Tax Cut And Jobs Act Deregulation And National Debt

Even before the virus further exacerbated U.S. income inequality, some experts say Trumps economic policies favored the wealthy — and left the poor and middle class behind.

His Tax Cuts and Jobs Act in December 2017 provided major tax breaks to corporations and wealthy individuals. The policy, among other things, reduced the corporate income tax rate from 35% to 21%.

Frankel called the policy “beyond ironic” for a president “who campaigned in 2016 on being the champion of the working man or working person and campaigned on ‘draining the swamp’ in Washington.”

Shierholz said this policy “absolutely increased inequality” and the “vast majority of the benefits of those tax cuts went to the already very wealthy.”

The economists also noted that the policy came at a time when unemployment was relatively low and the economy in good shape.

“That’s not the time to be giving away trillions of dollars to the wealthy,” Frankel said. “When you have a bad shock like the global financial crisis of 2008-09 or like the coronavirus crisis that we’re still going through — that’s the time to increase government spending and expansionary fiscal policy, but you lose the ability to do that if you gave it away.”

NYU’s Bowmaker noted that some “can make the case that the corporate tax rate was a little bit too high” and would welcome the tax cuts.

Despite his goal, the debt has ballooned under Trump. The total national debt has skyrocketed by more than $7 trillion during Trumps tenure.

Fact Check: Trumps Claims On The Economy

In an appearance at the Economic Club of New York, the president overstated some of the economys gains on his watch, understated others and often cited inaccurate statistics.

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

The United States economy is slowing and wage growth has slipped, but household incomes are rising and the unemployment rate is at a half-century low. This is the complicated and somewhat contradictory state of the American economy that President Trump painted over with a big smiley face at the Economic Club of New York on Tuesday.

In remarks and a question-and-answer session, Mr. Trump continued to portray himself as a savior of what had been a moribund economy, trumpeting job gains and increased worker pay on his watch. To support his claims, he unleashed a flurry of economic statistics. Some were accurate, some were misleading and some appear nowhere close to the truth.

Here are some of the presidents claims.

