How Banks Are Impacted By The Patriot Act

âThe greatest impact of the Patriot Act is that it requires banks to change the way checking, savings and loan accounts are handled. It contains an anti-money laundering provision that impacts every person who opens or holds a bank account. The reason for the anti-money laundering efforts is that the terrorists responsible for the September 11, 2001 attacks had no problem opening bank accounts in the United States. They were also able to obtain credit cards by completing applications with made-up social security numbers. The anti-money laundering clause of the Patriot Act attempts to hold banks more accountable for opening accounts or lending money to terrorists. As a result, honest individuals and business owners are scrutinized more carefully. A dozen years after the Patriot Act was passed, groups like the American Civil Liberties Union fight against it due to privacy concerns.

ââ

Check Out Your Registered Financial Professional

If you haven’t already done so, make sure you check out the background of your registered financial professional and the firm before you open an account with them. Although a history free from registration or licensing problems, disciplinary actions or bankruptcies is no guarantee of the same in the future, checking out your registered financial professional and firm in advance can help you avoid problems. Look up your registered financial professional and firm on FINRA Brokercheck by going to or by calling toll-free 289-9999.

Also make sure that the phone numbers and addresses that your registered financial professional and firm give you as their contact information are consistent with those listed in Brokercheck. Fraudulent entities and individuals have been known to steal the identities of legitimate registered financial professionals and broker-dealer firms so that they can get at your personal information!

Open Business Account On Site

A visit to the US allows you to open accounts with the big American banks.

The three most popular options are:

- Bank of America

- Wells Fargo

There are also hundreds of smaller local banks that might be worth checking out.

In order to open a business checking account with a retail bank, an authorized signer has to personally visit a branch. The authorized signer would typically be the company owner. If you want someone else to serve as the authorized signer, you need to prepare a Banking Resolution.

Some banks require the authorized signer to be in possession of an SSN. That basically disqualifies non-residents without US contacts.

Aside from the standard company documents, you will also need a proof-of-address for a US address in your name.

There are two ways to tackle this requirement.

Having an ITIN

If you have an Individual Taxpayer Identification Number, you are good to go. Although it does not make a lot of sense to me, your ITIN result document can serve as proof-of-address for the address on the same document.

Hacking a Proof-of-Address via AT& T

There is a simple method to legally obtain a document, that US banks can accept as a valid proof of address.

Banks like Bank of America will accept an invoice from a communications provider like AT& T as an utility bill / proof-of-address. Even if that invoice is for a prepaid mobile phone contract.

Go to a random AT& T store near your bank and ask for the cheapest prepaid plan they offer.

Fun anecdote:

You May Like: House Of Representatives Democratic Or Republican

Usa Patriot Act Policy/procedures

11/22/2015

I attended Ken Golliher’s seminar yesterday in Tulsa, it was very informative. I understood him to say that even if we don’t do international transactions at this time, that he would still advise us to address Section 311 of the USA PATRIOT Act in our policy/procedures. I was hoping someonecould weigh in on this for me.

Suspicious Activity Monitoring And Reporting

Section 356 of the USA PATRIOT Act amended the BSA to require broker-dealers to monitor for, and report, suspicious activity .

Under FinCENs SAR rule, a broker-dealer is required to file a suspicious activity report if: a transaction is conducted or attempted to be conducted by, at, or through a broker-dealer the transaction involves or aggregates funds or other assets of at least $5,000 and the broker-dealer knows, suspects, or has reason to suspect that the transaction:

Broker-dealers must report the suspicious activity using FinCEN SAR Form 111, which is confidential. FinCEN maintains instructions for filing the form, which detail, among other things, the minimum information requirements for the form.

Recommended Reading: Did Republicans Cut Funding For Embassy Security

Important Information About Opening A Legal Entity Account

Effective May 11, 2018, new rules under the Bank Secrecy Act will aid the government in the fight against crimes to evade financial measures designed to combat terrorism and other national security threats.

