Did Repealing Obamacares Individual Mandate Help

From 2014 to 2017, the Affordable Care Act required Americans to pay a penalty on their taxes if they did not have qualifying health insurance coverage during the year. This penalty was officially called the Individual Shared Responsibility Payment but was usually referred to as the individual mandate.

President Trumps tax plan repealed the individual mandate starting in 2018. The repeal of Obamacares individual mandate saved taxpayers $3.7 million in taxes. The penalty affected 4.7 million taxpayers in 2017 primarily for taxpayers with adjusted gross income between $5,000 and $15,000 and it cost an average of $788 per taxpayer. Presumably, repealing the individual mandate saved people hundreds of dollars on their taxes.

However, these tax savings need to be taken in context. Going without health insurance can leave you with big medical bills if you get sick and can end up costing you more overall. This may have happened in 2018. U.S. Census Bureau data shows that fewer Americans had health insurance coverage in 2018 than 2017, while data from the U.S. Bureau of Labor Statistics also shows that health care spending increased for 60% of Americans from 2017 to 2018. Average spending on health care rose by 3.2%, while health insurance spending decreased by 0.3%, on average.

In other words, Americans spent more on health care after the individual mandate was repealed. Whether these expenses exceeded the savings from the repeal remains to be seen in future federal data.

Trump Administration Forecasts Are Unusual In Departing So Dramatically From Independent Forecasts

It is not unusual for a presidential administration to produce an economic forecast that is somewhat more optimistic than those prepared by outside analysts, in part because administrations often assert that their policies will accelerate economic growth. But as Nick Timiraos of the Wall Street Journal reported, while there are often disparities between the White House and other agencies on growth projections, they are rarely this large.

Research by the Center on Budget and Policies Priorities revealed that the current discrepancy in long-run forecasts between the Trump Administration and the CBO is the largest on record, going back to 1978. In fact, throughout the last 25 years there has never been a gap of more than 0.4 percentage points between a presidential administrations long-run forecast and the one produced by the CBO. The long-run gap in the Trump Administrations budget, by contrast, stands at 1.1 percentage points.

Buying Insurance Through The Aca

The American Rescue Plan of 2021 reduces the cost of Marketplace plans, increases the tax credits for many Americans, and expands eligibility for the tax credits starting April 1, 2021. The average Marketplace user will pay $85 less every month per policy.

The Republicans got their wish to see the individual health insurance mandate penalty repealed. This change means that people who dont buy health insurance will not have to pay a fine to the Internal Revenue Service .

Dont Miss: Trump Tower Nightly Cost

You May Like: Patriot Candles Scents And Spirits

How Income Taxes Change

We still have seven brackets for income tax but lower tax rates. These changes will become apparent in the withholding for February 2018 paychecks. This only lasts until 2026, though.

The standard deduction you can now take has been doubled to $12,000 per single person. Married and joint taxpayers will see their deduction go up to $24,000 from $12,700, but in 2026 it will return to the 2017 level.

This is big news because 94% of taxpayers take a standard deduction.

Personal exemptions, however, are a thing of the past. That $4,150 deduction for each person claimed is a thing of the past. Now families with children may see their tax credits go up.

Most itemized deductions are also gone, which includes moving expenses and those paying alimony . Itemized deductions still apply for people in the military, making charitable donations, saving for retirement, and interest on student loans.

A big change is how the deduction on mortgage interest has been limited. It now only applies to the initial $750,000 of the mortgage. Also, you cant take a deduction for interest on equity lines of credit. If you already have a mortgage, though, the rules remain the same.

The Right Withholding Is Key

Hefty refund checks suggest that you overpaid Uncle Sam during the prior year. It also means you took home less money.

“Sure, you can have a bigger refund, but you’re going to have less money in your pocket,” said Joseph Perry, national tax and business services leader at Marcum LLP.

Meanwhile, a balance due means you had too few taxes withheld from your pay a situation some taxpayers found themselves in after the Treasury Department and IRS overhauled the tax withholding tables for the new law.

“Your refund or taxes due on April 15 isn’t really your tax,” said Zollars. “You’re just truing up for the year.”

To see how you really fared in the prior year, look at your tax liability.

That means examining line 16 of your 2019 Form 1040 and comparing it to line 15 of your 2018 individual income tax return.

