Just before 2:30 p.m., the House had passed the bill 227-203. But three provisions “violated Senate rules, forcing the Senate to vote to strip them out. So the massive bill was hauled back across the Capitol for the House to vote again , and Republicans have a chance to celebrate again.”

- Senate: “Voting yes were 0 Democrats and 51 Republicans. Voting no were 46 Democrats, 0 Republicans and 2 independents.”

- House:“Voting yes were 0 Democrats and 227 Republicans. Voting no were 191 Democrats and 12 Republicans. … There are 3 vacancies.”

- House Majority Whip Steve Scalise says House Appropriations Chair Rodney Frelinghuysen should retain his position even though he voted against the GOP tax overhaul.

Differences Between The House And Senate Bills

There were important differences between the House and Senate versions of the bills, due in part to the Senate reconciliation rules, which required that the bill impact the deficit by less than $1.5 trillion over ten years and have minimal deficit impact thereafter. For example:

In final changes prior to approval of the Senate bill on December 2, additional changes were made that were reconciled with the House bill in a conference committee, prior to providing a final bill to the President for signature. The Conference Committee version was published on December 15, 2017. It had relatively minor differences compared to the Senate bill. Individual and pass-through tax cuts expire after ten years, while the corporate tax changes are permanent.

In the Senate, Republicans “eager for a major legislative achievement after the Affordable Care Act debacle … have generally been enthusiastic about the tax overhaul.”

A number of Republican senators who initially expressed trepidation over the bill, including Ron Johnson of Wisconsin, Susan Collins of Maine, and Steve Daines of Montana, ultimately voted for the Senate bill.

Us House Set To Vote On Republican Tax Bill

The U.S. House of Representatives will vote Tuesday on a Republican $1.5 trillion tax bill that will provide tax relief for most Americans, but benefit the wealthy the most, according to a non-partisan tax analysis group.

Following the House vote, the Senate will vote on the measure later Tuesday, according to Senate Republican leader Mitch McConnell. If both houses approve the measure, it will be sent to President Donald Trump for him to sign into law, completing the first extensive modification of the U.S. tax code in more than 30 years and giving Trump his first major legislative victory.

Republican lawmakers appear to have the votes to permanently cut corporate taxes from 35 to 21 percent, temporarily and modestly reduce taxes paid by wage and salary earners, and boost Americas national debt by up to $1.5 trillion.

The non-partisan Tax Policy Center concluded Monday the bill would cut taxes for 95 percent of Americans next year, but average cuts for top earners would greatly exceed reductions for people earning less.

The legislation also partially repeals former president Barack Obama’s signature health care law and is expected to add nearly $1.5 trillion to the federal debt during the next decade.

“This is going to make such a positive difference in the lives of working Americans,” House Speaker Paul Ryan told reporters Tuesday on Capitol Hill.

Gop Members Most From High

House Republican leaders cheered passage of their sweeping tax overhaul Thursday, but 13 GOP lawmakers bucked their party and voted against the bill.

All but one of them hailed from New York, New Jersey and California each a high-tax state. These lawmakers largely opposed the legislation because it curtailed the state and local tax deduction, also known as SALT. The measure caps the deduction for property taxes at $10,000 while eliminating the tax break for state and local income or sales taxes.

Six of the lawmakers are in competitive races in 2018 based on ratings by Inside Elections with Nathan L. Gonzales. Eleven of the 13 Republicans are being targeted by the Democratic Congressional Campaign Committee.

Here are the Republicans who voted against the tax bill:

How Each House Member Voted On The Tax Bill

DEC. 19, 2017

WASHINGTON The House voted 227-203 on Tuesday to pass the Republican tax overhaul bill. The Times tracked how every representative voted, live from the House chamber.

UPDATE The Senate voted on Wednesday to pass the tax bill.

| Majority needed to pass | |

|---|---|

| 203 | 2 |

Twelve Republicans voted no, and all but one of them were from California, New Jersey or New York. The bill was expected to pass, and now it will head to the Senate. If it passes the Senate, President Trump could then sign the legislation into law.

It would have taken 23 Republican no votes for the bill to fail, and only 13 Republicans voted against the original House version of the tax plan. Representative Tom McClintock of California was the only Republican to change his vote to yes on this bill from no on the original House bill. All Democrats were expected to vote no.

New Tax Brackets For Individuals

10% $0 $9,525

35% $400,001 $600,000

37% $600,001 or more

But remember, these changes apply for when were filing for the 2018 calendar year. These wont be used a guidance next Spring.