What the president said

Dont Miss: How Can I Tweet Donald Trump

Tax Cuts Boosted Wealthy

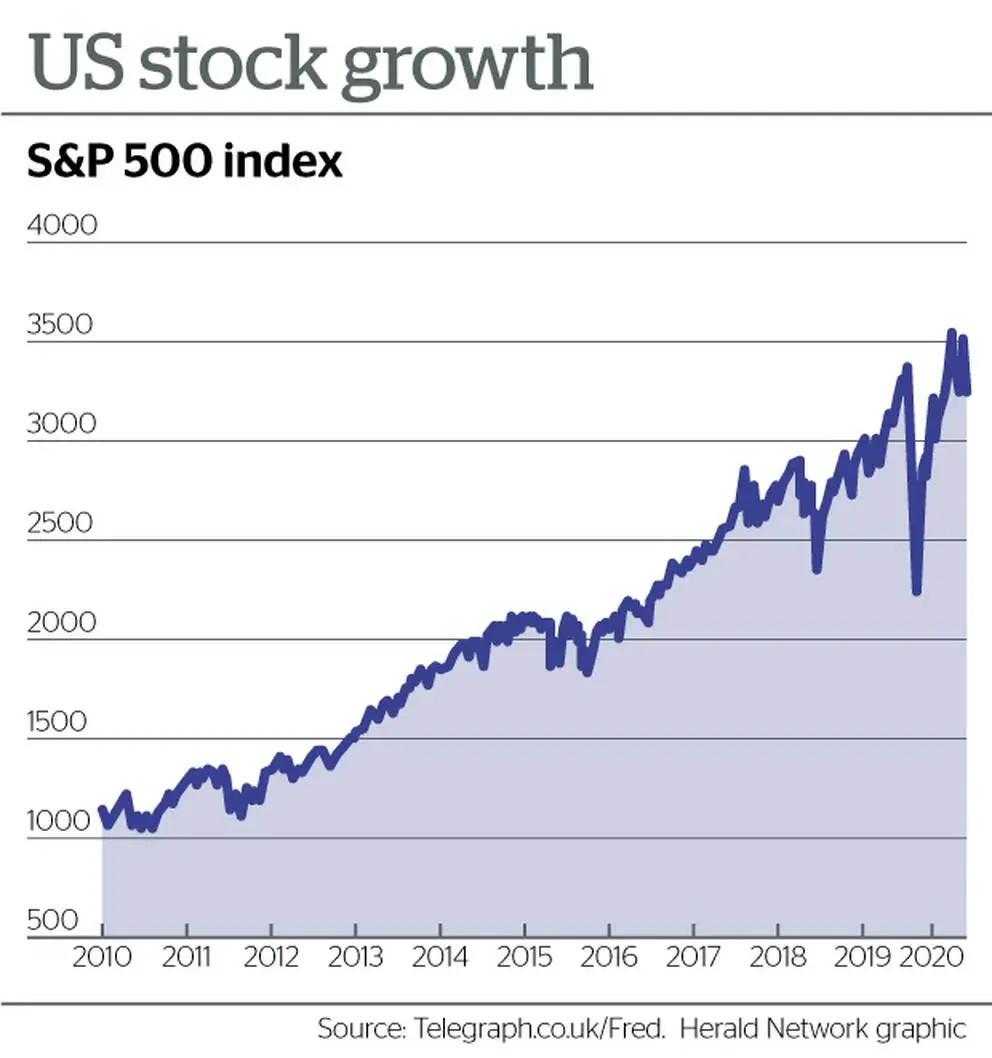

Tax cuts are another of Trump’s proudest achievements. In 2017, the top individual tax rate was cut from 39.6% to 37% until 2025, while corporate taxes were reduced permanently from 35% to 21%. Prakken said the cuts had helped boost the stock market by 5-7% but had also led to a “significant increase in the US budget deficit with potential negative long-run implications for the US standard of living.”

In a report shortly after the tax package went into effect, the nonpartisan Tax Policy Center wrote that the top 20% of Americans enjoyed more than 60% of Trump’s tax savings. Economists said any boost to consumer spending and business investment was shortlived and that little of the benefit had trickled down to low-income Americans. Despite this, Trump has promised to make the individual tax cuts permanent if reelected and plans to slash payroll taxes.

Also Check: Santa Clarita Republican Voter Guide

Achieving A Secure Border

Secured the Southern Border of the United States.

- Built over 400 miles of the worlds most robust and advanced border wall.

- Illegal crossings have plummeted over 87 percent where the wall has been constructed.

- Deployed nearly 5,000 troops to the Southern border. In addition, Mexico deployed tens of thousands of their own soldiers and national guardsmen to secure their side of the US-Mexico border.

- Ended the dangerous practice of Catch-and-Release, which means that instead of aliens getting released into the United States pending future hearings never to be seen again, they are detained pending removal, and then ultimately returned to their home countries.

- Entered into three historic asylum cooperation agreements with Honduras, El Salvador, and Guatemala to stop asylum fraud and resettle illegal migrants in third-party nations pending their asylum applications.

- Entered into a historic partnership with Mexico, referred to as the Migrant Protection Protocols, to safely return asylum-seekers to Mexico while awaiting hearings in the United States.

Fully enforced the immigration laws of the United States.

Ended asylum fraud, shut down human smuggling traffickers, and solved the humanitarian crisis across the Western Hemisphere.

Secured our Nations immigration system against criminals and terrorists.

Protected American workers and taxpayers.

A Botched Public Health Response

The Trump administration failed to take the coronavirus outbreak seriously. In late February, while other high-income countries were ramping up testing and developing tracing procedures, President Donald Trump stated that the Coronavirus very much under control. It was during these critical early weeks and months that the United States should have been stockpiling protective gear for frontline workers and making testing widely available. In contrast, South Korea, a country whose first confirmed case of COVID-19 coincided with that of the United States, bought 720,000 masks for employees of businesses considered at risk of exposure to the coronavirus. When asked if the U.S. federal government would supply personal protective equipment to states, President Trump responded that it would not act as a shipping clerk.

Figure 2

Recommended Reading: New England Patriots Radio Stream

Patient Protection And Affordable Care Act

During his campaign, Trump promised to repeal and replace the Patient Protection and Affordable Care Act , also known as “Obamacare.” Although Trump wasn’t successful, he launched many initiatives that changed portions of the law. The Tax Cuts and Jobs Act repealed the Affordable Care Act’s tax penalties for those who didn’t have health insurance.

President Trump’s plans aimed to reduce spending on Medicaid by allowing states to establish work requirements and reduce the number of people eligible for the program. They also provided incentives to increase recipient copays and other patient costs and to reduce program benefits.

Series: A Closer Look

Examining the News

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as theyre published.

This story was co-published with The Washington Post.

One of President Donald Trumps lesser known but profoundly damaging legacies will be the explosive rise in the national debt that occurred on his watch. The financial burden that hes inflicted on our government will wreak havoc for decades, saddling our kids and grandkids with debt.

