The Failure To Address Soaring Entitlements

For those concerned with fiscal responsibility, the Trump presidency represented a colossal missed opportunity. Presidential fiscal records should mainly be judged by the legislation they enact because that is a variable over which they have a reasonable degree of control. However, the escalating baseline deficits represent an economic danger that cannot be ignored. Presidents do not control the fiscal situation they inherit, but that does not absolve them of the responsibility to address worsening deficits.

President Trump inherited 74 million retiring baby boomers whose escalating Social Security and Medicare costs accounted for nearly all of the $10 trillion in projected 10-year deficits. Despite having a Republican Congress that had long promised to ensure the long-term fiscal sustainability of these programsand House Speaker Paul Ryan, who had dedicated his career to promoting such reformsTrump opposed all structural Social Security and Medicare reforms. Instead, the president cut taxes, increased discretionary spending, saw the loss of the Republican House majority, and then was pressured by the pandemic to sign $4 trillion in additional debt.

Faced with a potentially calamitous long-term fiscal outlook, President Trump and Congress joined a long line of politicians who kicked the can down the road.

What Does The Rest Of The Budget Look Like

Emergency spending aside, most of the federal budget goes toward entitlement programs, such as Social Security, Medicare, and Medicaid. Unlike discretionary spending, which Congress must authorize each year through the appropriations process, entitlements are mandatory spending, which is automatic unless Congress alters the underlying legislation. In 2019, only 30 percent of federal spending went toward discretionary programs, with defense spending taking up roughly half of that.

Raising Reserve Requirements And Full Reserve Banking

Two economists, Jaromir Benes and Michael Kumhof, working for the International Monetary Fund, published a working paper called The Chicago Plan Revisited suggesting that the debt could be eliminated by raising bank reserve requirements and converting from fractional-reserve banking to full-reserve banking. Economists at the Paris School of Economics have commented on the plan, stating that it is already the status quo for coinage currency, and a Norges Bank economist has examined the proposal in the context of considering the finance industry as part of the real economy. A Centre for Economic Policy Research paper agrees with the conclusion that “no real liability is created by new fiat money creation and therefore public debt does not rise as a result.”

The debt ceiling is a legislative mechanism to limit the amount of national debt that can be issued by the Treasury. In effect, it restrains the Treasury from paying for expenditures after the limit has been reached, even if the expenditures have already been approved and have been appropriated. If this situation were to occur, it is unclear whether Treasury would be able to prioritize payments on debt to avoid a default on its debt obligations, but it would have to default on some of its non-debt obligations.

You May Like: Eagles Vs Patriots Live Stream Free

Achieving A Budget Surplus

Under pressure from Republicans in Congress, President Bill Clinton, a Democrat, agreed to consistently cut the deficit and eventually oversaw the first budget surplus in decades.

The surplus stood at $236 billion in 2000, Clinton’s final year in office. The $128 billion surplus recorded in 2001 was the last time a surplus has been seen in this century.

Are These Purely Republican Deficits

Partisans often rate each partys commitment to fiscal responsibility by the budget surplus and deficit changes during their respective presidencies. This approach is flawed for several reasons. First, each president inherits a vastly different federal budget baseline, consisting of budget surpluses or deficits that are rising or falling almost entirely on autopilot. Second, as this report shows, much of the movement in the surplus or deficit is driven by economic and technical factors that are mostly outside of White House influence. Consequently, assessing a presidents deficit performance should be based largely on the legislation enacted rather than the inherited baseline or the economic and technical movements of that baseline.

Even when it comes to enacted legislation, however, presidents are also limited to signing what Congress will pass. And during the Trump presidency, much of the $8 trillion in enacted legislation was passed by overwhelmingly bipartisan Congressional majorities.

Consider the eight bills that Congress passed and President Trump signed costing at least $100 billion over the baseline, plus a separate pandemic relief bill that accelerated nearly $100 billion in previously enacted expenses. The most partisan of these nine bills was obviously the 2017 tax cuts . That law was passed exclusively by Republicans without a single Democratic vote.

