No Benefits Administration Or Free Hr Services

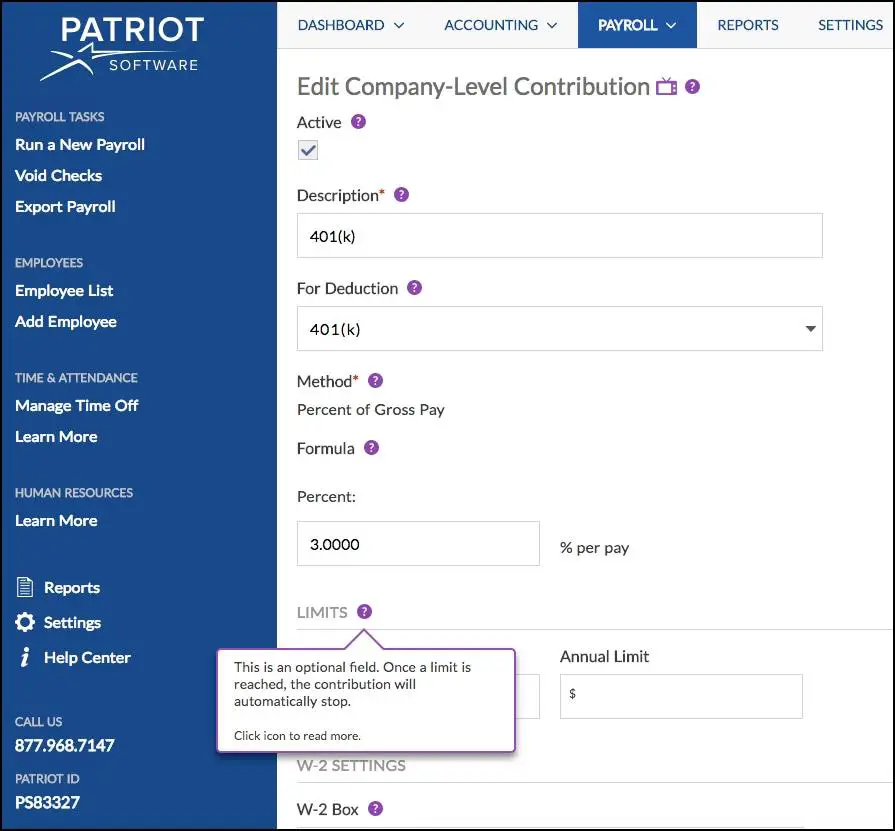

Companies like Gusto and OnPay throw in HR services such as employee onboarding documents or offer letters with the basic versions of their payroll software. Patriot doesn’t: An HR add-on has to be purchased separately. On the benefits front, Patriot doesn’t handle the administration of employee benefits with external providers, such as a health insurance company or 401 provider.

Employee paycheck deductions and contributions can be set up using Patriot, but it cannot send money to providers on your behalf. Patriot also doesn’t send payments for insurance, garnishments or child support. Gusto and OnPay, priced slightly higher than Patriot, both offer health benefit administration services through partners. Gusto also sends child support and garnishment funds to the appropriate agencies.

Alternatives To Patriot Payroll

With the basic or full-service option, Patriot carries an affordable price tag and many of the features users would want in payroll software. Roll by ADP, Payroll4Free and Wave Payroll are similarly priced options worth considering for a small business’s payroll needs. Heres how they stack up against each other:

|

Software |

|---|

What Is Patriot Software

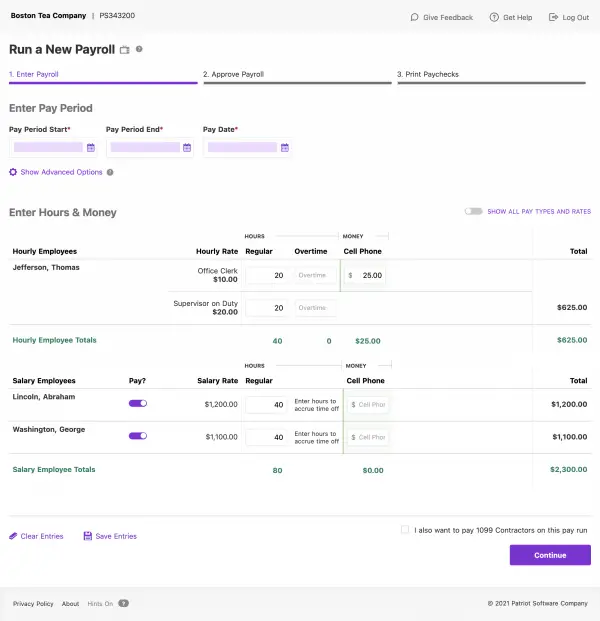

Patriot Software is a budget-friendly payroll solution offered in two products, Basic Payroll and Full Service. The basic package allows you to use the web-based app, while the full package includes payroll services on top of using the app, such as managing collections, deposits and taxes on your behalf. Small companies can start with the basic plan at $10 per month + $4 per employee.

