Pennsylvanias Senate Candidates Make Their Final Pitches: Were Not Politicians

Dr. Mehmet Oz is closing with compassion and opposition to extremism. Lt. Gov. John Fetterman comes bearing a message of love and a sharp warning about the lies of Dr. Oz, his Republican opponent.

In Pennsylvanias closely watched and often nasty Senate race, the rival candidates are making their final pitches to voters who have been bombarded with a record-shattering flood of negative advertising.

And for all of their disagreements, both have settled on a variant of the same theme: Politicians cant be trusted, and Im not a politician.

Whats missing from politics these days is compassion, Dr. Oz says in his final face-to-camera commercial. Thats why Ill cut taxes to help families struggling with inflation, strengthen Social Security and help those suffering.

He adds: Politicians point fingers. Doctors solve problems. Together, we’ll stand up to extremism on both sides, and bring balance to Washington.

Another Oz commercial in heavy rotation, called Bring America Back, echoes the themes Republican groups have used to pummel Mr. Fetterman, a Democrat, with attack ads accusing him of being soft on crime and too far left for Pennsylvania.

Todays kids arent safe in our communities, Dr. Oz says. Inflation is making it harder to buy a house to start a family.

Negative ads from outside allies of Mr. Fetterman depict Dr. Oz as a calculating con man, highlighting critical reporting on his record as a doctor and warning voters not to trust him.

Jeff Mays

Tracking The Federal Deficit: February 2022

The Congressional Budget Office estimates that the federal government ran a deficit of $216 billion in February 2022, the fifth month of fiscal year 2022. Februarys deficit followed a surplus in January and was the difference between $290 billion in revenues and $506 billion in spending. This deficit level is $95 billion less than the deficit recorded in February 2021.

Analysis of notable trends: In the first five months of FY2022, the federal government ran a deficit of $475 billion, 55% less than at this point in FY2021 . The cumulative deficit for FY2022 thus far is $149 billion lower than even the deficit over the comparable period in FY2020, pre-dating the onset of the COVID-19 pandemic.

Receipts continue to grow robustly at $1.8 trillion for FY2022 to date, $371 billion more than the government collected during the first five months of the prior fiscal year. Individual income and payroll tax receipts increased by 25% , reflecting rising wages and salaries primarily among higher-income workers subject to higher tax rates, as well as the influx of some payroll taxes that companies were allowed to defer under pandemic relief legislation. Corporate income tax revenues increased by 31% over the past five months compared to the same period last fiscal year.

The Claim: Trump Increased The National Debt By $83 Trillion In 4 Years

During his 2016 campaign, Trump ran on a promise to strengthen the countrys economy, which would in turn improve Americans quality of life. Trumps promise to improve the economy included a pledge to eliminate the national debt within eight years.

The national debt doesnt typically impact the day-to-day lives of most Americans unless it reaches a tipping point, which would slow the economy.

Under Trumps first four years as president, the national debt has markedly increased, including significant spending by the federal government to combat the COVID-19 pandemic.

The Instagram page Occupy Democrats reposted a meme made by the Biden support group Ridin with Biden that states, Hey Republicans do you still care about the national debt? Because Trump just increased it by $8.3 TRILLION in four years. Just sayin.

USA TODAY has reached out to the page for comment.

You May Like: Patriot America Plus Visitor Insurance

Tracking The Federal Deficit: March 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $658 billion in March 2021, the sixth month of fiscal year 2021. This months deficitthe difference between $267 billion in revenue and $925 billion in spendingwas $487 billion greater than last Marchs . The federal deficit has now swelled to $1.7 trillion in fiscal year 2021, 129% higher than at this point last year. While revenues have grown 6% year-over-year, cumulative spending has surged 45% above last years pacelargely a result of the COVID-19 pandemic, its economic fallout, and the federal governments fiscal response.

Analysis of Notable Trends: Adjusted for timing shifts, outlays in March 2021 were $517 billion greater than last March, an increase of 127%. Unemployment insurance, refundable tax credits, and the Small Business Administrations Paycheck Protection Program accounted for most of the increaseboth from March to March and from last fiscal year to this one. Spending on refundable tax credits was $346 billion higher in March 2021 than March 2020, mostly due to the payment of pandemic recovery rebates authorized by the Consolidated Appropriations Act and American Rescue Plan Act..