Also Check: How Much Money Has Trump Raised For 2020

Return To Record Deficits

When he took office in 2001, President George W. Bush cited the Clinton surplus as evidence that taxes were too high. He pushed through significant tax cuts and oversaw an increase in spending, and the combination again drove the U.S. budget into the red.

The deficit reached a record $458 billion in 2008, Bush’s last year in office, and would triple the following year as the Bush and Obama administrations faced the Global Financial Crisis.

Coronavirus Lockdown & Unemployment

But by far, one of the most significant impacts on the national debt occurred very recently during Donald Trumpâs administration. President Trump inherited a rising economy which continued to rise through the last two and a half years. The Dow reached 20,000, more than 140,000 jobs were added to the economy, and low unemployment persisted.

Then in February 2020, the COVID-19 pandemic, which had already caused economic havoc in China and Europe, reached the United States.

A highly contagious disease, COVID-19 could not only kill the very old, very young, and very sick, it could also be spread by carriers not displaying any symptoms who were completely unaware that they had it. And, it could live for hours in the air and up to days on surfaces. Faced with what was deemed an âinvisible enemy,â governors across the US ordered schools and non-essential businesses closed, and citizens to self-isolate, telling them to leave their homes only for essential supplies and only when absolutely necessary.

Needless to say, the economic impacts of these decisions were staggering. The eight largest drops in the Dow Jones Industrial Average were recorded during this period. 26 million people had filed for unemployment benefits by late March . And, Congress passed multiple large stimulus bills to assist individuals, families, and businesses.

Recommended Reading: Patriot Lighting Elegant Home Brooklyn

How Does Us Debt Compare To That Of Other Countries

The United States debt-to-GDP ratio is among the highest in the developed world. Among other major industrialized countries, the United States is behind only Japan.

The pandemic has sharply increased borrowing around the world, according to the International Monetary Fund. Among advanced economies, debt as a percentage of GDP has increased from around 75 percent to nearly 95 percent, driven by double-digit increases in the debt of the United States, Canada, France, Italy, Japan, Spain, and the United Kingdom .

The United States has long been the worlds largest economy, with no record of defaulting on its debt. Moreover, since the 1940s it has been the worlds reserve-currency country. As a result, the U.S. dollar is considered the most desirable currency in the world.

High demand for the dollar has helped the United States finance its debt, as many investors put a premium on holding low-risk, dollar-denominated assets such as U.S. Treasury bills, notes, and bonds. Steady demand from foreign creditorslargely central banks adding to their dollar reserves, rather than market investorsis one factor that has helped the United States to borrow money at relatively low interest rates. This puts the United States in a more secure position for a fiscal fight against COVID-19 compared to other countries.

Tracking The Federal Deficit: November 2018

The Congressional Budget Office reported that the federal government generated a $203 billion deficit in November, the second month of Fiscal Year 2019, for a total deficit of $303 billion so far this fiscal year. If not for timing shifts of certain payments, the deficit in November would have been roughly $158 billion, according to CBO. Novembers deficit is 46 percent higher than the deficit recorded a year earlier in November 2017. Total revenues so far in Fiscal Year 2019 increased by 3 percent , while spending increased by 18 percent , compared to the same period last year.

Analysis of Notable Trends in November 2018: Department of Homeland Security spending fell by 46 percent relative to November 2017, reflecting a decrease in spending on disaster relief. Conversely, Social Security spending increased by 5 percent compared to November 2017.

Also Check: Has Trump Been Impeached Yet

Don’t Miss: What Are The Republican Candidates For 2020

National Debt For Selected Years

| Fiscal year | |

|---|---|

| 130.6% | 21,850 |

On July 27, 2018, the BEA revised its GDP figures in a comprehensive update and figures back to FY2013 were revised accordingly.

On June 25, 2014, the BEA announced: “n addition to the regular revision of estimates for the most recent 3 years and for the first quarter of 2014, GDP and select components will be revised back to the first quarter of 1999.