However, Trump declared last week that Americans will see lower taxes and bigger paychecks starting in February.

The president made the announcement while urging Congress to give him a bill to sign before the holidays.

He said: Im excited to announce that if Congress sends me a bill before Christmas the IRS this is just out, this is breaking news has just confirmed that Americans will see lower taxes and bigger paychecks beginning in February. Just two short months from now. Just got that. We just got that.

Trump continued: This is for the people of middle income. This is for very, very special people. We are going to have a country that celebrates you again hard working, great people. Youre being celebrated again, remember that.

Someone else called me the deplorables, were proud to be the deplorables. Were going to make the American dream and thatll be the dream that you want for your children and your grandchildren.

If you make your voices heard, this moment will be forever remembered as the dawn of a great new American future.

To view this video please enable JavaScript, and consider upgrading to a webbrowser thatsupports HTML5video

Us Senate Advances Infrastructure Bill Inches Slowly Toward Passage

WASHINGTON, Aug 7 – The U.S. Senate voted to advance a $1 trillion infrastructure package on Saturday but remained on a slow path toward passage with two Republicans openly opposing behind-the-scenes efforts to wrap up work on one of President Joe Biden’s top priorities.

In a 67-27 vote demonstrating broad support, senators agreed to limit debate on the legislation, the biggest investment in decades in America’s roads, bridges, airports and waterways.

Eighteen of 50 Senate Republicans voted to move the legislation forward, with Senators John Cornyn and Deb Fischer backing the package for the first time.

But on Saturday evening, progress stalled on an agreement on amendments that could have allowed the Senate to speed up consideration of the legislation.

Senate Democratic leader Chuck Schumer said the Senate would convene at noon ET on Sunday to resume consideration of the infrastructure bill. “Hopefully we can come to some agreement tomorrow,” he said on the Senate floor.

Without that agreement, the Senate will hold a next procedural vote on Sunday evening, a Senate Democratic aide said.

Republican Senator Bill Hagerty took to the Senate floor to underscore his opposition to expediting the process, saying the legislation would add to the national debt and set the stage for Democrats to move forward with a separate $3.5 trillion spending package which Republicans vehemently oppose.

OVERDUE INVESTMENTS

Explaining The Trump Tax Reform Plan

For most people, tax season comes to a close on April 15 each year. In 2019, many taxpayers were surprised to find they had to pay more taxes than the previous year, while others received significantly lower refund checks from the Internal Revenue Service even though their financial circumstances didn’t change.

Many tax specialists and accountants urged their clients to update their withholdings in order to avoid a hefty bill at tax time.

But how did this happen? Let’s take a closer look at President Trump’s changes to the tax codethe largest overhaul made in the last 30 yearsand how it impacts taxpayers and business owners.

Money To State And Local Governments

The $350 billion to help cash-strapped states, cities and tribal governments confronting the pandemic has drawn ire from Republicans.

Pointing to the ballooning national debt, GOP lawmakers say the state and local aid provision is an unnecessary part of a “liberal wish list” that would disproportionately benefit blue states that were quicker than red ones to shut down their economies and suffered larger financial loses.

“They want to send wheelbarrows of cash to state and local bureaucrats to bail out mismanagement from before the pandemic,” Senate Minority Leader Mitch McConnell, R-Ky., said Wednesday. “They’re changing the previous bipartisan funding formula in ways that will especially bias the money toward big blue states.”

Democratic lawmakers and a bipartisan coalition of mayors support the funding due to a double whammy saddling states and local government through no fault of their own: declining tax revenues from the economic shutdown and swelling public assistance needs.

Can A Reconciliation Bill Increase The Budget Deficit

Yes. Although the reconciliation process originally was viewed as a way to reduce budget deficits by cutting projected spending and raising revenues, it has been used to expedite passage of tax cuts that increase budget deficits. If reconciliation is used this year to enact some version of President Bidens COVID relief bill, it will increase budget deficits.

Although a reconciliation bill can increase near-term budget deficits, there are a couple of wrinkles. A Senate rule says that a reconciliation bill cannot, under congressional scoring, increase the deficit beyond the period specified in the resolution, usually ten years. Thats why the reconciliation bills that enacted the Bush and Trump tax cuts said that some of the tax cuts expire before the tenth year.

