Trumps Scheme To Sabotage Medicare And Social Security

Dont get too comfortable with your Social Security and Medicare.

Thats the warning President Trump sent from his New Jersey golf course Saturday as he announced a package of coronavirus relief that turns out to be more of a cynical and cruel campaign stunt.

Heres why its cynical:

- Democrats and even some Republicans are questioning the legality of his new executive orders, which depend in large measure on the voluntary cooperation of employers and cash-strapped state legislatures.

- The cut in payroll taxes that finance Social Security and Medicare is actually a deferment that workers or their employers would have to cough up next year. But Trump vowed to make the cut permanent.

- The temporary $400 in weekly supplemental unemployment benefits turns out to be only $300. States would be challenged to kick in another $100, but most legislatures are cash-strapped and forbidden by constitutions or laws to run deficits like the federal government can. They cant print money either. Trump would filch the $300 of federal money from funds budgeted for natural disasters in hurricane season no less and that is certain to be challenged in court.;

- The order to resume a moratorium on evictions is nothing more than an instruction to government agencies to consider whether it needs to be done and to look for money in their existing budgets to help terrified renters.

Hes raising false hopes for everyone else. Thats what makes it cruel.

This is what he said:

Trumps Plan To Defund Social Security

On August 8, at his golf club in Bedminster, New Jersey, President Donald Trump announced that his administration is seeking to delay much of the payroll tax that funds Social Security1 of 4 unilateral actions he took in lieu of negotiating with Congress on meaningful economic relief legislation. The president also said that if he is reelected, he wants not only to turn the delay into a tax cut that would result in significant revenue losses for Social Security, but also to eliminate employee payroll taxes for good. As our analysis based on the Social Security trustees projections shows, eliminating employee payroll taxes along the lines that the president has proposed would, absent additional action, completely exhaust the Social Security trust fund by 2026 or earlier and result in steep benefit cuts.

Trump has made clear that he wants the tax that is delayed this fall under his unilateral action to be permanently forgiven, which would result in a permanent revenue loss of about $100 billion for Social Security. At the Bedminster press conference, President Trump also stated, If Im victorious on November 3rd, I plan to forgive these taxes and make permanent cuts to the payroll tax. Trump doubled down on these comments on Monday, August 10, reiterating, After the election, on the assumption that it will be victorious for an administration thats done a great job, we will be ending that tax, well be terminating that tax.

Social Security Is Facing A Nearly $17 Trillion Funding Gap

If Biden wins in November, he’ll have a host of issues to immediately tackle, including the ongoing response to the coronavirus pandemic, job creation, and growing the U.S. economy. But don’t overlook perhaps the biggest long-term challenge facing the president: Social Security’s widening cash shortfall.

Every year, the Social Security Board of Trustees releases a report that examines the short-term and long-term outlook for the program. In each of the past 35 years, the Trustees have cautioned that long-term revenue collection won’t be sufficient to cover outlays. This is a fancy way of saying that the existing payout schedule, inclusive of cost-of-living adjustments , isn’t sustainable. Social Security is facing an estimated $16.8 trillion funding shortfall between 2035 — when the Trustees anticipate the program will exhaust its $2.9 trillion in asset reserves — and 2094. Benefit cuts of up to 24% may await retired workers as a result.

Something needs to be done soon to shore up Social Security; otherwise, our nation’s retired workforce could be in big financial trouble in less than 15 years.

However, Biden has a plan.

You May Like: Donald Trump Calling Republicans Stupid

President Trump Wont Destroy Social Securitybut Hes Not Going To Save It

Former Vice President Joe Biden is running campaign ads that claim President Trump signed an executive action directing funding cuts for Social Security and proposed slashing hundreds of billions of dollars from the Social Security Trust Fund every year.;

The problem is, however, that this just isnt so.

A Biden campaign TV ad falsely claims that a government analysis of President Donald Trumps planned cuts to Social Security shows that if Trump gets his way, Social Security benefits will run out in just three years from now, says FactCheck.org.;

The cliche politics aint beanbag exists for a reason: Campaigns use overhyped rhetoric to distort their opponents positions and make them appear less electable. Seniors should rest easy and understand that their Social Security benefits arent going anywhere.

But this dynamic of misleading charges belies a more fundamental problem: Something will eventually need to be done to buttress Social Securitys finances. Episodes like this dont bode well for future attempts to reform Social Security.

President Trumps Record On Social Security

In 2016, the president distinguished himself from other Republicans by promising to leave Social Security alone. Over the past four years, hes pretty much done just that.