The national debt has risen by almost $7.8 trillion during Trumps time in office. Thats nearly twice as much as what Americans owe on student loans, car loans, credit cards and every other type of debt other than mortgages, combined, according to data from the Federal Reserve Bank of New York. It amounts to about $23,500 in new federal debt for every person in the country.

Also Check: Who Were The Republicans In The Civil War

Imbalances Are Transmitted Mainly Through The Capital Account

There is another compelling reason why bilateral trade data doesnt matter. The globalization of capital flows suggests that trade imbalances are more likely to be transmitted through the capital account than through the trade account. If China, for example, exports excess savings to the United States, U.S. attempts to reduce the bilateral trade deficit with China through tariffs are likely merely to reroute that deficit through other countries. At the end of the day, a reliance on tariffs leaves the overall U.S. deficit unchanged if Chinese capital flows to the United States are unchanged, even when the bilateral deficit with China appears on the surface to shift. That is why it is much more useful to focus on the capital account, and even then, the analysis must start with each countrys overall capital account, not just its bilateral capital account.

But things get even more complicated than that. The negative economic impact that these excess savings can have on the U.S. economy can manifest itself as either higher unemployment or higher debt . The actual impact depends on how domestic policies are designed to determine whether the United States chooses higher unemployment or higher debt.

Federal Budget Shutdown Of 20182019

On December 22, 2018, the federal government went into a partial shutdown caused by the expiration of funding for nine executive departments. The lapse in funding occurred after Trump demanded that the appropriations bill include funding for a U.S.-Mexico border wall. The shutdown ended on January 25, 2019, with the total shutdown period extending over a month, the longest in American history. By mid-January 2019, the White House Council of Economic Advisors estimated that each week of the shutdown reduced GDP growth by 0.1 percentage points, the equivalent of 1.2 points per quarter. About 380,000 federal employees were furloughed, some public services were shut down, and an additional 420,000 employees for the affected agencies were expected to work with their pay delayed until the end of the shutdown, totaling 800,000 workers affected out of 2.1 million civilian non-postal federal employees.

A January 2019 Congressional Budget Office report estimated that the 35-day partial government shutdown cost the American economy at least $11 billion, including $3 billion in permanent losses the CBO estimate excluded indirect costs that were difficult to quantify. The shutdown had an adverse effect on the budgets of state and local governments, as states covered some federal services during the shutdown.

Read Also: How Can I Listen To The Patriots Game

Economic And Technical Factors Produced Substantial Savings

CBO classifies three factors that drive all movements in budget deficits: new legislation, changes in economic growth rates, and technical changes brought on by noneconomic factors . Under President Trump, faster economic growth and technical revisions saved an estimated $3.9 trillion over the 20172027 decade relative to the initial CBO projections. However, new legislation and presidential initiatives cost $7.8 trillion over the same period . Most of these costs will be borne between 2017 and 2021, while the economic and technical savings are projected to accrue towards the end of the 10-year window.

The $3.9 trillion in economic and technical budget savings can be broken down as follows:

Falling interest rates on the national debt are by far the largest reason that CBOs projected baseline deficits for the 20232027 out-years actually fell during the Trump presidency despite the costs of new legislation. Even with trillions in new debt signed into law by President Trump, the projected 2027 interest amount fell from $768 billion to $435 billion. For comparison, between 1997 and 2027, the debt held by the public will have skyrocketed from $3.8 trillion to $28.7 trillion , yet annual interest costs will have grown only from $244 billion to $435 billion . Had interest rates remained at 1990s levels, annual budget interest costs would approach $2 trillion by 2027.

Rolling Back Regulations That Protect Worker Pay And Safety

President Trump and congressional Republicans have blocked regulations that protect workers pay and safety. Two of the blocked regulations are the Workplace Injury and Illness recordkeeping rule, and the Fair Pay and Safe Workplaces rule. By blocking these rules, the president and Congress are raising the risks for workers while rewarding companies that put their employees at risk.

On April 3, 2017, Trump signed a congressional resolution blocking the Workplace Injury and Illness recordkeeping rule, which clarifies an employers obligation under the Occupational Safety and Health Act to maintain accurate records of workplace injuries and illnesses. Recordkeeping is about more than paperwork. If an employee is injured on the job , contracts a job-related illness, or is killed in an accident on the job, then it is the employers duty to record the incident and work with the Occupational Safety and Health Administration to investigate what happened. Failure to keep injury/illness records means that employers, OSHA, and workers cannot learn from past mistakes, and makes it harder to prevent the same tragedies from happening to others. By signing the resolution to block this rule, Trump gave employers a get-out-of-jail-free card when they fail to maintain or when they falsifytheir injury/illness logs. Workers who could have been saved from preventable accidents on the job will have to pay the price with their health or even their lives.

