Enter Your Employees Tax Information

You should have a W-4 form for each employee, and youll need it to complete this section. If you have a 2019 form, youll need to specify that, because the IRS issued a new 2020 W-4 form for employers to use. Enter their filing status, single vs married vs head of household, withholding exemption status, dependents, and other information required by the form. If youre in a state that has income tax, you may need to enter information from each employees state W-4 form. Select Continue when youre done.

Map Employee Deduction To Qbo Accounts

This field only shows up if you have active employee deductions to set up in your payroll account and assigned to employees.

- Choose the default liability account you want to assign to your employee deductions

- If you want to map specific deductions, click +Map Employee Deduction to Account to specific liability accounts

- Click +Add Row to continue adding more deductions to specific liability accounts.

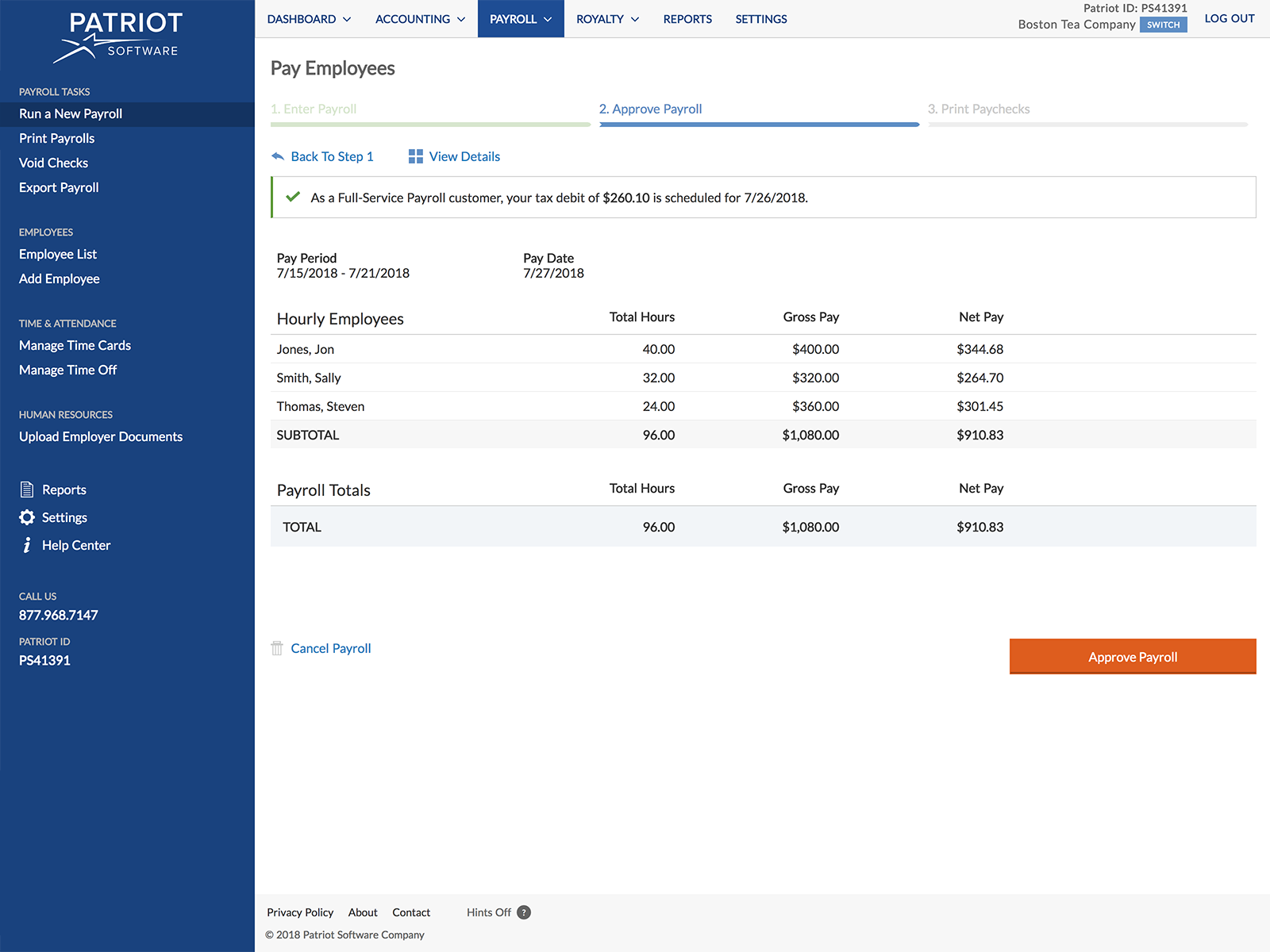

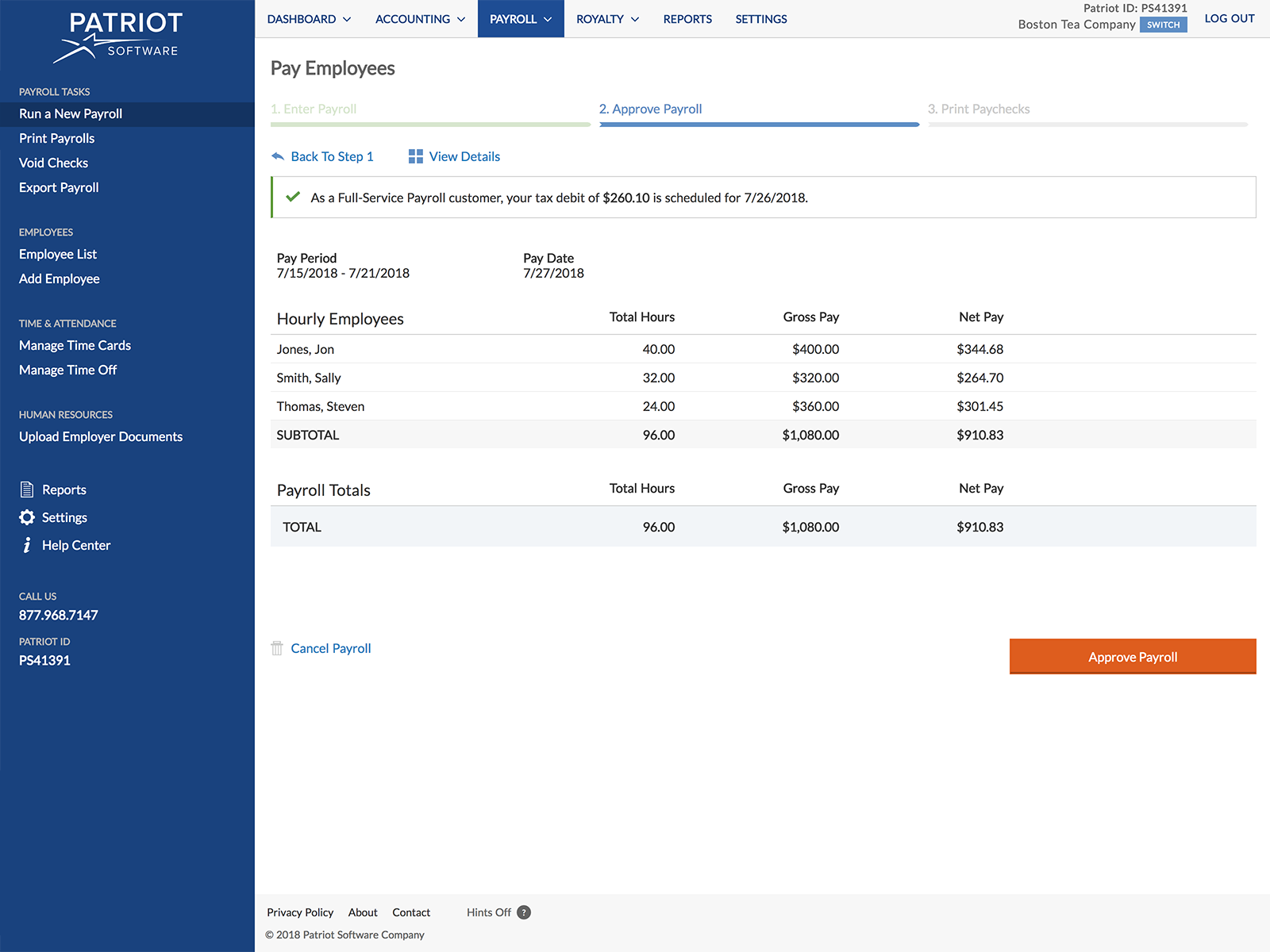

Review Payroll & Submit

Once you start a payroll, the task shows in yellow as Continue Your Payroll.

