What Is A Republican

As you can see, the dictionary definition of a Republican is very brief. And since a Republican is simply defined as a member of the Republican party of the U.S. it is important to understand what the Republican Party stands for. To understand what a Republican is you have to understand the Republican Party. And that is what the rest of this article examines.

Views Of Stricter Environmental Laws Climate Change

On environmental issues, 65% of adults say that stricter environmental laws and regulations are worth the cost, compared with 33% who say they cost too many jobs and hurt the economy.

A large majority of Democrats and Democratic leaners say stricter environmental laws are worth the cost, including 92% of liberal Democrats and 79% of conservative and moderate Democrats.

Republicans and Republican leaners are more likely to say stricter environmental laws cost jobs and hurt the economy than that they are worth the cost . However, there is a wide divide in views among Republicans by ideology. Two-thirds of conservative Republicans say stricter environmental laws hurt the economy. Views among moderate and liberal Republicans are nearly the reverse: 60% say stricter environmental laws are worth the cost.

Majorities across age groups and levels of educational attainment say stricter environmental laws are worth the cost. Adults younger than 30 and those with a postgraduate degree are among the most likely to say this.

As other surveys have found, there also continue to be wide partisan differences in opinions about climate change. Among the public overall, 52% say the Earth is getting warmer mostly because of human activity, while 17% say it is getting warmer mostly due to natural patterns in the environment. About two-in-ten say there is no solid evidence that the Earth is getting warmer, and 9% say they are not sure.

Gop Must Stop Believing In Magic

Im not making a plea for larger government just a plea for economic sanity. If Congress in its all-seeing wisdom wants to spend $700 billion on the military, billions of dollars on farm subsidies and so on, it must either raise enough money in taxes to pay for the programs it authorizes or reduce the size of government.

Instead, although Republicans controlled the White House, the Senate and the House from 2017 to 2019, they chose not to make any substantial cuts to government programs that would balance the revenue lost by their series of massive unfunded tax cuts.

Unquestioning and unsubstantiated belief in the magical power of tax cuts isnt a viable economic policy. The GOP is putting America on an unsustainable path that is disastrous both for its fiscal future and for the hopes of people trying to get ahead.

About UsNewsroom StaffEthical PrinciplesPress ReleasesTerms of ServiceYour California Privacy Rights/Privacy PolicyPrivacy Policy

Corporations Will Bring Back Profits Stashed Overseas

Republicans did their best to include as many corporate giveaways as possible in their tax cut, but spun them as a benefit to the greater economy. Take repatriated earnings. American multinational corporations like to keep their overseas profits away from the IRS, and the Republican tax plan aimed to change this by offering companies a temporary tax holiday. Earnings kept overseas would be subject to a one-time tax at a very low rate that could be paid over the course of eight years. President Trump promised that this would produce a flood of repatriated earnings amounting to $4$5 trillionnearly twice the amount that corporations were actually storing overseas.

This was just another lie, one that no serious economist believed for a moment. And indeed, after a brief boom in repatriated earnings after the tax cut passed, there was a bust. Repatriations to date have amounted to only $840 billion above normal, and the total amount of repatriations in the last quarter of 2019 is only $60 billion higher than it was before the tax cut passed. The total will never come anywhere close to $4$5 trillion.

But maybe foreign investors responded more positively to the tax cut than domestic investors did? Nope. Foreign investment increased briefly but then plunged. Apparently they didnt take Republican promises any more seriously than Americans did.

What Do Republicans Believe In

Do all Republicans believe the same things? Of course not. Rarely do members of a single political group agree on all issues. Even among Republicans, there are differences of opinion. As a group, they do not agree on every issue.

Some folks vote Republican because of fiscal concerns. Often, that trumps concerns they may have about social issues. Others are less interested in the fiscal position of the party. They vote they way they do because of religion. They believe Republicans are the party of morality. Some simply want less government. They believe only Republicans can solve the problem of big government. Republicans spend less . They lower taxes: some people vote for that alone.