There have been no Bush-like privatization plans from the Trump administration, no Simpson/Bowles-inspired murmings over cutting benefits or raising the full retirement age. Theres been no real plan to do much of anything. The Biden campaign ad is as close as theres been to a controversy, and even that misrepresents the presidents aims.

Should Trump win in November you can expect more of the same.;

I haven’t seen anything discussed on Social Security reform, Andrew Biggs, a research fellow at the conservative-leaning think tank AEI told Forbes Advisor. The president has argued against any Social Security benefit cuts but hasn’t waded into how Social Security’s long-term funding should be secured.

While this should assuage any fears about changes to the Social Security status quo and soothe soon-to-be retirees worried about cuts to their monthly checks, its less than ideal that the Trump administration has no plans to shore up Social Securitys long-term finances.;

Don’t Miss: How Many Republicans In California

Switch The Program’s Inflationary Tether To The Cpi

Fourth and finally, Biden has suggested that the inflationary tether for Social Security be changed from the Consumer Price Index for Urban Wage Earners and Clerical Workers to the Consumer Price Index for the Elderly .

The CPI-W has been the program’s inflationary measure since 1975, and while it’s resulted in a positive COLA in 42 of the past 45 years, the purchasing power of Social Security dollars has been slashed by 30% since 2000. That’s because the CPI-W doesn’t do a very good job of accurately measuring the costs that seniors are contending with. Even though more than 80% of Social Security beneficiaries are seniors, the CPI-W tracks the spending habits of urban and clerical workers, who often aren’t seniors or receiving Social Security benefits.

Under Biden’s plan, the CPI-E would become the new inflationary tether. The CPI-E specifically tracks the spending habits of households with persons aged 62 and up. In theory, this should result in a more accurate COLA each year.

Democrats Oppose Relief For Essential Workers Just Because Of Politics

Payroll taxes are the largest taxes most workers pay, and during the economic lockdown, many families have gone from earning two incomes to earning just one. Thats why Congress ought to provide an instant payraise for the frontline workers who are keeping this economy running by supporting Rep. Kevin Bradys Support for Workers, Families, and Social Security Act. The bill forgives employee …

Read Also: Did The Republicans Free The Slaves

They Aim To Fix Social Security Through Long

Finally, Republicans do want to fix Social Security, but they are at the opposite side of the spectrum from Democrats on how to do that. Whereas Democrats prefer raising revenue to make up for an expected $13.2 trillion cash shortfall between 2034 and 2092, Republicans want to reduce the program’s long-term expenditures.

How, you ask? As noted, they’d implement the Chained CPI, which would result in lower annual COLAs, and thereby reduce the amount of expenditures heading to beneficiaries over the long run.

Republicans are also big proponents of raising the full retirement age, or the age at which you become eligible for your full retirement benefit. Currently, set to peak at age 67 for those born in 2022 or later, Republicans would like to see this gradually increased to as high as age 70. This would require retired workers to either wait longer to receive their full payout, or to accept a steeper monthly reduction if claiming early. Either way, it reduces the lifetime benefits paid out by Social Security, and thereby saves the program money.

Some Republicans, including Donald Trump, have called for a form of means-testing, which would reduce or eliminate Social Security benefit payments for those folks or couples who are wealthy.

Do Republicans In Congress Want To Take Away Social Security Medicare Medicaid

Its been a time-tested Democratic attack line: Republicans are going to take away your Medicare, or maybe your Social Security. We gave a variant of the line our 2011 Lie of the Year.

Now the talking point has re-emerged, in a , from Oregons Ron Wyden, the top Democrat on the Senate Finance Committee:

“#TrumpTax was only the beginning. After giving massive tax giveaways to wealthy & powerful shareholders, Republicans in Congress are plotting to take away Medicare, Medicaid and Social Security.”

#TrumpTax was only the beginning. After giving massive tax giveaways to wealthy & powerful shareholders, Republicans in Congress are plotting to take away Medicare, Medicaid and Social Security.

Ron Wyden

In reality, the notion that congressional Republicans are scheming to “take away” Medicaid, Medicare or Social Security is inaccurate.

The Democratic news release

The first piece of evidence undercutting the tweets message is actually linked in the tweet itself.

An accompanying Senate Democratic press release, dated March 27, starts by saying, “Its only been a few months since Republicans jammed through their massive giveaway to corporate executives and wealthy shareholders. Now theyre planning on paying for it with huge cuts to Medicare, Medicaid, and Social Security, despite President Trumps promises that he wouldnt do so.”

These quotes suggest the Republican in charge of the House continues to seek overhauls of the entitlement system.