In addition, press reports suggest that Senate Majority Leader Chuck Schumer is considering invoking an obscure provision of the Congressional Budget Act that would essentially re-use the fiscal year 2021 budget resolution to allow for a majority in the Senate to approve Bidens big infrastructure package. Never used before, Section 304 says Congress may adopt a concurrent resolution on the budget which revises or reaffirms the concurrent resolution on the budget for such fiscal year most recently agreed to.

Rep John J Faso Of New York

Faso also opposed curtailing the SALT deduction and said the bill contained too many loopholes. He ranks third on Roll Calls list of most vulnerable House incumbents. Trump carried his 19th District but the central New York district voted twice for former President Barack Obama. A crowded Democratic field is vying to take on the freshman lawmaker, with two contenders outraising Faso in the most recent fundraising quarter. Inside Elections rates the race Tilts Republican.

Rep Elise Stefanik Of New York

She joined her New York GOP colleagues in opposing the bill due to the changes made to the SALT deduction. The second-term congresswoman is head of recruitment for the National Republican Congressional Committee. She is also a DCCC target. Trump carried her upstate New York district by 14 points in 2016, and she was re-elected by 35 points. Inside Elections rates her race Solid Republican.

An Affinity For Small Business

Passing a law that helped fuel increases in stock prices wasnt the only way Republicans enriched themselves. The new law also contained a 20 percent deduction for income from so-called pass-through businesses, a provision called the crown jewel of the act by the National Federation of Independent Businesses, a lobbying group.

Pass-throughs are single-owner businesses, partnerships, limited liability companies and special corporations called S-corps. Most real estate companies are organized as LLCs. Trump owns hundreds of them, and Public Integritys analysis found that 22 of the 47 members of the House and Senate tax-writing committees in 2017 were invested in them.

Pass-throughs can be found in any industry. They pay no corporate taxes and steer their profits as income to business owners or investors, who are taxed only once at their individual rates. Despite their favored treatment as a business vehicle, the 2017 tax act did them another favor: It allowed 20 percent to be deducted off the top of the pass-through income for tax purposes.

Our investigations. Your inbox.

Sign up for the Center for Public Integritys weekly Watchdog newsletter.

No doubt. Johnson, with his wife, held interests that year in four real estate or manufacturing LLCs worth between $6.2 million and $30.5 million, from which they received income that year between $250,000 and $2.1 million, according to his financial disclosure form.

What Are The Main Changes

The corporate tax rate is getting slashed from 35 percent to 20 percent in 2019.

Companies can fully deduct business expenses from 2017 to 2022.

The level at which estate tax must be paid has jumped dramatically. Currently, heirs of estates valued more than $5.6 million must pay tax. The threshold has now increased to $11 million.

Child tax credit is increasing from $1,000 to $2,000 per child.

Pass-through businesses will get a 23 percent deduction.

The standard deduction for married couples is now $24,000 and $12,000 for singles.

Taxpayers will be able to deduct up to $10,000 in state property taxes.

Rep Frank A Lobiondo Of New Jersey

A member of the moderate Tuesday Group, LoBiondo opposed the tax bill because of the changes to the SALT deduction and said in a statement it would be detrimental to New Jersey residents. LoBiondo, who also opposed the GOP health care bill, recently announced he is not running for re-election, making his seat more vulnerable to a Democratic takeover. Trump carried his 2nd District by nearly 7 points in 2016. The race is rated Leans Republican.

Rep Rodney Frelinghuysen Of New Jersey

Frelinghuysens position was unknown heading into the final vote, but the House Appropriations chairman ended up opposing the bill. He is a DCCC target in 2018 and his race is rated Likely Republican. Two Democratic hopefuls have outraised him by nearly three times in the most recent fundraising quarter. Trump carried his 11th District by 1 point last fall while Frelinghusyen was winning a 12th term by 19.

Makes Research On Drugs For Rare Conditions More Expensive

Another provision buried in both the House and Senate tax bills would weaken or even eliminate altogether a tax credit that encourages pharmaceutical companies to develop drugs for so-called orphan medical conditionsrare conditions such as cystic fibrosis, Lou Gehrigs disease, and Job syndrome. This tax credit is especially important, as development of new drugs and treatments for rare conditions may not be in a pharmaceutical companys financial interest. Its elimination could mean that people with rare diseases or health conditions may never receive life-saving treatment.

