Other Changes To Corporate Taxes

The TCJA eliminated the corporate AMT. The corporate AMT had a 20% tax rate that kicked in if tax credits pushed a firm’s effective tax rate below 20%. Under the AMT, companies could not deduct the cost of research and development.

Trump’s tax plan incorporated elements of a territorial tax system in what was previously a “worldwide” taxation of companies operating abroad. Under the worldwide system, multinationals are taxed on foreign income earned.

They don’t pay the tax until they bring the profits home. As a result, many corporations leave their revenue parked overseas.

The adoption of elements of territorial taxation allows companies to repatriate the approximately $1 trillion they hold in foreign cash stockpiles. They pay a one-time tax rate of 15.5% on liquid assets and 8% on illiquid assets.

The Federal Reserve found that U.S. firms repatriated $777 billion in 2018 that was around 78% of offshore cash holdings. Instead of investing those funds, corporations increased buybacks of their stocks to improve share prices.

The TCJA also allowed oil drilling in the Arctic National Wildlife Refuge. The drilling provision is estimated to add around $1.8 billion in revenue from 2019 to 2029. Half of that goes to the state of Alaska.

Changing Incomes In New Orleans

Early opportunity zone development is often happening in neighborhoods where income was already rising, not in struggling areas.

1 MILE

Those investors include Mr. Scaramucci, who briefly served as White House communications director in 2017 and has claimed credit for helping to create the opportunity-zone plan. We got to get into this business because this will be transformative to the United States, he said recently.

Mr. Scaramuccis investment firm, SkyBridge Capital, has raised more than $50 million in capital gains from outside investors, and most of it is being used to finance the hotel, according to Brett S. Messing, the companys president. He said the hotel was likely to be the first of numerous opportunity-zone projects financed by SkyBridge.

Less than two miles away is the poorest opportunity zone in Louisiana and one of the poorest nationwide. The zone includes the Hoffman Triangle neighborhood, where the average household earns less than $15,000 per year. Block after block, streets are lined with dilapidated, narrow homes, many of them boarded up. On a recent afternoon, one of them was serving as a work site for prostitutes.

City officials, including the head of economic development for New Orleans, said they were not aware of any opportunity-zone projects in this neighborhood.

Terrance Ross, a construction worker who has lived in the area for 20 years, is familiar with the building boom underway in the Warehouse District.

Trump Tax Cuts Helped Billionaires Pay Less Taxes Than The Working Class In 2018

US President Donald Trump claps during a campaign rally in Rio Rancho, New Mexico, on September 16, ⦠2019.

For the first time in American history, the 400 wealthiest people paid a lower tax rate than any other group, according to a new study by economists Emmanuel Saez and Gabriel Zucman at the University of California, Berkeley.

The startling data was brought to light on Monday in a New York Times column, and is based on an analysis by Saez and Zucman in their new book, The Triumph Of Injustice.

Some critics of the new research say that the data is skewed, or even potentially wrong. However, the fact that the ultra-rich potentially pay a lower tax rate than the working class is a massive problem. The Trump administrations tax cuts for the wealthy highlight the fact that policy is moving in the wrong direction. Especially when theres worry of a potential recession.

Bill Gates agrees and has previously said, Theres no doubt that what we want government to do in terms of better education and better health care means that we need to collect more in taxes. And theres no doubt that as we raise taxes, we can have most of that additional money come from those who are better off⦠I need to pay higher taxes.

Before your palms start sweating dont worry I dont think we should raise your taxes. We are talking about the top .01%. Those who own yachts and airplanes.

Read Also: Is The New York Times Republican Or Democrat

Does The Trump Tax Cut Give 83 Percent Of The Benefits To The Top 1 Percent

REP. DAVID N. CICILLINE :We need a tax cut for middle-class families, not 83 percent of it going to the top 1 percent, richest people in this country, and the most powerful corporations.

Well, I have got to push back on that, because 80 percent of the tax cut plan didnt go to the top 1 percent. As you know, congressman, the tax cut plan lowered all income levels, and they double the standard deduction. So that talking point . . .

CICILLINE:

BARTIROMO:No, it is true.

CICILLINE:

BARTIROMO:Congressman, its just not true. You know it, and I know it. Let me ask you

CICILLINE: It is true.

BARTIROMO:Part of maybe you get there because the corporate rate was cut. Are you saying you want to have the corporate

CICILLINE:Thats right. Thats right.

BARTIROMO:So you want the corporate rate at 35 percent?

CICILLINE: So, you acknowledge its right

BARTIROMO:Congressman

CICILLINE: that 83 percent does go to the top 1 percent.

BARTIROMO:All right. Congressman, do you want to raise the corporate tax rate? Is that what youre saying?