You May Like: How To Stream Patriots Game Free

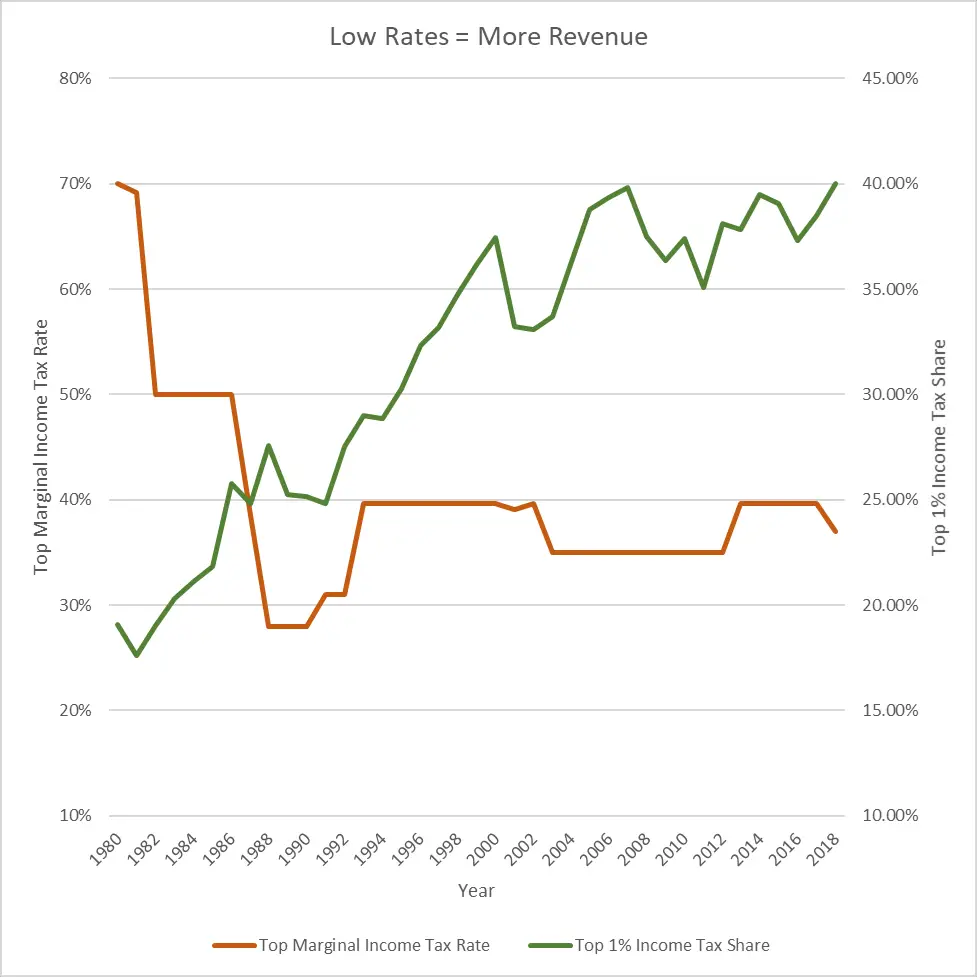

What Trumps Tax Cuts Wrought

In his short and stimulating book, Jason L. Riley, a columnist for the Wall Street Journal and the biographer of Thomas Sowell, argues that, far from being a bigot, Donald Trump was a boon to blacks. During Trumps first three years in office, Riley writes in The Black Boom, median household incomes grew by 15.4 percent among blacks while growing by only 11.5 percent among whites. By comparison, between 2009 and 2015, while Barack Obama was president, incomes rose 2.3 percent for blacks and 4.4 percent for whites.

Riley writes that the gains of blacks prior to the pandemic were unprecedented. He cites research showing that an average of 400,000 new black wage earners entered the workforce in each year of Trumps presidency, compared with 250,000 during Obamas terms. Black unemployment in 2019 hit the lowest level on record.

Riley attributes these accomplishments to two Trump policies: the cut in the corporate tax rate from 35 to 21 percent, which took effect on the first day of 2018, and reductions in regulations that he argued were weighing on economic growth, especially in the energy sector. Riley cites a Cato Institute study finding that the Trump administration instituted 36 percent fewer new rule-makings than Obamaalthough the Cato study adds that an unintended consequence of federal deregulation under Trump has been growth in state and local regulations.