Once you have recorded hours worked and hours taken off, click on Next Step. A summary will appear and the software will flag potential errors. If you are not ready to submit the payroll, you can save the entries. Look over the summary, and if its good, click Approve. If not, simply click Continue Your Payroll or Back to Employees to make edits.

Congratulations! You just ran your first payroll with Patriot Payroll. After this, you can print the payroll, review the register or tax bill, or run other reports. If you have contractors, youll run a separate payroll to pay them. Youll find that doing payroll with payroll software is much easier than doing it without. Payroll services make the process much smoother.

Although having payroll software makes paying your employees the right way much easier, you still need to know the basics. Check out our tips on how to get the best payroll training to help.

About the Author

Read Also: Did Republicans Cut Funding For Embassy Security

You Got Questions We Got Answers

Since our payroll software is online, you only need access to a web browser and the Internet. Thereâs no software to download.

The software is designed for small- or medium-sized businesses with up to 100 employees.

Yes. You may run a payroll whenever you need to in the payroll software.

Yes. You may begin using the payroll application at any time during the year. You will want to make sure you enter all of your employee payroll history in the software so end-of-the-year W2s are accurate.

Noâour software is only available to companies with employees working in the USA. Itâs our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

Patriot will e-File 1099s for Full Service Payroll customers who are paying contractors through payroll at no additional cost for 2020 1099s and later years. If you have Accounting Premium, Accounting Basic, or Basic Payroll, here are the filing fees:

| Number of 1099s |

|---|

The software is designed for small- or medium-sized businesses with up to 100 employees.

Yes. You may run a payroll whenever you need to in the payroll software.

Noâour software is only available to companies with employees working in the USA. Itâs our passion to help American businesses by providing streamlined, easy, and affordable payroll management solutions.

Patriot Software will not share your information with any outside party without your prior permission.

What We Recommend Patriot Payroll For

Patriot Payroll is one of our top picks for best small business payroll software, boasting a user-friendly platform that lets you run payroll online in just three steps. It offers free direct deposits and integration with AP Intego for automatic workers compensation insurance premium payments.

It also has affordable plans, including a budget-friendly option for businesses that prefer do-it-yourself payroll tax filings. If youd rather have Patriot file and submit payroll tax deposits and reports for you, consider its full-service plan. HR and time tracking tools are also available as paid add-ons, including an accounting solution.

In short, Patriot Payroll is best for:

Don’t Miss: Watch Patriots Games Live

Identity Verification For Direct Deposit

If you choose to pay via direct deposit, Patriot will need to confirm your identity using a third party service. To do so, enter basic information, like your name, address, Social Security number, and birth date. Keep in mind, however, that youll only get three chances to enter the correct information before Patriot will deny your identity verification. If youre only paying by check, you wont need to complete this step.

Software Thats Easier To Use And Has Better Functionality

Whether youre coming from manual entry and tracking or a patchwork of other software, youll find Patriot makes it easier with seamless integration and everything under one login.

Choose one or all four products, youll save time on your administrative tasks and get back to the things that matter most.

Their support group is excellent, whether using the chat or calling in. They are friendly, knowledgeable, and best of all, based in the US!

The Ottawa Club

You May Like: Patriots Road Trip Packages

Information To Gather For Patriot Payroll Setup

Before you dive into your payroll setup, take a look at the items Patriot recommends you have ready beforehand. This will make your setup process quicker and easier.

- Company location information: Where is your company headquarters located? Do you have different work locations?

- Tax identification numbers: Federal employer number, state income tax ID number , local tax ID number .

- State unemployment account number and rate: You should apply for state unemployment insurance on your states Department of Labor website. The account number and rate usually come in the mail a week or two later.

- Business bank account statement: We recommend using a separate bank account from the one you use for regular transactions.

- Employee W4s: This will show employee names, Social Security numbers, tax filing status, and other important information.

- Pay rate and frequency: Choose from payment frequency, including biweekly, semimonthly, or weekly.

- Payroll registers for the current year: This will show how much youve paid out in total to each employee year-to-date. Its important to ensure each employees pay stub is accurate.

- Employer taxes for the current year: Patriot will help prepare your year-end tax forms, so it needs to know what you paid before signing up for its service.

- Tax filings for the current year: If you sign up for Patriots service before quarter-end, Patriot will need to file taxes for you. The data from your prior tax filings will help them see what their responsibility is.