CICILLINE: Well, I dont what I say we have to do is, we have to be responsible about that. We created a $2 trillion deficit by giving 83 percent of the tax cut to the top 1 percent. And now Republicans are proposing to cut Social Security and Medicare to pay for that. Thats not acceptable.

BARTIROMO:Look, I understand that you want to keep with this talking point that is inaccurate. Thats fine.

CICILLINE:No, its a fact.

Impact Predicted By Other Organizations

In examining the likely impact of the TCJA, other organizations came to dramatically different conclusions about the likely impact of the new tax law. Their analysis predicted increases in the federal debt and deficit.

The Joint Committee on Taxation analyzed the tax cuts alone, independent of the FY 2018 budget. This analysis found that the TCJA wouldincrease the deficit by $1 trillion over the next 10 years. In creating this prediction, the committee expected the economy to grow 0.8% per year.

The Tax Foundation came up with a second conclusion, predicting that the TCJA would add almost $448 billion to the deficit over the next 10 years. It looked at the effect of the tax cuts themselves and the TCJA’s elimination of the Affordable Care Act mandate.

The Tax Foundation analysis stated that the tax cuts would cost $1.47 trillion in decreased revenue while adding only $600 billion in growth and savings. The plan would also:

- Boost economic growth by 1.7% per year

- Create 339,000 jobs

- Add 1.5% to wages

Recommended Reading: Ariat Men’s Camo Patriot Western Boots

Corporate Income Taxes Were Way Down In 2018

One of the biggest results of Trumps tax cuts was lowering the corporate income tax rate to 21% from 35%. This change appears to have benefited businesses greatly, because the corporate income tax payments collected by the IRS decreased by 22.4% from 2018 than 2017.

Looking just at year-over-year returns, businesses enjoyed an increase of 33.8% in tax refunds nationally from 2017 to 2018. The average business income refund varied by state, but businesses in some states appear to have received a major windfall. In Maryland, for example, businesses received total refunds worth 238.6% more .

The tax savings that businesses received from President Trumps tax plan could offset the benefits of the tax reform to workers. The lower corporate tax rate is also a permanent change to the U.S. tax code, but the lower tax rates for individuals are temporary and will expire in 2025. That means workers could receive a tax increase in five years even as businesses continue to pay a lower rate.

Adjustments To Charge The Credit

From $1 000 to $ 2000, TCJA expanded the Child Tax Credit. Even parents with insufficient income to pay tax rates can claim a credit tax rebate of up to US$1.400. The TCJA also initiated $500 in loans for other government benefits, helping children for whom welfare benefits are no longer satisfied by stringent requirements of minor children even though they are older and care for older family members. The government subsidies are fully accessible to ratepayers who file sure with altered AGIs of up to $200,000 and widowed contributions of $400,000. They had been gradually removed and eradicated until the TCJA, at $75,000 and $110,000.

Always stay more careful and vigilant when giving or adding your personal information to any app or software. This is quite a great move that you can follow to get the favorable and best results. A bit of carefulness is not going to hurt but will result in satisfaction.

You can have other ways to deal with this matter, but always remember that safety comes first, so try to be the one that follows SOPs to ensure that you remain safe while handling all other matters in this extreme pandemic situation.

Bring your mask along and wear it all the time you feel like being in a conversation with other people. Wash your hands regularly, plus try to use gloves if easy so.

Read Also: Mossberg Patriot 30 06 Price

Changes To Tax Credits

The TCJA increased the child tax credit from $1,000 up to $2,000. Even parents who don’t earn enough to pay taxes can claim a refund of the credit up to $1,400.

The TCJA also introduced a $500 credit for other dependents, which helps families whose dependent children no longer meet the strict criteria of child dependents because they’ve aged out, as well as families caring for elderly parents.

These tax credits are fully available to taxpayers with modified AGIs of up to $200,000 for single filers and $400,000 for married taxpayers who file joint returns. They were phased out and eliminated at $75,000 and $110,000 respectively before the TCJA.

Robert Reich: Guess Who Benefits From Trump’s Tax Cuts

Trump and congressional Republicans are engineering the largest corporate tax cut in history in order “to restore our competitive edge,” as Trump says.

Our competitive edge? Who’s us ?

Most American corporations especially big ones that would get most of the planned corporate tax cuts have no particular allegiance to America. Their only allegiance is to their shareholders.

For years they’ve been cutting the jobs and wages of American workers in order to generate larger profits and higher share prices.

Some of these jobs have gone abroad or been outsourced to lower-paid contractors in America. Others have been automated. Most of the remaining jobs pay no more than they did four decades ago, adjusted for inflation.

When GM went public again in 2010 after being bailed out by American taxpayers, it boasted of making 43 percent of its cars in places where labor is less than $15 an houroften outside the United States. And it got its American unions to agree that new hires would be paid half the wages and benefits of its old workers.