With the Basic payroll, small businesses use the software for running payroll with a simple 3-step process but will need to handle their own payroll tax deposits and payroll tax filings. The software offers detailed payroll reports and tax liabilities reports. The Full Service Payroll starts at $30/month + $4 per employee. The Full-Service Payroll is recommended for busy business owners who do not have the time or man-power for handling payroll tax deposits and payroll tax filings. All end of the year payroll tax filings is included with the Full Service Payroll.

The basic package also comes with setup and U.S.-based support. The software is simple enough to understand even for non-technical users and comes with an onboarding wizard. Even so, the vendor will help you with the setup.

On the other hand, the full service will take care of all your payroll filings at end of year, a great convenience for you, so you can focus on running the business. This plan takes care of federal, state and local taxes. Full Service Payroll starts at $30 per month.

Read Also: Why Are Republicans Trying To Repeal Obamacare

Affordable And Does The Job

At $37 per month, Patriots full-service plan is one of the more affordable options that NerdWallet has reviewed. It comes with all the basic features of payroll software, such as unlimited payroll runs, the ability to pay employees and contractors across multiple states and tax-filing services. It can also support up to 250 employees, unlike some less expensive options that come with lower limits.

Accounting That’s Easy And Grows With You Your Words Not Ours

The software is simple. The reports are sufficient and easily exported. For a staff of 1-25 or so, you cannot beat the value. I had great experience with their service team. Patriot took us from our first employee up until we had a major expansion and went to 40 employees.

Kevin, Riff Cold Brewed Coffee

I am currently successfully running payroll and using the accounting program. Both are INVALUABLE services to my business.

Amy, Wonderfully Maid Cleaning

The software is very easy to use. Setup was a breeze. Monthly processing and reporting is quick and detailed.

Josh, Mabloc, LLC

Patriot has saved me a lot of time on payroll and tax documents. This company has really given me a peace of mind and I’m able to focus on other aspects of my business.

Stephanie, Study to Show Learning Academy

Patriot has given us the ability to cost code all of our expenses through the accounting software. Without it, I would be spending hours upon hours creating spreadsheets that dont run reports.

Megan Every, Boss Cider Company

Before , every single year I had a huge stack of receipts that I had to type by hand for my expenses. But now, I sync up my bank account, and its all there. Its a lot easier than a spreadsheet of teeny-tiny receipts and going, Oh wait, did I put that bill in?

Rachel Beard, The Harmony Garden Music Center

Recommended Reading: Apartments Near Patriots Point Sc

Lots Of Accounting Reports With Filtering Sorting And Exporting Capabilities

Account Reconciliation

You dont need to remember it all. This report does it for you! This report provides a detailed record of account transactions that matched software entries, as well as outstanding transactions. Well save the details each time you reconcile your transactions in a handy PDF.

Customer Estimates

View a list of all estimates you have created for your customers. This report shows estimate details, like current status . Filter your list by start and end dates, customers, and more.

Check Register

Our check register report gives you running balances and bank activity details so you can easily keep track of cleared checks and other transactions. Old school? Not this report. It is so slick you can even attach your receipts and documents to the transactions to keep it all together.

Profit and Loss Statement

Get to know your income, expenses, and net profit up-close-and-personal. The P& L statement measures the financial health of your business by showing income and expense details. Select a timeframe to get started.

Accounts Receivable Aging

Stay on top of your past due customer invoices with a date-by-date breakdown. The Accounts Receivable Aging report clearly displays which customers are 30, 60 and 90+ days past due.

Account Trial Balances

Balance Sheet

General Ledger

Unpaid Customer Invoices

Bill Listing

Accounts Payable Aging

Vendor Payment History

Dont forget what you paid vendors. See how much you paid vendors, the account category, and 1099 Type.

Patriot Payroll Software Reviews

Businesses that use Patriot Payroll are happy with their experiences. When users have migrated from other products , they express an easy transition that saves them money and headaches.

The software receives 4.8/5 stars on Capterra . Patriot ranks well both with small business owners and accountants using the service for their clients. On Trustpilot, Patriot has a 4.8 rating .

While the complaints are few, some negative experiences include frustration at the lack of features and reporting options.