Patriot Software Full Service Payroll Specs

| Mobile Admin Access | |

| Submits Federal, State, Local, and Payroll Taxes | Yes |

Any small business that uses an online payroll service to manage employee payments usually needs a lot of support, especially during the setup process. Patriot Software Full Service Payroll excels at providing help from start to finish. It not only handles the basic tasks needed to create employee records, but it also helps you define deductions and contributions, processes payroll runs, and automatically submits payroll taxes. New features include an integration with QuickBooks Time , multifactor authentication, the ability to organized employees into departments, and e-signatures for vendor and contractor payments. An integrated accounting website makes the bundle a good choice for new users with modest needs, though it works just as well for running payroll for dozens of employees and contractors.

While it lacks some of the depth and customizability of Editors Choice winners Gusto and Rippling, Patriot Software Full Service Payroll is an strong choice for very small businesses that dont anticipate much growth, dont have expansive HR needs, and want lots of support.

You May Like: Control Of House And Senate 2016

Routinely Check In With Your Staff

Routinely check in with your staff to see if their availability has changed. Try making the schedule as predictable as possible. This will help your employees manage their time better.

Whether it is through text, over the phone, or through another form of communication, employees should know that they can reach you quickly and easily and without fear of judgment or reprisal.

Who Is Patriot Payroll For

Patriot Payroll is ideal for small and growing businesses. Patriot Payroll offers quick onboarding, with the company handling all initial payroll setup and data entry, including entering historical payroll data for all of your employees.

While the Basic version is suitable for very small businesses, if youre looking for someone to handle filing and depositing of federal, state, and local payroll taxes, youll want to look at the full-service option.

Either way, the product is easy to use, nicely automates the entire payroll process, and offers time and attendance and HR add-ons that can be useful for your small business.

Also Check: How Many State Legislatures Are Republican Controlled 2017

Create And Distribute A Schedule Ahead Of Time

Make sure to post the schedule promptly and with time to spare so that employees can know what to expect. This will also give you a better chance to cover shifts whenever the need arises.

Make sure that your schedule:

- Is easily accessible, in hardcopy and online

- Is easy to understand at a glance

- Clearly shows managers or shift supervisors

Why Do We Need Patriots Payroll And Accounting Software

Patriot is an accounting and payroll software that is affordable, powerful, and ridiculously easy to use. It is designed to run your business faster through various features available on the platform, such as invoicing customers, tracking your money, toggling between cash basis and accrual, importing bank transactions, paying organizations bills, and generating financial reports.

The Payroll tool of the software takes the pain and complexity out of the payrolls. With the help of Patriot, one can make accurate tax calculations, customize payrolls, and many more such things at no additional cost.

Business owners and accountants prefer Patriot over other vendors in the market for its high-performing functionality. Irrespective of the mode of data entry, be it manual or through a patchwork of different software, Patriot makes the integration seamless under one login.

Another salient feature of the Patriot is its USA-based customer service which gets a 5-star rating for almost every aspect. The free, USA-based customer service can be availed either through text, email, or phone from Monday to Friday between 9:00 AM to 7:00 PM.

Patriot offers the best value for its money. The service provided by the Patriot enterprise is unmatched in the industry. They aim to keep the prices low and the customer satisfaction high. It is evident because Patriot is rated highest by Capterra, which places and provides insights and competitive comparison based on end-user reviews.

You May Like: Trump Republicans Are The Dumbest

What Users Think About Patriot Payroll

| Users Like | |

|---|---|

| Easy to set up and use | Slow direct deposit turnaround times |

| Helpful and knowledgeable support team | Payroll reports arent robust |

| Ease of running payroll | Basic HR tools |

Many of the Patriot Payroll reviews online are positive. Users who left feedback on third-party review sites like G2 and Capterra highlighted its affordability, easy setup process, efficient payroll tools, and user-friendly interface as its best features. They also complimented its support team, citing the helpfulness of its customer representatives. On the other hand, some reviewers said that while it has made payroll processing an easier task for them, they wished the provider offered more integration options, reporting tools, automatic pay runs, and a faster direct deposit timeline.

At the time of publication, Patriot Payroll earned the following scores on popular user review sites:

- Capterra: 4.8 out of 5 based on more than 2,800 reviews

- G2: 4.8 out of 5 based on some 420 reviews

Connect Patriot Software With Quickbooks Online

- Go to Settings> Payroll Settings > Payroll Integration Options

- Select QuickBooks Online, and click Connect to QuickBooks

- Use your login credentials to connect to your QuickBooks Online account

- The QuickBooks Online sign-up page will pop up for you to authorize integrating your QuickBooks account under the same login, choose the account you want to connect to. Youll see a pop-up confirming your account is connected.