Capital is global. Big American corporations are “American” only because they’re headquartered and legally incorporated in the United States. But they could leave at a moment’s notice. They also employ or contract with workers all over the world.

And they’re owned by shareholders all over the world.

So when taxes of “American” corporations are cut, foreign investors get a windfall.

You May Like: Senator Lindsey Graham Republican Or Democrat

The Best Thing I Have Ever Done

Backers of the opportunity-zone program say luxury projects are the easiest to finance, which is why those have been happening first. Over the long run, they say, those deals will be eclipsed by ones that produce social benefits in low-income areas.

At least some struggling neighborhoods are already starting to receive investments.

In Birmingham, for example, a developer is using opportunity-zone funds to convert a building, vacant for decades, into 140 apartments primarily aimed at the local work force.

We are seeing projects that are being announced here in Alabama that would not have happened otherwise, said Alex Flachsbart, founder of Opportunity Alabama, which is trying to steer investors to economically struggling neighborhoods.

Similar projects are getting underway in Erie, Cleveland and Charlottesville, Va. Goldman Sachs is using some of its capital gains profits on the companys own investments in opportunity zones, including $364 million for mixed-income housing developments in Salt Lake City, Baltimore and other cities.

Mr. Case, the AOL co-founder, and Derrick Morgan, a former professional football player, are among those who have announced that they will invest in opportunity-zone projects that are designed to address clear social and economic problems.

Of course it will make a difference, Mr. Friedman said. It is mind-boggling. It is the best thing I have ever done.

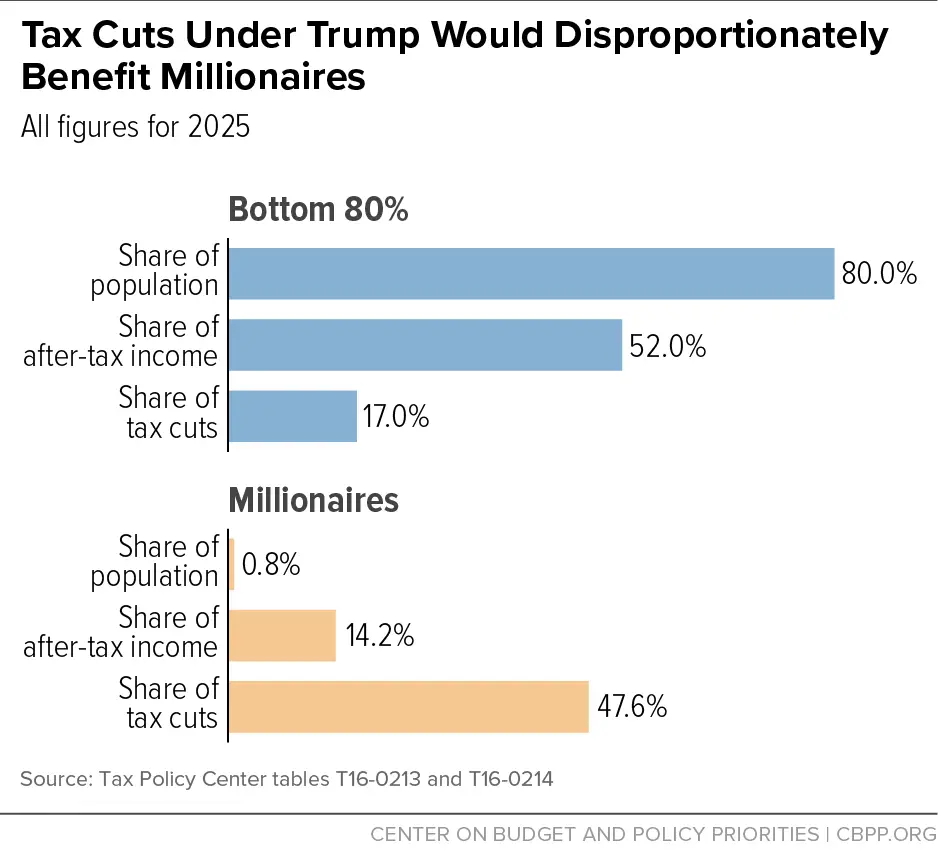

Law Does Relatively Little For Low

I have just outlined the three fundamental flaws of the 2017 tax law. Let me now examine in more detail how the 2017 tax largely leaves behind low- and moderate-income Americans and indeed hurts many.

The 2017 tax law should have placed top priority on raising the living standards of low- and moderate-income households, given decades of stagnant working-class incomes and growing income inequality. The share of after-tax income flowing to the bottom 60 percent fell by 3.8 percentage points between 1979 and 2015, while the share flowing to the top 1 percent rose by 5.6 percentage points. And looking at the working class a racially and geographically diverse group often defined as families with working-age adults in which no one has a college degree real working-class median income rose by only about 3 percent from 1979 to 2015.

