Tax Law Largely Left Behind Low

The drafters of the 2017 tax law ignored key tools they could have used to raise living standards for low- and moderate-income people. The Child Tax Credit and Earned Income Tax Credit are provisions of the tax code that lift the living standards of millions of working families. A growing body of evidence also links income from these tax credits to better infant health, improved school performance, higher college enrollment, and projected increases in earnings in adulthood for children in families that receive them. The 2017 tax law could have substantially helped low- and moderate-income households by boosting these tax credits in ways that would benefit them, but instead it:

1. Increased the CTC in a way that largely left behind millions of working families, while doing much more for high-income families.

The law increased the maximum CTC from $1,000 to $2,000 per child but denied that full increase to millions of children in low-income working families.

This outcome was a deliberate choice by the laws drafters: negotiators agreed last-minute to a deeper cut in the top individual tax rate, but rejected calls to use that same funding source a slight reduction in the laws cut in the corporate tax rate to deliver more than a token CTC increase to 11 million children in low-income working families.

2. Ignored the Earned Income Tax Credit, a critical tool for boosting workers incomes.

Taxpayers Who Claim The Standard Deduction

You’ll win on two levels if you claim the increased standard deduction because it’s now bigger than your old itemized deductions were. First, it will reduce your taxable income more than past years. Second, you can skip the complicated process of itemizing your deductions. That not only saves you time, but it will also save you money if you no longer have to pay a tax advisor.

Will Trumps Tax Cuts Be Extended If Democrats Take Over

Thats thanks to Senate rules that allow tax cuts to pass with fewer than 60 votes if they wont increase the deficit in 10 years a necessity for Republicans to get the tax reform through. But its possible that a future Congress and President would vote to extend Trumps tax cuts even if Democrats are in charge.

Also Check: Is Thom Tillis Republican Or Democrat

Individual Income Tax Rates

The TCJA lowered tax rates, but it kept seven income tax brackets. The brackets correspond with more favorable spans of income under the TCJA, however, than under previous law. Each bracket accommodates more income.

The highest tax bracket starts at taxable income greater than $523,600 for single filers and $6128,300 for married couples filing jointly in tax year 2021, and $539,900 and $647,850 for 2022. These taxpayers are subject to a 37% rate on incomes over these thresholds after exemptions and deductions.

| 2017 Income Tax Rate | 2022 Income Tax Rate |

These income levels are adjusted each year to keep pace with inflation.

Tax Increases To Fund Infrastructure Program

Corporate tax proposals included in the American Jobs Plan, the administrations infrastructure proposal, advance tax policies promoted throughout Bidens presidential election campaign. The plans corporate tax policy goals include incentivizing job creation and investment in the U.S., stopping corporate profit-shifting to tax havens, and ensuring that large corporations pay their fair share of taxes.

The Biden administrations tax proposals would raise the corporate tax rate, impose new minimum taxes to prevent profitable U.S. businesses from escaping taxes through aggressive tax planning, repeal incentives for offshoring jobs, end preferences for the fossil-fuel industry, and strengthen corporate tax law enforcement by the IRS.

The corporate tax changes in the American Jobs Plan would raise tax revenue to help pay for the plans programs and investments in infrastructure, which range from transportation and roads to broadband, water resources, healthcare facilities, education, and more. The estimated $2.3 trillion cost of the American Jobs Plan, the scope of the investments proposed to be made over 10 years, and the tax increases intended to support it have generated substantial policy and political debate.

Don’t Miss: Why Are Republicans Against The Era

Trump Tax Cuts Helped Billionaires Pay Less Taxes Than The Working Class In 2018

US President Donald Trump claps during a campaign rally in Rio Rancho, New Mexico, on September 16, … 2019.

AFP/Getty Images

For the first time in American history, the 400 wealthiest people paid a lower tax rate than any other group, according to a new study by economists Emmanuel Saez and Gabriel Zucman at the University of California, Berkeley.

The startling data was brought to light on Monday in a New York Times column, and is based on an analysis by Saez and Zucman in their new book, The Triumph Of Injustice.

