How Does Trump’s Tax Plan Affect You

How exactly the Trump tax plan affects you depends on your income, your current filing status and the deductions you take. But because of tax code changes, you might want to work with a financial advisor to optimize your tax strategy for your financial goals. Take a look at the following guide to help you better understand the main features …

Gift Tax Payments Decreased In 2018

Gift tax collections were significantly lower in 2018. Gift tax applies when people give items of value, including cash, worth more than $15,000, but you only need to pay gift tax after youve given more than your lifetime exemption.

Your lifetime exemption is the same as the estate tax exemption and each gift you make decreases your remaining exemption. So in 2018, the lifetime gift tax exemption was $11.18 million. If you gifted someone $1 million that year, you wouldnt actually have to pay gift tax it would lower your lifetime exemption to $10.18 million.

If you exceed the gift tax exemption during your lifetime, youll have to pay the gift tax each time your gifts exceed $15,000 in a tax year.

Because of the higher exemption from the TCJA, more people can give large gifts without having to pay gift tax. The IRS collected $1.9 million in gift tax in 2017, but only $1.2 million in 2018, a 38.4% decrease.

Learn more about gift tax and who needs to pay it.

How Itemized Deductions Changed

If taxpayers incur certain types of expenses, they can deduct the expenses on their federal taxes. These are called itemized expenses and you take them as itemized deductions instead of taking the standard deduction. That means your itemized deductions need to be worth more than your standard deduction to be worth claiming.

The TCJA made multiple changes to itemized deductions, like putting a $10,000 limit on the state and local tax deduction and eliminating a number of miscellaneous deductions. The new, higher standard deduction also means fewer taxpayers are able to itemize, because they need to have about twice as much in itemized deductions in to make itemizing worth it.

IRS data from 2020 shows that 30.9% of taxpayers itemized deductions in 2017, but only 11.3% itemized in 2018 88.4% of taxpayers took the standard deduction in 2018.

Taxpayers claimed the following types of itemized deductions about 60% less in 2018:

-

The medical expenses deduction was claimed 57.2% less in 2018 than 2017.

-

The mortgage interest deduction was claimed 60.9% less in 2018 than 2017.

-

The charitable contributions deduction was claimed 63.5% less in 2018 than 2017.

-

The deduction for total taxes paid, which includes the SALT deduction, was claimed 64.5% less in 2018 than 2017.

Read Also: Patriot Power Cell Solar Charger

Retirement Plans And Hsas

Health savings accounts were not affected by the law, and the traditional 401 plan contribution limit in 2019 increased to $19,000 and $25,000 for those aged 50 and older. The law left these limits unchanged but repealed the ability to recharacterize one kind of contribution as the other, that is, to retroactively designate a Roth contribution as a traditional one, or vice-versa. Since the passing of the Setting Every Community Up for Retirement Enhancement Act in Dec. 2019, though, people can now contribute to their individual retirement accounts past the age of 70½.

The IRS makes cost-of-living adjustments to contributions for retirement savings accounts every year. For 2022, the annual contribution limit for 401 and other workplace retirement plans is $20,500, up from $19,500 in 2021. Employees over age 50 can contribute an additional $6,000 âcatch-upâ$26,500 in total.