$8 Trillion In New Legislation And White House Policies

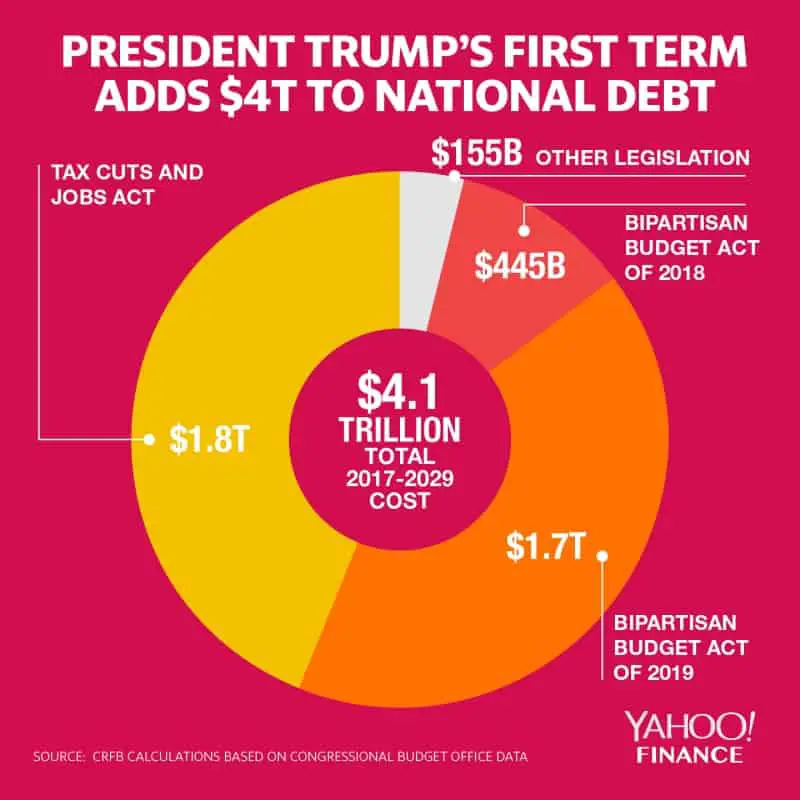

During President Trumps four years in office, he signed legislation that cumulatively added $7,787 billion to 10-year deficits. His policies reduced tax revenues by $2,098 billion, increased spending by $4,912 billion, and added $777 billion in interest costs.

The main components are listed in Figure 4, and summarized below:

Dont Miss: Did Trumps Tax Cuts Help The Middle Class

Read Also: Are There More Registered Republicans Or Democrats

Biden Leaves Misleading Impression On Us Debt

Posted on August 13, 2021

In promoting his own spending priorities, President Joe Biden blamed his predecessors unpaid tax cuts and other spending for increasing the national debt by nearly $8 trillion over four years. The total debt figure is correct, but trillions of that were due to bipartisan coronavirus relief packages.

Biden made the criticism of former President Donald Trump in an Aug. 11 speech about Bidens Build Back Better plan. He said the $3.5 trillion budget resolution, which the Senate approved the same day Biden spoke, was the framework for his plan.

Many of the details on the spending and funding for the budget still need to be written in separate legislation, but some of the major initiatives include child care, health care, universal pre-K, free tuition at community colleges and efforts to combat climate change, according to a Senate memo giving instructions to the committees drafting the bill.

In his speech, Biden said the 10-year budget resolution would be fully paid for over the long term through increased taxes on large corporations and the super wealthy. He claimed the plan would actually reduce the national debt over the long run, but that remains to be seen. And he claimed Trumps tax and spending priorities were fiscally irresponsible.

This isnt going to be anything like my predecessor, whose unpaid tax cuts and other spending added nearly $8 trillion in his four years to the national debt. Eight trillion dollars, Biden said.

Our Ruling: Partly False

The claim in the post has been rated PARTLY FALSE. The post is correct in its sentiment that the national debt has significantly increased during President Donald Trump’s first term, but the figure of $8.3 trillion is incorrect. In Trump’s first term, the national debt has increased by roughly $7 trillion.

Don’t Miss: Why Do Republicans Continue To Defend Trump

In The Final Days Of Pennsylvanias Senate Race A Celebrity Tries To Connect

ELIZABETHTOWN, Pa. Throughout the Pennsylvania Senate race, Mehmet Oz has toggled across multiple political identities, from the conservative candidate pushing for former President Donald J. Trumps endorsement to one who discusses bringing political balance to Washington and campaigns with Republicans who have sometimes distanced themselves from Mr. Trump.