Also Check: Senator Thom Tillis Republican Or Democrat

Best Customer Support: Patriot

Patriot and Gusto have similar customer support hours for business owners. You can contact either provider Monday through Friday via chat, email, or phone. Neither provider offers weekend hours, so if you run into an emergency payroll problem, youll have to wait until Monday for any assistance.

Patriot has a streamlined and super user-friendly startup wizard. But if youd prefer an expert to tackle the hardest parts, Patriot will set up payroll for you, free of charge. Youll hand your employee information over to your Patriot customer service rep, and theyll take care of all the data entry so payroll is ready to go ASAP.

But between Patriot and Gusto, Patriot has by far the better customer service reputation. Patriot users on the review site Trustpilot give Patriot an 4.8 out of 5 with most reviews labeling their overall Patriot experience as excellent.1 By comparison, Gusto currently scores just 3.5 out of 5 on Trustpilot.2 Customers note Gustos lack of customer service response, especially when customers run into tax and benefits issues.

Typically, only the most passionate customers leave reviewsso its worth tempering both companies Trustradius scores with a grain of salt. Still, Gusto used to have one of the best customer service reputations in the industry. Were troubled by growing customer complaints and Gustos lack of a response, and you should definitely take it into consideration as you find your preferred online payroll software.

Q: Can The Payroll Tax Service Handle Filings For Tax Periods That Ended Before We Signed Up

A: If you need Patriot to handle tax deposits and filings for periods before when you signed up, we will charge $37 per month for each prior months tax deposits and filings. The accuracy of these filings will be dependent upon the prior payroll data you provide, so you will need to enter all year-to-date payroll history for every employee accurately.

Also Check: What Republicans Are Running For Governor In Nevada

Patriot Pros And Cons

|

Patriot Payroll software is a very affordable payroll processing solution for small businesses. Geared toward businesses under 100 employees, this option is simple to use and offers exceptional setup and customer support. Unlike comparable payroll solutions, HR capabilities are an add-on feature and not quite as robust as the competition.

There are integration options for accounting, HR, and time tracking, though they are fee upgrades and not as robust as you might need for your small business. The Full Service plan is especially helpful for small business owners seeking assistance with payroll taxes.

Accounting Software Faqs Asked And Answered

Accounting Premium includes everything in our Basic option, plus added features like bank reconciliation, invoice templates, and much more!

Relax! Our cloud-based accounting software is designed to be easy for small business owners, yet powerful enough for accountants. Our software is simple, and there are plenty of guides, tutorials, and videos built right in if you need help.

Patriot makes it easy. Get started with a free, no-obligation 30-day free trial of Accounting. There are no strings attachedcancel anytime!

If you have questions, call our customer support department for help. We offer free routine support for all customers. You can also find quick answers with our online chat feature or search for answers on your own in our Help Center.

No. You can add an unlimited number of customers through our online accounting software.

If you have Accounting Premium or Accounting Basic, here are the 1099 e-Filing fees:

| Number of 1099s |

|---|

Also Check: Jeep Patriot Throttle Body Recall

How Much Does Patriot Software Cost

Patriot Softwares basic payroll plan starts at $17 a month plus $4 per payee per month. At this price, Patriot calculates payroll taxes for you, but youll have to submit taxes yourself. If you want automatic tax filing, youll need Patriots full-service plan. Its base price jumps up to $37 a month, but the $4 per-payee charge stays the same.

Lots Of Payroll Reports With Filtering Sorting And Exporting Capabilities

Payroll Tax Filing Report

All of the tax returns Patriot has filed for you in a neat little package. Choose the tax year and view tax filings by quarter. You can download forms and see when we filed them on your behalf.