You May Like: When Is Va Republican Primary

Trade War ‘disaster’ With China

Trade policy is where the president wields the most economic power, as Congress has over the years delegated negotiating authority to the presidents office, according to Menzie Chinn, professor of public affairs and economics at the University of Wisconsin, Madison. Chinn documented the trade war saga on his macroeconomic policy blog Econbrowser.

Trump exercised this power almost immediately during his first years in office and even went so far as to use national security as a basis for trade barriers with China — something that no president has done in recent times.

Ultimately, the tit-for-tat trade war that Trump waged with China was lost by the U.S., economists say, and data on trade deficits confirm.

Trumps dramatic trade war upended decades of policy, and kicked off with failed meetings with Chinese leaders in 2017. After the talks disintegrated, Trump initiated the trade war by imposing tariffs on all imported washing machines and solar panels in early 2018. He then announced 25% tariffs on steel imports and 10% tariffs on aluminum. China retaliated with tariffs of up to 25% on more than 100 U.S. products including soybeans and airplanes. The sporadic, retaliatory trade-off battles waged on for years, and dragged other countries that were trying to remain competitive in as well.

By the end of his term, the trade deficit will be larger in absolute terms than it was when he came to office, Chinn told ABC News.

Gross Domestic Producta Deep Recession

The widest measure of economic activity â gross domestic product â measures the value of the goods and services produced in the country. It typically grows between 2% to 3% per year after adjusting for inflation. Trumpâs first three years were all within that range, but 2020 saw a deep decline. We donât have a full year of data yet, but the second quarter was the worst in records going back to 1947. Third-quarter data, which was released on Thursday, showed a partial recovery.

Many economists predict businesses and workers will not fully bounce back from this severe economic downturn for years.

Additional development by Byron Manley

Don’t Miss: Reviews On Patriot Power Generator

Ensuring Wall Street Can Pocket More Of Workers Retirement Savings

The Trump administrations repeated delays to a rule protecting retirement savers from conflicted investment advice will cost retirement savers an estimated $18.5 billion over the next 30 years in hidden fees and lost earning potential.

Since Trump took office, the Department of Labor has actively worked to weaken or rescind the fiduciary rule, which requires financial advisers to act in the best interests of their clients when giving retirement investment advice. The rule was finalized by the Department of Labor in April 2016 after an exhaustive economic analysis found that adviser conflicts are inflicting large, avoidable losses on retirement investors, that appropriate, strong reforms are necessary, and that compliance with this final rule and exemptions can be expected to deliver large net gains to retirement investors. The rule was supposed to go into effect in April 2017 but key provisions were delayed multiple times, with the most recent 18-month delay pushing back the ability to enforce the rule to July 1, 2019. EPI estimates that retirement savers who will get, or have already received, advice tainted by conflicts of interest during the delays will lose a total of $18.5 billion out of their retirement savings over the next 30 years.

Industry Claim That Fiduciary Rule Harms Investors Is Flawed, Provides No Convincing Evidence, Letter from the Consumer Federation of America to the Department of Labor, October 24, 2017.

Ten Actions That Hurt Workers During Trumps First Year: How Trump And Congress Further Rigged The Economy In Favor Of The Wealthy

The tax cut law that President Trump boasts will make his wealthy friends a lot richer is just the latest in a series of betrayals of working people by the administration and Congress since Trump took the oath of office on January 20, 2017. In addition to passing a massive tax cut for wealthy business owners, Trump and Republicans in Congress have rolled back important worker protections, advanced nominees to key administration posts who have a history of exploiting working people, and taken other actions that further rig the system in favor of corporate interests and the wealthiest Americans.

Here are the 10 worst things Congress and Trump have done to undermine pay growth and erode working conditions for the nations workers.