But as he addressed a barn full of voters in Lancaster County on Wednesday evening at a rare large-scale public rally, Dr. Oz leaned into the identity voters have known the longest: celebrity physician.

Warm-up speakers reached for medical references, talking about the need to cure the economy or declaring a code red situation in the country. Dr. Oz spoke rapidly, in list form, about his priorities, as if offering a step-by-step guide to managing a condition. And, sounding much like the television personality who long offered self-help tips and dubious medical advice to the nation, he declared to the crowd, I believe in you.

Im not a politician, he said to a whooping audience. Im a surgeon. And you know what surgeons do? We focus on something really important in my case, the heart, which is pretty critical and you unite to fix it.

Dan Naylor, the chairman of the Republican Party of Lackawanna County, pointed to Dr. Ozs celebrity status when asked to name his biggest challenge.

I look at people, former celebrities, that have excelled in their political careers, like Ronald Reagan, he said.

The National Debt Under Trump

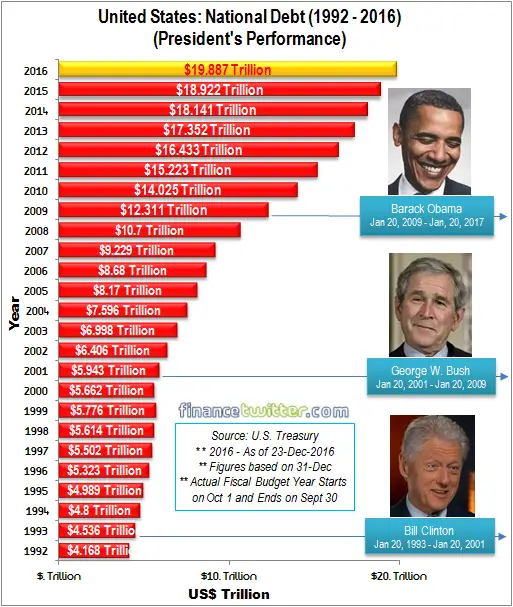

When Trump took office in January 2017, the national debt was $19.9 trillion, according to data published on Treasury Direct by the Treasury Departments Bureau of Fiscal Services.

During the first six months of Trump’s presidency, the debt actually decreased by $102 billion, but according to reporting from Snopes, there’s no proof that specific actions taken by Trump’s administration caused the decrease.

In September 2017, Trump signed a bill that raised the debt ceiling. On that same day, the national debt reached $20 trillion for the first time in the country’s history.

According to Treasury Direct which reports the national debt data at the end of each month in February 2019, the national debt was $22 trillion. Over the next calendar year, the debt increased by more than $1 trillion, reaching $23 trillion in February.

In September, Treasury Direct reported that the national debt reached $26.9 trillion, a significant rise in a short time as the country responded to the COVID-19 pandemic.

Treasury Direct has yet to report October’s numbers, but news outlets have reported that in October of this year, the national debt is sitting at just under $27 trillion.

Using Treasury Direct’s data, from the time Trump took office in January 2017 through September of this year, the national debt rose from $19.9 trillion to $26.9 trillion, which is an increase of $7 trillion in Trump’s first term.

Also Check: Promo Code For Patriot Mobile

Which Us President Added The Most To The National Debt

The national debt under President Franklin D. Roosevelt increased by a whopping 1,048 percent. However, he only added about $236 billion to the debt in dollar figures, which pales in comparison to debt increases under recent presidents.

Sitting President Joe Biden does take the award for the most national debt in dollar figures, reported to top $30 trillion this week. However, the increase was just 5.6 percent, or $1.5 trillion, YoY during Bidens first year in office .

The national debt was already on its way to reaching a record level when Biden took office. According to U.S. Treasury Department Fiscal Data, by the time Biden took over as the U.S. President, the national debt was already over $28 trillion.

A newly elected president doesnt have a lot of control over the national debt during the first year in office because the budget for that year is approved by their predecessor. So, Biden was operating under Trumps 2021 fiscal budget until October 1, 2021.