Ends A Tax Credit That Spurs Investment In Struggling Communities

President Trump made saving and bringing back jobs in left-behind communities a cornerstone of his campaign. However, the House tax bill would eliminate the New Markets Tax Credit, which is dedicated to spurring investment in poor communities. Investors who qualify receive a tax credit to offset a portion of their investments in hard-hit rural or urban communities facing poverty rates of 20 percent or more. Over the years, the lions share of the funds paid out through the New Markets Tax Credit has benefited communities facing unemployment rates at least 1.5 times higher than the national average, poverty rates of at least 30 percent, or both.

Since people with disabilities face poverty rates that are nearly three times higher than the national average, as well as unemployment rates that are twice those of their nondisabled peers, they are likely to be especially hard hit by the elimination of this tax credit. What is more, high-poverty areas generally have higher rates of disability, in large part because poverty can limit access to health care and preventive services while simultaneously increasing an individuals chances of living and working in an environment that may adversely affect health.

Rep Dana Rohrabacher Of California

Rohrabacher told Roll Call before the vote that his vote would be determined by how his constituents would fare if the bill became law. He is one of the most vulnerable House members in 2018, in part because of his ties to Russia. He is a top DCCC target. Clinton carried his 48th District by 2 points in 2016 while Rohrabacher won re-election to a 15th term by 17 points. Inside Elections rates the race Tilts Republican.

Increases Income And Wealth Inequality

“Overall, the combined effect of the change in net federal revenue and spending is to decrease deficits allocated to lower-income tax filing units and to increase deficits allocated to higher-income tax filing units.–Congressional Budget Office“

The New York Times editorial board explained the tax bill as both consequence and cause of income and wealth inequality: “Most Americans know that the Republican tax bill will widen economic inequality by lavishing breaks on corporations and the wealthy while taking benefits away from the poor and the middle class. What many may not realize is that growing inequality helped create the bill in the first place. As a smaller and smaller group of people cornered an ever-larger share of the nation’s wealth, so too did they gain an ever-larger share of political power. They became, in effect, kingmakers; the tax bill is a natural consequence of their long effort to bend American politics to serve their interests.” The corporate tax rate was 48% in the 1970s and is 21% under the Act. The top individual rate was 70% in the 1970s and is 37% under the Act. Despite these large cuts, incomes for the working class have stagnated and workers now pay a larger share of the pre-tax income in payroll taxes.

In 2027, if the tax cuts are paid for by spending cuts borne evenly by all families, after-tax income would be 3.0% higher for the top 0.1%, 1.5% higher for the top 10%, -0.6% for the middle 40% and -2.0% for the bottom 50%.

The Political Power Of Business And The Donor Class

The Tax Cuts and Jobs Act provides a tremendous windfall for the already wealthy. The top 1 percent of earners can expect to take home, on average, an extra $51,140 each, according to the Tax Policy Centers calculations. One potential electoral effect of the TCJA, therefore, could be its impact on the political behavior of the rich, who make up the laws primary beneficiaries and who provide a growing percentage of campaign resources. The wealthy will both have more money as a result of the TCJA, andfor somemore incentive to engage in politics.

If the TCJA were to influence the campaign donation patterns of wealthy people, it would likely redound to the benefit of Republicans. First, though there are rich people in both the Democratic and Republican parties, wealthy people are more likely to be Republicans. Second, the cap on the state and local tax deduction in the TCJA was intentionally structured to provide less of a tax cut to wealthy people in high-tax blue states, where many rich Democrats reside. Finally, the wealthy are economically conservative, so the political incentive created by the legislation is more likely to motivate Republican donors to support their party, rather than to encourage Democratic donors to invest more than they otherwise would. Newsreportsconfirmthat some Republican donors did threaten to withhold their campaign support if a tax bill were not passed.

All Of The Above Is Acceptable

Republican lawmakers also boosted the value of their stock holdings when they encouraged American corporations to repatriate money they were holding overseas. The tax law decreed that future foreign profits would not be taxed at high rates, and that previously earned profits stashed abroad an estimated $2.7 trillion would be taxed one time at no more than 15.5 percent.

In 2017, Apple was sitting on $250 billion in overseas profits. In January 2018, the month after President Donald Trump signed the tax bill into law, the tech behemoth and third-largest American company said it would pay the new, lower tax and start bringing the cash home. Just four months later, Apple said it would buy back $100 billion of its stock and hike its dividend by 16 percent. Apple shares increased almost 9 percent by the weeks end. In April 2019, Apple announced $75 billion more in buybacks, a move analysts said would likely drive its stock price higher. A day after the announcement, shares increased in value nearly 5 percent. The stock continued to hit record highs late last year.