Don’t Miss: Are Republicans Or Democrats Better For Small Business

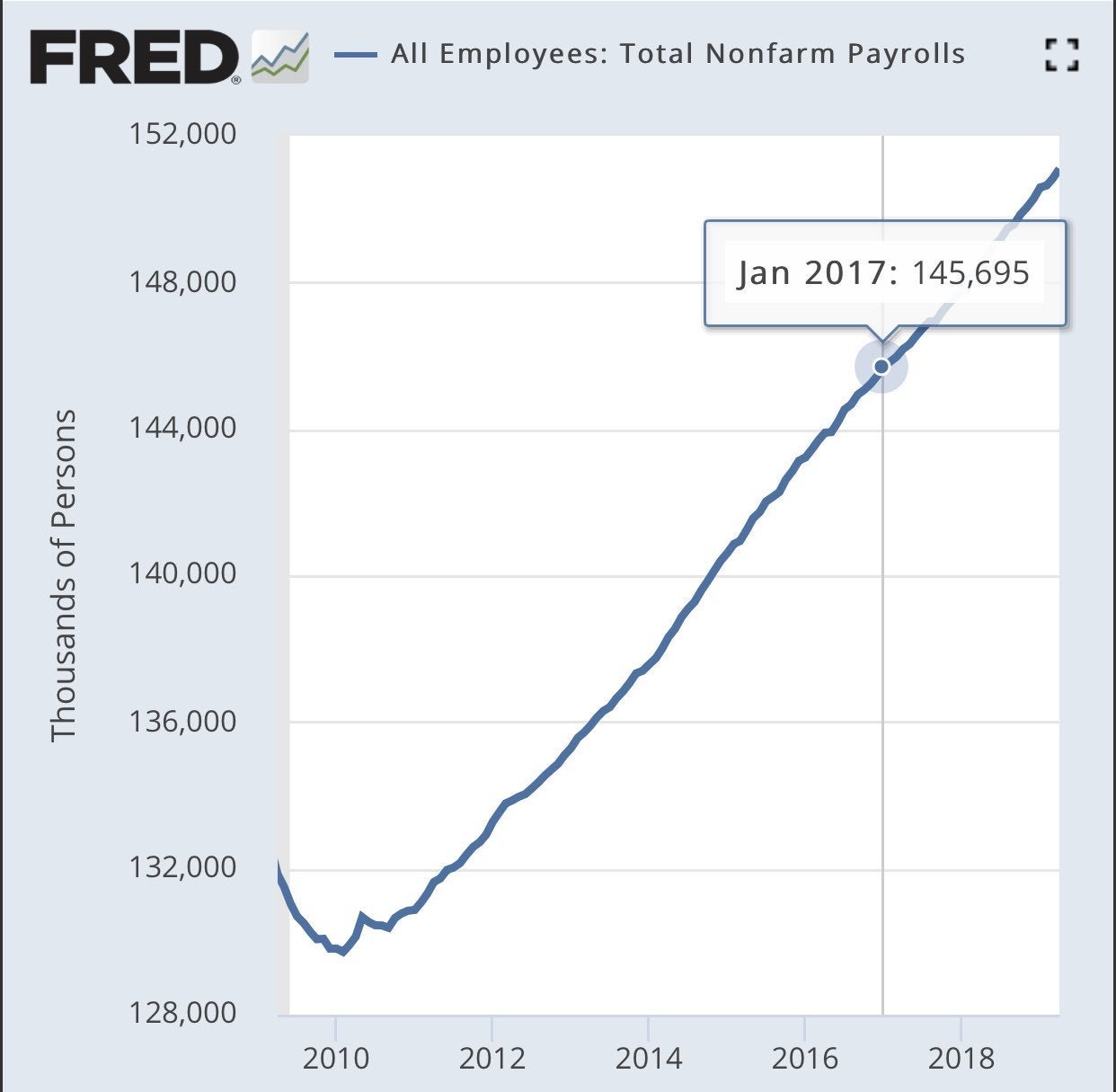

Even Before The Pandemic Trump Failed To Unleash An Economic Miracle

President Trumps failure to save the economy from the coronavirus is consistent with his record of failure before the pandemic. Upon inheriting a growing economy with low and falling unemployment from the Obama Administration, President Trumps first order of business was to squander $2 trillion on a taxgiveaway that showered unnecessary benefits on corporations and the wealthy with little to show for it. Like his tax scam, progress on the Presidents other major promises to eliminate the trade deficit that China would pay for the costs of his tariffs that manufacturing would boom everyone would have health insurance not only failed to materialize, but in many cases moved in the wrong direction. The share of Americans uninsured has grown every yearhe has been in office, for instance, reversing six consecutive years of insurance gains prior to his presidency. Rather than put his economic inheritance to good use, President Trump failed to meaningfully change the economys trajectory or achieve his major economic goals before running the economy further into the ground with his mismanagement of COVID-19.