Don’t Miss: Patriot Cabin Rentals Gatlinburg Tn

The Tax Cuts Have Not Led To Increased Economic Competitiveness

Another core argument of TCJA proponents was that the laws tax cuts would help improve economic competitiveness. Requiring U.S. corporations to pay less tax on their profits would give them a leg up over firms in other countries with higher tax rates. Even before the TCJA, however, effective corporate tax rates were in line with major trading partners, and the United States raised less revenue from corporate taxes than most other peer countries. In 2017, only four countries in the Organization for Economic Cooperation and Development raised revenue from corporations as a share of GDP at a lower rate than the United States by 2018, there was only one. Because of the TCJA, the United States now collects only 1 percent of GDP in corporate tax revenuejust one-third of the OECD average and far less than neighbors Canada and Mexico, which collect 3.7 percent and 3.4 percent, respectively. Part of the reason the United States ranks so low is that a larger share of business income is earned by noncorporate businesses that are not subject to any corporate tax their profits pass through to their owners, who pay tax on that income as individuals. So-called pass-through business income also received large tax cuts in the TCJA.

Gop Real Estate Owners Make Out Big

Besides the laws benefits to real estate pass-throughs, real estate in general was hugely favored by the tax law, allowing property exchanges to avoid taxation, the deduction of new capital expenses in just one year versus longer depreciation schedules, and an exemption from limits on interest deductions.

If you are a real estate developer, you never pay tax, said Ed Kleinbard, a former head of Congresss Joint Committee on Taxation.

Members of Congress own a lot of real estate. Public Integritys review of financial disclosures found that 29 of the 47 GOP members of the committees responsible for the tax bill hold interests in real estate, including small rental businesses, LLCs, and massive real estate investment trusts , which pay dividends to investors. The tax bill allows REIT investors to deduct 20 percent from their dividends for tax purposes.

Who We Are

The Center for Public Integrity is an independent, investigative newsroom that exposes betrayals of the public trust by powerful interests.

You May Like: Trump Lies Fact Check

Read Also: Patriotic Shirts Made In America

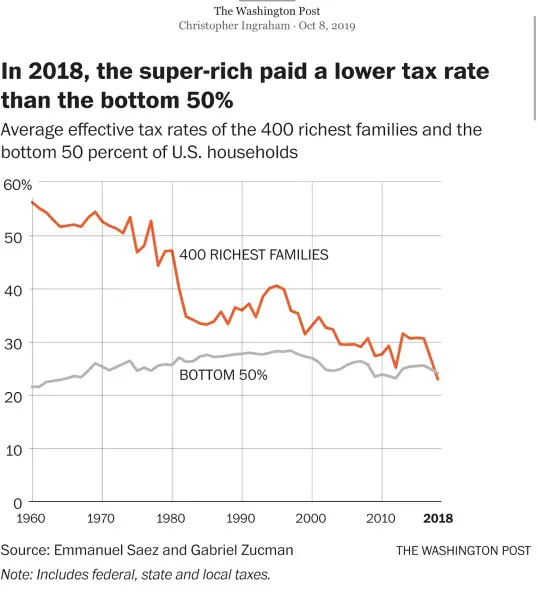

Trumps Tax Cuts Helped Billionaires Pay Less Than The Working Class For First Time

Economists calculate richest 400 families in US paid an average tax rate of 23% while the bottom half of households paid a rate of 24.2%

They were billed as a middle-class miracle but according to a new book Donald Trumps $1.5tn tax cuts have helped billionaires pay a lower rate than the working class for the first time in history.

In 2018 the richest 400 families in the US paid an average effective tax rate of 23% while the bottom half of American households paid a rate of 24.2%, University of California at Berkeley economists Emmanuel Saez and Gabriel Zucman calculate in their new book, The Triumph of Injustice.

Taxes on the rich have been falling for decades. In 1960 the 400 richest families paid as much as 56% in taxes, by 1980 the rate had fallen to 40%. But Trumps tax cuts his most significant legislative victory proved a tipping point.

Thanks to the controversial tax package the top 0.1% of US households were granted a 2.5% tax cut that pushed their rate below that of the lower 50% of US earners.

This is a revolutionary change and the biggest winners will be the everyday American workers as jobs start pouring into our country, as companies start competing for American labor, and as wages start going up at levels that you havent seen in many years, Trump said in September 2017 as he fought to pass the tax package.

Changing Incomes In Houston

Early opportunity zone investment is coming to Market Square, already a site of high-end developments and major income growth.

Median household

Opportunity zones

And in downtown Portland, Ore., the developers of a 35-story tower with a hotel, condos and office space are hoping to raise up to $150 million in opportunity-zone money to pay for the project. Condos will go for as much as $7.5 million each. The hotel is a Ritz-Carlton.

Recommended Reading: 2011 Jeep Patriot Tow Hitch