Fiscal years 19402009 GDP figures were derived from February 2011 Office of Management and Budget figures which contained revisions of prior year figures due to significant changes from prior GDP measurements. Fiscal years 19502010 GDP measurements were derived from December 2010 Bureau of Economic Analysis figures which also tend to be subject to revision, especially more recent years. Afterwards the OMB figures were revised back to 2004 and the BEA figures were revised back to 1947.

Fiscal years 19401970 begin July 1 of the previous year fiscal years 19802010 begin October 1 of the previous year. Intragovernmental debts before the Social Security Act are presumed to equal zero.

19091930 calendar year GDP estimates are from MeasuringWorth.com Fiscal Year estimates are derived from simple linear interpolation.

Audited figure was “about $5,659 billion.”

Audited figure was “about $5,792 billion.”

Audited figure was “about $6,213 billion.”

Audited figure was said to be “about” the stated figure.

Audited figure was “about $7,918 billion.”

Audited figure was “about $8,493 billion.”

The National Debt Under Trump

When Trump took office in January 2017, the national debt was $19.9 trillion, according to data published on Treasury Direct by the Treasury Departments Bureau of Fiscal Services.

During the first six months of Trump’s presidency, the debt actually decreased by $102 billion, but according to reporting from Snopes, there’s no proof that specific actions taken by Trump’s administration caused the decrease.

In September 2017, Trump signed a bill that raised the debt ceiling. On that same day, the national debt reached $20 trillion for the first time in the country’s history.

According to Treasury Direct which reports the national debt data at the end of each month in February 2019, the national debt was $22 trillion. Over the next calendar year, the debt increased by more than $1 trillion, reaching $23 trillion in February.

In September, Treasury Direct reported that the national debt reached $26.9 trillion, a significant rise in a short time as the country responded to the COVID-19 pandemic.

Treasury Direct has yet to report October’s numbers, but news outlets have reported that in October of this year, the national debt is sitting at just under $27 trillion.

Using Treasury Direct’s data, from the time Trump took office in January 2017 through September of this year, the national debt rose from $19.9 trillion to $26.9 trillion, which is an increase of $7 trillion in Trump’s first term.

Don’t Miss: How To Watch Patriots Game Without Cable

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

The Senate Gop Rationale For Forcing A First

WSJ: ” Raising The Debt Limit Wouldnt Facilitate Future Spending And Congress Would Still Need To Raise The Debt Limit This Fall Even If No New Major Spending Programs Are Enacted.NBC News: Raising The Debt Limit Would Not Authorize New Spending It Would Enable The U.S. To Borrow Money To Pay Spending That Congress Has Approved.

The chief argumentfrom Senator Mitch McConnell and Senate Republicans – that they will vote todefault on the debt because of potential future legislative action to expandhealth care, improve child care, and tackle the climate crisis – just isnttrue.

In fact, the debtceiling must be lifted because of spending under current law. According to the Wall Street Journal, “Raising the debtlimit wouldnt facilitate future spending, and Congress would still need toraise the debt limit this fall even if no new major spending programs are enacted.The Journal also notes that raising the debt limit doesntauthorize new spending, but rather allows the Treasury Department to issue newdebt to cover spending that Congress has already authorized, including paymentsto bondholders, Social Security recipients and veterans.

Furthermore, accordingto Treasury Department, the total new debt incurred in the entirety of the fouryears of the Trump-McConnell leadership was approx. $8 trillion, which includesthe $5.446 trillion of new debt the Trump admin incurred since the last timethe debt limit was suspended in August 2019 through the final day of the Trumpadmin .