Trumps Iowa Rally Is About More Than The Midterms

Former President Donald J. Trump opens up his final swing of midterm campaign rallies on Thursday night in Iowa, targeting one of the most conservative regions of the state to promote a pair of Republican candidates who, polls show, are overwhelming favorites to win re-election.

But the stop in Iowa is as much about the race that starts when voting concludes on Tuesday.

Mr. Trump has been increasingly eager to announce a third bid for the White House formally, and Iowa holds outsize importance both in the early nominating process and, for the past several presidential cycles, as a secondary battleground during the general election.

Still, Mr. Trump is expected to devote much of his speech tonight to the consequences of the midterm elections. He previewed his closing message on Wednesday during a conference call with Arizona Republican voters and candidates in which he described America as a nation in decline and Democrats as the leading cause.

We have to basically, in a nutshell, save our country, Mr. Trump said.

Mr. Trump came very close to offering himself as a solution at a recent rally in Texas, where he again repeated the lie that he won in 2020, adding, In order to make our country successful, safe and glorious again, I will probably have to do it again.

Those incumbents are both scheduled to return to the stage Thursday night for the rally in Sioux City. Both candidates have led their Democratic challengers by double digits in some recent polls.

Alyce McFadden

Recommended Reading: Brigham And Women’s At Patriot Place

Tracking The Federal Deficit: March 2020

The Congressional Budget Office reported that the federal government generated a $117 billion deficit in March, the sixth month of fiscal year 2020. Marchs deficit is a $30 billion decrease from the $147 billion deficit recorded a year earlier in March 2019. Marchs deficit brings the total deficit so far this fiscal year to $741 billion, which is 7% higher than the same period last year. Total revenues so far in FY2020 increased by 6% , while spending increased by 7% , compared to the same period last year.

Analysis of Notable Trends in This Fiscal Year to Date: Through the first six months of FY2020, federal reserve remittances increased by 22% because of lower short-term interest rates, which decreased the Federal Reserves interest expenses and increased its payments to the Treasury. As in previous months, the rise in spending was driven by increasing expenditures on the military , Social Security, Medicare, and Medicaid , and net interest on the public debt . Notably, the March 2020 report was not significantly impacted by the new coronavirus pandemic nor the federal governments emergency measures responding to it. CBO anticipates that those budgetary effects will be more noticeable in April.

Tracking The Federal Deficit: December 2021

The Congressional Budget Office estimates that the federal government ran a deficit of $20 billion in December 2021, the third month of fiscal year 2022. This deficit was the difference between $486 billion in revenues and $507 billion of spending. Decembers deficit was 85% smaller than that of December 2020. Additionally, both this year and last year, the timing of the New Years Day federal holiday shifted payments that would normally have occurred at the beginning of January into December. In the absence of these timing shifts, the federal government would have run a monthly surplus in December 2021 for the first time since January 2020, prior to the onset of the COVID-19 pandemic.

Analysis of notable trends: Through the first quarter of FY2022, the federal government has run a deficit of $377 billion, $196 billion less than at this point in FY2021. After factoring in the aforementioned timing shifts, the FY2022 deficit to date is $353 billion, or 33% smaller than FY2021the rest of this discussion accounts for these payment shifts. However, this deficit is $17 billion larger than the deficit accrued during the first quarter of FY2020, before the start of the pandemic.

Also Check: Patriot Act Identity Verification Requirements

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Key Dates In Trumps Trade War With China The Trouble With Tariffs Is Unintended Consequences Https: //wwwbarronscom/articles/trump

Trumpâs trade war with China produced several new trade agreements both with China and other nations, but at what cost?

In August of 2019, the Congressional Budget Office reported their estimates of the U.S. economic impact of tariffs . Congressional Budget Office: The Effects of Tariffs and Trade Barriers in CBOâs Projections

In this estimate, the CBO projected that by 2020, tariffs would:

- Reduce the U.S. GDP by 0.3 percent

- Reduce real consumption by 0.3 percent

- Reduce real private investment by 1.3 percent

- Reduce real income by $580 per household.

- U.S. exports would be 1.7 percent lower and imports would be 2.6 percent lower

This is economistsâ arguments against tariffs coming to fruition. Tariffs affect economic activity in three ways:

- Consumer goods become more expensive

- Business uncertainty increases, which slows investment

- Other countries follow by imposing retaliatory tariffs, which makes US exports more expensive.

Don’t Miss: 2008 Jeep Patriot Rims And Tires