_____________

_____________

Budget Deficits And Debt

Fiscal year 2018 results

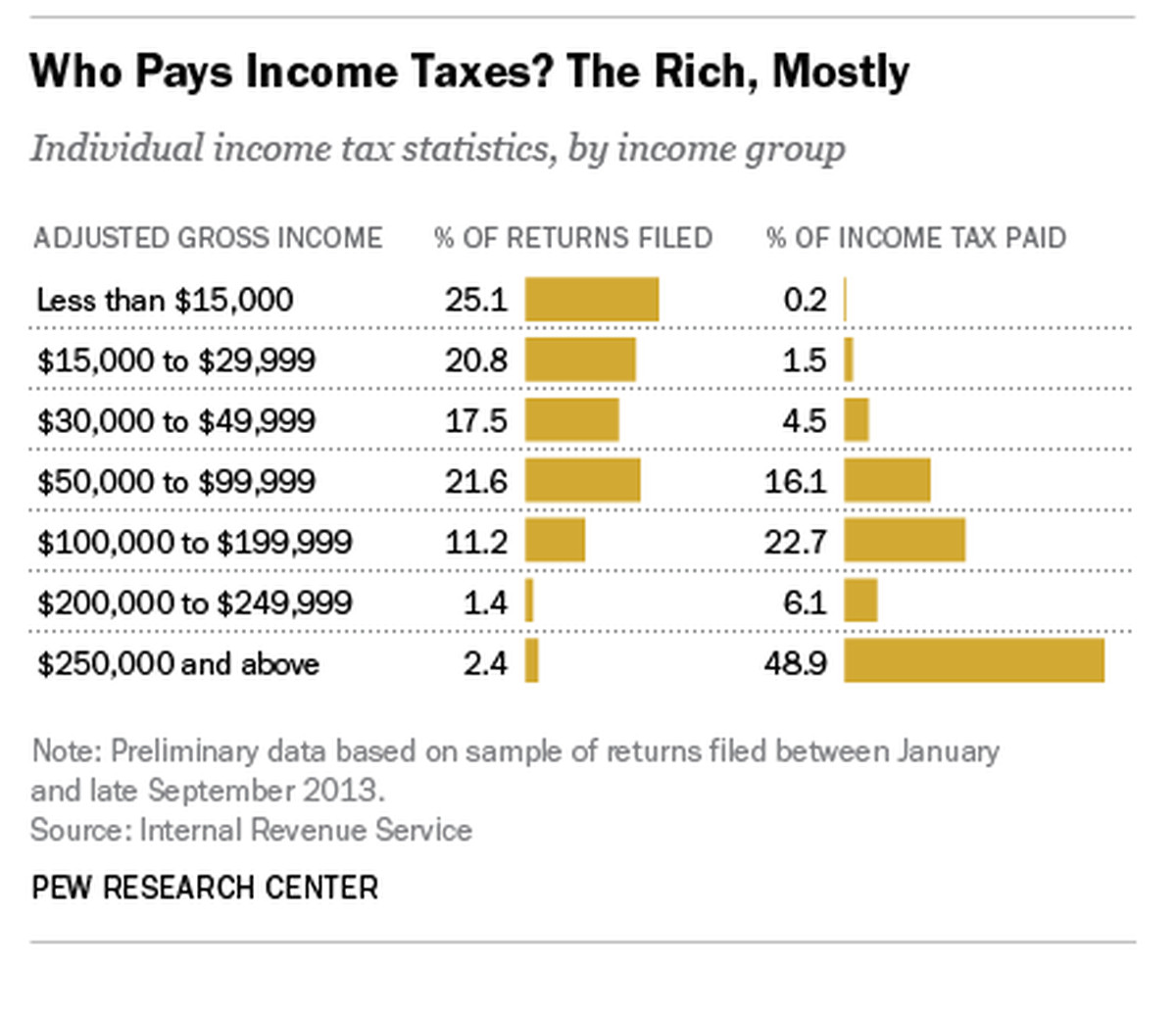

CBO reported that the budget deficit was $779 billion in fiscal year 2018, up $113 billion or 17% from 2017. The budget deficit increased from 3.5% GDP in 2017 to 3.9% GDP in 2018. Revenues fell by 0.8% GDP due in part to the Tax Act, while spending rose by 0.4% GDP. Total tax revenues in dollar terms were similar to 2017, but fell from 17.2% GDP to 16.4% GDP , below the 50-year average of 17.4%. Individual income tax receipts rose by $96 billion as the economy grew, rising from 8.2% GDP in 2017 to 8.3% GDP in 2018. Corporate tax revenues fell by $92 billion due primarily to the Tax Act, from 1.5% GDP in 2017 to 1.0% GDP in 2018, half the 50-year average of 2.0% GDP. Fiscal year 2018 ran from October 1, 2017 to September 30, 2018, so the deficit figures did not reflect a full year of tax cut impact, as they took effect in January 2018.