Also Check: Trump Lies How Many

Impacts On The Economy

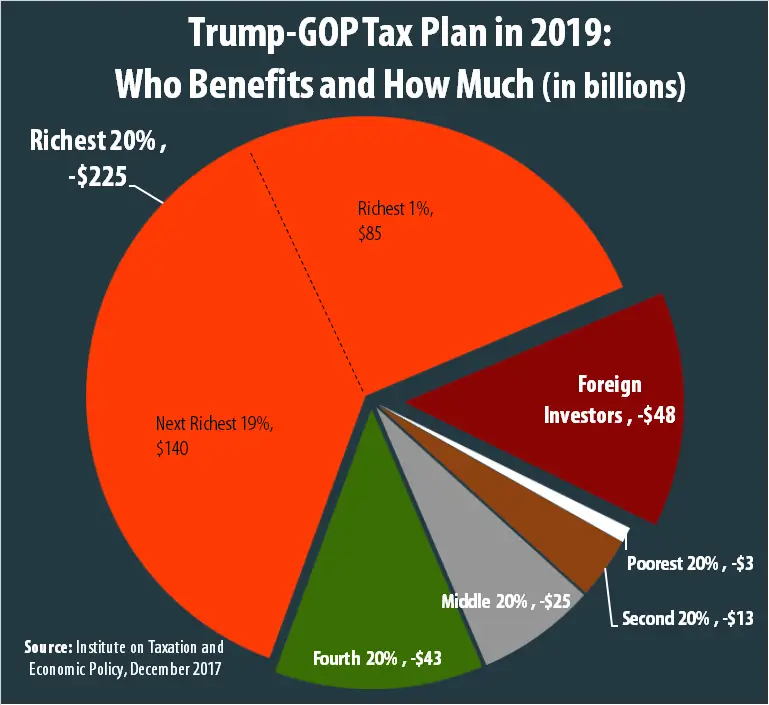

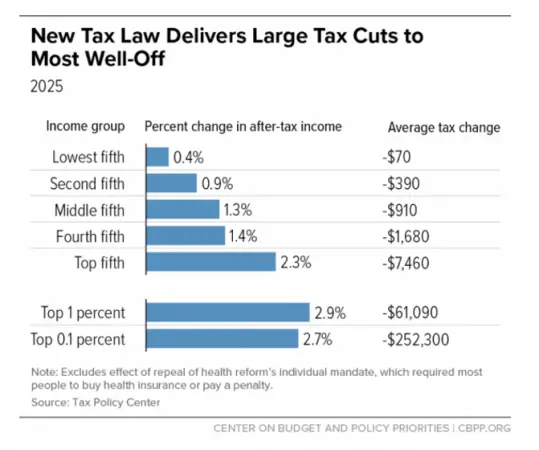

- The tax plan made the U.S. progressive income taxmore regressive. Tax rates are lowered for everyone, but they are lowered the most for the highest-income taxpayers. The Trump tax cuts were estimated to cost the government $1 trillion, according to the Joint Committee on Taxation. The $1 trillion figure is the result of the overall $1.5 trillion th…

Don’t Miss: Patriot Lighting Tape Light Extension

The Gop Tax Law Showers Benefits On The Wealthy And Large Corporations While Abandoning Middle

One year after President Trump and congressional Republicans enacted their tax cut for the wealthy and large corporations, none of their promised results are happening. While the law spurred a brief boost in economic growth, our long-term growth trajectory is unchanged. There is no sign of an investment boom. Real wage growth for workers remains modest. Factories and jobs are more likely to go overseas. The federal deficit is soaring as corporate tax receipts plummet. And the tax code is riddled with even more special-interest tax breaks and loopholes. By any measure, there is no evidence showing that the GOP tax cut is trickling down to working Americans. On February 27, the House Budget Committee will hear testimony from four expert witnesses on the real-world implications of the GOP tax cut.

GOP tax cut led to record $1 trillion in stock buybacks that do little for working Americans The GOP tax cut delivered huge benefits to rich investors and CEOs through a record-setting $1 trillion in stock buybacks in 2018 while average workers struggle to pay for rising health care and living costs. Stock buybacks do nothing to improve business operations or help workers. The corporate tax cut gave more cash to companies that are sitting on historically large cash reserves, while failing to provide firms with any incentive to hire workers or boost pay.

- Caroline Bruckner

- William G. Gale

- Chye-Ching Huang

Trump Tax Cuts And The Middle Class: Here Are The Facts

Ever since Congressional Republicans passed the Tax Cuts and Jobs Act in 2017, the left has sought to portray the tax cuts as a bad deal for the middle class.

Now that they have taken back Congress, Democrats on Capitol Hill are holding a hearing on Wednesday to examine how the middle class is faring. While they will undoubtedly use this hearing to score political points, the fact is the tax cuts have created unprecedented prosperity for the middle class in the form of higher wages, more take-home pay, more jobs and new employee benefits.

Read Also: New England Patriots Area Rug

The Impossible Inevitable Survival Of The Trump Tax Cuts

How Democrats went from unanimous opposition to an unpopular policy to doing nothing about it in the five years since it became law.

Evan Vucci/AP Photo

President Donald Trump shakes hands with then-House Speaker Paul Ryan during an event after the passage of the “Tax Cut and Jobs Act Bill” on the South Lawn of the White House, Dec. 20, 2017.

Right as the Trump tax cuts were being finalized in December 2017, I wrote a piece for The New Republic about the silver lining that accompanied this large giveaway to the wealthy and well-connected. Democrats had put themselves in a straitjacket for years, with self-imposed paygo laws that they offset all new spending with revenue. That was fairly absurd in and of itself, but suddenly it was no longer a problem. The Trump tax cuts rolled back the estate tax, eliminated the alternative minimum tax, slashed the corporate tax rate, and created a new loophole, used mostly by the rich, for pass-through businesses.