Don’t Miss: 2008 Jeep Patriot Tire Pressure Sensor

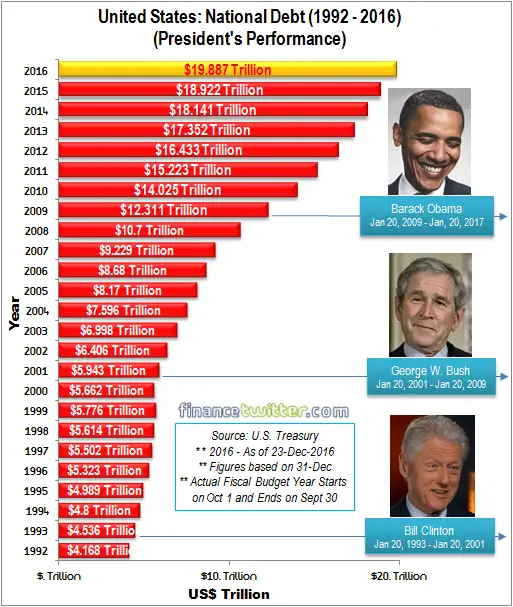

Fact Check: Did The National Debt Double Under Obama

tweet this show comments

President Donald Trump claimed Feb. 15 that former President Barack Obama put on more debt on this country than every president in the history of our country combined.

Verdict: True

Public debt more than doubled in the eight years of Obamas presidency, rising from $6.3 trillion to $14.4 trillion. Gross federal debt which includes the amount owed to Social Security and other government accounts nearly, but did not quite, double.

Fact Check:

Trump held a press conference Feb. 15 at the White House to declare a national emergency at the southern border. After his remarks, Trump took questions from reporters, including one about his plan to combat the growing national debt.

Trump said economic growth will straighten it out and criticized Obamas management of the debt. When I took over, we had one man that put on more debt than every other president combined, he said.

The national debt can be divided into two parts the amount owed to the public, including private citizens, foreign governments and international investors, and whats known as intragovernmental holdings, the amount owed to the Social Security Trust Fund and other government accounts.

While the national debt has been increasingfor decades due to near-annual budget deficits, it grew dramatically under Obama, increasing from $10.6 trillion in January 2009 to $19.9 trillion in January 2017, according to Treasury Department figures.

Have a fact check suggestion? Send ideas to

Our Ruling: Partly False

The claim in the post has been rated PARTLY FALSE. The post is correct in its sentiment that the national debt has significantly increased during President Donald Trump’s first term, but the figure of $8.3 trillion is incorrect. In Trump’s first term, the national debt has increased by roughly $7 trillion.

Recommended Reading: Jeep Patriot Touch Up Paint

Economic And Technical Factors Produced Substantial Savings

CBO classifies three factors that drive all movements in budget deficits: new legislation, changes in economic growth rates, and technical changes brought on by noneconomic factors . Under President Trump, faster economic growth and technical revisions saved an estimated $3.9 trillion over the 20172027 decade relative to the initial CBO projections. However, new legislation and presidential initiatives cost $7.8 trillion over the same period . Most of these costs will be borne between 2017 and 2021, while the economic and technical savings are projected to accrue towards the end of the 10-year window.

The $3.9 trillion in economic and technical budget savings can be broken down as follows:

Falling interest rates on the national debt are by far the largest reason that CBOs projected baseline deficits for the 20232027 out-years actually fell during the Trump presidency despite the costs of new legislation. Even with trillions in new debt signed into law by President Trump, the projected 2027 interest amount fell from $768 billion to $435 billion. For comparison, between 1997 and 2027, the debt held by the public will have skyrocketed from $3.8 trillion to $28.7 trillion , yet annual interest costs will have grown only from $244 billion to $435 billion . Had interest rates remained at 1990s levels, annual budget interest costs would approach $2 trillion by 2027.

What Is The Debt Ceiling

The debt ceiling is the legal limit set by Congress on how much the Treasury Department can borrow, including to pay debts the United States already owes. Since it was established during World War I, the debt ceiling has been raised dozens of times. In recent years, this once routine act has become a game of political brinkmanship that has brought the United States near default on several occasions, CFRs Roger W. Ferguson Jr. writes. Ferguson and other experts argue that the debt ceiling should be scrapped entirely. The only other advanced economy to have one is Denmark, and it has never come close to reaching its ceiling.

Recommended Reading: New England Patriots Vs Jacksonville Jaguars