Read Also: When Did The Parties Switch Platforms

Biden To Meet With Senate Republicans About Covid

The cuts can be avoided, budget experts say, only with 60 Senate votes leaving Democrats back where they started, because it’s unclear whether Republicans would vote to prevent the cuts after having opposed a partisan relief package.

“It’s Medicare. It’s farm subsidies,” said Marc Goldwein, a budget expert at the nonpartisan Committee for a Responsible Federal Budget. “It’s a bunch of programs that would be cut.”

The size of the reductions in Medicare and other social safety net program would depend on the size of the package, but they’d be significant even if the price tag fell under $1 trillion. Social Security and low-income programs would be exempt.

“The cuts would be huge,” said Paul Van de Water, a senior fellow at the Center on Budget and Policy Priorities, a liberal think tank. “It’s a critical issue, which, at some point, is going to have to be dealt with.”

Senate Budget Committee Chairman Bernie Sanders, I-Vt., who will shepherd the reconciliation process and has been a supporter of expanding safety net programs, will work to prevent the cuts, said his spokesman, Keane Bhatt.

Bhatt pointed to the last time budget reconciliation was used to make a big change when Republicans passed a costly tax cut on a partisan vote, which triggered $25 billion in Medicare cuts. But Democrats joined Republicans to prevent the cuts from taking effect in a government funding measure that was passed subsequently.

NBC News app for breaking news and politics

Republicans Are Pushing Myths About Social Security

Republican politicians want to cut Social Security. They never say so out loud, but their 2016 platform reveals the truth. In the section labeled, Saving Social Security, it proclaims, As Republicans, we oppose tax increases Since Social Security cannot deficit spend and is projecting a shortfall in 2035 if Congress doesnt act, that only leaves benefit cuts.

Representative John Larson , the Chairman of the House of Representatives Subcommittee on Social Security, is trying to force his Republican colleagues into the open. Larson is the sponsor of the Social Security 2100 Act, which increases Social Securitys modest benefits. Additionally, it raises enough revenue to ensure that all benefits can be paid in full and on time through the year 2100 and beyond. Ninety percent of the Democrats in the House of Representatives are co-sponsors, but not a single Republican. Given their refusal to back his bill, Rep. Larson has urged Republicans to offer an alternative proposal to no avail.

Non-action is not an option, unless your goal is to cut Social Security. The most recent Social Security Trustees’ Report projects that with no action, benefits will be automatically reduced by 20 percent in 2035. As Chairman Larson has plainly stated, The hard truth of the matter is that Republicans want to cut Social Security, and doing nothing achieves their goal.

Recommended Reading: Did Trump Say Republicans Are Stupid

Trump White House Claim The Tax Relief Will Not Impact Social Security

On Sunday, as he boarded Marine One, Trump told reporters that the executive order deferring;payroll taxes for some Americans;will “have zero impact on Social Security.”;

“We protect Social Security,” he added, according to Fox News.

An official from the;White House told USA TODAY on Tuesday that the Social Security Trust Fund is not at risk, since payment deferral is only temporary, and at present, must be paid back early in 2021. The official confirmed, though, that the president;called;on;Congress to make the;deferral permanent,;thereby eliminating the tax.

Garrett Watson, a senior policy analyst at the Tax Foundation, an independent tax policy think tank, told USA TODAY that eliminating the tax is not the same as eliminating Social Security.

More:Fact check: Democrats have condemned violence linked to BLM, anti-fascist protests

“Strictly speaking, Social Security could be funded using general fund revenue or alternative revenue source, so terminating a tax and terminating a program are distinct things,” he;wrote in an email.

“However, it would be reasonable to ask what would happen with the program absent an alternative plan to fund it,” Watson added.

On Wednesday, Trump suggested an alternate source for the first time the general fund of government revenues ;per Fox Business.

More:The top 3 unanswered questions about Trump’s executive orders on coronavirus relief