Ten-year forecasts

The non-partisan Congressional Budget Office estimated in April 2018 that implementing the Act would add an estimated $2.289 trillion to the national debt over ten years, or about $1.891 trillion after taking into account macroeconomic feedback effects, in addition to the $9.8 trillion increase forecast under the current policy baseline and existing $20 trillion national debt.

The Joint Committee on Taxation estimated the Act would add $1,456 billion total to the annual deficits over ten years and described the deficit effects of particular elements of the Act on December 18, 2017:

Recommended Reading: Patriotic Beads For Jewelry Making

British Pound Plummets To Record Low Against The Dollar

The British pound crashed to a record low against the US dollar on Monday on growing fears about the stability of UK government finances.

The plunge of nearly5% to just above $1.03 came during trading in Asia and Australia on Monday and extended a 3.6% dive from Friday, spurring predictions the pound could plunge to parity with the US dollar. It recovered slightly as European traders came online, rising back to $1.07.

The currency slump follows British Chancellor of the Exchequer Kwasi Kwartengs announcement on Friday that the United Kingdom would implement the biggest tax cuts in 50 years at the same time as boosting government borrowing and spending in the face of high inflation.

Serious questions are already being asked about the economic competency of the new government, said Craig Erlam, senior market analyst at Oanda. So much so that markets are factoring in a strong chance of a substantial emergency rate hike from the Bank of England in order to shore up the currency and confidence in the markets.

The new tax-slashing fiscal measures, which include scrapping plans for an increase in corporation tax and slashing the top rate of income tax, have been criticized as trickle-down economics by the opposition Labour Party and even lambasted by members of the Chancellors own Conservative party.

Former Tory chancellor Lord Ken Clarke criticized the tax cuts on Sunday, saying they could lead to the collapse of the pound.

Losers: Residents Of High

Theupside of residing in states with high income and property taxes including New Jersey, New York and California was that you could write off tens of thousands of dollars in state and local levies if you itemized your tax return.

For instance, New Yorkers who itemized returns in 2017 claimed an average state and local tax deduction of $23,804, according to the Tax Policy Center.

Under the new law, that write-off has been limited to $10,000.

“You can argue that those who live in Florida or in other low or zero state tax places fared better compared to high-tax states,” said John Voltaggio, CPA and managing director at Northern Trust.

Be aware that if you were hit by the AMT under the old law, you were probably not benefiting from the SALT deduction, either. “They weren’t able to deduct it anyway because of AMT,” Voltaggio said.

You May Like: Why Are Republicans Against The Era

Do Corporate Tax Cuts Create Jobs

President Trump said that his tax reforms would be a job creator like we havent seen since Ronald Reagan. However, in 2014, New York University economists Alexander Ljungqvist and Michael Smolyansky said that they found little evidence that corporate tax cuts boost economic activity unless implemented during recessions when they lead to significant increases in employment and income.

According to a CNBC report, a 2017 analysis by the Institute for Policy Studies found that among 92 publicly held U.S. corporations corporations that posted profits every year from 2008 to 2015 and paid less than 20 percent of their earnings in federal income tax more than half actually cut back on jobs during that period. Many of the companies used tax savings to buy back stock, while CEO pay among all 92 companies rose 18 percent.

Trumps Corporate Tax Cut Is Not Trickling Down

Business investment is slowing, despite lofty promises, and worker bonuses were a mirage.

- Michael Madowitz

Two years ago, President Donald Trump and Republicans in Congress cut the corporate tax rate from 35 percent to 21 percent via the Tax Cuts and Jobs Act of 2017 . At the time, the Trump administration claimed that its corporate tax cuts would increase the average household income in the United States by $4,000. But two years later, there is little indication that the tax cut is even beginning to trickle down in the ways its proponents claimed.

Also Check: Jeep Patriot For Sale Louisville Ky

Personal Exemption And Healthcare Mandate

The law suspended the personal exemption, which was $4,150, through 2025. The law also ended the individual mandate, a provision of the Affordable Care Act or “Obamacare” that provided tax penalties for individuals who did not obtain health insurance coverage, in 2019. the taxpayer will still be exposed to a penalty for not being covered by health insurance all year.)

According to the Congressional Budget Office , repealing the measure is likely to reduce federal deficits by around $338 billion from 2018 to 2027, but lead 13 million more people to live without insurance at the end of that period, pushing premiums up by an average of around 10%. Unlike other individual tax changes, the repeal will not be reversed in 2025.