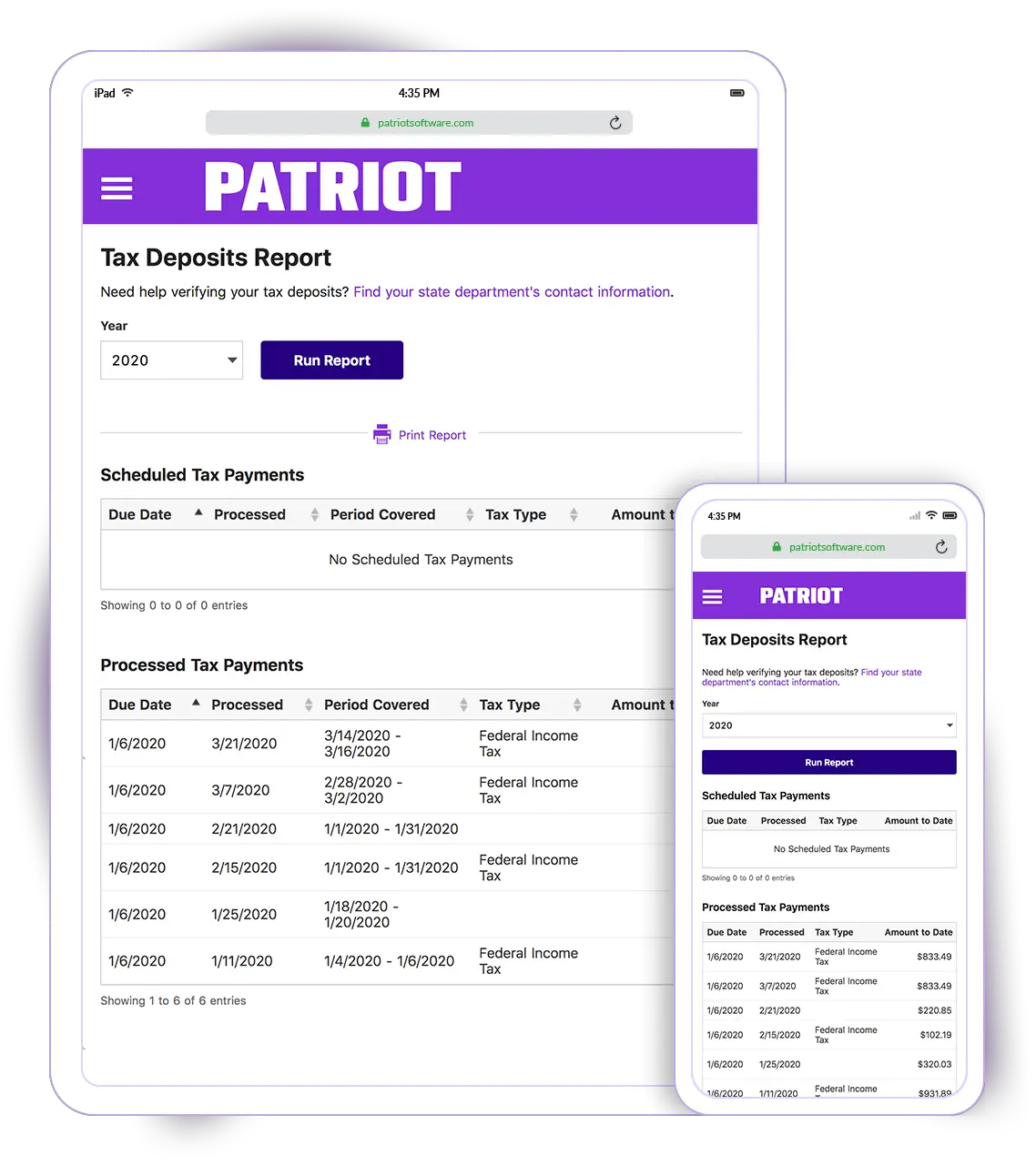

Payroll Tax Deposit Report

Shows all the payroll taxes that we deposited with tax agencies on your behalf . Select a year to view both processed and scheduled tax payments.

Payroll Register

This shows all of the payroll you have run for all employees in the software, broken down easily by pay date. View details like employee hours, earnings, taxes withheld, and deductions, as well as employer taxes owed and contributions.

Individual Paycheck History

The payroll details you need for individual paychecks processed in our software. View an employees payroll details like hours, earnings, employee taxes withheld, employer taxes owed, deductions, and contributions.

Payroll Details

Your go-to report for breaking down year-to-date details by employee, location, totals, or checks. Plus, we give you easy ways to download the report either with a PDF or CSV file.

Check/Deposit Payment Detail

See all payments made to all employees with this report. Select one or all employees for a specific payday range to see payment type , amount, and account type.

Manage Time Off

Managing time off has never been easier. View time off balances for vacation, sick, or personal time. To get started tracking employees used and available time off, set up the hour codes you want to use.

Don’t Miss: 2020 California Republican Primary Candidates

Patriot Payroll Software Review 2023

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

Bottom line: Patriot Softwares payroll software is a splendid choice for businesses operating exclusively in the United States with fewer than 100 employees. We particularly love the platforms low costs, full-service tax filing perks, and dedication to customer service.

The company falls short with its broader personnel administration approach as there is no substantial human resource support. But other than a lack of meaningful HR perks, there isnt much wrong with Patriot Software. That’s why it’s one of our top picks for small-business payroll services.