EACH time an account is opened for a covered Legal Entity, we are required to ask you for identifying information for:

- Each individual that has beneficial ownership and,

- One individual that has significant managerial control, of the Legal Entity.

If you are opening an account on behalf of a Legal Entity, you will be required to provide the appropriate documentation and to certify that this information is true and accurate to the best of your knowledge.

We proudly support all efforts to protect and maintain the security of our customers and our country.

Open Personal Checking Account While In The Us

If you have the opportunity to travel to the US through ESTA or on a visa, then you should not have too many difficulties opening a personal account.

Some general considerations upfront:

Opening accounts is more of an art than a science. The requirements are often not clearly defined, and you will get different requirements from different employees at the same bank. And the end, it is always at the discretion of the bank or individual account manager.

You will increase your chances, if you

- Dress and look professional

- Have a plausible reason ready why you want to open the account

- Have your documents in order

- Stay persistent and prepared to visit multiple branches of the same bank. Its not uncommon to get rejected.

The following banks are known to open accounts for non-residents without a SSN:

- Bank of America

There are of course hundreds more smaller local banks that you can try.

You will generally require the following:

- Two forms of ID

- Proof of address

- US phone number

- ITIN

In some cases, the bank will accept a foreign proof of address. In other cases, they will ask for a US utility bill. Read below, how you can get such a document.

You should also have access to a US phone number.

Having an ITIN can make the process considerably easier.

Firstly, the address on your ITIN result can serve as your required proof of address. Secondly, with an ITIN the bank tends to no longer treat you as a non-resident.

Recommended Reading: Composition Of State Legislatures By Political Party Affiliation

Disadvantages Of The Usa Patriot Act

Opponents of the Act argue it effectively lets the U.S. government investigate anyone it sees fit, colliding directly with one of the most cherished American values: a citizen’s right to privacy. Questions of misusing government funds arise when limited resources are used in tracking American citizens, especially those moving overseas. It is unclear what federal authorities plan to do with information discovered through tracking public records, raising concerns about the governments autonomy and power.

Suspected terrorists have been imprisoned at Guantanamo Bay, Cuba, and other sites without always explaining why or allowing legal representation, violating their right to due process some prisoners have been proven, subsequently, to not even have any ties to terrorism.

The business, finance, and investment communities are more likely to be affected by heightened documentation requirements and due diligence responsibilities. Though the impact falls more on institutions than individual investors, anyone who conducts international business is likely to experience added costs and greater hassles with something as mundane as opening a simple foreign checking account.

The Information In This Guide Is Current As Of January 5 2021

This research guide, or source tool, is a compilation of key AML laws, rules, orders, and guidance applicable to broker-dealers. Several statutory and regulatory provisions, and related rules of the securities self-regulatory organizations , impose AML obligations on broker-dealers. A wealth of related AML guidance materials is also available. To aid research efforts into AML requirements and to assist broker-dealers with AML compliance, this source tool organizes key AML compliance materials and provides related source information.

When using this research tool, you should keep the following in mind:

First, broker-dealers are responsible for complying with all AML requirements to which they are subject. Although this research guide summarizes some of the key AML obligations that are applicable to broker-dealers, it is not comprehensive. You should not rely on the summary information provided, but should refer to the relevant statutes, rules, orders, and interpretations.

Second, AML laws, rules, and orders are subject to change and may change quickly. Statutes that include AML-related provisions may be amended from time to time, and new statutes may be enacted which include AML-related provisions.

The Division of Examinations regularly publishes Risk Alerts on its webpage, www.sec.gov/exams, some of which deal with AML topics, and also maintains a regarding the AML obligations of mutual funds.

Recommended Reading: Donald Trump Interview Republicans Are Stupid

Requirements For Opening A Bank Account

A bank or credit unions general requirements to open an account may include:

- Your contact information, such as name, address and phone number

- At least two forms of government-issued ID, such as a valid drivers license or passport

- Social Security number or Individual Taxpayer Identification Number

- Utility bill with current address

- Cash deposit

Requirements may vary depending on the state or financial institution.