However, the Republican Party does stand for certain things. So I’m answering with regard to the party as a whole. Call it a platform. Call them core beliefs. The vast majority of Republicans adhere to certain ideas.

So what do Republicans believe? Here are their basic tenets:

Republicans Can’t Handle The Truth About Taxes

Congressional Republicans are channeling one of my favorite political hacks, the late Massachusetts Congressman Jimmy Burke, who boasted he voted for spending bills, tax cuts and against any increase in the debt ceiling.

House and Senate Republicans voted against the COVID-stimulus bill and oppose the Biden infrastructure and tax measures. Yet, despite the votes, more than a few cite their support for popular provisions in each spending initiative, rail against deficits, and oppose tax increases.

Republicans complain the $2 trillion Biden initiative is full of stuff that really isn’t infrastructure. Sen. Roy BluntRoy Dean BluntA tale of two chambers: Trump’s power holds in House, wanes in Senate46 GOP senators warn they will not vote to raise debt ceiling says all that should be taken out and reduce the size to $600 billion.

The biggest, $400 billion over eight years, is to provide more personnel and resources for in-home care for the elderly or people with disabilities. We have a son with disabilities, and we can afford expensive good care; we have encountered many families who cannot. If you know anyone with a loved one with Alzheimer’s, you’ll look more kindly on this provision. Does Sen. Blunt believe this isn’t an urgent need?

But what really gets the conservative juices going is opposing the proposed tax increases; since the fall of the Berlin Wall, tax cuts have been the only glue that holds increasingly disparate Republicans together.

Poverty Must Solve Itself

Republicans believe that poor people are usually poor for a reason, be it laziness, choice or whatever. Unless we demand that people pull themselves up by the bootstraps and solve their own problems, people will not be motivated to do things. Therefore, the issue of poverty cannot be solved by the government. Charity should be the choice of individuals.

Gop Real Estate Owners Make Out Big

Besides the laws benefits to real estate pass-throughs, real estate in general was hugely favored by the tax law, allowing property exchanges to avoid taxation, the deduction of new capital expenses in just one year versus longer depreciation schedules, and an exemption from limits on interest deductions.

If you are a real estate developer, you never pay tax, said Ed Kleinbard, a former head of Congresss Joint Committee on Taxation.

Members of Congress own a lot of real estate. Public Integritys review of financial disclosures found that 29 of the 47 GOP members of the committees responsible for the tax bill hold interests in real estate, including small rental businesses, LLCs, and massive real estate investment trusts , which pay dividends to investors. The tax bill allows REIT investors to deduct 20 percent from their dividends for tax purposes.

Who We Are

The Center for Public Integrity is an independent, investigative newsroom that exposes betrayals of the public trust by powerful interests.

Republicans Invented Progressive Income Taxes Will They Turn Left Again

Rendering of a red elephant in a spotlight representing the Republican Political Party in front of … the American Flag.

getty

President Trumps sagging poll numbers have prompted some eager speculation about the future of the Republican Party.

If Trump loses, will the GOP rethink its political strategy? Recast its policy agenda? Or will it double down on both on Trumpism, whatever that might mean?

Whether Trump wins or loses in November wont settle these questions.

The future of the Republican Party belongs to him, Matthew Walther in a recent analysis for The Week. His legacy arguments about its true value and how it should be understood, its relationship with previous right-wing insurgent movements such as the Tea Party will determine the course of the GOPs fortunes for the next decade.

Indeed, Trumps legacy will almost certainly endure for over a decade because its about more than just him. Trumpism is part of the Republican Partys broader historical evolution. It began to emerge long before Trump took his famous ride down the escalator in Trump Tower to announce his candidacy in 2015; it will persist long after he vacates the Oval Office, whether thats in January 2021 or January 2025.

American presidents even the transformational, disruptive ones exist as part of a process. They dont emerge from nowhere to upend and recast political institutions single-handedly. They channel and give expression to changes already underway in American society.