SurePayroll is an affordable and straightforward payroll software that offers automatic payroll runs, tax filing, and exceptional customer service.

Top Alternatives To Patriot Payroll Software

If you want to look beyond Patriot Payroll for the perfect payroll software for your small business, then youâre in luck. There is a market full of payroll services for small businesses, and each of them is vying for your business. Each will offer something unique for your business, so itâs certainly worth checking out all of your options. To start, here are two top payroll alternatives to consider if Patriot Payroll software isnât right for your needs:

Don’t Miss: 2011 Jeep Patriot Radio Replacement

Are Patriot Payroll Software Reviews Good

Patriot Payroll has amazing customer reviews. The company exceeds the ratings for the industry average and shows it cares quite a bit about the customer experience. The software is constantly changing and adapting to fit client needs. Patriot Payroll is attentive to the voices of its clients and shows steady improvement.

Patriot Software Customer Support

Patriot Software has excellent customer support from a team of 100% US-based agents. Their support staff are true experts and can help walk you through any issues you may have. They are easy to reach via phone, email, or online chat, during normal business hours.

If you look at sites like TrustPilot and the Better Business Bureau , you can see that customers rate their experiences with Patriot Software very highly.

Don’t Miss: Which Republicans Voted To Impeach Trump Today

Patriot Plans & Pricing

| Unlimited payroll, direct deposit, employee portal, multiple integrations | ||

| Full Service | $30/month + $4/employee | Basic features, plus payroll taxes and tax filing |

|---|

Both the Basic and Full Service plans allow for a 30 day free trial, and include monthly subscriptions with no additional fees. You can scale up or down each month as needed, and there are no setup or payroll processing fees.

Which Is Better Gusto Or Paychex

Gusto and Paychex are two of the best small-business payroll services, but the best one for you depends on your payroll and HR needs. If you want thorough HR support with a customizable payroll package, Paychex might be a better fit for you. Or if you dont care as much about HR and prefer a fully automated payroll provider, we recommend Gusto over Paychex.

Recommended Reading: What Do Republicans And Democrats Stand For

Patriot Full Service Payroll

Alternatively, if you want to access more comprehensive payroll tax services with your Patriot Payroll account, then we suggest you look more closely at their Full Service Payroll plan. This more advanced version of Patriot Payroll software comes with all the features that the Basic Payroll plan offers, plus some extras.

If youâre looking to upgrade into a payroll software thatâs more hands-on with your businessâs payroll tax processes, then itâs worth considering Full Service Patriot Payroll.

Just like the Basic Patriot Payroll plan, the Full Service Patriot Payroll plan comes with a 30-day free trial so that you can try it out for a month with no obligation or cost. After your first month, Full Service Patriot Payroll pricing will set in with a base fee of $30 per month, plus $4 per month per employee or contractor.

- File and deposit federal taxes

- File and deposit state taxes

- File and deposit local taxes

If you anticipate needing to outsource your payroll taxes to an expert, then we suggest you opt for the Full Service Patriot Payroll. And even if youâre willing to file your payroll taxes on your own, having an expert team do it for you could help you avoid common payroll compliance mistakes that could cost your business.

Add-On Features

Beyond the two plans that Patriot Software has for their payroll, they also have two add-on features that you can tack onto your payroll account for an additional monthly cost.

Payroll Taxes Simply Cant Get Any Easier Because Youll Never Have To Worry About Them Again

Everything in our Basic Online Payroll is included in Full-Service Payroll. You simply enter your employees work hours and calculate your payroll. Print your paychecks instantly, or pay your employees with our free direct deposit.

With Full-Service Payroll, we handle all aspects of depositing and filing your federal, state, and local payroll taxes for you. We determine which payroll taxes are necessary for your business. Dont worry about payroll tax filing deadlines. We guarantee to file and remit your payroll taxes on time. Plus, we handle any correspondence with government tax agencies. Patriot does not handle the Schedule H .

While 99% of our customers have employees in one state, you can run payroll in other states for an additional $12 per month, per state.

Don’t Miss: Thompson Center Patriot Pistol Kit

Q: What Does Full Service Payroll Include

A: If you are a Full-Service Payroll customer, we will handle all the necessary collections for your payroll tax deposits and filing of ALL applicable Federal, State, and Local taxes that you have set up in the system. This includes creating and submitting the 940 and 941 Filing payroll tax filing forms needed at quarter-end and year-end. Unlike other payroll software providers, we wont send you forms you must sign, seal and deliver. We will submit all of your forms to the appropriate taxing agency for you, so when you see them, theyll be finished! And, we include ALL state and local taxes that might be applicable.