Whether youre a U.S. citizen or non-U.S. citizen, you typically must be at least 18 years old to set up a checking or savings account and typically must have a U.S. address. It also is possible for an undocumented immigranta foreign-born person who has no legal right to be or remain in the U.S.to open a bank account in the U.S. Key requirements include having an ITIN and a U.S. address.

In most cases, a non-U.S. citizen cannot open an account online. Instead, youd need to visit a branch for a bank or credit union to open an account. Santander Bank, for example, accepts online applications only from U.S. residents or resident aliens who have a Social Security number or ITIN.

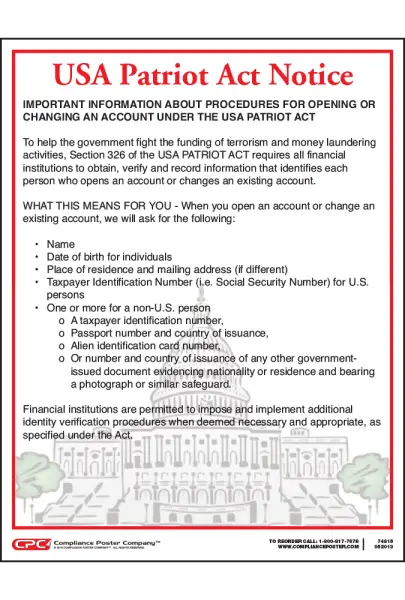

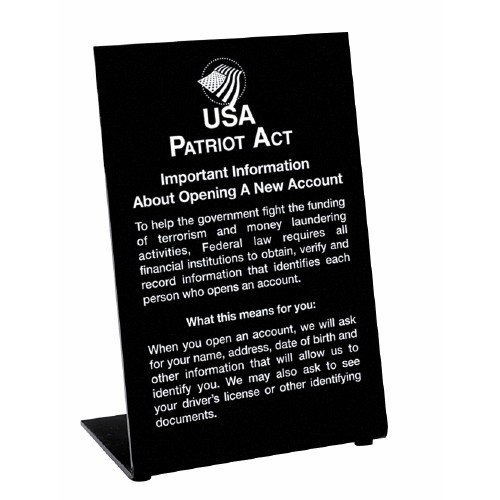

Important Information About Procedures For Opening A New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your drivers license or other identifying documents.

In some cases, identification will be requested for those individuals banking with us prior to the effective date of the customer identification requirements because original documentation was not obtained with the opening of the account, or we are unable to form a reasonable belief that we know the true identity of the existing customer. In all cases protection of our customers identity and confidentiality is our pledge to you.

Recommended Reading: Did Trump Call Republicans Stupid In 1998

Can I Open A Bank Account Without Id

Personal identification is an obstacle when you are among the 10 million people in the U.S. without a bank account and you want to open an account. Because of recent U.S. and international legislation, and IRS agreements with foreign financial institutions, banks, credit unions, and savings and loan associations worldwide must verify the identity of U.S. citizens and residents when they open an account. You cannot open an account without ID however, you do have options for the types of ID the bank accepts.

Information You’ll Be Asked To Provide

When you decide to open an account, there will be paperwork to complete. This will include a new account application, which broker-dealer firms may also call a new account form, account opening form or something similar. This application form will require you to provide some information about yourself, as well as ask you to make certain decisions about your account. As explained in more detail below, a broker-dealer firms registered financial professionals use this information for several purposes, including learning about you and your financial needs and meeting certain regulatory obligations. While it may take a little time to fill out the application, it is important to answer the questions on the application accurately. So, be sure to read the application and the accompanying agreements and other documents the brokerage firm gives you carefullyand ask questions about anything you don’t understand.