Senators Lamar Alexander and Patty Murray proposed a bill, the Bipartisan Health Care Stabilization Act, on Mar. 19, 2018, to mitigate the effects of repealing the individual mandate. The CBO estimated that this legislation would still leave 13 million more people uninsured after a decade. The bill failed to make it into the $1.3 trillion spending bill that was passed on Mar. 23, 2018. As such, the burden of providing affordable health insurance will be on states and health insurers.

Unrealistic Economic Growth Claims Were A Central Feature Of Kansass Failed Tax Cutting Experiment As Well

The Trump Administration included unreasonably optimistic economic growth assumptions in its budget to create the erroneous impression that the administration has a plan for balancing the federal budget. As a rule of thumb, each 0.1 percent increase in the rate of economic growth reduces the federal deficit by roughly $300 billion over a decade. The Trump Administrations roughly 1 percentage point exaggeration, therefore, is an essential component of its budget balancing claims which shaves at least $3 trillion off its cumulative deficit estimates. Under a more reasonable projection of economic growth, the Trump budget would fail to balance.

Manipulating the governments fiscal outlook in this way is helpful to the administrations aim of enacting large tax cuts that will primarily benefit the wealthy. Among the Presidents preferred tax policy changes are reduced tax rates for corporations, business owners, successful investors, high-income taxpayers, and large estates. Regardless of how many tax deductions and carve-outs the administration is willing to end to help fund its tax cuts, the sheer size of these proposed cuts virtually guarantees that they will add to the nations debt. Making the federal budget outlook appear as favorable as possible is therefore part of a larger strategy aimed at boosting the tax plans political appeal.

Read Also: How Many Registered Republicans In Maine

The Lowered Corporate Income Tax Rate Makes The Us More Competitive Abroad

One of the most significant provisions in the Tax Cuts and Jobs Act was the reduction of the U.S. corporate income tax rate from 35 percent to 21 percent. Over time, the lower corporate rate will encourage new investment and lead to additional economic growth. It will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions.

Also Check: Whats The Latest News On Donald Trump

When Do The Tax Cuts Expire

Some of the tax cuts have already expired. For example, the previously mentioned medical expense deduction change expired at the end of 2018.

Other TCJA provisions will expire at the ends of 2020, 2021, and 2022. Taxpayers will likely see the most change on December 31, 2025. The Tax Foundation said, Twenty-three provisions from the Tax Cuts and Jobs Act directly relating to individual income taxes will expire, meaning most taxpayers will see a tax hike unless some or all provisions are extended.

The provisions scheduled to expire at the end of 2025 include the increased standard deduction, the reduction of individual income rates, the increased child tax credit, and the increased AMT exemption and phaseout threshold.

Recommended Reading: When Will Republicans Stop Supporting Trump

Retirement Plans And Hsas

Health savings accounts were not affected by the law, and the traditional 401 plan contribution limit in 2019 increased to $19,000 and $25,000 for those aged 50 and older. The law left these limits unchanged but repealed the ability to recharacterize one kind of contribution as the other, that is, to retroactively designate a Roth contribution as a traditional one, or vice-versa. Since the passing of the Setting Every Community Up for Retirement Enhancement Act in Dec. 2019, though, people can now contribute to their individual retirement accounts past the age of 70½.

The IRS makes cost-of-living adjustments to contributions for retirement savings accounts every year. For 2022, the annual contribution limit for 401 and other workplace retirement plans is $20,500, up from $19,500 in 2021. Employees over age 50 can contribute an additional $6,000 “catch-up”$26,500 in total.

Student Loans And Tuition

The House bill would have repealed the deduction for student loan interest expenses and the exclusion from gross income and wages of qualified tuition reductions. The new law left these breaks intact and allowed 529 plans to be used to fund K to 12 private school tuitionup to $10,000 per year, per child. Under the SECURE Act of 2019, the benefits of 529 plans were expanded, allowing plan holders to also withdraw a maximum lifetime amount of $10,000 per beneficiary penalty-free to pay down qualified student debt.

Recommended Reading: How Many Black Republicans In Congress

The Standard Deduction Vs Itemized Deductions

A single filer’s standard deduction increased from $6,350 in 2017 to $12,550 in 2021 and $12,950 in 2022. The deduction for married joint filers increases from $12,700 in 2017 to $25,100 in 2021 and $25,900 in 2022.

The Tax Foundation estimated in September 2019 that only about 13.7% of taxpayers would itemize on their 2018 returns due to these changes. That’s less than half of the 31.1% who would have itemized before the TCJA.

That would save them time in preparing their taxes. It might also hurt the tax preparation industry and decrease charitable contributions, which are an itemized deduction.