Inequality Poverty Divide Republicans More Than Democrats

In recent weeks, many political observers have described a rift between liberals and centrists in the Democratic Party over how to tackle poverty, income inequality, and broader issues of economic fairness. Some have framed the discussion around Elizabeth Warren vs. Hillary Clinton. Others have focused on between New York City Mayor Bill de Blasio, who has proposed raising taxes on the rich to pay for a citywide prekindergarten program, and Governor Andrew Cuomo, who has vowed to lower taxes.

But a new Pew Research Center/USA TODAY survey suggests that, at least for the moment, the issue of how best to deal with poverty and income inequality and whether the government should address these issues at all divides Republicans and those who lean toward the Republican Party more than it does Democrats and leaners.

To be sure, majorities of 60% or more among Republicans and Democrats across the ideological spectrum agree that inequality is on the rise, and about 90% of liberal and centrist Democrats say the government should do something about it. But while a 61%-majority of moderate and liberal Republicans say the government should do something to reduce the gap between the rich and everyone else, 55% of conservative Republicans dont want the government to do much or anything at all about inequality.

Most Welfare Recipients Are Makers Not Takers

The first myth, that people who receive public benefits are takers rather than makers, is flatly untrue for the vast majority of working-age recipients.

Consider Supplemental Nutrition Assistance Program benefits, formerly known as food stamps, which currently serve about 42 million Americans. At least one adult in more than half of SNAP-recipient households are working. And the average SNAP subsidy is $125 per month, or $1.40 per meal hardly enough to justify quitting a job.

As for Medicaid, nearly 80 percent of adults receiving Medicaid live in families where someone works, and more than half are working themselves.

In early December, House Speaker Paul Ryan said, We have a welfare system thats trapping people in poverty and effectively paying people not to work.

Not true. Welfare officially called Temporary Assistance to Needy Families has required work as a condition of eligibility since then-President Bill Clinton signed welfare reform into law in 1996. And the earned income tax credit, a tax credit for low- and moderate-income workers, by definition, supports only people who work.

Workers apply for public benefits because they need assistance to make ends meet. American workers are among the most productive in the world, but over the last 40 years the bottom half of income earners have seen no income growth. As a result, since 1973, worker productivity has grown almost six times faster than wages.

What Is A Republican Republican Definition

April 11, 2014 By

This article fully answers what a Republican is and gives the definition of a Republican in a fair, unbiased, and well-researched way. To start the article we list out the definition of a Republican, then we cover the Republican Partys core beliefs, then we list out the Republican Partys beliefs on all the major issues.

The Definition of a Republican: a member of the Republican party of the U.S.

The Economy Will Be Supercharged

If an investment boom was the big lie that drove everything, the arguments made to the general public in support of the tax cut mostly revolved around a better-known metric: economic growth. The usual way of measuring this is by looking at gross domestic product, the sum of all goods and services produced in the United States. In the decade since the end of the Great Recession, GDP growth has averaged 2.3 percent per year.

Republicans claimed that the investment growth spurred by the tax cut would drive GDP growth higher. predicted growth rates of 3 to 4 percent. Treasury Secretary Steven Mnuchin went with a more modest 2.9 percent. Trump himself told reporters at his Cabinet meeting that he was holding out for 6 percent growth. These projections were mostly just spun out of thin air.

So how did we do? Since the investment boom never materialized, its hardly a shock to learn that GDP growth didnt boom either. The growth rate increased modestly for two quarters and then dropped steadily. In the last quarter unaffected by the coronavirus crisis, it was barely above 2 percent. Not only didnt the tax cut usher in the growth that Republicans predicted, but growth rates started dropping soon after.

History Of The Republican Party

The Republican Party came into existence just prior to the Civil War due to their long-time stance in favor of abolition of slavery. They were a small third-party who nominated John C. Freemont for President in 1856. In 1860 they became an established political party when their nominee Abraham Lincoln was elected as President of the United States. Lincolns Presidency throughout the war, including his policies to end slavery for good helped solidify the Republican Party as a major force in American politics. The elephant was chosen as their symbol in 1874 based on a cartoon in Harpers Weekly that depicted the new party as an elephant.