Some critics of the new research say that the data is skewed, or even potentially wrong. However, the fact that the ultra-rich potentially pay a lower tax rate than the working class is a massive problem. The Trump administrations tax cuts for the wealthy highlight the fact that policy is moving in the wrong direction. Especially when theres worry of a potential recession.

Bill Gates agrees and has previously said, Theres no doubt that what we want government to do in terms of better education and better health care means that we need to collect more in taxes. And theres no doubt that as we raise taxes, we can have most of that additional money come from those who are better off… I need to pay higher taxes.

Before your palms start sweating dont worry I dont think we should raise your taxes. We are talking about the top .01%. Those who own yachts and airplanes.

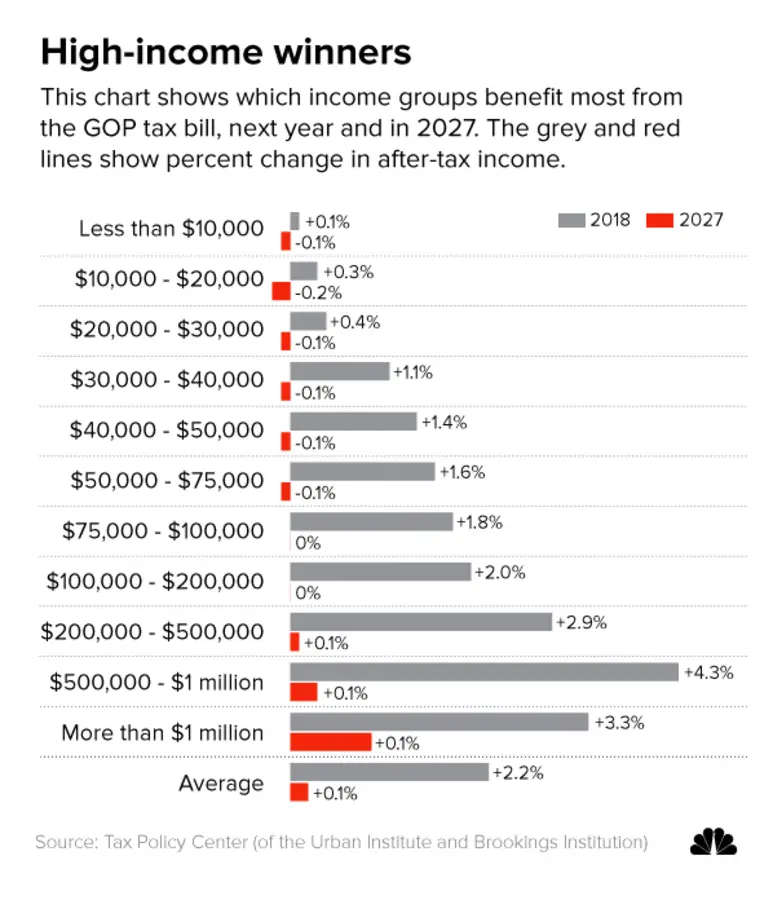

Who Benefits From The Tax Cut 10 Months Later

Tweet This

In December 2017, Congress cut government revenues by passing a $1.5 trillion tax cut. Congress claimed the corporate tax cuts would benefit everyone because businesses would invest or use the tax cut to raise wages. Donald Trump tweeted TAX CUTS will increase investment in the American economy and in U.S. workers, leading to higher growth, higher wages, and more JOBS! The promise hasnât materialized. Even Fox News, in an August 2018 poll, found Obamacare to be more popular than the tax cuts.

Here is the Fox News poll.

But so far, the cuts have not been linked to an increase in labor share or more investments. The Federal Reserve Bank of Chicagos current capital spending index indicates private business investment plans have remained in negative territory since 2015. The most certain effect of the tax cuts has been to help fuel a massive increase in the federal deficit and debt.

Buybacks are attractive because most CEO pay is directly linked to stock values and not to productive capital expansion. Increasing pay for the wealthiest Americans and reducing their taxes will boost equity values, but Americas inequality will get worse. The Economic Policy Institute documented that 2017 average compensation for the CEO of large companies increased by 17.6%. And that was before the tax cuts kicked in.