Recommended Reading: How Many Governors Are Republican In 2015

Set Up Payment Details

Patriot will ask you the following questions to help you set up payment details for your employees:

- Does your company need to add employee deductions? Youll need to add specifics about each deduction type you need set up, including benefit premiums, 401 contributions, and garnishments.

- Does your company offer contributions? If youll match retirement contributions or pay a portion of employee benefit premiums, add a description of each and how the contribution will be calculated.

- Do you use workers compensation codes? If you use codes to report workers compensation for each employee, enter them here along with the applicable state.

- How will you be paying your employees? You can handwrite your own checks or print them using Patriots software. Other pay options are direct deposit, which is most convenient and common, and a direct deposit-check combo.

Create A Shift Swapping Policy

Create a detailed policy that keeps everyone and their needs in mind.

Your policy should be flexible enough for employees to use easily, but also transparent enough that managers can quickly understand how the shift has changed.

To make sure that all of the steps are clearly defined, consider:

- Who can and cant cover shifts

- Whether or not shift swaps require management approval

- The deadline for swapping shifts

- How swaps are confirmedover the phone, via call or text, or directly on the schedule

Once youve created a new policy, make sure that it goes into your employee handbook so that everyone can see it and refer back to it when needed.

Read Also: Patriot Under Cabinet Lighting

Add Your Bank Account

Patriot will also need your bank account information to ensure it pulls funds from the correct place. Setting up your bank account is straightforward. Add your routing number if you dont know it, check the bottom of one of your paper checks. Patriot will then verify it through Plaid or by sending a test transaction. You can also upload a copy of your business bank account statement personal bank accounts arent accepted.

You can edit your bank account information at any time in Settings.

You need to electronically sign IRS Form 8655 to authorize Patriot Software as your Reporting Agent to deposit and file your federal and state taxes on your behalf. Click Preview Unsigned Form 8655 to download a PDF of the unsigned form. The form will be pre-filled with all required information. This is just for information only so you can see the form you will be electronically signing. You do not need to sign this hard copy. Back on the setup screen, check the box to certify you have the authority to electronically sign the 8655. Click Submit.

Benefits Of Patriot Payroll

For new business owners, small businesses, or restaurants that are running payroll for the first time, Patriot Payroll can be a lifesaver. Designed for ease of use, the product offers all of the necessary features a good payroll application should have, including direct deposit, an employee portal, and limited data entry required.

It doesnt come with a lot of bells and whistles, which is okay, since small business owners are likely more concerned with paying their employees properly and filing payroll taxes correctly.

There are also a lot of help and support resources available in Patriot Payroll, though you likely wont need them, since the product is so easy to use.

Read Also: Jeep Patriot Wheels And Tires For Sale

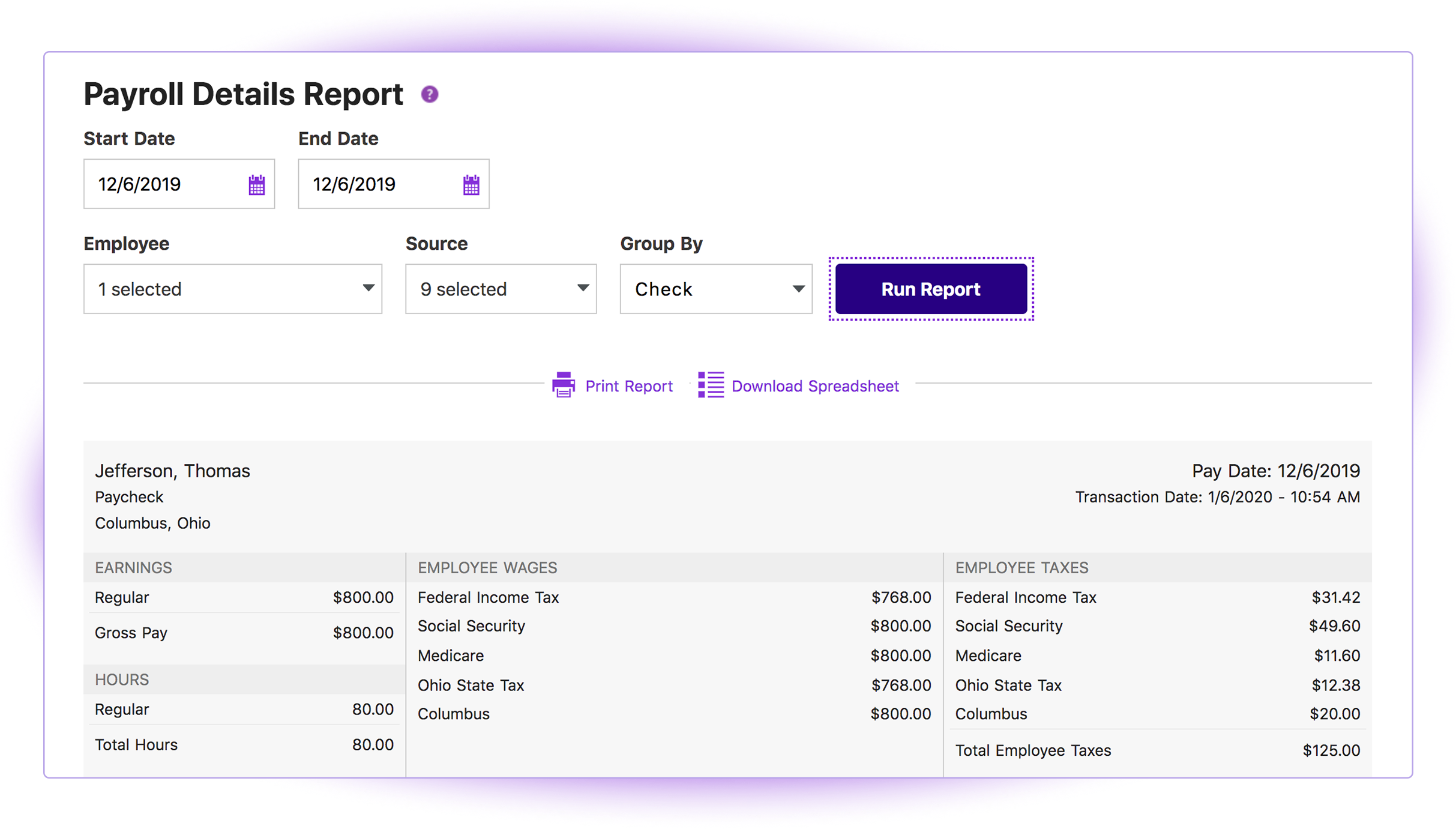

Reports And Mobile Access

Patriot Software Full Service Payroll includes many preformatted reports, several of which are standard accounting reports that you wont access if youre not using the accounting module. Theyre not as customizable as OnPays, but what’s available is quite enough to cover the sites capabilities.

You can run a payroll by accessing Patriot Software through a web browser on your Android or iOS device.

Patriot does not offer dedicated apps like Intuit does, but you can access mobile versions of the site on both Android and iOS devices. These versions look and work much like their desktop-based counterparts, with just a few user interface differences, but you can do everything on your mobile device that you can on the desktop, including running a payroll. The employee portals work great on smartphones, too.

Patriot Payrolls Ease Of Use

Patriot Payroll is a great solution for small businesses, particularly those that have never run payroll before. The payroll dashboard offers easy access to complete payroll processing, where you can also add a new employee or view all current employees.

A vertical menu bar to the left of the screen displays all of the features available in Patriot Payroll, including any optional modules such as Time and Attendance and Human Resources.

When you enter a new employee, you can add pay information, taxes, and advanced tax settings, along with deductions and contributions as needed. The entire payroll process is easy, with limited data entry needed in order to process payroll even if youre not using the Time and Attendance module.

When youre ready to run a payroll, just access the Run a Payroll feature, enter employee hours and overtime, and move to the next step, which provides an overview of payroll totals. Once payroll is approved, you can choose to run payroll immediately or come back later to complete the process.

Also Check: Trump People 1998 Quote

Input Federal Tax Details

To add your payroll settings, youll also need to input your federal tax identification number. If you dont have one, Patriot has a link that will send you to an article explaining how to get an account number in your state. Select Show Advanced Tax Settings to choose your default payroll frequency . Youll also need to identify your federal filer type, Form 941 or Form 944 small employers that typically owe less than $1,000 a year file Form 944. When youre done, select Continue.