Energy Issues And The Environment

There have always been clashes between the parties on the issues of energy and the environment. Democrats believe in restricting drilling for oil or other avenues of fossil fuels to protect the environment while Republicans favor expanded drilling to produce more energy at a lower cost to consumers. Democrats will push and support with tax dollars alternative energy solutions while the Republicans favor allowing the market to decide which forms of energy are practical.

Majority Of Americans Say Government Has Responsibility To Ensure Health Coverage

A majority of the public says that the federal government has a responsibility to make sure that all Americans have health care coverage, while 41% say this is not the governments responsibility.

However, most of those who say the government does not have a responsibility to provide health coverage nonetheless favor continuing programs like Medicare and Medicaid. Roughly a third of the public holds this view. Just 6% say the government should not be involved in providing health insurance at all.

Among those who say it is the governments responsibility to make sure all Americans have health care coverage, there are differences over how to achieve this goal.

Overall, 30% of adults say government is responsible for ensuring that all Americans have health care coverage and that health insurance should be provided through a single national health insurance system run by the government. A similar share of the public thinks health care for all Americans is a government responsibility but supports providing health insurance through a mix of private companies and government programs.

Seven-in-ten Republicans and Republican leaners say it is not the governments responsibility to make sure all Americans have health insurance. Among Republicans, conservatives are much more likely than moderates and liberals to take this view. Still, just 12% of conservative Republicans say the government should not be involved in health care at all.

Crime And Capital Punishment

Republicans generally believe in harsher penalties when someone has committed a crime, including for selling illegal drugs. They also generally favor capital punishment and back a system with many layers to ensure the proper punishment has been meted out. Democrats are more progressive in their views, believing that crimes do not involve violence, such as selling drugs, should have lighter penalties and rehabilitation. They are also against capital punishment in any form.