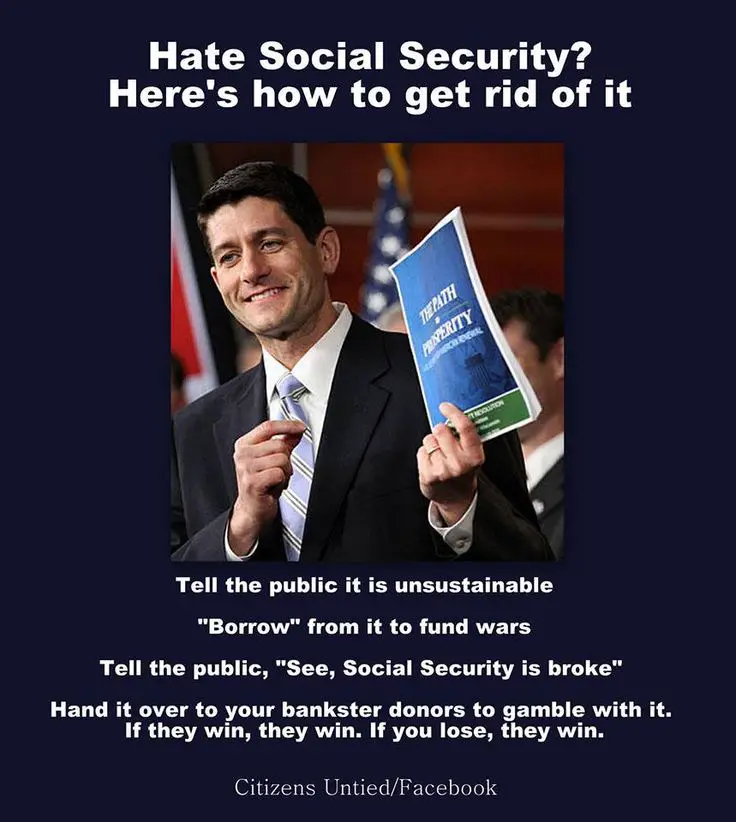

Republicans Demand Social Security And Medicare Cuts Is It Reported

Yesterday The Hill reported, in House GOP says sequester is leverage in next budget battle, that Rep. Paul Ryan is pushing for cuts in Social Security and Medicare:

In a meeting with House conservatives, Rep. Paul Ryan , told rank-and-file lawmakers that, as the partys chief budget negotiator, he would push instead for long-term reforms to entitlement programs in exchange for changes to sequestration spending cuts that Democrats are expected to demand.

Rep. Matt Salmon said that during the GOP meeting, Ryan pointed to sequestration as the partys leverage with Democrats and said the Republican negotiators would not accept revenue increases in exchange.

Were going to try to push for some substantial reforms on entitlement spending and our backstop is sequestration, Salmon said in describing Ryans remarks.

Most Americans dont read The Hill. And most Americans dont know that long-term reforms to entitlement spending specifically means cuts to Social Security and Medicare.

Reuters is pretty much the only outlet carrying this news, in;U.S. Rep. Paul Ryan wants narrower focus for new budget talks,

Thats about it. So lets go back to a few weeks before The Hills report, and see if there have been reports in the major media that spell out for the public that, having dropped their demand to get rid of Obamacare Republicans are demanding cuts in Social Security and Medicare.

Read Also: Who Is Right Republicans Or Democrats

Democrats Risk Unintended Medicare Cuts If They Pass Partisan Covid Relief

WASHINGTON Democrats considering a maneuver to forgo bipartisan support to pass Covid-19 relief are confronting an unintended consequence: Doing so could automatically cut Medicare.

Many Democrats want to pass President Joe Biden’s $1.9 trillion Covid-19 relief proposal, which includes $1,400 stimulus checks and aid to local governments. A group of Republican senators is pushing for a smaller plan that would provide $1,000 checks.

So Democratic leaders are preparing to use a process known as budget reconciliation, which would allow them to pass Biden’s proposal without getting 60 votes in the Senate, which would require at least 10 Republicans.

But under the Pay-As-You-Go Act of 2010, known as PAYGO, new laws that raise the national debt automatically trigger offsetting cuts in some safety net programs.

They Haven’t Taken A Dime From The Social Security Program That Isn’t Accounted For

Another misconception is that the Republican Party stole money from the Social Security Trust and used it to fund wars. More specifically, Ronald Reagan, George H.W. Bush, and George W. Bush have come under intense scrutiny for borrowing from Social Security and “not putting the money back.”

However, the truth of the matter is that Congress has been able to “borrow” Social Security’s excess cash for five decades, and it’s happened under every single president over that stretch. In fact, the Social Security Administration is required by law to purchase special-issue bonds and certificates of indebtedness with this excess cash. Please note the emphasis on “required by law” that I’ve added above. The federal government isn’t simply going to sit on this excess cash it borrows from Social Security. It’s spending this cash on various line items, which may be wars and the defense budget, as well as education, healthcare, and pretty much any other expenditure you can think of.

This setup is actually a win-win for both parties. The federal government has a relatively liquid source of borrowing with the Social Security Trust, and the Trust is able to generate significant annual income from the interest it earns on its loans. Last year, $85.1 billion of the $996.6 billion that was generated by the program came from interest income.

Recommended Reading: Did Trump Say Republicans Are Stupid