Repealing those measures alone could net you around $3 trillionand all you would have to do is go back to the pre-Trump tax code circa fall 2017. Every Democrat in office at the time opposed the Trump tax cuts: Joe Manchin, Kyrsten Sinema, Josh Gottheimer, and Kurt Schrader every single one of the cast of characters that has become so familiar today. They all opposed it, and presumably would all be satisfied with a 2017-era tax code.

Myths About The Trump Tax Cuts

Donald Trump is running for president again, and voters are going to hear a lot about the 2017 tax cuts he signed into law. Trump, for one, will brag about the economic magic borne of tax cuts that supposedly pumped prosperity everywhere. Theres also the curious fact that the tax cuts for businesses were permanent, but the tax cuts for individuals were temporary. Republicans are already campaigning to extend those individual tax cuts before they expire at the end of 2025.

As a reminder, the 2017 Tax Cuts and Jobs Act , as it was known, simplified tax filing for many families and lowered the tax rates most filers pay. It also lowered the corporate income tax rate from 35% to 21% and cut other business taxes. The law cost about $1.9 trillion, which means thats the amount budget analysts estimated it would add to the national debt during the decade after it went into effect.

The law has generated many competing claims about whether it boosted growth, employment, or incomes, and whether it was a net positive or negative for the economy. The COVID pandemic that erupted in 2020 distorted the economy in many ways that make it hard to gauge the longer-term effect of the TCJA. But theres plenty of data from 2018 and 2019, the first two years the law was in effect, to draw some conclusions. Here are some bogus claims to watch out for.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman

Don’t Miss: New England Patriots Newborn Outfit

Hunt: Good Education Is A Moral Mission

Billions more will be invested in schools in England over the next two years, the Chancellor has announced as he described ensuring a good education for children as an economic and moral mission.

Jeremy Hunt said the Government will invest an extra £2.3 billion per year in schools over the next two years.

Announcing the rise in funding during the autumn statement on Thursday, he said thank you to heads, teachers and classroom assistants for their brilliant work which he said must continue in the current difficult economic circumstances.

He rejected calls to put VAT on independent school fees, saying it would be like giving with one hand and taking away with another.

He said while it could raise about £1.7 billion to increase core funding for schools, some estimates showed it could also result in up to 90,000 children switching from the independent sector to state schools.

Some Taxpayers Missed Personal Exemptions

In 2017, each taxpayer could also claim a personal exemption worth $4,050 for themselves and for each dependent. This exemption lowered their taxable income because, along with the $6,350 standard deduction, a single filer with no kids would effectively deduct $10,400. This isnt much lower than the new standard deduction and for certain taxpayers it wouldnt result in much tax savings.

Example: Lets say a single parent has two children and qualifies as a head of household. In 2018, this parent would have gotten a standard deduction of $18,000 and their taxable income would be lowered by that amount. This is up from the head of household standard deduction of $9,350 in 2017, the last year before the tax reform took effect.

But in 2017, this parent would have been able to claim not only the standard deduction of $9,350 but also three personal exemptions worth a total of $12,150 , allowing them to lower their taxable income by $21,500. The result of the Trump tax reform is that, for this household, the new standard deduction is worth less than the combined value of the standard deduction and personal exemptions in 2017. The change could leave this single parent owing more in taxes.

Also Check: 2008 Jeep Patriot Transmission Problems

The Tcja 2 Years Later: Corporations Not Workers Are The Big Winners

The massive corporate tax cut is costing more than expected and not trickling down to workers.

On December 22, 2017, President Donald Trump signed into law the so-called Tax Cuts and Jobs Act , a $1.9 trillion tax bill favoring corporations and wealthy Americans. At its heart is a large cut in the corporate tax rate. Corporations are literally going wild over this, Trump said upon signing the bill. He predicted that the corporate tax cut would cause a boom in business investment and that factories are not going to be abandoned any longer. His White House, meanwhile, estimated that the corporate tax cuts would trickle down to workers in the form of a $4,000 annual raise.

Two years later, however, business investment is actually declining. Factory closings and mass layoffs have not ended. Wage growth is tepid, despite the continuation of the economic expansion that began 10 years ago, and gross domestic product growth is slowing and projected to revert to its long-term trend or below. Meanwhile, budget deficits are higher due to revenue losseswhich have largely been triggered by the massive corporate tax cut at the heart of the TCJA. Nevertheless, earlier this month, acting White House Chief of Staff Mick Mulvaney told a gathering of CEOs that the Trump administration will seek to cut the corporate tax rate further if the president gains a second term in office.

The Promised Boom In Business Investment Never Happened

In the year following the tax cut, business investment increasedbut not by nearly as much as the tax cut proponents predictions would have implied. Furthermore, a study by the International Monetary Fund concluded that the relatively healthy business investment in 2018 was driven by strong aggregate demand in the economynot the supply-side factors that tax cut proponents used to justify the tax cut. In other words, the increase in business investment from the relatively weak 2015-2016 period seems like another example of an economic indicator returning to more-normal levels.

Worse, business investment has slowed more recently. The most recent data show that private nonresidential investment actually declined in the second quarter of 2019, contributing to an overall slowdown in growth. Federal Reserve Chairman Jay Powell pointed to the continued softness expected in business investment and declining output in manufacturing sector as reasons for the Feds recent rate cut. Measures of the investments that companies are planning have also . As analysts at the nonpartisan Tax Policy Center wrote recently, This slowdown in business purchases of plant and equipment contrasts sharply with President Trumps rosy forecast of a long-term investment boom that would lead to annual wage increases of $4,000 or more. Moreover, investment in housing has declined every quarter since the passage of the tax legislation.

Read Also: What Are Trump’s Latest Poll Numbers

What Jeremy Hunts Autumn Statement Means For You

From income tax changes to help with the cost of living crisis, all you need to know about the chancellors changes

That everyone will be paying more tax after the autumn statement was the big spoiler from Jeremy Hunt before the event and so it came to pass, with a programme of tax creepage that was short on good news amid a cost of living crisis.

Irs Data Proves Trump Tax Cuts Benefited Middle Working

President Biden and congressional Democrats’ Build Back Better Act is now in the hands of the Senate. That legislative body’s 50-50 partisan split will undoubtedly make the bill’s passage difficult.

In order for BBB to become law, Democratic Senate leadership will need to convince moderates such as Sens. Kyrsten Sinema and Joe Manchin that the legislation’s $2.4 trillion price tag can be offset by expanding the IRS and its enforcement efforts while imposing substantial tax reform measures.

Congressional Democrats have argued that one of the best ways to pay for the legislation is to raise taxes on wealthy households, which, according to many on the left, have benefited disproportionately and unfairly from the 2017 tax reform law passed by Republicans and signed by former President Trump. The latest data, however, proves that this claim is pure mythology.

Income data published by the IRS clearly show that on average all income brackets benefited substantially from the Republicans’ tax reform law, with the biggest beneficiaries being working and middle-income filers, not the top 1 percent, as so many Democrats have argued.

Filers who earned $50,000 to $100,000 received a tax break of about 15 percent to 17 percent, and those earning $100,000 to $500,000 in adjusted gross income saw their personal income taxes cut by around 11 percent to 13 percent.

It would be a grave mistake for Democrats to eliminate key parts of this important legislation.

Recommended Reading: Patriot Buick Gmc Killeen Tx

Personal Exemption And Healthcare Mandate

The law suspended the personal exemption, which was $4,150, through 2025. The law also ended the individual mandate, a provision of the Affordable Care Act or “Obamacare” that provided tax penalties for individuals who did not obtain health insurance coverage, in 2019. the taxpayer will still be exposed to a penalty for not being covered by health insurance all year.)

According to the Congressional Budget Office , repealing the measure is likely to reduce federal deficits by around $338 billion from 2018 to 2027, but lead 13 million more people to live without insurance at the end of that period, pushing premiums up by an average of around 10%. Unlike other individual tax changes, the repeal will not be reversed in 2025.

Senators Lamar Alexander and Patty Murray proposed a bill, the Bipartisan Health Care Stabilization Act, on Mar. 19, 2018, to mitigate the effects of repealing the individual mandate. The CBO estimated that this legislation would still leave 13 million more people uninsured after a decade. The bill failed to make it into the $1.3 trillion spending bill that was passed on Mar. 23, 2018. As such, the burden of providing affordable health insurance will be on states and health insurers.

A Preliminary Look At 2019 Tax Data For Individuals

Taylor LaJoie, Erica York

The IRS has released tax data covering the first 30 weeks of the tax season, providing a glimpse of how individual taxpayers fared in 2019, the second tax year under the Tax Cuts and Jobs Act . The preliminary data provides aggregate information by income group on a range of topics, including sources of income as well as deductions and credits taken by taxpayers.

It is important to note that this data represents about 95 percent of filers and excludes those that requested a six-month filing extension. For this reason, the data represents about 82 percent of total tax liability that will be reported on individual income tax returns filed for tax year 2019.

In a previous piece, we outlined how the TCJA reduced effective tax rates and increased use of the standard deduction, among other changes, for all income groups in 2018 compared to 2017. When we account for the 2019 data, a similar trend emerges.

Recommended Reading: Patriot Docks Universal Dock Fender