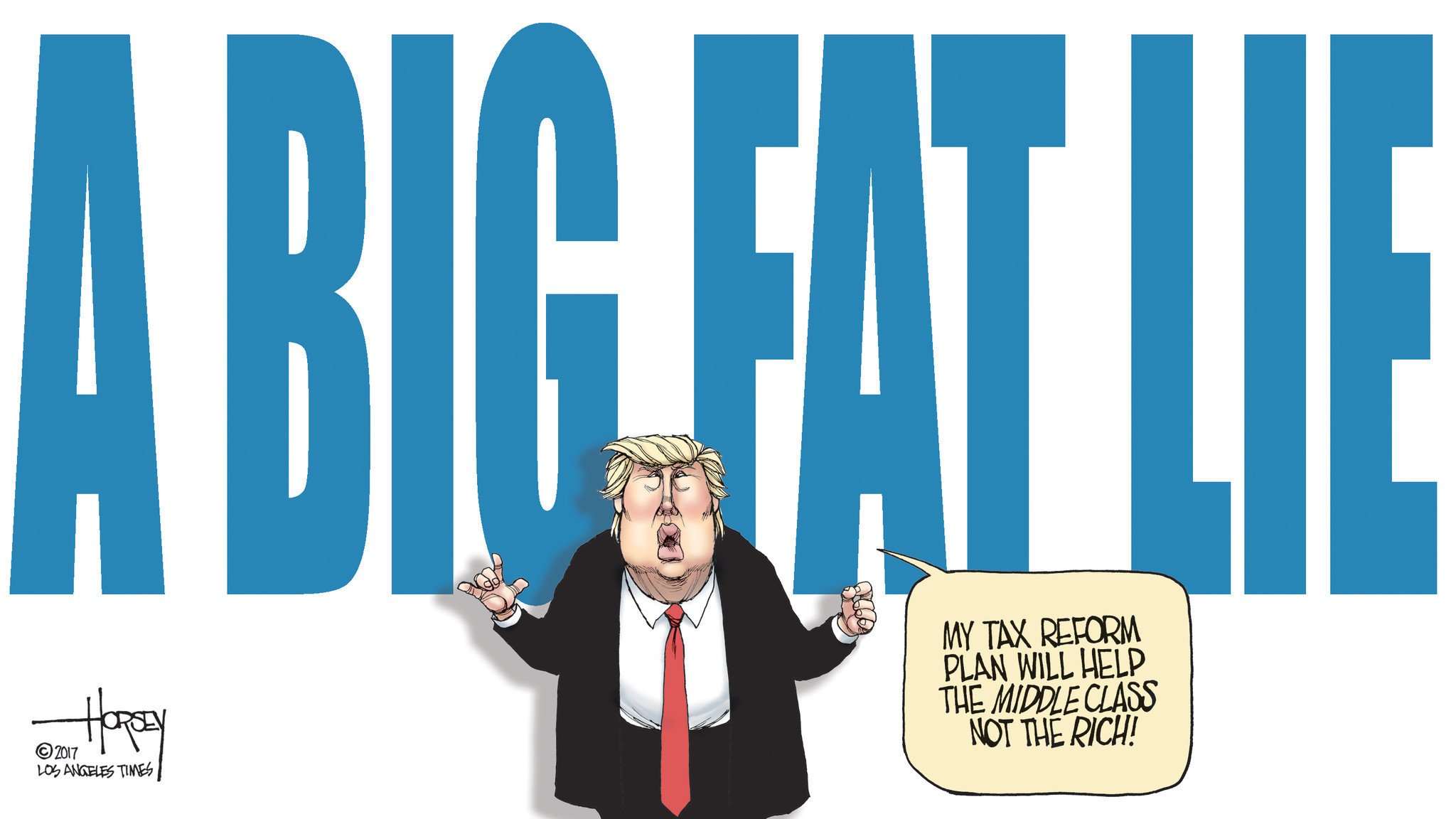

Trump Keeps Pretending To Want To Tax The Rich

Trump as a candidate promised to raise taxes on the rich, and after taking office he again promised to raise taxes on the rich. Trump said he believed in raising taxes on the wealthy, including myself and later promised that his administrations tax reform would not benefit the wealthy at all.

None of this was true, of course instead he backed a plan from congressional Republicans for a large regressive tax cut. Once that was enacted, House Republicans began to queue up a program they called Tax Reform 2.0 that would be an even larger and only modestly less regressive tax cut. Trump, again aware that this is not popular, tried to make up a fake middle-class tax cut during the waning days of the midterms, but as soon as the election was over .

This is all nonsense, but its telling nonsense.

Even very dishonest politicians dont routinely pretend to hold the opposite of their partys position on key issues. Trump isnt out there pretending to champion abortion rights, clean energy, or humane treatment of refugees. Hes trying to muddy the waters on taxes because he knows the standard Republican position on tax policy is unpopular.

Yet this is rarely covered as a striking, daring, or even noteworthy stance.

Most Americans Favor Expanding Renewable Energy Sources But Divides Remain Over Expanding Offshore Drilling Nuclear Power

Most Americans favor expanding solar power or wind power , including strong majorities of both Republicans and Democrats. The public, however, is evenly divided over whether to expand nuclear power . Fewer than half of Americans support more offshore oil and gas drilling , hydraulic fracturing for oil and natural gas, known as fracking or coal mining .

These findings are broadly in line with previous Center surveys, which found strong majorities in favor of increasing solar or wind power and more mixed views about expanding other energy sources. Support for more nuclear power plants has inched up 6 percentage points since 2016 . Support for coal mining has declined from 41% to 35% in the same period.

Sizable majorities of both Republicans and Democrats including those who lean to each party favor more solar panel farms or wind turbine farms . More Republicans than Democrats support expanding nuclear power plants; support for nuclear power is stronger among conservative Republicans than among moderate or liberal Republicans .

Conservative Republicans also stand out as more inclined to support expansion of hydraulic fracturing for oil and gas as well as coal mining . By comparison, fewer than half of moderate or liberal Republicans favor expanding these energy sources .