Also Check: Who Are The Republican Candidates For President 2020

The Tcja Gave Corporations An Even Bigger Tax Cut Than Originally Projected

Since the TCJA was enacted, corporate tax revenue has been down from its projected level by about one-third, even as pretax corporate profits have continued to rise toward historic highs. The main reason for the drop in corporate tax revenue is obvious: The TCJA slashed the corporate rate by 40 percent, from 35 percent to 21 percent. But the falloff in corporate revenue has been even sharper than expected.

Several months before the TCJA was enacted, the Congressional Budget Office projected that corporate tax revenues for fiscal years 2018 and 2019 would total $668 billion. In the forecast published soon after the TCJA was enacted, however, the CBO projected $519 billion in corporate tax revenue over those two yearsa $149 billion decrease. Actual corporate tax revenue over that period came in significantly lower, at $435 billiona $233 billion drop. Essentially, corporations have already received $233 billion in tax cuts, $84 billion more than the CBO projected. To put that in perspective, the federal government spent just $47 billion on Pell Grants over the past two years.

The CBOs adjusted forecasts now put the 10-year cost of corporate tax cuts at roughly $750 billion, $400 billion more than the pre-TCJA projections. That figure includes the temporary revenue from the TCJAs repatriation provision, which gave corporations steeply discounted tax rates on stockpiles of overseas profits from prior years.

Why Dont People Believe It

The tax savings were relatively small for many families, however. The middle fifth of earners got about a $780 tax cut last year on average, according to the Tax Policy Center.

Most Americans would probably welcome a $780 windfall. But in contrast to 2001, when President George W. Bushs Treasury Department mailed rebate checks to taxpayers, last years tax cuts showed up mostly in the form of lower withholding from workers paychecks. A few extra dollars in a biweekly paycheck proved easy to miss. Moreover, as taxpayers filed their returns, many found they were due smaller refunds than in the past, which may have further skewed perceptions of the law.

Most people didnt recognize the increase in take-home pay, or at least didnt attribute it to the tax cut, Mr. Rigney said. Some of them might realize it now that theyre filing their taxes, he said, but its little consolation to discover that you received a couple thousand dollars during the year but you already spent it.

High earners did far better under the law. The top 20 percent of earners received more than 60 percent of the total tax savings, according to the Tax Policy Center the top 1 percent received nearly 17 percent of the total benefit, and got an average tax cut of more than $30,000. And thats not even factoring in the laws huge cut to corporate taxes, which disproportionately benefit the wealthy households that own the most stock.

Dont Miss: How Many New Jobs Has Trump Created

Recommended Reading: Carolina Panthers New England Patriots

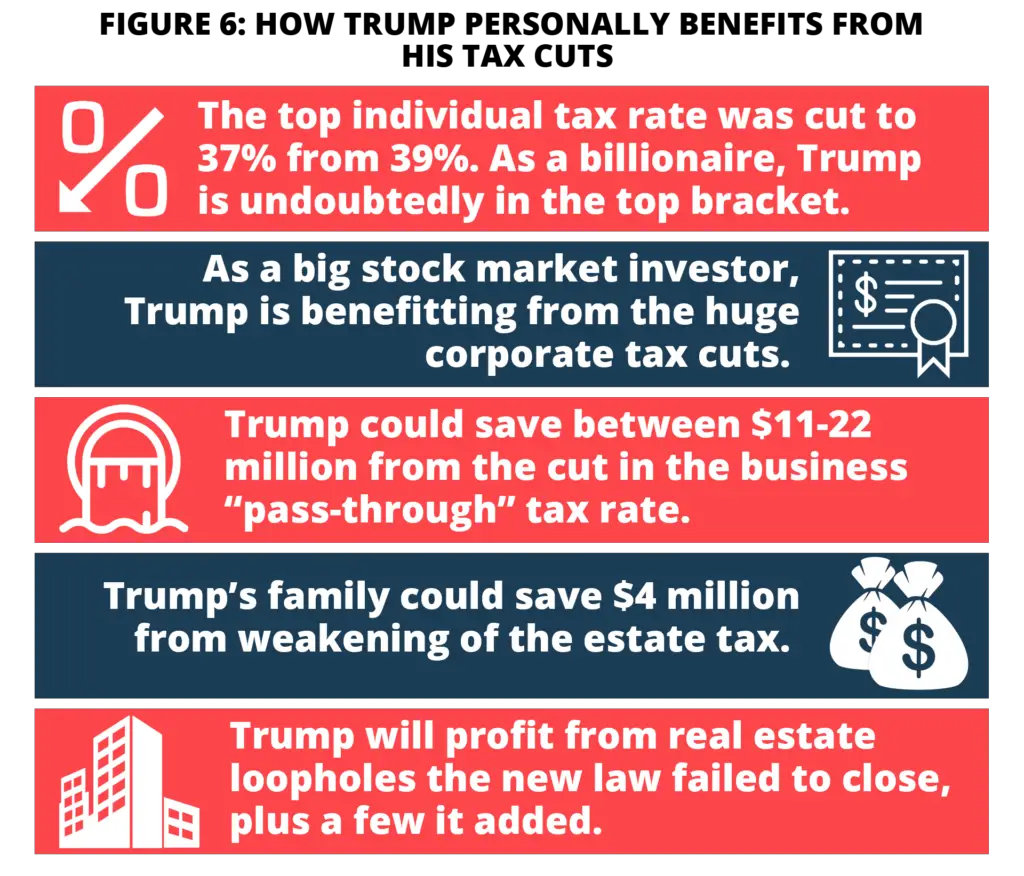

Gop Real Estate Owners Make Out Big

Besides the laws benefits to real estate pass-throughs, real estate in general was hugely favored by the tax law, allowing property exchanges to avoid taxation, the deduction of new capital expenses in just one year versus longer depreciation schedules, and an exemption from limits on interest deductions.

If you are a real estate developer, you never pay tax, said Ed Kleinbard, a former head of Congresss Joint Committee on Taxation.

Members of Congress own a lot of real estate. Public Integritys review of financial disclosures found that 29 of the 47 GOP members of the committees responsible for the tax bill hold interests in real estate, including small rental businesses, LLCs, and massive real estate investment trusts , which pay dividends to investors. The tax bill allows REIT investors to deduct 20 percent from their dividends for tax purposes.

Who We Are

The Center for Public Integrity is an independent, investigative newsroom that exposes betrayals of the public trust by powerful interests.

You May Like: Trump Lies Fact Check

Tax Returns And Withholding

Tax filing season brings up many questions for taxpayers, such as, How big will my tax refund be? or, Will I have a balance due when I file taxes this year? Changes to withholding tables in the aftermath of the TCJA resulted in lower-than-expected refunds, but it is important to remember that decreased tax refunds do not necessarily translate to increased tax liabilities.

The chart below shows the aggregate amount of refunds returned to taxpayers in each income group through the 30th week of the filing season in 2017 and 2019. While total refunds in 2019 fell for some income groups relative to 2017, effective tax rates dropped across all income groups over the same period. This pattern is similar to tax year 2018, when aggregate refunds also fell for most income groups.

Also Check: B& w Patriot 18k 5th Wheel Hitch

Ctc Gains May Have Just Cancelled Out Other Losses

As mentioned earlier, some families may have owed more tax because the expansion of the standard deduction meant the loss of personal exemptions. The TCJA expanded a few tax credits and deductions, including the child tax credit, and families may have needed to claim them just to offset the loss of personal exemptions.

Example: A two-parent family with two children may have actually owed more in taxes in 2018 than in 2017. The following table shows how:

|

Tax Break Type |

|

|---|---|

|

$30,900 |

$28,000 |

This family received a standard deduction of $24,000 in 2018. The family would have effectively received a deduction of $28,900 in 2017, because of the combined standard deduction and personal exemptions . In this scenario, the family could need to claim the child tax credit of $2,000 per child in 2018 just to break even. Even then, the total value of the combined standard deduction and CTC in 2018 would be less than the combined value of the standard deduction, personal exemptions, and CTC in 2017 .

So while Trumps tax reform allowed families to claim a higher child tax credit, some families may not have saved very much from it. As the IRS releases more data, it will be possible to look at whether the combined effect of the TCJA changes were enough to help certain working-class families save money.

Adjustments To Charge The Credit

From $1 000 to $ 2000, TCJA expanded the Child Tax Credit. Even parents with insufficient income to pay tax rates can claim a credit tax rebate of up to US$1.400. The TCJA also initiated $500 in loans for other government benefits, helping children for whom welfare benefits are no longer satisfied by stringent requirements of minor children even though they are older and care for older family members. The government subsidies are fully accessible to ratepayers who file sure with altered AGIs of up to $200,000 and widowed contributions of $400,000. They had been gradually removed and eradicated until the TCJA, at $75,000 and $110,000.

Always stay more careful and vigilant when giving or adding your personal information to any app or software. This is quite a great move that you can follow to get the favorable and best results. A bit of carefulness is not going to hurt but will result in satisfaction.

You can have other ways to deal with this matter, but always remember that safety comes first, so try to be the one that follows SOPs to ensure that you remain safe while handling all other matters in this extreme pandemic situation.

Bring your mask along and wear it all the time you feel like being in a conversation with other people. Wash your hands regularly, plus try to use gloves if easy so.

Read Also: Patriots Point Golf Charleston Sc

How Did The Tax Cuts And Jobs Act Affect The Federal Government

The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes. It was pro-growth reform, significantly lowering marginal tax rates and cost of capital. We estimated it reduced federal revenue by $1.47 trillion over 10 years before accounting for economic growth.

Law Does Relatively Little For Low

I have just outlined the three fundamental flaws of the 2017 tax law. Let me now examine in more detail how the 2017 tax largely leaves behind low- and moderate-income Americans and indeed hurts many.

The 2017 tax law should have placed top priority on raising the living standards of low- and moderate-income households, given decades of stagnant working-class incomes and growing income inequality. The share of after-tax income flowing to the bottom 60 percent fell by 3.8 percentage points between 1979 and 2015, while the share flowing to the top 1 percent rose by 5.6 percentage points. And looking at the working class a racially and geographically diverse group often defined as families with working-age adults in which no one has a college degree real working-class median income rose by only about 3 percent from 1979 to 2015.

You May Like: How Much Is A 2008 Jeep Patriot Worth

Judge Eviscerates Trump’s Bogus Lawsuit Against Hillary Clinton

Trumps Make America Great Again sloganeering tapped into honest nostalgia for a more economically just America. The post-World War II boom created broad prosperity: The wages of the bottom 90 percent of Americans grew in line with the overall economy. But that trajectory flat-lined in the mid-1970s. And the share of the nations income accruing to the bottom 90 percent shrank from close-to-half to barely one-third. A new study by the RAND Institute offers insight into how different America could be today had the post-war trend continued: The median worker would be making $57,000 a year, instead of just $36,000. In aggregate, the 90 percent have been $47 trillion richer, taking home an extra $2.5 trillion in 2018 alone. What happened to the bottoms share of Americas expanding economic pie? Economist Kathryn Edwards, co-author of the RAND study, explains simply: The top ate it.

Many Large Profitable Corporations Are Paying No Tax

Researchers at the Institute on Taxation and Economic Policy surveyed corporate financial reports for the first year that the TCJA was in effect and recently published their findings. Examining 379 profitable Fortune 500 companies, they found that the companies paid an average effective tax rate of just 11.3 percent on their U.S. income in 2018slightly more than half of the 21.2 percent average effective rate that large corporations paid from 2008 to 2015. Shockingly, ITEP found that 91, or nearly one-quarter, of these major corporations paid no federal income tax on their U.S. income in 2018.

Don’t Miss: New England Patriots License Plate Frame