In a new account application, along with other information, you’ll likely be asked to provide your:

Be accurate when you are providing the information requested on these forms. Your registered financial professionals will use the information to understand your financial needs and to meet certain regulatory obligations. In addition, you are certifying that the information you’ve provided is accurate when you sign the new account application.

Also Check: Who Is In Republican Debate

As You Monitor Your Account

After you open your account, you should monitor its activity regularly. Make sure that you review all of your account statements and trade confirmations for any errors or any transactions that you did not authorize. If you see any evidence of unauthorized trading or errors, notify your registered financial professional, the financial professionals supervisor or the firm’s compliance department immediately to further protect your rights. Make sure to take notes of any conversations you have with your firm concerning such disputes, to send in your complaints in writing as well and to keep copies of these notes and all communications related to such disputes for your records.

Ask yourself whether your investments are meeting your expectations and goals and whether your goals have changed. Do your investments still appear to be right for you, and what criteria will you use to decide when to sell?

Important Information About Opening A New Account

To help the government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act, a Federal Law, requires all financial institutions to obtain, verify, and record information identifying each person who opens an account, including business accounts.

What this means for you: When you open an account, we will ask for your name, address, date of birth and other information allowing us to identify you. We may also ask to see your driver’s license or other identifying documents. If you are opening an account on behalf of a business entity, documents relating to the business may also be requested.

Additionally, FinCEN has adopted what they describe as a “two pronged” approach to beneficial ownership. The ownership prong includes all natural persons with 25% or more direct or indirect equity interest in a legal entity while the control prong is a single individual with significant managerial responsibility over the legal entity. We will ask to see each person’s driver’s license and other identifying documents, and copy or record information from each of them.

Recommended Reading: Trump Interview Republicans Are Stupid

Related To Usa Patriot Act Section 326 Customer Identification Program

Customer Identification – USA Patriot Act NoticeCustomer Identification ProgramCustomer Identification Program NoticeUSA PATRIOT Act, EtcUSA Patriot Act NotificationUSA PATRIOT Act NoticeU.S.A. Patriot Act ComplianceUSA PATRIOT Act DisclosureCustomer IdentificationUSA PATRIOT Act OFACPlans & Pricing

Showing Id Is A Crime Deterrent

The U.S. Patriot Act makes a customer identity program, or CIP, mandatory for all U.S. financial institutions as a terrorism deterrent. Section 326 of this law allows them to set their own criteria for verifying a new account holder’s identity, provided they gather at least four key types of information: Name, address, date of birth and taxpayer identification number.

Video of the Day

Thanks to “Know Your Customer” or KYC rules followed globally to reduce money laundering, you must provide a certified or notarized copy of your passport to open a numbered account in a foreign or offshore bank. This applies even if you use an agent or intermediary to assist you. Fifty-six countries have KYC agreements with the IRS stating they require a passport or photo ID to open a new account. This includes Switzerland, historically a guardian of account-holder identity.

Read Also: Did Political Parties Switch

Expanded Money Laundering Definition

Nomenclature/definitions are also affected by Title III. For example, the definition of money laundering was broadened in scope to include computer crimes, the bribing of elected officials, and the fraudulent handling of public funds. And money laundering now encompasses the exportation or importation of controlled munitions not approved by the U.S. Attorney General. Finally, any offense for which the U.S. is obligated to extradite a citizen under a mutual treaty with another country likewise falls under the broadened laundering banner.

The final subtitle under the Title III provision deals with an effort to rein in the illegal physical transport of bulk currency. This movement builds upon the Bank Secrecy Act of 1970 also known as The Currency and Foreign Transactions Reporting Actwhich requires banks to record cash purchases of instruments that have daily aggregate values of $10,000 or morean amount that triggers suspicion of tax evasion and other questionable practices.

Because of the BSAs success, sharp money launderers now know to bypass traditional banking institutions, and instead, move cash into the country using suitcases and other containers. For this reason, Title III makes concealing more than $10,000 on anyones physical person an offense punishable by up to five years in prison.