Foreign Policy And National Defense

Republicans supported Woodrow Wilson‘s call for American entry into World War I in 1917, complaining only that he was too slow to go to war. Republicans in 1919 opposed his call for entry into the League of Nations. A majority supported the League with reservations; a minority opposed membership on any terms. Republicans sponsored world disarmament in the 1920s, and isolationism in the 1930s. Most Republicans staunchly opposed intervention in World War II until the Japanese attack on Pearl Harbor in 1941. By 1945, however, internationalists became dominant in the party which supported the Cold War policies such as the Truman Doctrine, the Marshall Plan, and NATO.

Americans Want To Tax The Rich

Theres no polling on specific brackets or exactly who counts as rich that I can find, but surveys are very consistent that for some definition of rich the voters would like to see higher taxes:

- The most recent poll on this I can find is an April 2018 Gallup survey which had 62 percent of respondents saying the wealthy do not pay their fair share in taxes, a number thats been consistently in the high 50s or low 60s in the 21st century.

- Pew found in 2017 that said it was bothered a lot by the fact that rich people dont pay their fair share.

- A 2017 CBS poll found that 56 percent of voters said wealthy people should pay higher taxes.

One person who gets this, incidentally, is President Donald Trump.

Political Positions Of The Republican Party

Republicanism in the United States

The platform of the Republican Party of the United States is generally based on American conservatism, contrasting with the modern liberalism of the Democratic Party. The positions of the Republican Party have evolved over time. Currently, the party’s fiscal conservatism includes support for lower taxes, free market, of corporations, and restrictions on labor unions. The party’s social conservatism includes support for gun rights and other traditional values, often with a foundation, including restrictions on abortion. In foreign policy, Republicans usually favor increased military spending and action. Other Republican positions include restrictions on immigration, opposition to drug legalization, and support for school choice.

Regulating The Economy Republican Style

The Republican Party is generally considered business-friendly and in favor of limited government regulation of the economy. This means favoring policies that put business interests ahead of environmental concerns, labor union interests, healthcare benefits and retirement benefits. Given this more pro-business bias, Republicans tend to receive support from business owners and capitalists, as opposed to support from labor.

Republicans Economic Views And How They Work In The Real World

Kimberly Amadeo is an expert on U.S. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of the economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact.

Republican economic policies focus on what’s good for businesses and investors. Republicans say that prosperous companies will boost economic growth for everyone.

Republicans promote supply-side economics. That theory says reducing costs for business, trade, and investment is the best way to increase growth. Investors buy more companies or stocks. Banks increase business lending. Owners invest in their operations and hire workers. These workers spend their wages, driving both demand and economic growth.

Republicans define the American Dream as the right to pursue prosperity without government interference. That’s achieved by self-discipline, enterprise, saving, and investment by individuals. Warren Harding said, “Less government in business and more business in government.” Calvin Coolidge said, The chief business of the American people is business.

Here is a short list of the pros and cons of some Republican economic policies.

Compare And Contrast: How Do The Republican And Democratic Tax Plans Differ

SEPTEMBER 29, 2020

With the presidential election only weeks away, many people are beginning to pay closer attention to each candidates positions on such issues as the COVID-19 pandemic, health care, the environment and taxes.

Among their many differences, President Donald Trump and former Vice President Joe Biden have widely divergent tax proposals. Their stances could have a major impact on the amount of taxes youll owe in the future. Heres an overview of each candidates tax proposals for both individuals and businesses.

Trumps tax proposals for individuals

The GOP-backed Tax Cuts and Jobs Act was signed into law in December 2017. It included a number of temporary federal tax cuts and breaks for individuals and families for 2018 through 2025. President Trump has indicated support for preserving tax reforms under the TCJA and possibly providing additional breaks for individuals and families.

The White House budget document for the governments 2021 fiscal year indicates support for extending these TCJA individual tax provisions beyond 2025:

- The current federal income tax and estate tax regimes,

- The expanded child and dependent tax credits ,

- Increased standard deduction amounts ,

- More favorable alternative minimum tax rules, and

- Continued limitations on itemized deductions for home mortgage interest and state and local taxes .

Bidens tax proposals for individuals

Other elements of Bidens plan that would affect individual taxpayers include: